Adaptive Channel Breakout Strategy dengan Dynamic Support and Resistance Trading System

Penulis:ChaoZhang, Tanggal: 2025-01-06 11:40:35Tag:SRATRRRSLTPMA

Gambaran umum

Strategi ini adalah sistem perdagangan canggih yang didasarkan pada level support dan resistance, menggabungkan saluran tren dinamis dengan fungsionalitas manajemen risiko. Strategi ini mengidentifikasi level support dan resistance utama dengan menganalisis fluktuasi harga

Prinsip Strategi

Logika inti mencakup beberapa elemen kunci:

- Tingkat support dan resistance dihitung berdasarkan harga terendah dan tertinggi dalam periode lookback yang ditentukan pengguna

- Lebar saluran dinamis diatur melalui parameter persentase, membangun saluran atas dan bawah berdasarkan tingkat dukungan dan resistensi

- Sinyal beli dipicu ketika harga mendekati level support (dalam jarak 1%).

- Sistem secara otomatis menghitung tingkat stop loss dan take profit berdasarkan persentase yang ditentukan pengguna

- Perdagangan dieksekusi hanya dalam rentang waktu backtesting yang ditentukan

- Rasio risiko terhadap imbalan dihitung dan ditampilkan secara real time untuk membantu pedagang mengevaluasi potensi pengembalian terhadap risiko

Keuntungan Strategi

- Kemampuan beradaptasi yang tinggi: Tingkat dukungan dan resistensi menyesuaikan secara dinamis dengan perubahan pasar, beradaptasi dengan lingkungan pasar yang berbeda

- Manajemen Risiko Komprehensif: Mengintegrasikan perhitungan stop-loss, take-profit, dan rasio risiko-imbalan dengan visualisasi

- Sinyal Perdagangan yang Jelas: Menyediakan sinyal masuk yang berbeda, mengurangi dampak penilaian subjektif

- Visualisasi yang sangat baik: Berbagai tingkat harga ditampilkan secara intuitif melalui garis dan label berwarna yang berbeda

- Parameter Fleksibel: Memungkinkan pengguna untuk menyesuaikan parameter berdasarkan gaya perdagangan pribadi dan karakteristik pasar

Risiko Strategi

- Risiko Volatilitas Pasar: Dapat memicu sinyal perdagangan yang berlebihan di pasar yang sangat volatile

- Risiko Pemecahan Palsu: Harga mendekati level dukungan dapat mengakibatkan pemecahan palsu yang mengarah pada sinyal yang salah.

- Sensitivitas Parameter: Kinerja strategi sangat tergantung pada periode tampilan kembali dan pengaturan lebar saluran

- Pembatasan perdagangan unidirectional: Saat ini hanya mendukung posisi panjang, berpotensi kehilangan peluang pendek

- Time Dependency: Efektivitas strategi terbatas pada rentang waktu backtesting yang ditentukan

Arah Optimasi Strategi

- Tambahkan Filter Tren: Masukkan rata-rata bergerak atau indikator momentum untuk menyaring sinyal kontra-tren

- Arahan Perdagangan Lengkap: Tambahkan logika perdagangan singkat untuk meningkatkan komprehensifitas strategi

- Mengoptimalkan Generasi Sinyal: Mengintegrasikan indikator volume untuk memverifikasi validitas price breakout

- Pengaturan Stop Loss Dinamis: Sesuaikan jarak stop loss secara dinamis berdasarkan ATR atau volatilitas

- Meningkatkan Manajemen Posisi: Sesuaikan ukuran posisi secara dinamis berdasarkan rasio risiko-manfaat dan volatilitas pasar

Ringkasan

Strategi ini menggabungkan konsep analisis teknis utama - level support/resistance dan saluran tren - untuk membangun sistem trading yang secara logis ketat dan dikendalikan risiko. Kekuatan strategi ini terletak pada kemampuan beradaptasi dan manajemen risiko yang komprehensif, tetapi pedagang masih perlu menyesuaikan parameter dengan hati-hati berdasarkan kondisi pasar dan toleransi risiko pribadi. Melalui arah optimasi yang disarankan, strategi ini memiliki ruang untuk perbaikan lebih lanjut dan dapat berkembang menjadi sistem trading yang lebih komprehensif dan kuat.

