Multi-timeframe Fair Value Gap Breakout Strategy with Historical Backtest

Author: ChaoZhang, Date: 2025-01-17 14:45:10Tags: FVGBOSHTFRRSL

Strategy Overview

This strategy is a comprehensive trading system that combines multi-timeframe analysis, Fair Value Gap (FVG), and Break of Structure (BOS). It identifies potential trading entries by detecting structure breakouts on higher timeframes while looking for fair value gap opportunities on lower timeframes. The strategy also incorporates a risk management system with automated stop-loss and take-profit settings.

Strategy Principles

The core logic is built on three main pillars: First, it uses a higher timeframe (default 1 hour or above) to identify Break of Structure (BOS), which provides the foundational framework for trading direction. Second, it looks for Fair Value Gaps (FVG) on lower timeframes, indicating potential supply-demand imbalances in those areas. Finally, it combines these conditions with current price position to trigger trading signals when price is in favorable locations. The system manages risk through risk-reward ratios and stop-loss factors.

Strategy Advantages

- Multi-dimensional Analysis: Combines multiple timeframe analysis to enhance signal reliability.

- Comprehensive Risk Management: Built-in risk-reward settings and stop-loss control mechanisms ensure clear risk management for each trade.

- Visual Feedback: Strategy provides clear visual feedback including FVG box display and potential trade opportunity markers.

- High Adaptability: Through parameter adjustment, the strategy can adapt to different market conditions and trading styles.

Strategy Risks

- False Breakout Risk: Markets may exhibit false breakouts leading to incorrect trading signals. Solution is to add signal confirmation mechanisms.

- Signal Delay: Due to the use of higher timeframe data, there may be signal lag. Recommended to combine with other technical indicators for confirmation.

- Market Volatility Risk: During high volatility periods, FVG formation may not be stable. Can be addressed by adjusting the FVG observation length.

Strategy Optimization Directions

- Signal Filtering: Add volume confirmation mechanism to confirm signals only when supported by volume.

- Dynamic Parameters: Dynamically adjust risk-reward ratio and stop-loss factor based on market volatility.

- Trend Filtering: Add trend identification indicators to only take positions in trend direction.

- Time Filtering: Add trading session filters to avoid trading during unfavorable market periods.

Summary

This strategy constructs a complete trading system through the comprehensive use of multi-timeframe analysis, price structure breakouts, and fair value gaps. Its strengths lie in its multi-dimensional analysis approach and comprehensive risk management mechanisms, but traders still need to optimize parameters and control risks according to actual market conditions. Further optimization can focus on signal confirmation, dynamic parameter adjustment, and market environment filtering to further improve strategy stability and reliability.

