概述

该策略使用5日指数移动平均线(EMA5)和13日指数移动平均线(EMA13)的交叉来产生交易信号。当EMA5上穿EMA13时,产生做多信号;当EMA5下穿EMA13时,产生做空信号。该策略旨在捕捉短期趋势的变化,并利用两条移动平均线的交叉来确定进场和出场点。

策略原理

该策略的核心是利用两条不同周期的指数移动平均线(EMA)的交叉来产生交易信号。EMA是一种常用的技术指标,它对最近的价格数据赋予更高的权重,因此相比简单移动平均线(SMA)更能及时反映价格的变化。当短期EMA(如EMA5)上穿长期EMA(如EMA13)时,表明价格上涨动能增强,产生做多信号;反之,当短期EMA下穿长期EMA时,表明价格下跌动能增强,产生做空信号。

策略优势

- 简单易懂:该策略仅使用两条EMA指标,原理简单,易于理解和实现。

- 适应性强:通过调整EMA的周期参数,可以适应不同的市场环境和交易品种。

- 及时性高:相比SMA,EMA对价格变化的响应更为及时,有助于快速捕捉趋势变化。

- 可扩展性:在该策略的基础上,可以结合其他技术指标或基本面因素,以进一步优化策略表现。

策略风险

- 假信号:在震荡市场或趋势不明朗时,EMA交叉可能产生较多的假信号,导致频繁交易和资金损失。

- 滞后性:虽然EMA相比SMA滞后性较小,但仍存在一定的滞后性,可能错过最佳进场时机。

- 缺乏止损:该策略未设置明确的止损条件,在行情反转时可能承担较大损失。

- 参数优化:EMA周期参数的选择需要根据不同市场和品种进行优化,否则可能影响策略表现。

策略优化方向

- 加入趋势过滤:在EMA交叉信号的基础上,结合长期趋势指标(如EMA50)进行趋势过滤,以减少假信号。

- 设置止损:根据ATR等指标设置动态止损,或者使用固定百分比止损,以控制单笔交易的最大损失。

- 优化参数:通过对历史数据进行回测,优化EMA周期参数,找到最适合当前市场和品种的参数组合。

- 结合其他指标:与其他技术指标(如RSI、MACD等)结合使用,以提高信号确认度和可靠性。

总结

EMA5与EMA13交叉策略是一种简单易用的趋势跟踪策略,通过两条不同周期EMA的交叉来捕捉价格趋势的变化。该策略优势在于简单、适应性强、及时性高,但同时也存在假信号、滞后性和缺乏止损等风险。为进一步优化策略表现,可以考虑加入趋势过滤、设置止损、优化参数以及结合其他技术指标等方法。在实际应用中,需要根据具体的市场环境和交易品种进行调整和优化。

