Adaptive Momentum Martingale Trading System (Sistem Perdagangan Momentum Martingale yang Adaptif)

Penulis:ChaoZhang, Tanggal: 2025-01-06 11:01:12Tag:SMACNNGAN

Tinjauan Strategi

Strategi ini adalah sistem perdagangan otomatis yang menggabungkan momentum adaptif dan manajemen posisi Martingale. Sistem ini menggunakan beberapa indikator teknis untuk analisis pasar, termasuk penghalusan autoencoder, ekstraksi fitur momentum simulasi CNN, dan penyaringan sinyal perdagangan berbasis volatilitas.

Prinsip Strategi

Strategi ini beroperasi pada tiga modul inti:

- Data Preprocessing Module - Menggunakan SMA untuk mencapai autoencoder seperti price smoothing dan filter pasar noise.

- Modul Generasi Sinyal - Mensimulasikan ekstraksi fitur CNN dengan menghitung perbedaan harga dengan rata-rata bergerak jangka panjang, dikombinasikan dengan ambang volatilitas untuk menyaring peluang perdagangan kemungkinan tinggi.

- Modul Manajemen Posisi - Mengimplementasikan penyesuaian posisi gaya Martingale, meningkatkan ukuran posisi secara proporsional setelah kerugian berturut-turut dan kembali ke garis dasar setelah keuntungan.

Keuntungan Strategi

- Keandalan Generasi Sinyal - Meningkatkan kualitas sinyal perdagangan melalui beberapa indikator teknis dan penyaringan volatilitas.

- Manajemen Risiko yang Komprehensif - Mempunyai beberapa mekanisme perlindungan termasuk mengambil keuntungan, stop loss, dan batas posisi maksimum.

- Adaptabilitas yang kuat - Secara dinamis menyesuaikan strategi perdagangan berdasarkan kondisi pasar.

- Logika Operasional yang jelas - Kondisi masuk dan keluar yang didefinisikan dengan baik memfasilitasi backtesting dan optimasi.

Risiko Strategi

- Risiko Martingale - Kerugian berturut-turut dapat menyebabkan pertumbuhan posisi yang cepat, yang membutuhkan kontrol posisi maksimum yang ketat.

- Risiko Pembalikan Tren - Sinyal momentum dapat gagal selama volatilitas pasar yang ekstrim.

- Sensitivitas Parameter - Beberapa parameter kunci secara signifikan mempengaruhi kinerja strategi.

Arah Optimasi Strategi

- Peningkatan sinyal - Menggabungkan model pembelajaran mesin untuk meningkatkan akurasi sinyal.

- Peningkatan Pengendalian Risiko - Tambahkan pengendalian penarikan dan batas durasi posisi.

- Adaptive Parameters - Mengembangkan mekanisme adaptasi parameter untuk meningkatkan stabilitas strategi.

- Adaptasi multi-aset - Memperluas penerapan strategi untuk perdagangan multi-aset.

Ringkasan

Strategi ini menggabungkan teknik perdagangan kuantitatif modern dengan metode Martingale klasik untuk menciptakan sistem perdagangan dengan dasar teoritis dan kepraktisan.

