Overview

This strategy is a trend following system that combines Bollinger Bands, volatility metrics, and risk management. It captures trending opportunities by monitoring price breakouts beyond Bollinger Bands while dynamically adjusting position sizes using ATR for precise risk control. The strategy also incorporates a consolidation period detection mechanism to effectively filter false signals in ranging markets.

Strategy Principles

The strategy operates based on the following core logic: 1. Uses a 20-period moving average as the middle band of Bollinger Bands, with upper and lower bands at 2 standard deviations. 2. Identifies market consolidation periods by comparing current Bollinger Band width to its moving average. 3. During non-consolidation periods, enters long positions on upper band breakouts and short positions on lower band breakouts. 4. Utilizes 14-period ATR to dynamically calculate stop-loss levels and sets take-profit levels based on a 2:1 risk-reward ratio. 5. Automatically calculates position sizes for each trade based on 1% account risk limit and ATR value.

Strategy Advantages

- High Adaptability - Bollinger Bands automatically adjust width based on market volatility, adapting to different market conditions.

- Comprehensive Risk Control - Effectively controls risk per trade through percentage risk limits and dynamic position sizing using ATR.

- High Signal Quality - Filters low-quality signals by identifying consolidation periods, improving win rate.

- Complete Trading System - Includes entry, exit, and position management components.

- Clear Operating Rules - Clear rules for signal generation and position calculation, easy to execute.

Strategy Risks

- Trend Reversal Risk - May suffer significant losses during sudden trend reversals.

- Slippage Impact - May face significant slippage costs during highly volatile periods.

- False Breakout Risk - False breakouts may still occur despite consolidation filtering.

- Capital Efficiency - May generate frequent trades in ranging markets, increasing transaction costs.

- Parameter Sensitivity - Strategy performance significantly affected by choice of Bollinger Bands and risk control parameters.

Optimization Directions

- Add Trend Confirmation Indicators - Can incorporate other trend indicators like MACD or RSI for signal confirmation.

- Improve Consolidation Detection - Can introduce volume information to enhance consolidation period detection accuracy.

- Dynamic Parameter Adjustment - Automatically adjust Bollinger Bands and ATR parameters based on market volatility.

- Enhanced Stop-Loss Mechanism - Can add trailing stop-loss functionality for better profit protection.

- Add Time Filters - Consider adding trading time windows to avoid low liquidity periods.

Summary

This strategy captures trends through Bollinger Bands breakouts while incorporating a comprehensive risk control system. Its strengths lie in high adaptability and controlled risk, though attention must be paid to false breakouts and trend reversal risks. The strategy has room for further improvement through adding trend confirmation indicators and optimizing parameter adjustment mechanisms. Overall, it represents a logically sound and practical trend following strategy.

