Multi-EMA Trend-Following Swing Trading Strategy with ATR-Based Risk Management

Author: ChaoZhang, Date: 2024-12-20 17:06:20Tags: EMAATR

Overview

This strategy is a trend-following trading system based on multiple Exponential Moving Averages (EMAs) and Average True Range (ATR). It uses three EMAs (20, 50, and 100 periods) in conjunction with ATR for dynamic risk management and profit targeting. This approach ensures systematic trading while maintaining dynamic risk control.

Strategy Principles

The core logic is built on the interaction between price and multiple EMAs: 1. Entry signals are based on price crossovers with the 20-period EMA, filtered by the 50-period EMA 2. Long entry conditions: price crosses above 20 EMA and is above 50 EMA 3. Short entry conditions: price crosses below 20 EMA and is below 50 EMA 4. Stop-loss: dynamically calculated using 14-period ATR to adapt to market volatility 5. Profit target: uses a 1.5 risk-reward ratio, setting profit targets at 1.5 times the stop-loss distance

Strategy Advantages

- Multiple timeframe validation: Uses 20/50/100 EMAs to reduce false signals

- Dynamic risk management: ATR-based stops provide market-adaptive risk control

- Clear risk-reward ratio: Fixed 1.5 R/R setting promotes long-term profitability

- Combines trend-following with swing trading: Captures both major trends and short-term opportunities

- Visualized trading signals: Provides clear graphical interface for better understanding and execution

Strategy Risks

- Choppy market risk: May generate frequent false breakout signals during consolidation

- Slippage risk: Actual execution prices may differ from signal prices during rapid market movements

- Trend reversal risk: Sudden trend reversals may result in significant losses

- Parameter optimization risk: Over-optimization may lead to poor real-world performance

Optimization Directions

- Incorporate volume indicators: Use volume to confirm price breakout validity

- Add trend strength filters: Consider ADX or similar indicators to improve entry quality

- Optimize stop-loss method: Consider implementing trailing stops for better profit protection

- Market environment classification: Adjust parameters based on different market conditions

- Add volatility filters: Suspend trading during excessive market volatility

Summary

This strategy combines multiple EMAs and ATR-based dynamic risk control to create a trading system that features both trend-following and swing trading characteristics. Its strengths lie in systematic approach and controllable risk, but practical application requires attention to market adaptability and specific optimizations based on actual conditions. Through proper parameter settings and strict risk control, the strategy has the potential to achieve stable trading results across most market environments.

