Multi-Moving Average Trend Following Strategy - Long-term Investment Signal System Based on EMA and SMA Indicators

Author: ChaoZhang, Date: 2024-12-13 10:28:02Tags: EMASMA

Overview

This strategy is a trend following system based on multiple moving averages combination, mainly utilizing the crossover and position relationships between Weekly EMA20, Daily SMA100, Daily SMA50, and Daily EMA20 to capture medium to long-term investment opportunities. The strategy identifies potential long entry points by observing the relationship between price and moving averages, combined with duration requirements.

Strategy Principles

The core logic of the strategy is based on the following key conditions: 1. Uses 20-period Weekly Exponential Moving Average (EMA1W20) as the primary trend indicator 2. Combines with 100-day Simple Moving Average (SMA1D100) for secondary trend confirmation 3. Employs 50-day Simple Moving Average (SMA1D50) as medium-term trend reference 4. Utilizes 20-day Exponential Moving Average (EMA1D20) for short-term trend confirmation The system generates a long signal when the price maintains above EMA1W20 and SMA1D100 for 14 consecutive days and then falls below SMA1D50. This design combines trend confirmation across multiple timeframes to enhance signal reliability.

Strategy Advantages

- Multi-timeframe validation: Combines weekly and daily moving averages for more comprehensive trend assessment

- Strict entry conditions: Requires price to maintain above major moving averages for sufficient duration, effectively filtering false signals

- Reasonable risk control: Uses multiple moving average crossovers and positions for clear risk boundaries

- High adaptability: Strategy parameters can be adjusted for different market environments

- Clear execution: Trading signals are well-defined and suitable for programmatic implementation

Strategy Risks

- Lag risk: Moving averages inherently have some lag, potentially causing delayed entries

- Sideways market risk: May generate frequent false breakout signals in ranging markets

- Parameter sensitivity: Optimal parameters may vary in different market environments

- Drawdown risk: May experience significant drawdowns during sudden trend reversals

- Execution risk: Requires stable system operation to avoid signal loss or execution delays

Strategy Optimization Directions

- Incorporate volume indicators: Add volume confirmation mechanism to improve signal reliability

- Optimize parameter adaptation: Develop dynamic parameter adjustment mechanisms

- Add filtering conditions: Consider adding market environment indicators

- Improve stop-loss mechanism: Design more detailed stop-loss and profit-taking rules

- Enhance signal confirmation: Consider adding other technical indicators for auxiliary confirmation

Summary

This strategy establishes a relatively comprehensive trend following system through multiple moving average combinations, suitable for medium to long-term investors. While it has certain lag and parameter sensitivity risks, the strategy has practical value through proper risk control and continuous optimization. Investors are advised to make appropriate adjustments based on their risk preferences and market conditions.