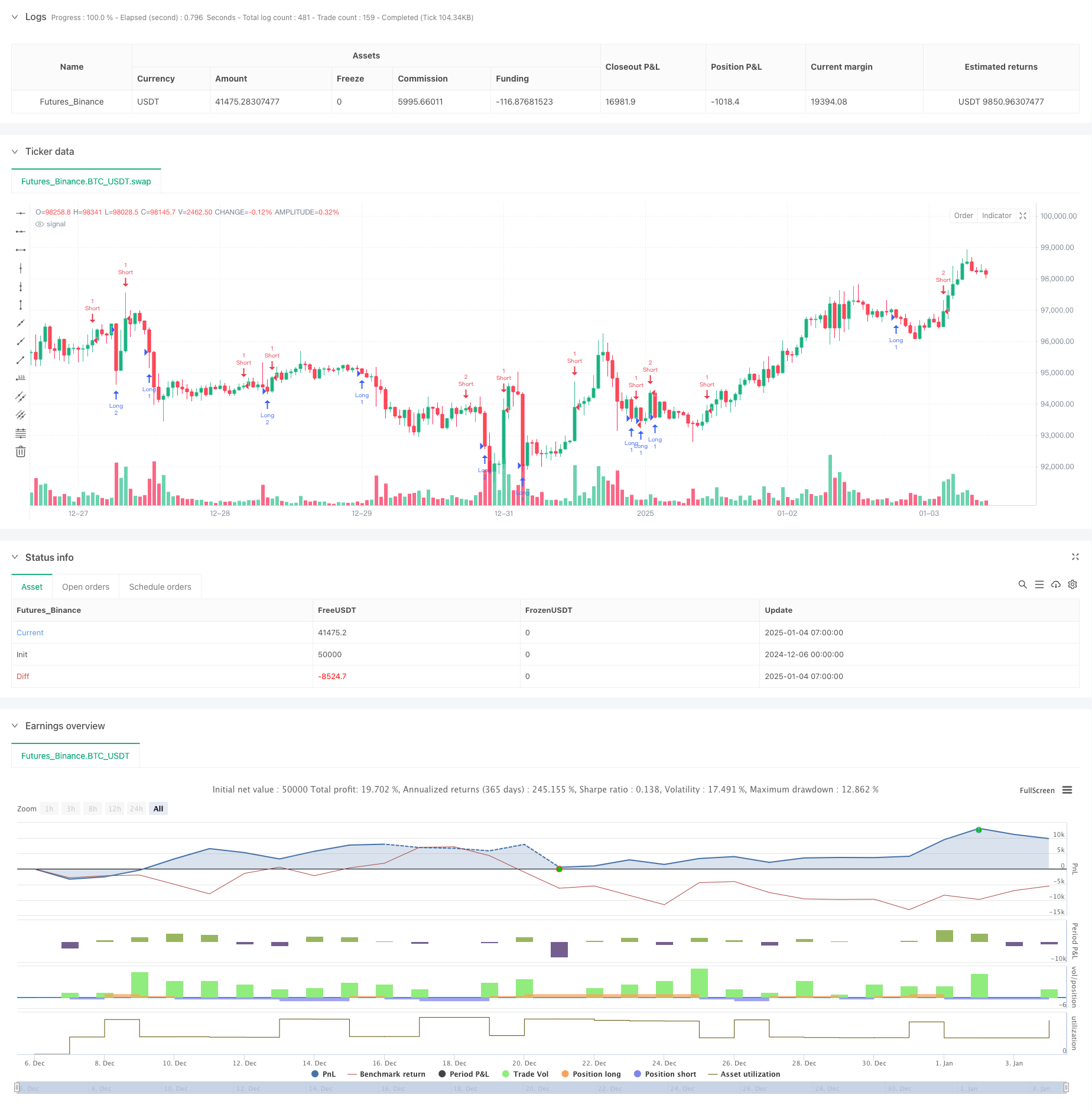

/*backtest

start: 2024-12-06 00:00:00

end: 2025-01-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Adaptive Crypto Trading Strategy with Martingale", shorttitle = "ACTS_w_MG_V1",overlay=true)

// Inputs

smoothing_length = input.int(14, title="Smoothing Length (Autoencoder)")

momentum_window = input.int(21, title="Momentum Window (CNN)")

volatility_threshold = input.float(0.02, title="Volatility Threshold (GAN Simulation)")

take_profit = input.float(0.05, title="Take Profit (%)")

stop_loss = input.float(0.02, title="Stop Loss (%)")

// Martingale Inputs

base_lot_size = input.float(1, title="Base Lot Size") // Initial trade size

multiplier = input.float(2, title="Martingale Multiplier") // Lot size multiplier after a loss

max_lot_size = input.float(2, title="Maximum Lot Size") // Cap on lot size

var float lot_size = base_lot_size // Initialize the lot size

// Step 1: Data Smoothing (Autoencoder)

smoothed_price = ta.sma(close, smoothing_length)

