Multi-Timeframe Heikin-Ashi Moving Average Trend Following Trading System

Author: ChaoZhang, Date: 2025-01-06 16:20:56Tags: EMAMACDHASMABUYSELL

Overview

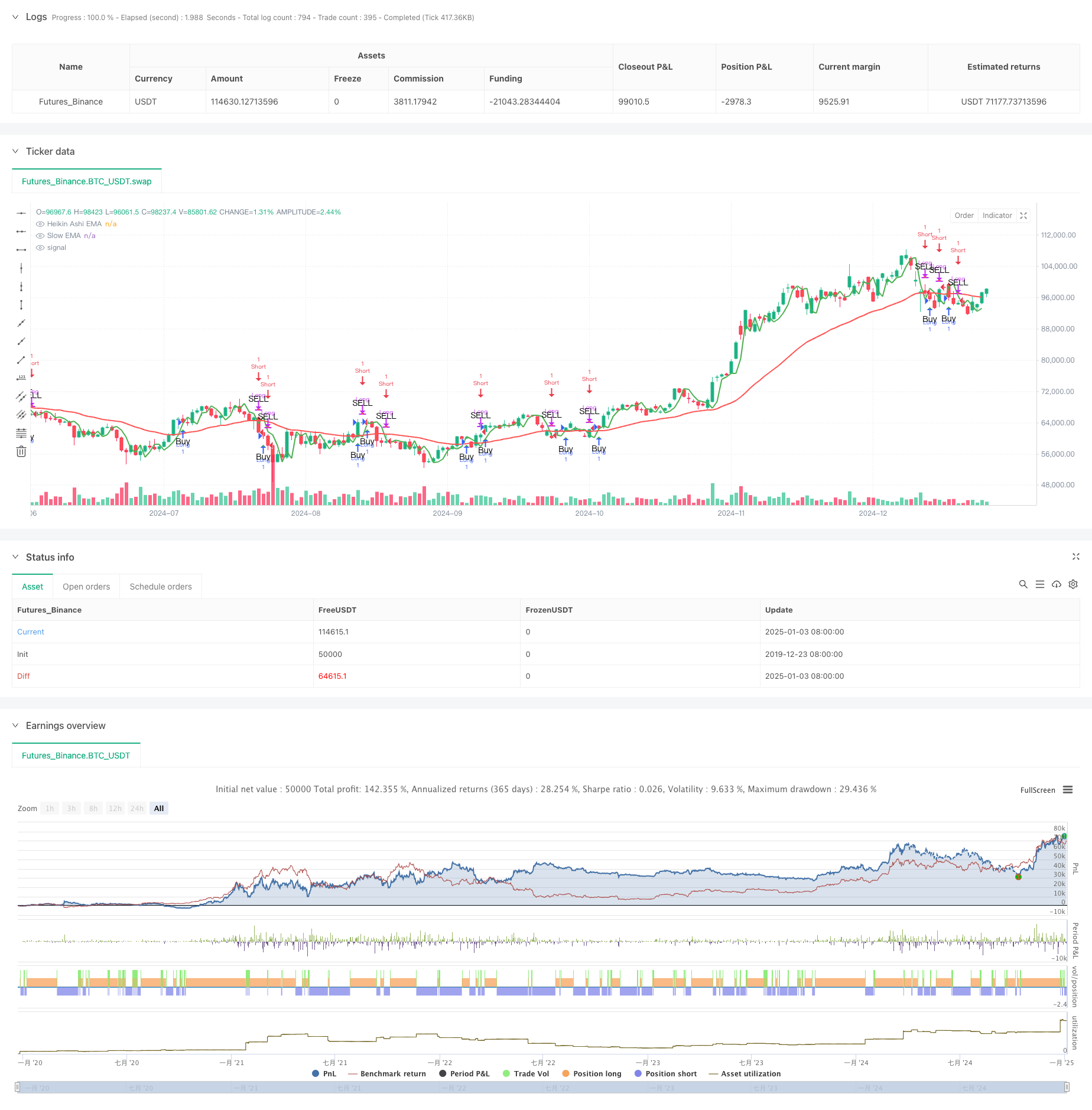

This strategy is a multi-timeframe trend following system based on Heikin-Ashi candlesticks and Exponential Moving Average (EMA) crossovers. It combines the smoothing properties of Heikin-Ashi candlesticks with the trend-following capabilities of moving averages across different timeframes, using MACD as an additional filter to accurately capture market trends. The strategy employs a hierarchical timeframe design, calculating and validating signals across 60-minute, 180-minute, and 15-minute timeframes.

Strategy Principles

The core logic includes several key components:

- Heikin-Ashi calculation: Smooths original price data through special OHLC calculations to reduce market noise.

- Multi-timeframe EMA system: Calculates Heikin-Ashi EMA on 180-minute timeframe, forming crossover signals with slow EMA on 60-minute timeframe.

- MACD filter: Calculates MACD indicator on 15-minute timeframe to validate trading signals.

- Signal generation rules: Generates buy signals when fast Heikin-Ashi EMA crosses above slow EMA with MACD confirmation (if enabled); reverse for sell signals.

Strategy Advantages

- Strong signal smoothing: Heikin-Ashi candlesticks effectively reduce false signals.

- Multi-timeframe validation: Using different timeframes increases signal reliability.

- Effective trend following: EMA crossover system effectively captures medium to long-term trends.

- Flexible filtering mechanism: Optional MACD filter provides additional signal confirmation.

- Strong parameter adaptability: Multiple key parameters can be optimized for different market characteristics.

Strategy Risks

- Choppy market risk: May generate frequent false breakout signals in sideways markets.

- Lag risk: Multi-timeframe validation may lead to slightly delayed entries.

- Parameter sensitivity: Different parameter combinations may result in significant performance variations.

