Bull Bear Power Trading Strategy with Volume-Percentile Based Dynamic Take-Profit System

Author: ChaoZhang, Date: 2025-01-06 16:16:04Tags: BBPEMAATRTP

Overview

This strategy combines the Bull Bear Power (BBP) indicator with a multi-level dynamic take-profit system based on volume percentiles. It creates an adaptive and risk-controlled trading system through multi-dimensional analysis of price, volume, and momentum data. The core logic includes using the Z-Score normalized BBP values as trade signal triggers, while incorporating volume percentile analysis for dynamic take-profit adjustments.

Strategy Principles

The core calculations include several key components:

- BBP Indicator: Measures market force balance by summing the difference between high price and EMA (bull power) and low price and EMA (bear power).

- Z-Score Normalization: Standardizes BBP values to assess market strength deviation levels.

- Volume Analysis: Calculates current volume relative to moving average to gauge market activity.

- Percentile Analysis: Computes historical percentiles of price and volume for market state probability distribution.

- Dynamic Take-Profit: Adjusts take-profit levels based on composite scoring of ATR, volume percentile, and price percentile.

Strategy Advantages

- Multi-dimensional Analysis: Provides comprehensive market perspective through price momentum, volume, and market positioning.

- High Adaptability: Adapts to different market environments through dynamic take-profit mechanism.

- Risk Diversification: Implements multi-level take-profit strategy for profit realization at different price levels.

- Statistical Edge: Achieves significant advantage through Z-Score and percentile analysis.

- Extensibility: Framework allows easy addition of new analysis dimensions.

Strategy Risks

- Parameter Sensitivity: Multiple parameters require optimization for different market environments.

- Market Environment Dependency: May underperform during volatile periods or trend transitions.

- Execution Slippage: Multi-level take-profit orders may face execution slippage.

- Computational Complexity: Real-time calculation of multiple indicators may cause system load.

- False Signal Risk: May generate incorrect trading signals in ranging markets.

Optimization Directions

- Parameter Adaptation: Introduce machine learning methods for automatic parameter optimization.

- Market Prediction: Add market environment classification module for early identification of adverse conditions.

- Stop-Loss Optimization: Implement dynamic stop-loss mechanism for improved risk control.

- Signal Filtering: Add trend strength filters to reduce false signals.

- Position Management: Optimize position allocation algorithm for improved capital efficiency.

Summary

This strategy combines traditional BBP indicator with modern quantitative analysis methods to create a trading system with solid theoretical foundation and strong practicality. It achieves good balance between returns and risk through multi-level take-profit and dynamic adjustment mechanisms. While parameter optimization presents some challenges, the strategy framework’s extensibility provides ample room for future improvements. In practical application, traders should make specific adjustments based on market characteristics and individual risk preferences.