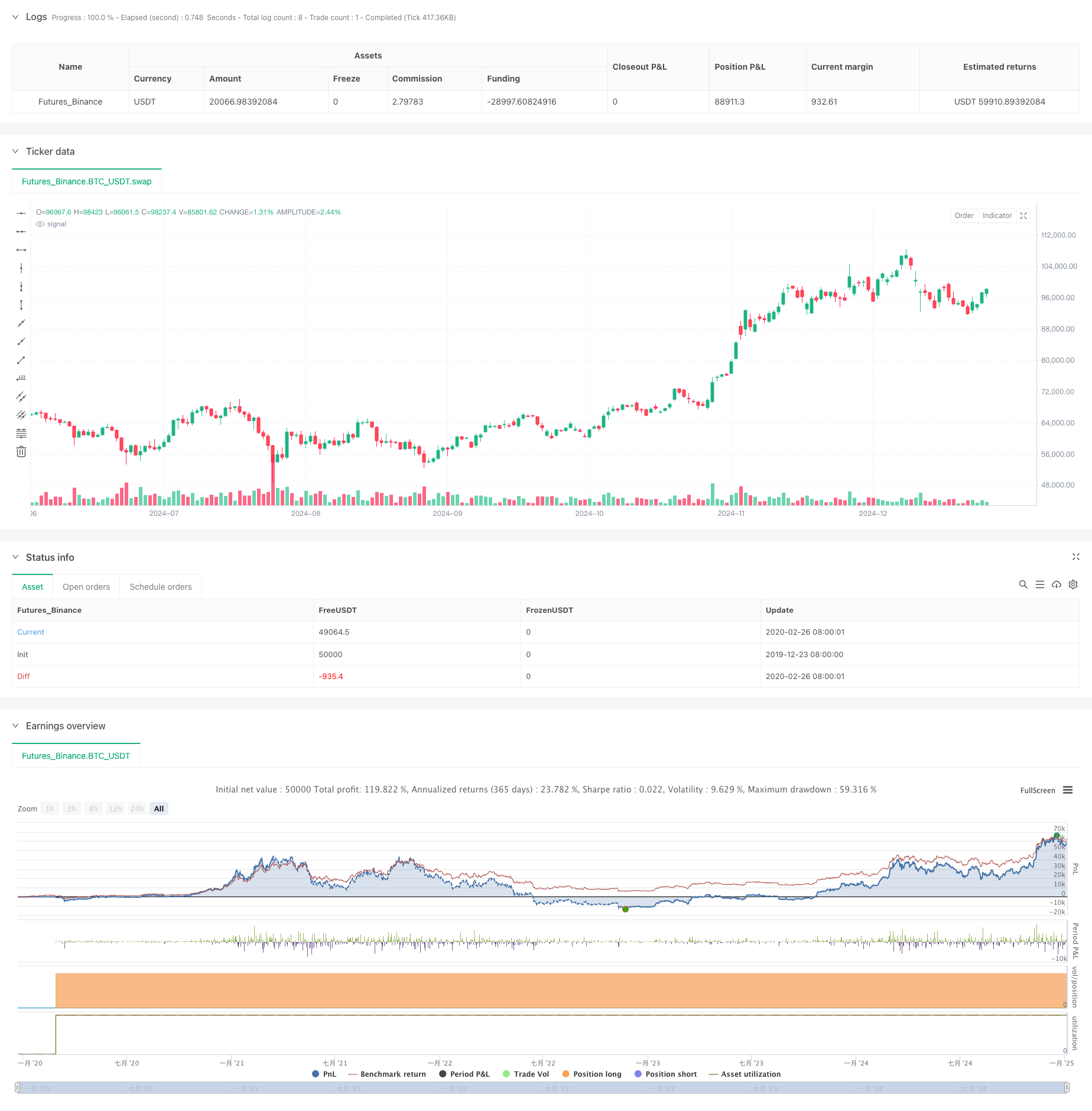

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Support and Resistance with Trend Lines and Channels", overlay=true)

// Inputs

lookback = input.int(20, title="Lookback Period for Support/Resistance", minval=1)

channelWidth = input.float(0.01, title="Channel Width (%)", minval=0.001) / 100

startDate = input(timestamp("2023-01-01 00:00"), title="Backtesting Start Date")

endDate = input(timestamp("2023-12-31 23:59"), title="Backtesting End Date")

// Check if the current bar is within the testing range

inTestingRange = true

// Support and Resistance Levels

supportLevel = ta.lowest(low, lookback) // Swing low (support)

resistanceLevel = ta.highest(high, lookback) // Swing high (resistance)

// Trend Lines and Channels

var line supportLine = na

var line resistanceLine = na

var line upperChannelLine = na

var line lowerChannelLine = na

// Calculate channel levels

upperChannel = resistanceLevel * (1 + channelWidth) // Upper edge of channel

lowerChannel = supportLevel * (1 - channelWidth) // Lower edge of channel

// Create or update the support trend line

// if na(supportLine)

// supportLine := line.new(bar_index, supportLevel, bar_index + 1, supportLevel, color=color.green, width=2, extend=extend.right)

// else

// line.set_y1(supportLine, supportLevel)

// line.set_y2(supportLine, supportLevel)

// // Create or update the resistance trend line

// if na(resistanceLine)

// resistanceLine := line.new(bar_index, resistanceLevel, bar_index + 1, resistanceLevel, color=color.red, width=2, extend=extend.right)

// else

// line.set_y1(resistanceLine, resistanceLevel)

// line.set_y2(resistanceLine, resistanceLevel)

// // Create or update the upper channel line

// if na(upperChannelLine)

// upperChannelLine := line.new(bar_index, upperChannel, bar_index + 1, upperChannel, color=color.blue, width=1, style=line.style_dashed, extend=extend.right)

// else

// line.set_y1(upperChannelLine, upperChannel)

// line.set_y2(upperChannelLine, upperChannel)