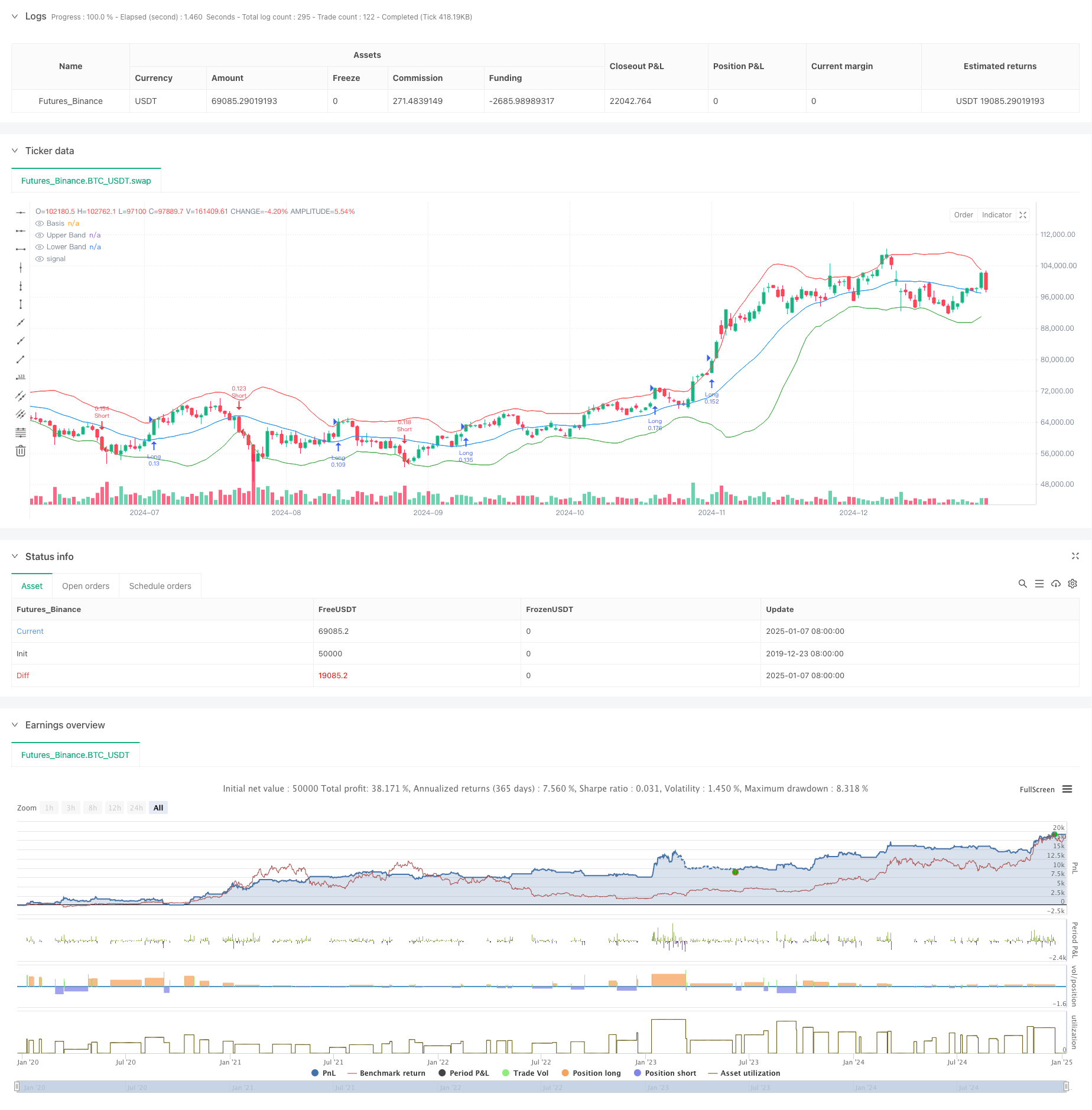

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Breakout Strategy", overlay=true)

// Input parameters

length = input(20, title="Bollinger Bands Length")

stdDev = input(2.0, title="Standard Deviation")

riskRewardRatio = input(2.0, title="Risk/Reward Ratio")

atrLength = input(14, title="ATR Length")

riskPercentage = input(1.0, title="Risk Percentage per Trade")

// Calculate Bollinger Bands

basis = ta.sma(close, length)

dev = stdDev * ta.stdev(close, length)

upperBand = basis + dev

lowerBand = basis - dev

// Calculate ATR for position sizing

atr = ta.atr(atrLength)

// Plot Bollinger Bands

plot(basis, color=color.blue, title="Basis")

plot(upperBand, color=color.red, title="Upper Band")

plot(lowerBand, color=color.green, title="Lower Band")

// Market Consolidation Detection

isConsolidating = (upperBand - lowerBand) < ta.sma(upperBand - lowerBand, length) * 0.5

// Breakout Conditions

longCondition = ta.crossover(close, upperBand) and not isConsolidating

shortCondition = ta.crossunder(close, lowerBand) and not isConsolidating

// Risk Management: Calculate position size

equity = strategy.equity

riskAmount = equity * (riskPercentage / 100)

positionSize = riskAmount / (atr * riskRewardRatio)

// Execute trades with risk management

if (longCondition)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("Take Profit", from_entry="Long", limit=close + atr * riskRewardRatio, stop=close - atr)

if (shortCondition)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("Take Profit", from_entry="Short", limit=close - atr * riskRewardRatio, stop=close + atr)

// Alert conditions for breakouts

alertcondition(longCondition, title="Long Breakout", message="Long breakout detected!")

alertcondition(shortCondition, title="Short Breakout", message="Short breakout detected!")