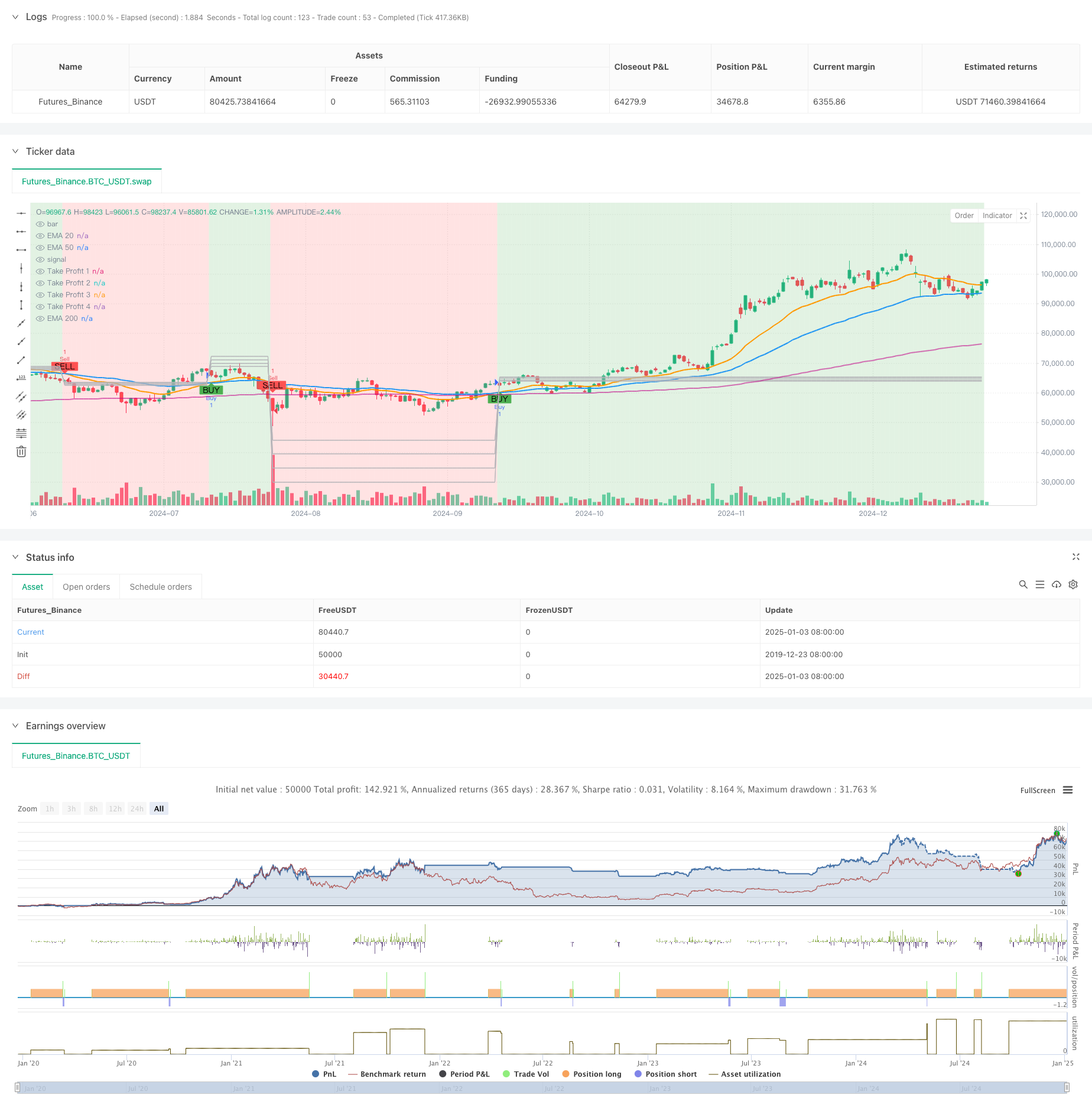

Strategi Optimisasi Keuntungan Dinamis EMA Crossover Multi-Level Multi-Periode

Penulis:ChaoZhang, Tanggal: 2025-01-06 10:50:38Tag:EMATPSLRSIMACDCCIATRROCMFIOBV

Gambaran umum

Strategi ini adalah sistem perdagangan yang didasarkan pada Exponential Moving Averages (EMA), terutama memanfaatkan persilangan EMA20 dan EMA50 untuk mengidentifikasi perubahan tren pasar. Strategi ini menampilkan titik take profit multi-level dinamis dikombinasikan dengan mekanisme stop-loss untuk pengendalian risiko. Sistem ini secara visual menampilkan arah tren pasar melalui perubahan warna latar belakang, membantu pedagang lebih memahami pergerakan pasar.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada aspek berikut:

