Estrategia de negociación ATR de varias etapas con obtención de beneficios dinámicos

El autor:¿ Qué pasa?, Fecha: 2024-12-05 16:49:57Las etiquetas:El ATRLa SMAEn el caso de lasEn el caso de las empresasTPSL- ¿Qué es?AATR

Resumen general

Esta es una estrategia de negociación de múltiples capas que integra cálculos adaptativos de Rango Verdadero Promedio (ATR) con detección de tendencia basada en el impulso. La característica más distintiva de la estrategia es su mecanismo único de toma de ganancias en 7 pasos, que combina cuatro niveles de salida basados en ATR y tres niveles de porcentaje fijo. Este enfoque híbrido permite a los operadores ajustarse dinámicamente a la volatilidad del mercado mientras capturan sistemáticamente ganancias en posiciones de mercado largas y cortas. La estrategia proporciona una solución comercial integral a través de la combinación de cálculos dinámicos de ATR, detección de fuerza de tendencia y múltiples mecanismos de toma de ganancias.

Principios de estrategia

La estrategia opera a través de varios componentes clave: 1. Cálculo de rango verdadero mejorado: mide la volatilidad del mercado considerando los movimientos de precios más significativos. 2. Integración del factor de impulso: Ajusta el ATR en función de los movimientos recientes de precios para una mejor adaptabilidad. 3. Cálculo de ATR adaptativo: modifica el ATR tradicional basado en el factor de impulso para aumentar la sensibilidad durante los períodos volátiles. Cuantificación de la fuerza de la tendencia: evalúa la fuerza de la tendencia a través de algoritmos sofisticados. Mecanismo de ganancias de siete pasos: Incluye cuatro niveles de salida basados en ATR y tres niveles de porcentaje fijo.

Ventajas estratégicas

- Alta adaptabilidad: se adapta a las diferentes condiciones del mercado mediante cálculos dinámicos de ATR.

- Gestión integral del riesgo: el mecanismo de obtención de beneficios de múltiples capas proporciona un control sistemático del riesgo.

- Alta flexibilidad: Funciona con la misma eficacia tanto en los mercados largos como en los cortos.

- Parámetros ajustables: ofrece múltiples parámetros personalizables para adaptarse a diferentes estilos de negociación.

- Ejecución sistemática: reglas claras de entrada y salida reducen el comercio emocional.

Riesgos estratégicos

- Sensibilidad de los parámetros: la configuración incorrecta de los parámetros puede conducir a un exceso de negociación o a oportunidades perdidas.

- Dependencia de las condiciones del mercado: puede tener un rendimiento inferior en mercados altamente volátiles o variables.

- Riesgo de complejidad: el mecanismo de obtención de beneficios de múltiples capas puede aumentar la dificultad de ejecución.

- Impacto del deslizamiento: el deslizamiento puede afectar significativamente a varios puntos de ganancia.

- Requisitos de capital: Se requiere suficiente capital para ejecutar una estrategia de beneficios de múltiples capas.

Direcciones para la optimización de la estrategia

- Ajuste dinámico de parámetros: ajusta automáticamente los parámetros según las condiciones del mercado.

- Filtración del entorno de mercado: añadir un mecanismo de identificación del entorno de mercado.

- Mejora de la gestión de riesgos: introducir un mecanismo dinámico de stop-loss.

- Optimización de la ejecución: simplificar el mecanismo de obtención de beneficios para reducir el impacto del deslizamiento.

- Mejora del marco de pruebas de retroceso: Incluir factores comerciales más realistas.

Resumen de las actividades

Esta estrategia proporciona a los traders un sistema comercial integral mediante la combinación de ATR adaptativo y mecanismos de toma de ganancias de múltiples capas. Su fortaleza radica en su capacidad para adaptarse a diferentes condiciones del mercado mientras gestiona el riesgo a través de un enfoque sistemático. Si bien hay algunos riesgos potenciales, la estrategia puede convertirse en una herramienta comercial efectiva a través de la optimización y gestión de riesgos adecuados. Su innovador mecanismo de toma de ganancias de múltiples capas es particularmente adecuado para los traders que buscan maximizar las ganancias manteniendo el control del riesgo.