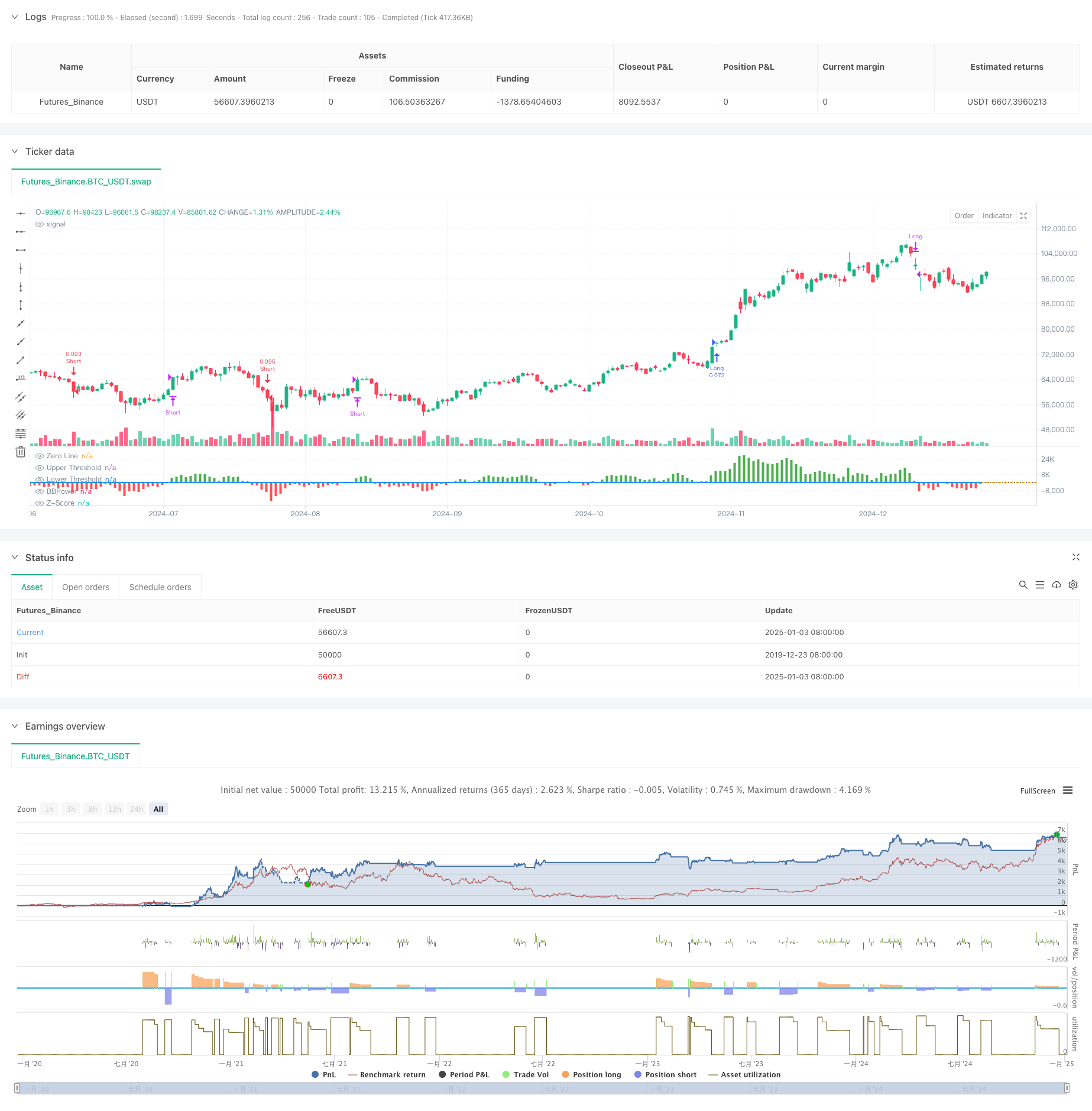

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The BBP Strategy with Volume-Percentile TP by PresentTrading emerges as a sophisticated approach that integrates multiple analytical layers to enhance trading precision and profitability.

// Unlike traditional strategies that rely solely on price movements or volume indicators, this strategy synergizes Bollinger Bands Power (BBP) with volume percentile analysis to determine optimal entry and exit points. Additionally, it employs a dynamic take-profit mechanism based on ATR (Average True Range) multipliers adjusted by volume and percentile factors, ensuring adaptability to varying market conditions.

// This multi-faceted approach not only enhances signal accuracy but also optimizes risk management, setting it apart from conventional trading methodologies.

//@version=5

strategy("BBP Strategy with Volume-Percentile TP - Strategy [presentTrading] ", overlay=false, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// Bull Bear Power Strategy Settings

// ————————

lengthInput = input.int(21, "EMA Length")

zLength = input.int(252, "Z-Score Length")

zThreshold = input.float(1.618, "Z-Score Threshold")

// ————————

// Take Profit Settings

// ————————

tp_group = "Take Profit Settings"

// Enable/disable take profit function

useTP = input.bool(true, "Use Take Profit", group=tp_group)

// === ATR Base Settings ===

// ATR calculation period for determining base price movement range

baseAtrLength = input.int(20, "ATR Period", minval=1, group=tp_group, tooltip="ATR period for calculating base price movement range. Shorter periods are more sensitive to recent volatility")

// === Take Profit Multiplier Settings ===

// First take profit ATR multiplier, usually the most conservative target

atrMult1 = input.float(1.618, "TP1 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="First take profit level ATR multiplier, recommended 1.5-2.0")

// Second take profit ATR multiplier, medium profit target

atrMult2 = input.float(2.382, "TP2 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="Second take profit level ATR multiplier, recommended 2.5-3.0")

