Descripción general

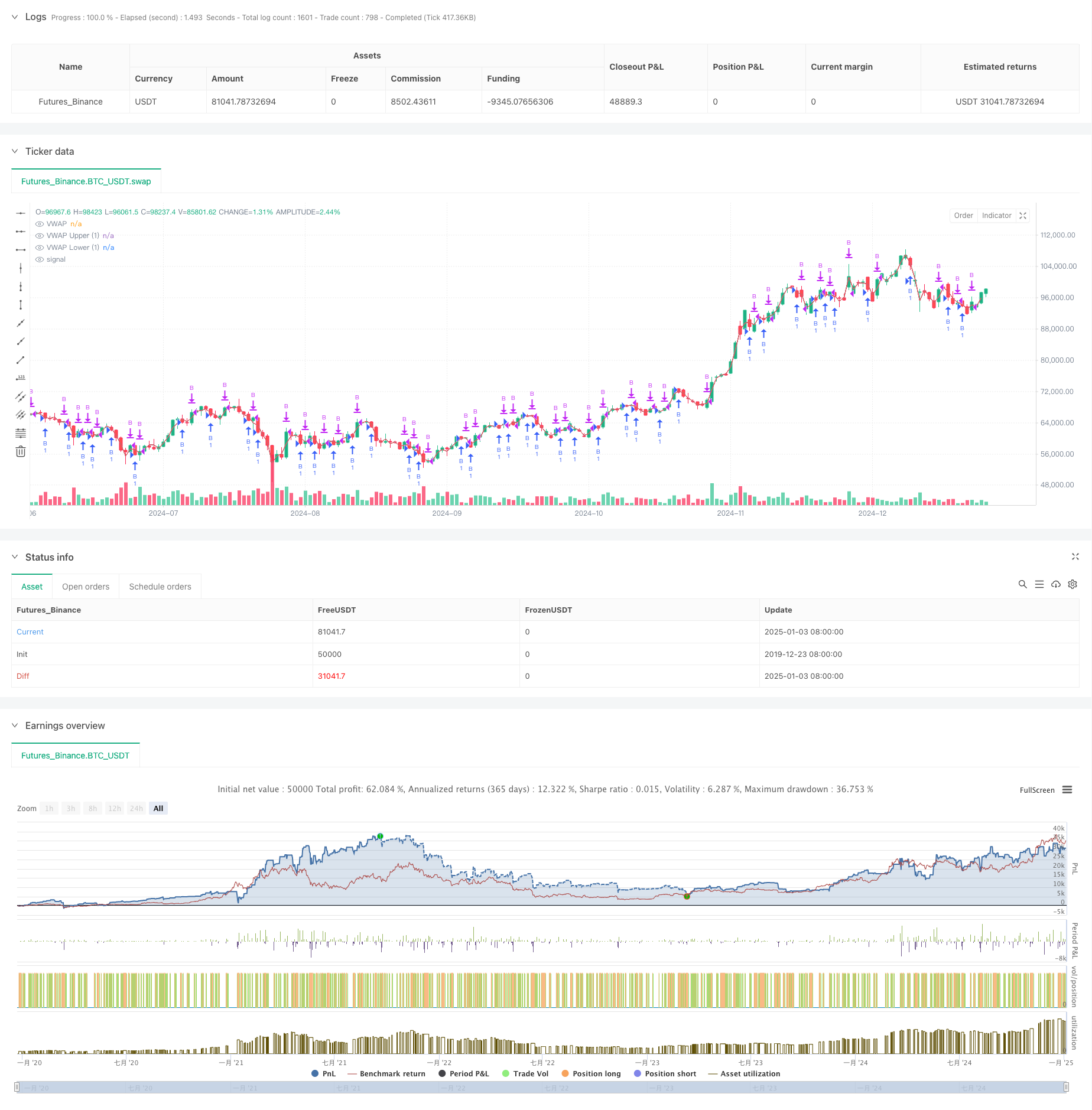

La estrategia es una estrategia de ruptura de tendencia basada en VWAP (precio promedio ponderado por volumen) y canales de desviación estándar. Construye un rango de fluctuación de precios dinámico calculando VWAP y los canales de desviación estándar superior e inferior para capturar oportunidades comerciales cuando los precios suben. La estrategia se basa principalmente en las señales de ruptura de la banda de desviación estándar para operar y establece objetivos de ganancias e intervalos de órdenes para controlar los riesgos.

Principio de estrategia

- Cálculo del indicador básico:

- Calcule VWAP utilizando el precio y el volumen intradiarios de HL2

- Calcular la desviación estándar en función de las fluctuaciones de precios

- Establezca los canales superior e inferior en 1,28 veces la desviación estándar

- Lógica de transacción:

- Condiciones de entrada: El precio cruza la pista inferior y luego sube a la pista superior.

