Stratégie d'optimisation dynamique des bénéfices de l'EMA à plusieurs niveaux et à plusieurs périodes

Auteur:ChaoZhang est là., Date: 2025-01-06 10:50:38 Je suis désoléLes étiquettes:Le taux d'intérêtTPSLIndice de résistanceLe MACDCCIATRROCFinances monétairesVAB

Résumé

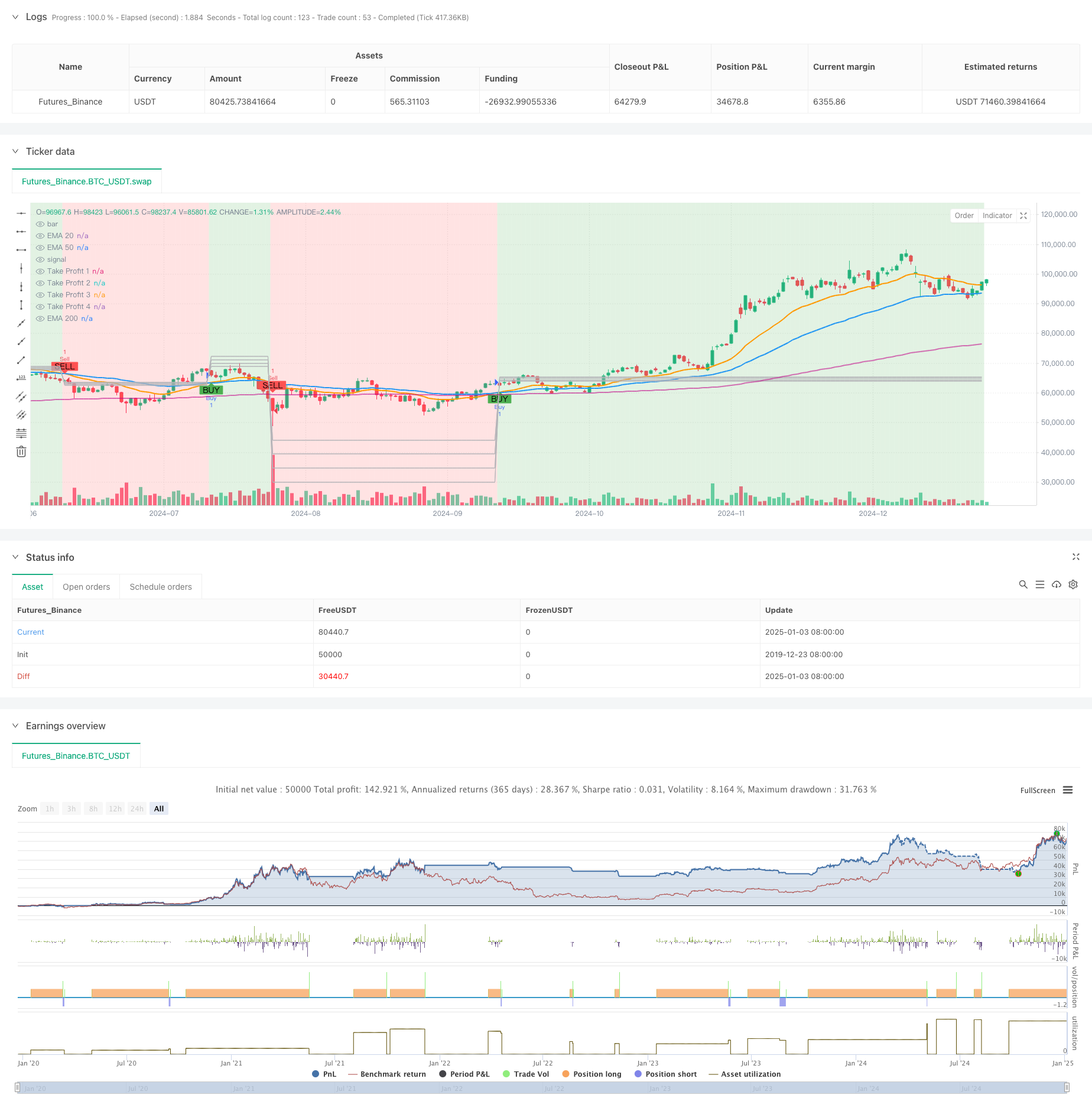

Cette stratégie est un système de trading basé sur des moyennes mobiles exponentielles (EMA), utilisant principalement le croisement de l'EMA20 et de l'EMA50 pour identifier les changements de tendance du marché.