// Third take profit ATR multiplier, most aggressive target

atrMult3 = input.float(3.618, "TP3 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="Third take profit level ATR multiplier, recommended 4.0-5.0")

// === Position Size Allocation ===

// First take profit position size, usually larger for securing basic profits

tp1_size = input.float(13, "TP1 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for first take profit, recommended 30-40%")

// Second take profit position size, medium allocation

tp2_size = input.float(13, "TP2 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for second take profit, recommended 30-40%")

// Third take profit position size, usually smaller for catching larger moves

tp3_size = input.float(13, "TP3 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for third take profit, recommended 20-30%")

// ————————

// Volume Analysis Settings

// ————————

vol_group = "Volume Analysis Settings"

// Volume MA period for determining relative volume levels

vol_period = input.int(100, "Volume MA Period", minval=1, group=vol_group, tooltip="Period for calculating volume moving average, recommended 20-30")

// === Volume Level Thresholds ===

// High volume threshold relative to MA

vol_high = input.float(2.0, "High Volume Multiplier", minval=1.0, step=0.1, group=vol_group, tooltip="High volume threshold multiplier, typically 2x MA or above")

// Medium volume threshold

vol_med = input.float(1.5, "Medium Volume Multiplier", minval=1.0, step=0.1, group=vol_group, tooltip="Medium volume threshold multiplier, typically around 1.5x MA")

// Low volume threshold

vol_low = input.float(1.0, "Low Volume Multiplier", minval=0.5, step=0.1, group=vol_group, tooltip="Low volume threshold multiplier, typically around 1x MA")

// === Volume Adjustment Factors ===

// High volume adjustment factor, usually extends take profit targets

vol_high_mult = input.float(1.5, "High Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for high volume")

// Medium volume adjustment factor

vol_med_mult = input.float(1.3, "Medium Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for medium volume")

// Low volume adjustment factor

vol_low_mult = input.float(1.0, "Low Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for low volume")

// ————————

// Percentile Analysis Settings

// ————————

perc_group = "Percentile Analysis Settings"

// Percentile calculation period for evaluating price position

perc_period = input.int(100, "Percentile Period", minval=20, group=perc_group, tooltip="Historical period for percentile calculations, recommended 100-200")

// === Percentile Thresholds ===

// High percentile threshold, typically indicates relative high levels

perc_high = input.float(90, "High Percentile", minval=50, maxval=100, group=perc_group, tooltip="High level percentile threshold, typically above 90")

// Medium percentile threshold

perc_med = input.float(80, "Medium Percentile", minval=50, maxval=100, group=perc_group, tooltip="Medium level percentile threshold, typically around 80")

// Low percentile threshold

perc_low = input.float(70, "Low Percentile", minval=0, maxval=100, group=perc_group, tooltip="Low level percentile threshold, typically around 70")

// === Percentile Adjustment Factors ===

// High percentile adjustment factor

perc_high_mult = input.float(1.5, "High Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for high percentile levels")

// Medium percentile adjustment factor

perc_med_mult = input.float(1.3, "Medium Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for medium percentile levels")

// Low percentile adjustment factor

perc_low_mult = input.float(1.0, "Low Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for low percentile levels")

// ————————

// Core Bull Bear Power Calculations

// ————————

emaClose = ta.ema(close, lengthInput)

bullPower = high - emaClose

bearPower = low - emaClose

bbp = bullPower + bearPower

bbp_mean = ta.sma(bbp, zLength)

bbp_std = ta.stdev(bbp, zLength)

zscore = (bbp - bbp_mean) / bbp_std

// ————————

// Volume & Percentile Analysis

// ————————

// 成交量分析

vol_sma = ta.sma(volume, vol_period)

vol_mult = volume / vol_sma

// 百分位數計算

calcPercentile(src) =>

var values = array.new_float(0)

array.unshift(values, src)

if array.size(values) > perc_period

array.pop(values)

array.size(values) > 0 ? array.percentrank(values, array.size(values)-1) * 100 : 50

price_perc = calcPercentile(close)

vol_perc = calcPercentile(volume)