- Menggunakan crossover EMA20 dan EMA50 untuk menentukan arah tren: menghasilkan sinyal beli ketika EMA20 melintasi di atas EMA50, dan sinyal jual ketika melintasi di bawah

- Secara dinamis menetapkan empat target keuntungan berdasarkan kisaran lilin sebelumnya:

- TP1 diatur pada kisaran 0,5x

- TP2 diatur pada kisaran 1,0x

- TP3 diatur pada kisaran 1,5x

- TP4 diatur pada kisaran 2,0x

- Menetapkan titik stop loss 3% untuk pengendalian risiko

- Menampilkan arah tren melalui warna latar belakang lilin: hijau untuk tren naik dan merah untuk tren turun

Keuntungan Strategi

- Pengaturan take-profit dinamis: secara otomatis menyesuaikan target keuntungan berdasarkan volatilitas pasar real-time

- Mekanisme keuntungan multi-level: memastikan penguncian keuntungan sambil memungkinkan tren untuk berkembang sepenuhnya

- Visualisasi yang luar biasa: arah tren ditampilkan dengan jelas melalui warna latar belakang

- Pengendalian risiko yang komprehensif: stop loss tetap secara efektif mengontrol kerugian maksimum per perdagangan

- Parameter fleksibel: pedagang dapat menyesuaikan pengganda keuntungan dan persentase stop-loss berdasarkan kondisi pasar

Risiko Strategi

- EMA lag: keterlambatan yang melekat pada sinyal EMA dapat menyebabkan titik masuk tertunda

- Risiko pasar sampingan: dapat menghasilkan sinyal palsu yang sering terjadi di pasar yang berbeda

- Stop loss tetap: stop loss berdasarkan persentase mungkin tidak sesuai dengan semua kondisi pasar

- Perbedaan antara target keuntungan: interval target keuntungan mungkin terlalu luas atau sempit di pasar yang volatile

Arah Optimasi Strategi

- Memperkenalkan indikator tambahan: tambahkan RSI atau MACD untuk konfirmasi sinyal

- Mengoptimalkan mekanisme stop-loss: pertimbangkan untuk menggunakan ATR untuk jarak stop-loss dinamis

- Tambahkan penyaringan waktu: menerapkan jendela waktu perdagangan untuk menghindari periode yang sangat volatile

- Meningkatkan manajemen posisi: menyesuaikan ukuran posisi secara dinamis berdasarkan volatilitas pasar

- Tingkatkan konfirmasi sinyal: tambahkan indikator volume sebagai kondisi konfirmasi tambahan

Ringkasan

Ini adalah strategi trend-mengikuti terstruktur dengan logika yang jelas. Ini menangkap tren melalui EMA crossover, mengelola keuntungan dengan titik mengambil keuntungan dinamis, dan mengontrol risiko dengan stop-loss. Desain visualisasi strategi ini intuitif dan efektif, dengan pengaturan parameter yang fleksibel. Meskipun memiliki masalah lag EMA yang melekat, pengoptimalan dan penyempurnaan dapat lebih meningkatkan stabilitas dan profitabilitas strategi.

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Take Profit and Candle Highlighting", overlay=true)

// Define the EMAs

ema200 = ta.ema(close, 200)

ema50 = ta.ema(close, 50)

ema20 = ta.ema(close, 20)

// Plot the EMAs

plot(ema200, color=#c204898e, title="EMA 200", linewidth=2)

plot(ema50, color=color.blue, title="EMA 50", linewidth=2)

plot(ema20, color=color.orange, title="EMA 20", linewidth=2)

// Define Buy and Sell conditions based on EMA crossover

buySignal = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

sellSignal = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Define input values for Take Profit multipliers

tp1_multiplier = input.float(0.5, title="TP1 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp2_multiplier = input.float(1.0, title="TP2 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp3_multiplier = input.float(1.5, title="TP3 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp4_multiplier = input.float(2.0, title="TP4 Multiplier", minval=0.1, maxval=5.0, step=0.1)

// Define Take Profit Levels as float variables initialized with na

var float takeProfit1 = na

var float takeProfit2 = na

var float takeProfit3 = na

var float takeProfit4 = na

// Calculate take profit levels based on the multipliers

if buySignal

takeProfit1 := high + (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range above the high

takeProfit2 := high + (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range above the high

takeProfit3 := high + (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range above the high

takeProfit4 := high + (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range above the high

if sellSignal

takeProfit1 := low - (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range below the low

takeProfit2 := low - (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range below the low

takeProfit3 := low - (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range below the low

takeProfit4 := low - (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range below the low