- Market environment dependency: Strategy performs better in strong trend markets, may underperform in other conditions.

Optimization Directions

- Add volatility filtering: Introduce ATR or Bollinger Bands for market volatility assessment.

- Optimize timeframe selection: Adjust timeframe combinations based on specific instrument characteristics.

- Improve stop-loss mechanism: Add trailing stops or volatility-based dynamic stop-losses.

- Enhance position sizing: Dynamically adjust position sizes based on signal strength and market volatility.

- Include market environment analysis: Add trend strength indicators to differentiate market conditions.

Summary

This strategy constructs a complete trend following trading system using multi-timeframe Heikin-Ashi and EMA systems combined with MACD filtering. The design thoroughly considers signal reliability and system stability, capable of adapting to different market environments through parameter optimization and risk control mechanisms. The strategy’s core strengths lie in signal smoothing and multi-validation mechanisms, while attention must be paid to choppy market risks and parameter optimization issues.

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tradingbauhaus

//@version=5

strategy("Heikin Ashi Candle Time Frame @tradingbauhaus", shorttitle="Heikin Ashi Candle Time Frame @tradingbauhaus", overlay=true)

// Inputs

res = input.timeframe(title="Heikin Ashi Candle Time Frame", defval="60")

hshift = input.int(1, title="Heikin Ashi Candle Time Frame Shift")

res1 = input.timeframe(title="Heikin Ashi EMA Time Frame", defval="180")

mhshift = input.int(0, title="Heikin Ashi EMA Time Frame Shift")

fama = input.int(1, title="Heikin Ashi EMA Period")

test = input.int(1, title="Heikin Ashi EMA Shift")

sloma = input.int(30, title="Slow EMA Period")

slomas = input.int(1, title="Slow EMA Shift")

macdf = input.bool(false, title="With MACD filter")

res2 = input.timeframe(title="MACD Time Frame", defval="15")

macds = input.int(1, title="MACD Shift")