// 止盈動態調整系數計算

getTpFactor() =>

vol_score = vol_mult > vol_high ? vol_high_mult : vol_mult > vol_med ? vol_med_mult : vol_mult > vol_low ? vol_low_mult : 0.8

price_score = price_perc > perc_high ? perc_high_mult :price_perc > perc_med ? perc_med_mult :price_perc > perc_low ? perc_low_mult : 0.8

math.avg(vol_score, price_score)

// ————————

// Entry/Exit Logic

// ————————

longCondition = ta.crossover(zscore, zThreshold)

shortCondition = ta.crossunder(zscore, -zThreshold)

exitLongCondition = ta.crossunder(zscore, 0)

exitShortCondition = ta.crossover(zscore, 0)

if (barstate.isconfirmed)

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

if exitLongCondition

strategy.close("Long")

if exitShortCondition

strategy.close("Short")

// ————————

// Take Profit Execution

// ————————

if useTP and strategy.position_size != 0

base_move = ta.atr(baseAtrLength)

tp_factor = getTpFactor()

is_long = strategy.position_size > 0

entry_price = strategy.position_avg_price

if is_long

tp1_price = entry_price + (base_move * atrMult1 * tp_factor)

tp2_price = entry_price + (base_move * atrMult2 * tp_factor)

tp3_price = entry_price + (base_move * atrMult3 * tp_factor)

strategy.exit("TP1", "Long", qty_percent=tp1_size, limit=tp1_price)

strategy.exit("TP2", "Long", qty_percent=tp2_size, limit=tp2_price)

strategy.exit("TP3", "Long", qty_percent=tp3_size, limit=tp3_price)

else

tp1_price = entry_price - (base_move * atrMult1 * tp_factor)

tp2_price = entry_price - (base_move * atrMult2 * tp_factor)

tp3_price = entry_price - (base_move * atrMult3 * tp_factor)

strategy.exit("TP1", "Short", qty_percent=tp1_size, limit=tp1_price)

strategy.exit("TP2", "Short", qty_percent=tp2_size, limit=tp2_price)

strategy.exit("TP3", "Short", qty_percent=tp3_size, limit=tp3_price)

// ————————

// Plotting

// ————————

plot(bbp, color=bbp >= 0 ? color.new(color.green, 0) : color.new(color.red, 0),

title="BBPower", style=plot.style_columns)

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

plot(zscore, title="Z-Score", color=color.blue, linewidth=2)

hline(zThreshold, "Upper Threshold", color=color.orange, linestyle=hline.style_dashed)

hline(-zThreshold, "Lower Threshold", color=color.orange, linestyle=hline.style_dashed)

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Triple Exponential Moving Average Trend Trading Strategy

- Advanced EMA Crossover Trend Following Strategy with ATR-Based Dynamic Stop Management System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- Dynamic Long/Short Swing Trading Strategy with Moving Average Crossover Signal System

- Multi-Timeframe Candlestick Pattern Trading Strategy

- Multi-Timeframe Supertrend Dynamic Trend Trading Algorithm

- Advanced MACD Crossover Trading Strategy with Adaptive Risk Management

- Quantitative Trend Capture Strategy Based on Candlestick Wick Length Analysis

- Statistical Dual Standard Deviation VWAP Breakout Trading Strategy

- Long Grid Strategy Based on Drawdown and Target Profit

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Multi-Indicator Optimized KDJ Trend Crossover Strategy Based on Dynamic Stochastic Pattern Trading System

- Multi-Timeframe Heikin-Ashi Moving Average Trend Following Trading System

- Dynamic Volatility-Adjusted Trend Following Strategy Based on DI Indicators with ATR Stop Management

- Z-Score Normalized Linear Signal Quantitative Trading Strategy

- Multi-Parameter Stochastic Intelligent Trend Trading Strategy

- Multi-EMA Cross with Volume-Price Momentum Trading Strategy

- Multi-Period Price Level Breakout Trend Trading System Based on Key Price Levels

- Advanced Fibonacci Retracement Trend-Following and Reversal Trading Strategy

- Advanced EMA Crossover Trend Following Strategy with ATR-Based Dynamic Stop Management System

- Mean Reversion Bollinger Bands Trading Strategy with Rational Return Signal

- Multi-Period Moving Average Trend Following with VWAP Cross Strategy

- Dual Moving Average-RSI Synergy Options Quantitative Trading Strategy

- Advanced WaveTrend and EMA Ribbon Fusion Trading Strategy