Principes de stratégie

La logique de base de la stratégie repose sur les aspects suivants:

- Utilisation des croisements EMA20 et EMA50 pour déterminer la direction de la tendance: génération de signaux d'achat lorsque EMA20 dépasse EMA50 et de signaux de vente lorsqu'il dépasse EMA50

- Définition dynamique de quatre objectifs de profit basés sur la fourchette précédente des bougies:

- TP1 réglé à 0,5x

- TP2 réglé à une plage de 1,0x

- TP3 réglé sur une plage de 1,5x

- TP4 réglé à une plage de 2,0x

- Définition d'un point d'arrêt des pertes de 3% pour la maîtrise des risques

- Affichage de la direction de la tendance à travers les couleurs de fond de la bougie: vert pour la tendance haussière et rouge pour la tendance baissière

Les avantages de la stratégie

- Réglage dynamique des bénéfices: ajuste automatiquement les objectifs de bénéfices en fonction de la volatilité du marché en temps réel

- Mécanisme de profit à plusieurs niveaux: assure le verrouillage des bénéfices tout en permettant à la tendance de se développer pleinement

- Visualisation exceptionnelle: la direction de la tendance est clairement affichée à travers les couleurs de fond

- Contrôle complet des risques: le stop-loss fixe contrôle efficacement les pertes maximales par transaction

- Paramètres flexibles: les opérateurs peuvent ajuster les multiplicateurs de profit et le pourcentage de stop-loss en fonction des conditions du marché

Risques stratégiques

- Décalage EMA: le retard inhérent aux signaux EMA peut entraîner des points d'entrée retardés

- Risque de marché latéral: peut générer de fréquents faux signaux sur des marchés variés

- Stop-loss fixe: les stops basés sur le pourcentage peuvent ne pas convenir à toutes les conditions du marché

- Distance entre les bénéfices: les intervalles d'objectifs de profit peuvent être trop larges ou trop étroits sur les marchés volatils

Directions d'optimisation de la stratégie

- Introduire des indicateurs auxiliaires: ajouter RSI ou MACD pour la confirmation du signal

- Optimiser le mécanisme de stop-loss: envisager l'utilisation de l'ATR pour les distances de stop-loss dynamiques

- Ajouter le filtrage du temps: mettre en place des fenêtres de temps de négociation pour éviter les périodes très volatiles

- Améliorer la gestion des positions: ajuster dynamiquement la taille des positions en fonction de la volatilité du marché

- Améliorer la confirmation du signal: ajouter des indicateurs de volume comme conditions de confirmation auxiliaires

Résumé

Il s'agit d'une stratégie de suivi des tendances bien structurée avec une logique claire. Elle capture les tendances à travers les croisements EMA, gère les bénéfices avec des points de prise de profit dynamiques et contrôle les risques avec des stop-loss. La conception de la visualisation de la stratégie est intuitive et efficace, avec des paramètres flexibles. Bien qu'elle présente des problèmes de décalage EMA inhérents, l'optimisation et le raffinement peuvent encore améliorer la stabilité et la rentabilité de la stratégie.

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Take Profit and Candle Highlighting", overlay=true)

// Define the EMAs

ema200 = ta.ema(close, 200)

ema50 = ta.ema(close, 50)

ema20 = ta.ema(close, 20)

// Plot the EMAs

plot(ema200, color=#c204898e, title="EMA 200", linewidth=2)

plot(ema50, color=color.blue, title="EMA 50", linewidth=2)

plot(ema20, color=color.orange, title="EMA 20", linewidth=2)

// Define Buy and Sell conditions based on EMA crossover

buySignal = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

sellSignal = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Define input values for Take Profit multipliers

tp1_multiplier = input.float(0.5, title="TP1 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp2_multiplier = input.float(1.0, title="TP2 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp3_multiplier = input.float(1.5, title="TP3 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp4_multiplier = input.float(2.0, title="TP4 Multiplier", minval=0.1, maxval=5.0, step=0.1)

// Define Take Profit Levels as float variables initialized with na

var float takeProfit1 = na

var float takeProfit2 = na

var float takeProfit3 = na

var float takeProfit4 = na

// Calculate take profit levels based on the multipliers

if buySignal

takeProfit1 := high + (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range above the high

takeProfit2 := high + (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range above the high

takeProfit3 := high + (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range above the high

takeProfit4 := high + (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range above the high

if sellSignal

takeProfit1 := low - (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range below the low

takeProfit2 := low - (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range below the low

takeProfit3 := low - (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range below the low

takeProfit4 := low - (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range below the low