// Heikin Ashi calculation

var float ha_open = na

ha_close = (open + high + low + close) / 4

ha_open := na(ha_open[1]) ? (open + close) / 2 : (ha_open[1] + ha_close[1]) / 2

ha_high = math.max(high, math.max(ha_open, ha_close))

ha_low = math.min(low, math.min(ha_open, ha_close))

// Adjusted Heikin Ashi Close for different timeframes

mha_close = request.security(syminfo.tickerid, res1, ha_close[mhshift])

// MACD calculation

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

macdl = request.security(syminfo.tickerid, res2, macdLine[macds])

macdsl = request.security(syminfo.tickerid, res2, signalLine[macds])

// Moving Averages

fma = ta.ema(mha_close[test], fama)

sma = ta.ema(ha_close[slomas], sloma)

plot(fma, title="Heikin Ashi EMA", color=color.green, linewidth=2)

plot(sma, title="Slow EMA", color=color.red, linewidth=2)

// Strategy Logic

golong = ta.crossover(fma, sma) and (macdl > macdsl or not macdf)

goshort = ta.crossunder(fma, sma) and (macdl < macdsl or not macdf)

// Plot Shapes for Buy/Sell Signals

plotshape(golong, color=color.green, text="Buy", style=shape.triangleup, location=location.belowbar)

plotshape(goshort, color=color.red, text="SELL", style=shape.triangledown, location=location.abovebar)

// Strategy Orders

strategy.entry("Long", strategy.long, when=golong)

strategy.close("Long", when=goshort)

strategy.entry("Short", strategy.short, when=goshort)

strategy.close("Short", when=golong)

// Alerts

alertcondition(golong, "Heikin Ashi BUY", "")

alertcondition(goshort, "Heikin Ashi SELL", "")

- Moving Average Crossover + MACD Slow Line Momentum Strategy

- ZeroLag MACD Long Short Strategy

- Zero Lag MACD Dual Crossover Trading Strategy - High-Frequency Trading Based on Short-Term Trend Capture

- K's Reversal Indicator I

- CM MACD Custom Indicator - Multiple Time Frame - V2

- Dual MACD Trend Confirmation Trading System

- Dual Moving Average MACD Crossover Date-Adjustable Quantitative Trading Strategy

- MACD and Martingale Combination Strategy for Optimized Long Trading

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- MACD BB Breakout Strategy

- Multi-Timeframe Quantitative Trading Strategy Based on EMA-Smoothed RSI and ATR Dynamic Stop-Loss/Take-Profit

- Adaptive Fibonacci Bollinger Bands Strategy Analysis

- Multi-Timeframe Candlestick Pattern Trading Strategy

- Multi-Timeframe Supertrend Dynamic Trend Trading Algorithm

- Advanced MACD Crossover Trading Strategy with Adaptive Risk Management

- Quantitative Trend Capture Strategy Based on Candlestick Wick Length Analysis

- Statistical Dual Standard Deviation VWAP Breakout Trading Strategy

- Long Grid Strategy Based on Drawdown and Target Profit

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Multi-Indicator Optimized KDJ Trend Crossover Strategy Based on Dynamic Stochastic Pattern Trading System

- Dynamic Volatility-Adjusted Trend Following Strategy Based on DI Indicators with ATR Stop Management

- Bull Bear Power Trading Strategy with Volume-Percentile Based Dynamic Take-Profit System

- Z-Score Normalized Linear Signal Quantitative Trading Strategy

- Multi-Parameter Stochastic Intelligent Trend Trading Strategy

- Multi-EMA Cross with Volume-Price Momentum Trading Strategy

- Multi-Period Price Level Breakout Trend Trading System Based on Key Price Levels

- Advanced Fibonacci Retracement Trend-Following and Reversal Trading Strategy

- Advanced EMA Crossover Trend Following Strategy with ATR-Based Dynamic Stop Management System

- Mean Reversion Bollinger Bands Trading Strategy with Rational Return Signal

- Multi-Period Moving Average Trend Following with VWAP Cross Strategy