策略源码

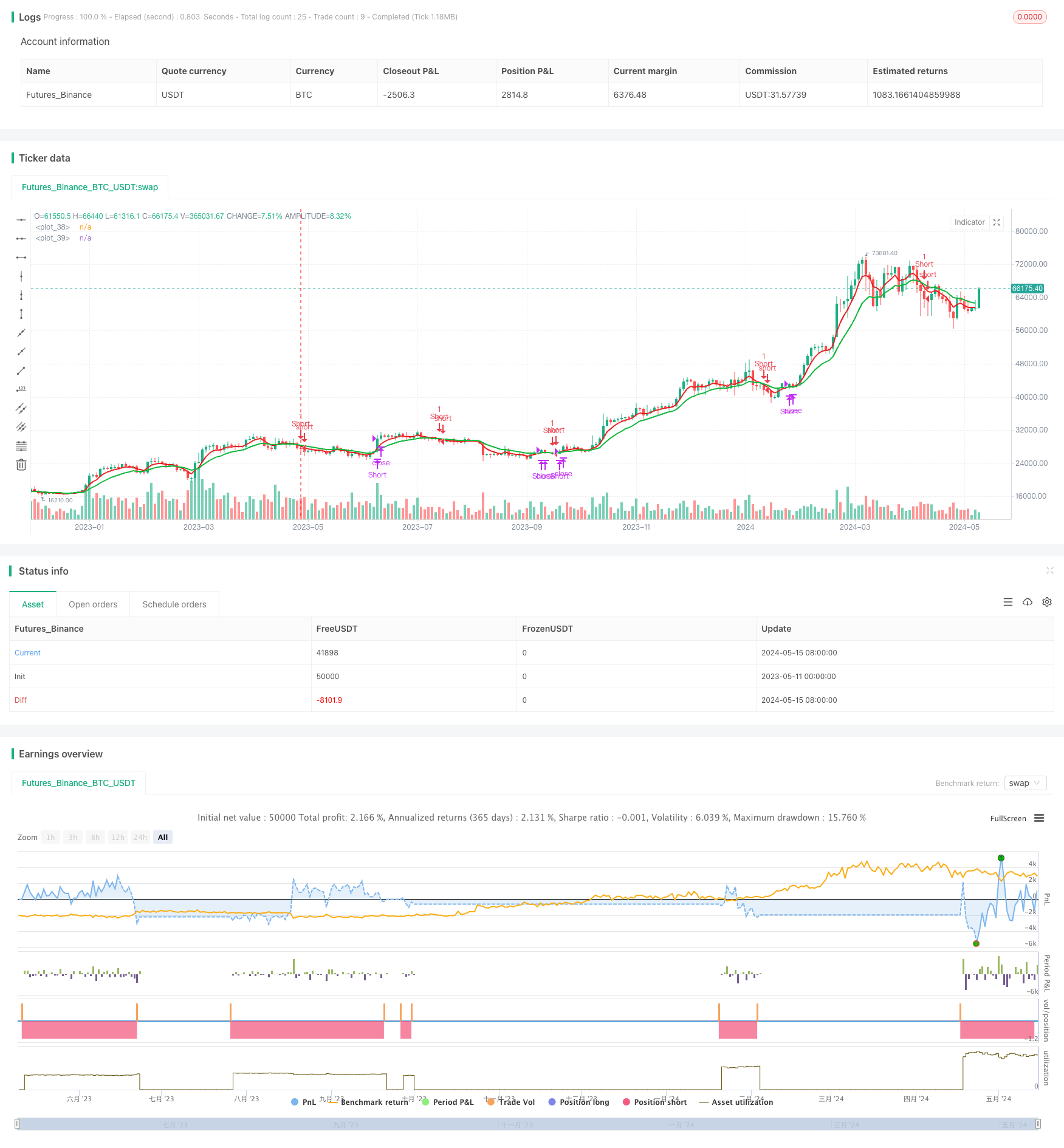

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 2d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Milankacha

//@version=5

strategy('5-13 EMA by Naimesh ver04', overlay=true)

qty = input(1, 'Buy quantity')

testStartYear = input(2021, 'Backtest Start Year')

testStartMonth = input(1, 'Backtest Start Month')

testStartDay = input(1, 'Backtest Start Day')

testStartHour = input(0, 'Backtest Start Hour')

testStartMin = input(0, 'Backtest Start Minute')

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, testStartHour, testStartMin)

testStopYear = input(2099, 'Backtest Stop Year')

testStopMonth = input(1, 'Backtest Stop Month')

testStopDay = input(30, 'Backtest Stop Day')

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriodBackground = input(title='Color Background?', defval=true)

testPeriodBackgroundColor = testPeriodBackground and time >= testPeriodStart and time <= testPeriodStop ? #00FF00 : na

testPeriod() => true

ema1 = input(5, title='Select EMA 1')

ema2 = input(13, title='Select EMA 2')

//ema3 = input(50, title='Select EMA 3')

//SL = input(70, title='Stoploss')

//TR = input(250, title='Target')

expo = ta.ema(close, ema1)

ma = ta.ema(close, ema2)

//EMA_50 = ta.ema(close, ema3)

//avg_1 = avg (expo, ma)

//s2 = ta.cross(expo, ma) ? avg_1 : na

//plot(s2, style=plot.style_line, linewidth=3, color=color.red, transp=0)

p1 = plot(expo, color=color.rgb(231, 15, 15), linewidth=2)

p2 = plot(ma, color=#0db63a, linewidth=2)

fill(p1, p2, color=color.new(color.white, 80))

longCondition = ta.crossover(expo, ma)

shortCondition = ta.crossunder(expo, ma)

if testPeriod()

//strategy.entry('Long', strategy.long, when=longCondition)

strategy.entry('Short', strategy.short, when=expo<ma)

//strategy.close("Long", expo<ma, comment= 'SL hit')

strategy.close("Short", expo>ma, comment= 'SL hit')

//plotshape(longCondition and close>EMA_50, title='Buy Signal', text='B', textcolor=color.new(#FFFFFF, 0), style=shape.labelup, size=size.normal, location=location.belowbar, color=color.new(#1B8112, 0))

//plotshape(shortCondition and close<EMA_50, title='Sell Signal', text='S', textcolor=color.new(#FFFFFF, 0), style=shape.labeldown, size=size.normal, location=location.abovebar, color=color.new(#FF5733, 0))

相关推荐