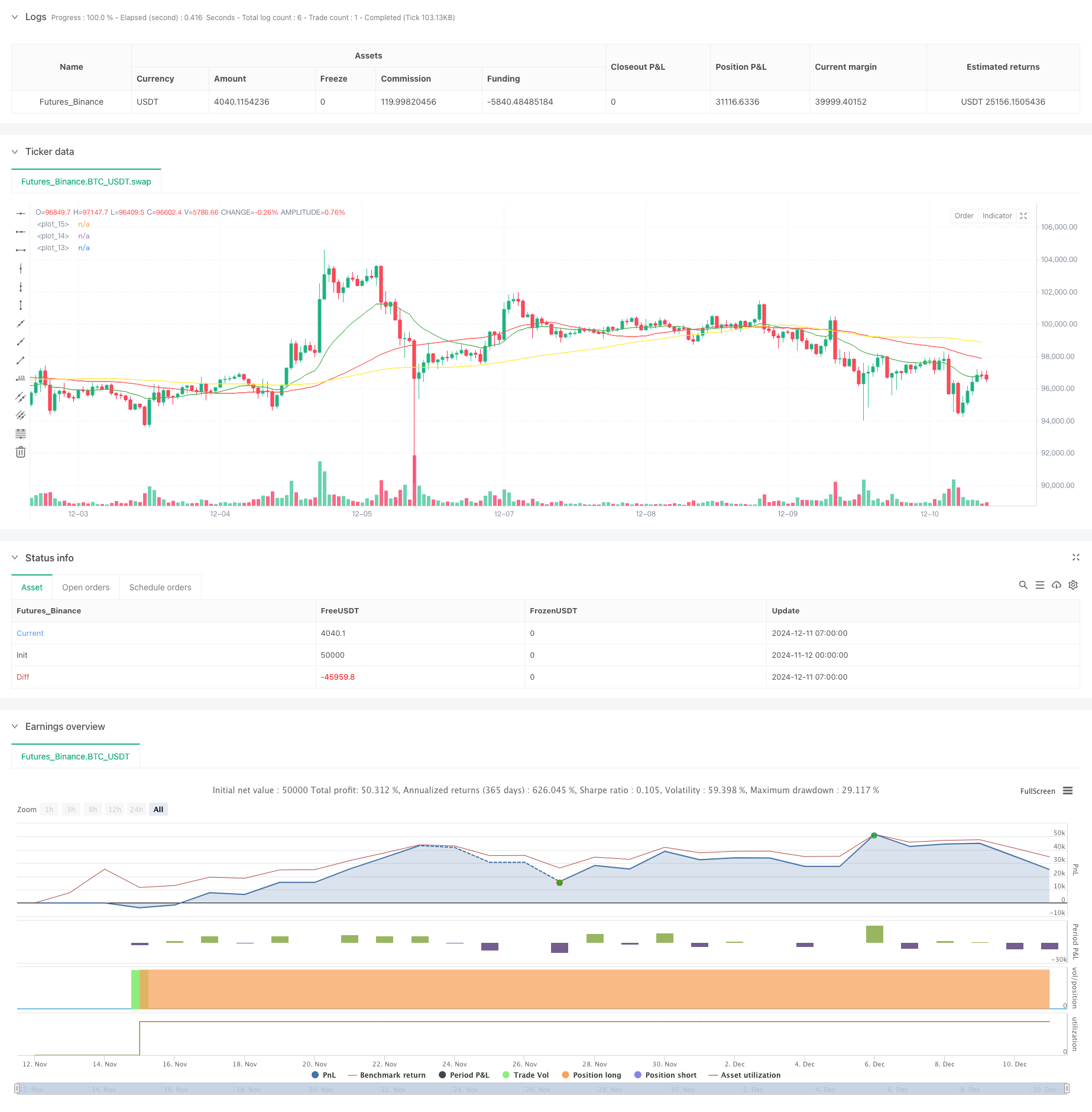

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © petitepupu

//@version=5

ema20wTemp = ta.ema(close, 20)

ema20w = request.security(syminfo.tickerid, "1W", ema20wTemp, barmerge.gaps_on, barmerge.lookahead_off)

sma100d = ta.sma(close, 100)

sma50d = ta.sma(close, 50)

ema20d = ta.ema(close, 20)

daysAbove = input.int(14, title="Days", minval=1)

plot(ema20w, color=color.blue)

plot(sma100d, color=color.yellow)

plot(sma50d, color=color.red)

plot(ema20d, color=color.green)

longCondition = true

clean = true

for i = 0 to daysAbove

if close[i] < ema20w or close[i] < sma100d or close > sma50d

longCondition := false

clean := false

break

//TODO:

if clean != true

longCondition := true

for i = 0 to daysAbove

if close[i] > ema20w or close[i] > sma100d or close >= ema20d or -100 * (close - ema20d)/ema20d < 5.9

longCondition := false

break

// plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.triangleup, title="Buy Signal", size = size.small)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy(title="LT Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=800)

- Multi-Wave Trend Crossing Risk Management Quantitative Strategy

- Multi-EMA Crossover Momentum Strategy

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy

- EMA Crossover Momentum Scalping Strategy

- SMA Dual Moving Average Crossover Strategy

- Trading ABC

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- EMA5 and EMA13 Crossover Strategy

- Multi-EMA Trend Momentum Recognition and Stop-Loss Trading System

- Super Moving Average and Upperband Crossover Strategy

- Dual Moving Average and MACD Combined Trend Following Dynamic Take Profit Smart Trading System

- Triple Standard Deviation Bollinger Bands Breakout Strategy with 100-Day Moving Average Optimization

- Dynamic EMA Trend Crossover Entry Quantitative Strategy

- Multi-Wave Trend Crossing Risk Management Quantitative Strategy

- Dual EMA Stochastic Trend Following Trading Strategy

- Dynamic Trend Following Multi-Period Moving Average Crossover Strategy

- Dual Momentum Breakthrough Confirmation Quantitative Trading Strategy

- MACD-RSI Trend Momentum Cross Strategy with Risk Management Model

- Multi-Period EMA Crossover with RSI Momentum and ATR Volatility Based Trend Following Strategy

- Dual EMA Crossover Strategy with Smart Risk-Reward Control

- Historical High Breakthrough with Monthly Moving Average Filter Trend Following Strategy

- Multi-Equilibrium Price Trend Following and Reversal Trading Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- Multi-Indicator Adaptive Trading Strategy Based on RSI, MACD and Volume

- Price Pattern Based Double Bottom and Top Automated Trading Strategy

- Dynamic ATR Trend Following Strategy Based on Support Breakout

- Multiple Moving Average and Stochastic Oscillator Crossover Quantitative Strategy

- Adaptive Trend Following and Reversal Detection Strategy: A Quantitative Trading System Based on ZigZag and Aroon Indicators

- Multi-Indicator Synergistic Trading Strategy with Bollinger Bands, Fibonacci, MACD and RSI

- Mean Reversion Bollinger Band Dollar-Cost Averaging Investment Strategy