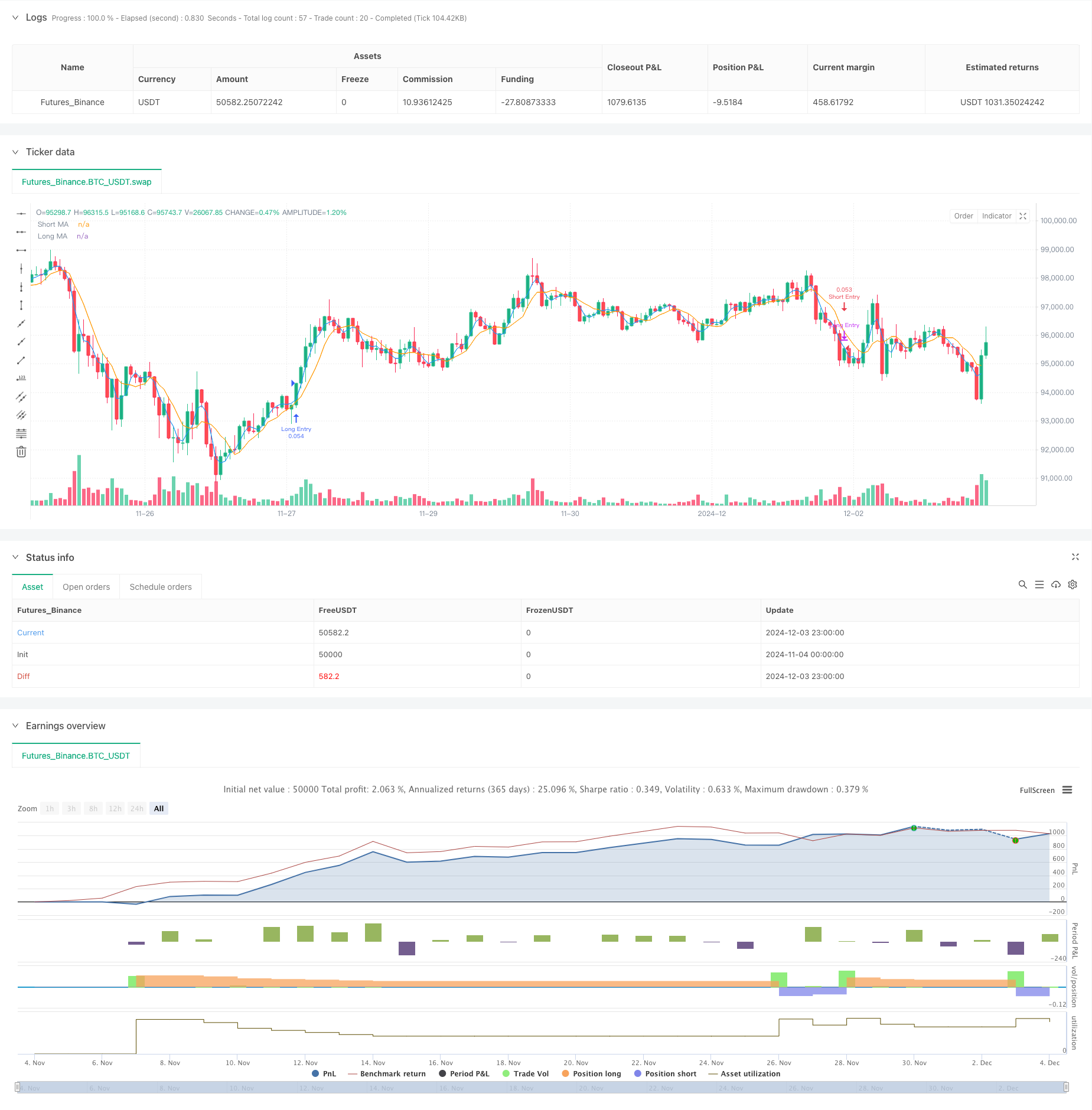

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

- Estrategia doble de cruce de medias móviles con gestión dinámica del riesgo

- Estrategia de Stop Loss & Take Profit de promedio móvil sin problemas con filtro de tendencia y salida excepcional

- Estrategia cruzada de promedio móvil dinámico y bandas de Bollinger con modelo de optimización de stop-loss fijo

- Estrategia del modelo de optimización de la tendencia de fusión de ATR

- La media móvil adaptativa se cruza con la estrategia de stop-loss posterior.

- Estrategia de negociación filtrada por múltiples indicadores con bandas de Bollinger y CCI de Woodies

- Sistema de negociación de ruptura de tendencia con media móvil (Estrategia TBMA)

- Tendencia cruzada de la media móvil dinámica siguiendo una estrategia con gestión adaptativa del riesgo

- Estrategia de negociación cuantitativa adaptativa con doble cruce de media móvil y toma de ganancias/detención de pérdidas

- Estrategia de cruce de doble objetivo en movimiento promedio

- Las operaciones de inversión en el mercado de divisas se clasifican en el grupo de operaciones de inversión.

- Las bandas de Bollinger y la estrategia de negociación dinámica combinada del RSI

- Estrategia de negociación combinada de volatilidad de impulso RSI-ATR

- Estrategia de doble seguimiento de tendencias de la EMA con entrada de compra limitada

- Sistema de negociación de análisis técnico multiestratégico

- Estrategia de negociación combinada de reconocimiento de patrones de velas de varios plazos

- Las bandas de triple Bollinger tocan la tendencia siguiendo una estrategia de negociación cuantitativa

- Sistema de negociación de ruptura dinámica multidimensional basado en bandas de Bollinger y RSI

- Estrategia de ruptura de la inversión media del RSI

- Tendencia del impulso de la doble EMA a través de la estrategia

- Sistema de negociación de soporte dinámico de doble marco de tiempo

- Tendencia cruzada de la media móvil de varios períodos y el impulso del RSI siguiendo la estrategia

- Sistema de mediación de la zona de salida y señal de venta excesiva de activos financieros basado en las IFM

- Estrategia de negociación multi-EMA con indicadores de impulso

- Estrategia de negociación cuantitativa de pirámide de Martingale combinada MACD-KDJ

- Reconocimiento de patrones múltiples y estrategia de negociación a nivel de SR

- Sistema de negociación de filtros de tendencia G-Channel y EMA

- Tendencia dinámica del índice de rentabilidad de pérdidas y pérdidas de cierre de varios períodos siguiendo la estrategia

- Sistema dinámico de negociación de media móvil doble

- Tendencia de impulso cruzado de múltiples indicadores siguiendo una estrategia con un sistema optimizado de toma de ganancias y parada de pérdidas