- Condiciones de salida: alcanzar el objetivo de beneficio preestablecido

- Establezca un intervalo de pedido mínimo para evitar transacciones frecuentes

Ventajas estratégicas

- Estadísticas básicas

- Referencia de precio pivote basada en VWAP

- Uso de la desviación estándar para medir la volatilidad

- Ajuste dinámico del rango de negociación

- Control de riesgos

- Establecer objetivos de beneficios fijos

- Control de la frecuencia de las transacciones

- Las estrategias de long-only reducen el riesgo

Riesgo estratégico

- Riesgo de mercado

- La volatilidad salvaje puede provocar falsas rupturas

- Es difícil captar con precisión el punto de inflexión de la tendencia.

- La caída unilateral conduce a mayores pérdidas

- Riesgo de parámetro

- Sensibilidad de configuración múltiple con desviación estándar

- Es necesario optimizar la fijación de objetivos de beneficios

- El intervalo de negociación afecta el rendimiento de las ganancias

Dirección de optimización

- Optimización de señal

- Añadir filtro de juicio de tendencias

- Confirmado por cambios en el volumen comercial

- Agregue otros indicadores técnicos para verificar

- Optimización de la gestión de riesgos

- Establecer dinámicamente la posición de stop loss

- Ajustar posiciones en función de la volatilidad

- Mejorar el mecanismo de gestión de pedidos

Resumir

Se trata de una estrategia comercial cuantitativa que combina principios estadísticos y análisis técnico. Mediante la coordinación del VWAP y la banda de desviación estándar, se construye un sistema de comercio relativamente confiable. La principal ventaja de la estrategia radica en su base estadística científica y su mecanismo perfecto de control de riesgos, pero aún necesita optimizar continuamente los parámetros y la lógica comercial en aplicaciones prácticas.

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("VWAP Stdev Bands Strategy (Long Only)", overlay=true)

// Standard Deviation Inputs

devUp1 = input.float(1.28, title="Stdev above (1)")

devDn1 = input.float(1.28, title="Stdev below (1)")

// Show Options

showPrevVWAP = input(false, title="Show previous VWAP close?")

profitTarget = input.float(2, title="Profit Target ($)", minval=0) // Profit target for closing orders

gapMinutes = input.int(15, title="Gap before new order (minutes)", minval=0) // Gap for placing new orders

// VWAP Calculation

var float vwapsum = na

var float volumesum = na

var float v2sum = na

var float prevwap = na // Track the previous VWAP

var float lastEntryPrice = na // Track the last entry price

var int lastEntryTime = na // Track the time of the last entry

start = request.security(syminfo.tickerid, "D", time)

newSession = ta.change(start)

vwapsum := newSession ? hl2 * volume : vwapsum[1] + hl2 * volume

volumesum := newSession ? volume : volumesum[1] + volume

v2sum := newSession ? volume * hl2 * hl2 : v2sum[1] + volume * hl2 * hl2

myvwap = vwapsum / volumesum

dev = math.sqrt(math.max(v2sum / volumesum - myvwap * myvwap, 0))

// Calculate Upper and Lower Bands

lowerBand1 = myvwap - devDn1 * dev

upperBand1 = myvwap + devUp1 * dev

// Plot VWAP and Bands with specified colors

plot(myvwap, style=plot.style_line, title="VWAP", color=color.green, linewidth=1)

plot(upperBand1, style=plot.style_line, title="VWAP Upper (1)", color=color.blue, linewidth=1)

plot(lowerBand1, style=plot.style_line, title="VWAP Lower (1)", color=color.red, linewidth=1)

// Trading Logic (Long Only)

longCondition = close < lowerBand1 and close[1] >= lowerBand1 // Price crosses below the lower band

// Get the current time in minutes

currentTime = timestamp("GMT-0", year(timenow), month(timenow), dayofmonth(timenow), hour(timenow), minute(timenow))

// Check if it's time to place a new order based on gap

canPlaceNewOrder = na(lastEntryTime) or (currentTime - lastEntryTime) >= gapMinutes * 60 * 1000

// Close condition based on profit target

if (strategy.position_size > 0)

if (close - lastEntryPrice >= profitTarget)

strategy.close("B")

lastEntryTime := na // Reset last entry time after closing

// Execute Long Entry

if (longCondition and canPlaceNewOrder)

strategy.entry("B", strategy.long)

lastEntryPrice := close // Store the entry price

lastEntryTime := currentTime // Update the last entry time

// Add label for the entry

label.new(bar_index, close, "B", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

// Optional: Plot previous VWAP for reference

prevwap := newSession ? myvwap[1] : prevwap[1]

plot(showPrevVWAP ? prevwap : na, style=plot.style_circles, color=close > prevwap ? color.green : color.red)