// Step 2: Feature Extraction (Momentum - CNN Simulation)

momentum = ta.sma(close, momentum_window) - close

volatility = ta.stdev(close, momentum_window)

// Step 3: Entry Conditions (GAN-Inspired Pattern Detection)

long_condition = (momentum > 0 and volatility > volatility_threshold)

short_condition = (momentum < 0 and volatility > volatility_threshold)

// Martingale Logic

if (strategy.closedtrades > 0)

if (strategy.closedtrades.profit(strategy.closedtrades - 1) < 0)

lot_size := math.min(lot_size * multiplier, max_lot_size) // Increase lot size after a loss, but cap it

else

lot_size := base_lot_size // Reset lot size after a win or on the first trade

// Step 4: Take Profit and Stop Loss Management

long_take_profit = close * (1 + take_profit)

long_stop_loss = close * (1 - stop_loss)

short_take_profit = close * (1 - take_profit)

short_stop_loss = close * (1 + stop_loss)

// Execute Trades

if (long_condition)

strategy.entry("Long", strategy.long, qty=lot_size, stop=long_stop_loss, limit=long_take_profit)

if (short_condition)

strategy.entry("Short", strategy.short, qty=lot_size, stop=short_stop_loss, limit=short_take_profit)

Berkaitan

- Hurst Garis Masa Depan Strategi Demarkasi

- Bollinger Bands Standard Deviation Breakout Strategi

- Strategi Stop Loss dan Take Profit Bollinger Bands yang Dinamis

- Bollinger Bands Strategi osilator stokastik

- Dual Moving Average Crossover Confirmation Strategy dengan Model Optimasi Integrasi Volume-Harga

- Nik Stoch

- Strategi Bollinger Bands Take Profit yang Dinamis

- MTF RSI & Strategi STOCH

- NMVOB-S

- Indikator Momentum Squeeze

Lebih banyak

- Strategi perdagangan stop trailing multi-indikator dinamis

- Sistem osilator stokastik EMA ganda: Model perdagangan kuantitatif yang menggabungkan trend berikut dan momentum

- Strategi Perdagangan Volatilitas Dinamis Multi-Indikator

- Teori Perdagangan Dinamis: Eksponensial Moving Average dan Cumulative Volume Periode Crossover Strategy

- Strategi Crossover EMA Dinamis dengan Sistem Penyaringan Kekuatan Tren ADX

- Strategi Perdagangan Kuantitatif

- Adaptive Channel Breakout Strategy dengan Dynamic Support and Resistance Trading System

- Filter Dinamis EMA Cross Strategy untuk Analisis Tren Harian

- Multi-EMA Crossover dengan Camarilla Support/Resistance Trend Trading System

- Strategi Perdagangan Dinamis Trend Multi-Signal yang Ditingkatkan

- Tren Mengikuti RSI dan Moving Average Combined Quantitative Trading Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy (Strategi Perdagangan Komposit Mengikuti Tren Kuantitatif Lanjutan dan Pembalikan Awan)

- Trend Berbasis EMA 5 Hari Mengikuti Model Optimasi Strategi

- Strategi Optimisasi Keuntungan Dinamis EMA Crossover Multi-Level Multi-Periode

- Sistem Perdagangan Synergistic Multi-Technical Indicator

- Strategi Optimisasi Dinamis Frekuensi Tinggi Berbasis Indikator Multi-Teknis

- Triple Supertrend dan Trend Exponential Moving Average Mengikuti Strategi Perdagangan Kuantitatif

- Cloud-Based Bollinger Bands Strategi Tren Kuantitatif Rata-rata Bergerak Ganda

- Strategi perdagangan kuantitatif multi-level berdasarkan Bollinger Bands Trend Divergence

- Strategi Perdagangan Kuantitatif Berdasarkan Fibonacci 0.7 Level Trend Breakthrough