// // Create or update the lower channel line

// if na(lowerChannelLine)

// lowerChannelLine := line.new(bar_index, lowerChannel, bar_index + 1, lowerChannel, color=color.purple, width=1, style=line.style_dashed, extend=extend.right)

// else

// line.set_y1(lowerChannelLine, lowerChannel)

// line.set_y2(lowerChannelLine, lowerChannel)

// Buy Condition: When price is near support level

buyCondition = close <= supportLevel * 1.01 and inTestingRange

if buyCondition

strategy.entry("Buy", strategy.long)

// Stop Loss and Take Profit

stopLossPercentage = input.float(1.5, title="Stop Loss Percentage", minval=0.0) / 100

takeProfitPercentage = input.float(3.0, title="Take Profit Percentage", minval=0.0) / 100

var float longStopLoss = na

var float longTakeProfit = na

if strategy.position_size > 0

longStopLoss := strategy.position_avg_price * (1 - stopLossPercentage)

longTakeProfit := strategy.position_avg_price * (1 + takeProfitPercentage)

strategy.exit("Exit Buy", "Buy", stop=longStopLoss, limit=longTakeProfit)

// Visualize Entry, Stop Loss, and Take Profit Levels

var float entryPrice = na

if buyCondition

entryPrice := close

if not na(entryPrice)

label.new(bar_index, entryPrice, text="Entry: " + str.tostring(entryPrice, "#.##"), style=label.style_label_up, color=color.green, textcolor=color.white)

if strategy.position_size > 0

line.new(bar_index, longStopLoss, bar_index + 1, longStopLoss, color=color.red, width=1, extend=extend.right)

line.new(bar_index, longTakeProfit, bar_index + 1, longTakeProfit, color=color.blue, width=1, extend=extend.right)

// Risk-to-Reward Ratio (Optional)

if not na(entryPrice) and not na(longStopLoss) and not na(longTakeProfit)

riskToReward = (longTakeProfit - entryPrice) / (entryPrice - longStopLoss)

label.new(bar_index, entryPrice, text="R:R " + str.tostring(riskToReward, "#.##"), style=label.style_label_up, color=color.yellow, textcolor=color.black, size=size.small)

- Strategi Trading Intensitas Tren Multi-MA - Sistem Trading Pintar Fleksibel Berdasarkan Penyimpangan MA

- Tren multi-kondisi mengikuti strategi perdagangan kuantitatif berdasarkan tingkat retracement Fibonacci

- Rasio Risiko-Reward Optimized Strategy Berdasarkan Moving Average Crossover

- Strategi crossover rata-rata bergerak eksponensial yang dikelola risiko dinamis

- Strategi crossover rata-rata bergerak ganda dengan manajemen risiko dinamis

- Strategi lintas rata-rata bergerak dinamis dan Bollinger Bands dengan model optimasi stop-loss tetap

- Adaptive Range Trading System Berdasarkan Indikator RSI Dual

- Strategi perdagangan pembalikan titik pivot ganda yang ditingkatkan

- Adaptive Moving Average Crossover dengan Trailing Stop-Loss Strategy

- Sistem osilator stokastik EMA ganda: Model perdagangan kuantitatif yang menggabungkan trend berikut dan momentum

- RSI Trend Breakthrough dan Momentum Enhancement Strategi Perdagangan

- Tren Dinamis Dual EMA Crossover Mengikuti Strategi Perdagangan Kuantitatif

- Adaptive Trend Flow Multiple Filter Strategi Perdagangan

- Indikator Teknis Dual Dinamis Strategi Perdagangan Konfirmasi Terlalu Terjual-Terlalu Dibeli

- Strategi perdagangan stop trailing multi-indikator dinamis

- Sistem osilator stokastik EMA ganda: Model perdagangan kuantitatif yang menggabungkan trend berikut dan momentum

- Strategi Perdagangan Volatilitas Dinamis Multi-Indikator

- Teori Perdagangan Dinamis: Eksponensial Moving Average dan Cumulative Volume Periode Crossover Strategy

- Strategi Crossover EMA Dinamis dengan Sistem Penyaringan Kekuatan Tren ADX

- Strategi Perdagangan Kuantitatif

- Filter Dinamis EMA Cross Strategy untuk Analisis Tren Harian

- Multi-EMA Crossover dengan Camarilla Support/Resistance Trend Trading System

- Strategi Perdagangan Dinamis Trend Multi-Signal yang Ditingkatkan

- Adaptive Momentum Martingale Trading System (Sistem Perdagangan Momentum Martingale yang Adaptif)

- Tren Mengikuti RSI dan Moving Average Combined Quantitative Trading Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy (Strategi Perdagangan Komposit Mengikuti Tren Kuantitatif Lanjutan dan Pembalikan Awan)

- Trend Berbasis EMA 5 Hari Mengikuti Model Optimasi Strategi

- Strategi Optimisasi Keuntungan Dinamis EMA Crossover Multi-Level Multi-Periode

- Sistem Perdagangan Synergistic Multi-Technical Indicator

- Strategi Optimisasi Dinamis Frekuensi Tinggi Berbasis Indikator Multi-Teknis