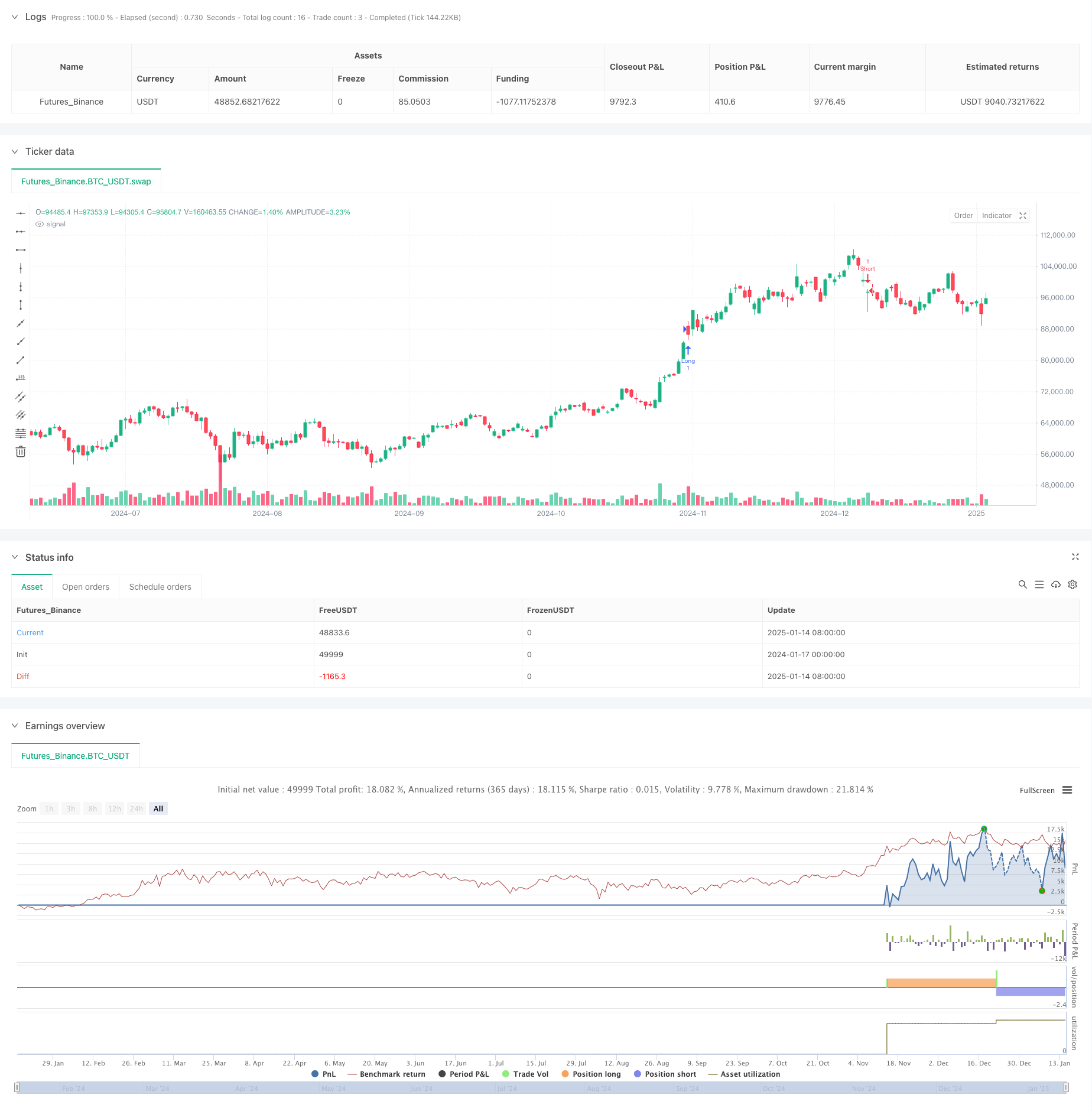

/*backtest

start: 2024-01-17 00:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("ICT Strategy with Historical Backtest", overlay=true)

// === Настройки ===

tf = input.timeframe("60", title="Higher Timeframe (1H or above)") // Таймфрейм для анализа BOS

fvg_length = input(3, title="FVG Lookback Length") // Длина для поиска FVG

risk_reward = input(2, title="Risk-Reward Ratio") // Риск-вознаграждение

show_fvg_boxes = input(true, title="Show FVG Boxes") // Показывать FVG

stop_loss_factor = input.float(1.0, title="Stop Loss Factor") // Множитель для стоп-лосса

// === Переменные для анализа ===

var float bos_high = na

var float bos_low = na

// Получаем данные с более старшего таймфрейма

htf_high = request.security(syminfo.tickerid, tf, high)

htf_low = request.security(syminfo.tickerid, tf, low)

htf_close = request.security(syminfo.tickerid, tf, close)

// Определение BOS (Break of Structure) на старшем таймфрейме

bos_up = ta.highest(htf_high, fvg_length) > ta.highest(htf_high[1], fvg_length)

bos_down = ta.lowest(htf_low, fvg_length) < ta.lowest(htf_low[1], fvg_length)

// Обновляем уровни BOS

if (bos_up)

bos_high := ta.highest(htf_high, fvg_length)

if (bos_down)

bos_low := ta.lowest(htf_low, fvg_length)

// === Определение FVG (Fair Value Gap) ===

fvg_up = low > high[1] and low[1] > high[2]

fvg_down = high < low[1] and high[1] < low[2]

// Визуализация FVG (Fair Value Gap)

// if (show_fvg_boxes)

// if (fvg_up)

// box.new(left=bar_index[1], top=high[1], right=bar_index, bottom=low, bgcolor=color.new(color.green, 90), border_color=color.green)

// if (fvg_down)

// box.new(left=bar_index[1], top=high, right=bar_index, bottom=low[1], bgcolor=color.new(color.red, 90), border_color=color.red)

// === Логика сделок ===

// Условия для входа в Лонг

long_condition = bos_up and fvg_up and close < bos_high

if (long_condition)

strategy.entry("Long", strategy.long, stop=low * stop_loss_factor, limit=low + (high - low) * risk_reward)

// Условия для входа в Шорт

short_condition = bos_down and fvg_down and close > bos_low

if (short_condition)

strategy.entry("Short", strategy.short, stop=high * stop_loss_factor, limit=high - (high - low) * risk_reward)

// === Надписи для прогнозируемых сделок ===

if (long_condition)

label.new(bar_index, low, text="Potential Long", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.small)

if (short_condition)

label.new(bar_index, high, text="Potential Short", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.small)

- Multi-MA Trend Intensity Trading Strategy - A Flexible Smart Trading System Based on MA Deviation

- Multi-Period Dynamic Signal Integration ICT Smart Structure Breakthrough Strategy

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Trend Structure Break with Order Block and Fair Value Gap Strategy

- Risk-Reward Ratio Optimized Strategy Based on Moving Average Crossover

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Dual EMA Crossover Strategy with Smart Risk-Reward Control

- Multi-Timeframe Trading Strategy Combining Harmonic Patterns and Williams %R

- Dual Moving Average Trend Following Strategy with ATR-Based Risk Management System

- Multi-Trend Following and Structure Breakout Strategy

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Multi-Channel Dynamic Support Resistance Keltner Channel Strategy

- Machine Learning Adaptive SuperTrend Quantitative Trading Strategy

- Dynamic WaveTrend and Fibonacci Integrated Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic Volatility Filter

- Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

- Year-end Trend Following Momentum Trading Strategy(60-day MA Breakout)

- Multi-Indicator Trend Following with RSI Overbought/Oversold Quantitative Trading Strategy

- Efficient Price Channel Trading Strategy Based on 15-Minute Breakout

- Dynamic QQE Trend Following with Risk Management Quantitative Trading Strategy

- Dual Trend Confirmation Trading Strategy Based on Moving Averages and Outside Bar Pattern

- Dynamic Trend Following SuperTrend Triple Enhancement Strategy

- RSI Dynamic Breakout Retracement Trading Strategy

- Optimized Dual T3 Trend Tracking Strategy

- Multi-Condition Donchian Channel Momentum Breakout Strategy

- Multi-Period Technical Indicator Dynamic Trading System Strategy

- Dynamic Support Resistance & Bollinger Bands Multi-Indicator Cross Strategy

- Multi-Dimensional Ichimoku Cloud Price Breakthrough Trend Confirmation Trading Strategy

- Dynamic Neural RSI Trend-Following Trading Strategy