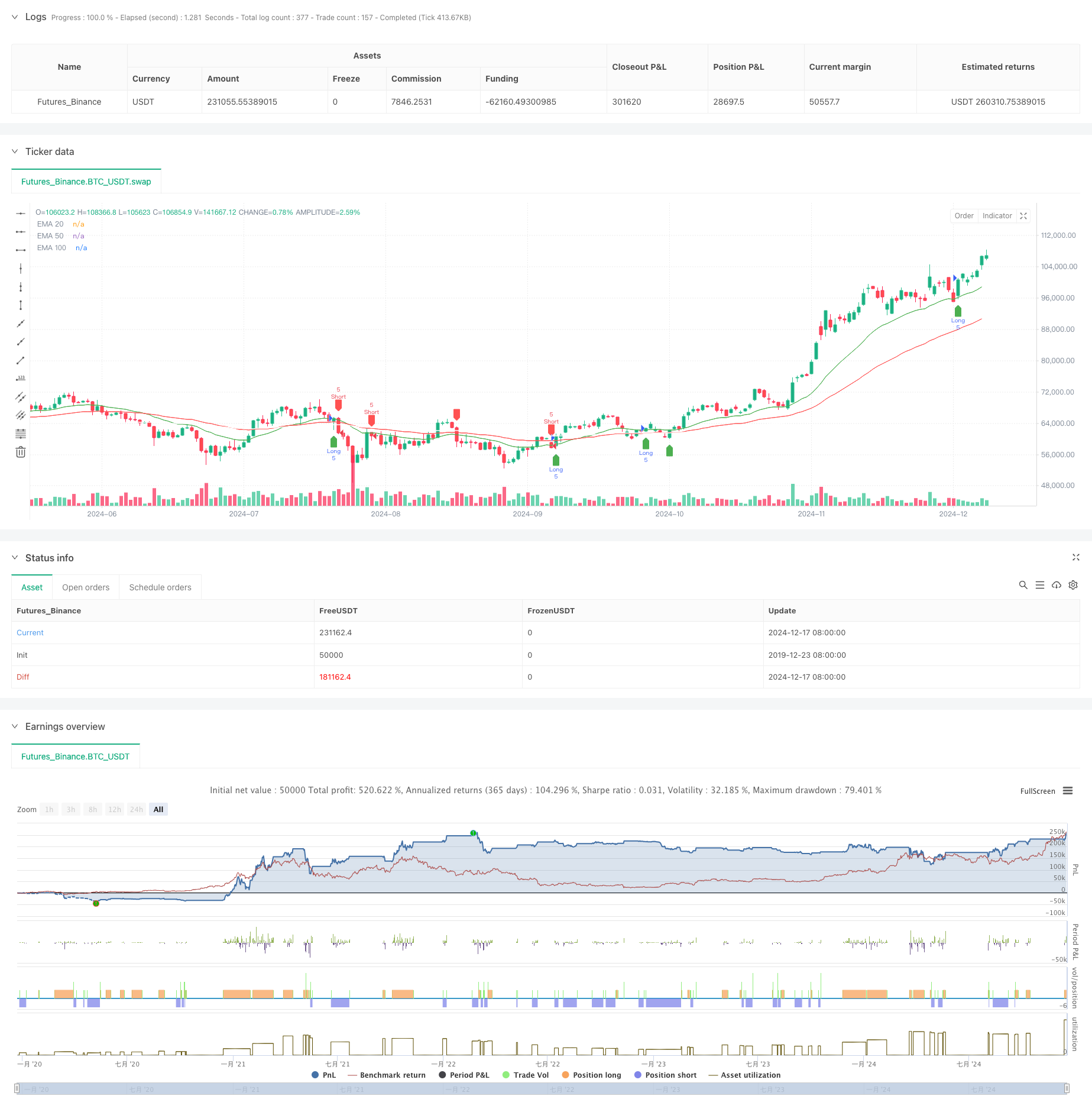

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("EMA Swing Strategy with ATR", overlay=true)

// Inputs

emaShort = input.int(20, "Short EMA")

emaMid = input.int(50, "Mid EMA")

emaLong = input.int(100, "Long EMA")

rrRatio = input.float(1.5, "Risk-Reward Ratio")

contracts = input.int(5, "Number of Contracts")

// Calculations

ema20 = ta.ema(close, emaShort)

ema50 = ta.ema(close, emaMid)

ema100 = ta.ema(close, emaLong)

atr = ta.atr(14)

// Conditions

longCondition = ta.crossover(close, ema20) and close > ema50

shortCondition = ta.crossunder(close, ema20) and close < ema50

// Variables for trades

var float entryPrice = na

var float stopLoss = na

var float takeProfit = na

// Long Trades

if (longCondition)

entryPrice := close

stopLoss := close - atr

takeProfit := close + atr * rrRatio

strategy.entry("Long", strategy.long, contracts)

strategy.exit("Exit Long", from_entry="Long", stop=stopLoss, limit=takeProfit)

// Short Trades

if (shortCondition)

entryPrice := close

stopLoss := close + atr

takeProfit := close - atr * rrRatio

strategy.entry("Short", strategy.short, contracts)

strategy.exit("Exit Short", from_entry="Short", stop=stopLoss, limit=takeProfit)

// Plot EMAs

plot(ema20, color=color.green, title="EMA 20")

plot(ema50, color=color.red, title="EMA 50")

plot(ema100, color=color.white, title="EMA 100")

// Visualization for Entries

plotshape(series=longCondition, style=shape.labelup, color=color.green, location=location.belowbar, title="Long Entry")

plotshape(series=shortCondition, style=shape.labeldown, color=color.red, location=location.abovebar, title="Short Entry")

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- G-Trend EMA ATR Intelligent Trading Strategy

- EMA Dynamic Trend Following Trading Strategy

- Enhanced Multi-Indicator Momentum Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- K Consecutive Candles Bull Bear Strategy

- Triple EMA Crossover Strategy

- Keltner Channels EMA ATR Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Supertrend and EMA Combination Strategy

- Multi-EMA Cross with Oscillator and Dynamic Support/Resistance Trading Strategy

- Multi-Indicator Trend Crossing Strategy: Bull Market Support Band Trading System

- Multi-Level Dynamic MACD Trend Following Strategy with 52-Week High/Low Extension Analysis System

- Dual EMA RSI Momentum Trend Reversal Trading System - A Momentum Breakthrough Strategy Based on EMA and RSI Crossover

- Multi-Indicator High-Frequency Range Trading Strategy

- Dynamic Trendline Breakout Reversal Trading Strategy

- Multi-Indicator Dynamic Trend Following Strategy Based on EMA and SMA

- Enhanced Fibonacci Trend Following and Risk Management Strategy

- Adaptive Multi-State EMA-RSI Momentum Strategy with Choppiness Index Filter System

- Intelligent Exponential Moving Average Trading Strategy Optimization System

- AI-Powered Volatility Price System Divergence Trading Strategy

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Multi-Period RSI Divergence with Support/Resistance Quantitative Trading Strategy

- Adaptive Trend Following Strategy with Dynamic Drawdown Control System

- Multi-EMA Golden Cross Strategy with Tiered Take-Profit

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI and Stochastic RSI Synergy Trading System

- Dynamic Buy Entry Strategy Combining EMA Crossing and Candle Body Penetration

- Intelligent Wave-Trend Dollar Cost Averaging Cyclical Trading Strategy

- MACD-RSI Crossover Trend Following Strategy with Bollinger Bands Optimization System

- Adaptive EMA Dynamic Position Break-out Trading Strategy

- Multi-Indicator Dynamic Trading Optimization Strategy