// Plot Take Profit Levels on the chart

plot(takeProfit1, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 1")

plot(takeProfit2, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 2")

plot(takeProfit3, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 3")

plot(takeProfit4, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 4")

// Create buy and sell signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Highlight the candles based on trend direction

uptrend = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

downtrend = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Highlighting candles based on trend

bgcolor(color = ema20 > ema50 ? color.new(color.green, 80) : ema20 < ema50 ? color.new(color.red, 80) : na)

// Execute buy and sell orders on the chart

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Exit conditions based on Take Profit levels

strategy.exit("Take Profit 1", "Buy", limit=takeProfit1)

strategy.exit("Take Profit 2", "Buy", limit=takeProfit2)

strategy.exit("Take Profit 3", "Buy", limit=takeProfit3)

strategy.exit("Take Profit 4", "Buy", limit=takeProfit4)

strategy.exit("Take Profit 1", "Sell", limit=takeProfit1)

strategy.exit("Take Profit 2", "Sell", limit=takeProfit2)

strategy.exit("Take Profit 3", "Sell", limit=takeProfit3)

strategy.exit("Take Profit 4", "Sell", limit=takeProfit4)

// Optionally, add a stop loss

stopLoss = 0.03 // Example: 3% stop loss

strategy.exit("Stop Loss", "Buy", stop=close * (1 - stopLoss))

strategy.exit("Stop Loss", "Sell", stop=close * (1 + stopLoss))

- Système d'analyse stratégique de l'anomalie du vendredi d'or multidimensionnel

- Système de négociation suivant la tendance à plusieurs délais avec intégration ATR et MACD

- Stratégie dynamique de DCA basée sur le volume

- Stratégie améliorée de renseignements sur l'inversion des tendances multi-indicateurs

- Stratégie de dynamique de la dynamique MACD avec optimisation dynamique du profit et de l'optimisation du stop-loss

- Stratégie de négociation multi-EMA croisée avec indicateurs de dynamique

- Stratégie dynamique de négociation long/courte avec système de signaux croisés de moyenne mobile

- La stratégie suivie par l'EMA multipériodique avec dynamique RSI et ATR basée sur la tendance à la volatilité

- Stratégie de trading de dynamique croisée multi-indicateur avec système optimisé de prise de profit et de stop-loss

- Stratégie d'optimisation dynamique à haute fréquence basée sur des indicateurs techniques multiples

- Stratégie de croisement dynamique EMA avec système de filtrage de la force de tendance ADX

- Stratégie de négociation quantitative de tendance linéaire englobante à plusieurs périodes

- Stratégie de rupture de canal adaptative avec système de négociation dynamique de support et de résistance

- Filtrage dynamique Stratégie croisée EMA pour l'analyse des tendances quotidiennes

- Le système de négociation des tendances de support/résistance Camarilla

- Stratégie de négociation dynamique à tendance multi-signaux améliorée

- Système de négociation de Martingale à dynamique adaptative

- Tendance à la suite de la stratégie de négociation quantitative combinée RSI et moyenne mobile

- Stratégie de négociation composite de suivi quantitatif avancé des tendances et d'inversion des nuages

- Tendance basée sur l'EMA à 5 jours suivant le modèle d'optimisation de la stratégie

- Système de négociation synergique multi-indicateurs techniques

- Stratégie d'optimisation dynamique à haute fréquence basée sur des indicateurs techniques multiples

- Triple supertrend et tendance moyenne mobile exponentielle suivant une stratégie de négociation quantitative

- Stratégie de tendance quantitative de la moyenne mobile double basée sur le cloud Bollinger Bands

- Stratégie de négociation quantitative à plusieurs niveaux basée sur la divergence de tendance des bandes de Bollinger

- Stratégie de négociation quantitative basée sur la tendance de rupture de niveau Fibonacci 0,7

- Stratégie de négociation adaptative de bloc d'ordre de rupture fractal à plusieurs périodes

- Stratégie optimisée pour le rapport risque-rendement basée sur le croisement des moyennes mobiles

- Stratégie de négociation de reconnaissance dynamique de tendance adaptative

- Stratégie de négociation quantitative de gamme dynamique transfrontalière basée sur des bandes de Bollinger