// Plot Take Profit Levels on the chart

plot(takeProfit1, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 1")

plot(takeProfit2, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 2")

plot(takeProfit3, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 3")

plot(takeProfit4, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 4")

// Create buy and sell signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Highlight the candles based on trend direction

uptrend = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

downtrend = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Highlighting candles based on trend

bgcolor(color = ema20 > ema50 ? color.new(color.green, 80) : ema20 < ema50 ? color.new(color.red, 80) : na)

// Execute buy and sell orders on the chart

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Exit conditions based on Take Profit levels

strategy.exit("Take Profit 1", "Buy", limit=takeProfit1)

strategy.exit("Take Profit 2", "Buy", limit=takeProfit2)

strategy.exit("Take Profit 3", "Buy", limit=takeProfit3)

strategy.exit("Take Profit 4", "Buy", limit=takeProfit4)

strategy.exit("Take Profit 1", "Sell", limit=takeProfit1)

strategy.exit("Take Profit 2", "Sell", limit=takeProfit2)

strategy.exit("Take Profit 3", "Sell", limit=takeProfit3)

strategy.exit("Take Profit 4", "Sell", limit=takeProfit4)

// Optionally, add a stop loss

stopLoss = 0.03 // Example: 3% stop loss

strategy.exit("Stop Loss", "Buy", stop=close * (1 - stopLoss))

strategy.exit("Stop Loss", "Sell", stop=close * (1 + stopLoss))

- Sistem Analisis Strategi Anomali Jumat Emas Multidimensional

- Tren Multi-Timeframe Mengikuti Sistem Trading dengan Integrasi ATR dan MACD

- Strategi DCA dinamis berbasis volume

- Strategi Intelijen Pembalikan Tren Multi-Indikator yang Ditingkatkan

- Strategi Momentum Crossover MACD dengan Optimasi Take Profit dan Stop Loss Dinamis

- Multi-EMA Crossover dengan Indikator Momentum Trading Strategy

- Strategi perdagangan swing panjang/pendek yang dinamis dengan sistem sinyal crossover rata-rata bergerak

- Multi-Periode EMA Crossover dengan RSI Momentum dan ATR Volatility Based Trend Mengikuti Strategi

- Multi-Indikator Crossover Momentum Trading Strategy dengan Optimized Take Profit dan Stop Loss System

- Strategi Optimisasi Dinamis Frekuensi Tinggi Berbasis Indikator Multi-Teknis

- Strategi Crossover EMA Dinamis dengan Sistem Penyaringan Kekuatan Tren ADX

- Strategi Perdagangan Kuantitatif

- Adaptive Channel Breakout Strategy dengan Dynamic Support and Resistance Trading System

- Filter Dinamis EMA Cross Strategy untuk Analisis Tren Harian

- Multi-EMA Crossover dengan Camarilla Support/Resistance Trend Trading System

- Strategi Perdagangan Dinamis Trend Multi-Signal yang Ditingkatkan

- Adaptive Momentum Martingale Trading System (Sistem Perdagangan Momentum Martingale yang Adaptif)

- Tren Mengikuti RSI dan Moving Average Combined Quantitative Trading Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy (Strategi Perdagangan Komposit Mengikuti Tren Kuantitatif Lanjutan dan Pembalikan Awan)

- Trend Berbasis EMA 5 Hari Mengikuti Model Optimasi Strategi

- Sistem Perdagangan Synergistic Multi-Technical Indicator

- Strategi Optimisasi Dinamis Frekuensi Tinggi Berbasis Indikator Multi-Teknis

- Triple Supertrend dan Trend Exponential Moving Average Mengikuti Strategi Perdagangan Kuantitatif

- Cloud-Based Bollinger Bands Strategi Tren Kuantitatif Rata-rata Bergerak Ganda

- Strategi perdagangan kuantitatif multi-level berdasarkan Bollinger Bands Trend Divergence

- Strategi Perdagangan Kuantitatif Berdasarkan Fibonacci 0.7 Level Trend Breakthrough

- Strategi perdagangan adaptif untuk pemesanan pemutusan fraktal multi periode

- Rasio Risiko-Reward Optimized Strategy Berdasarkan Moving Average Crossover

- Adaptive Trend Following Dynamic Trend Recognition Trading Strategy (Strategi Perdagangan Pengakuan Tren Dinamis)

- Strategi Perdagangan Kuantitatif Jangkauan Dinamis lintas batas Berdasarkan Bollinger Bands