多要素適応動力追跡戦略

作者: リン・ハーンチャオチャン開催日:2023年12月12日 12:02:13タグ:

概要

マルチファクター適応モメントトラッキング戦略は,複数の技術指標を統合することにより,市場動向と主要なサポート/レジスタンスレベルを特定することによって,暗号通貨のような非常に不安定な資産の自動取引を実現する.この戦略は,RSI,MACD,ストーカスティックなどの指標を組み合わせて,エントリーと出口タイミングを決定し,より正確なパターン認識を可能にするために価格パーセント変化も組み込む.

戦略原則

多要素適応動量追跡戦略の核心は,複数の技術指標の統合にあります.この戦略で使用される主な構成要素には,以下の通りがあります.

-

RSIは,過買い/過売り状態を判断する.異なるパラメータを使用して,通常のRSI信号または調整されたConnors RSI信号を特定し,逆転の機会が存在するかどうかを判断することができます.

-

MACD は,トレンド方向を決定するのに役立ちます.MACD 線が信号線の上または下を横切るときに,買い売りシグナルが生成されます.

-

ストキャストは,買い過ぎ/売り過ぎのゾーンをスポットする.K線とD線の黄金十字と死十字の組み合わせは,逆転が起こるかどうかを示します.

-

ブレイクアウトが現実であるかどうかを確認するための価格パーセント変化. 真のブレイクアウトが起こったかどうかを判断するために,一定期間における最高価格,最低価格,閉値などにおけるパーセント変化を計算します.

-

EMAは全体的な傾向を判断します. 低速EMAを上回しすると上昇信号が伝わります. 下回りすると下回り信号が伝わります.

戦略は,市場の状況に基づいて,ロングまたはショートに行くことを選択し,リスクを効果的に制御するためにポジションに入るとストップ損失と利益を得ることを設定します.逆転信号が発生すると退出します. 意思決定プロセスは複数の要因からの判断を統合してより正確な結果を実現します.

利点分析

この戦略の利点は以下の通りです.

-

複数の要因がよりよい判断を促します.単一の指標と比較して,複数の指標を組み合わせることで,相互の検証とより信頼性の高い結果が得られ,不必要な取引コストが削減されます.

-

厳格な条件は不良取引を避ける.戦略は,雑音をフィルタリングし,不良取引を避けるために複数の同時信号を必要とする,購入/販売信号に厳格な要件を設定する.

-

アダプティブパラメータは手動的な干渉を軽減する. インディケーターパラメータを動的に計算する内蔵機能は,手動的なパラメータ選択の主観性を回避し,パラメータをより科学的で客観的にします.

-

ストップ・ロスト/テイク・プロフィート リスクをコントロールする.戦略は,ポジションを開設した後,ストップ・ロスト/テイク・プロフィートのレベルを継続的に計算し,効果的に取引損失を制限し,マーージンコールを防止する.

リスク分析

予防すべきリスクは以下のとおりです.

-

インディケーターからの誤った信号の確率. 複数の検証プロセスにより誤った信号が大幅に減少するが,一定の確率が残る.これは不必要な損失につながる可能性がある.

-

ストップ・ロスの破損リスク: 極端な市場状況では,価格は崖っぷちを突っ込み,当初設定されたストップ・ロスを簡単に破り,平均以上の損失につながる可能性があります.

-

パラメータチューニングによる過剰最適化. ダイナミックパラメータは主観性を減らすが,過度にフィットし,一般化性を失うこともあります.

解決策:

- 誤った信号を減らすために信号フィルタリングの厳格さを高めます

- 単止止損を避けるために 段階的なエントリを採用します

- パラメーターの安定性を厳密に評価するためにサンプルテストを強化する.

オプティマイゼーションの方向性

この戦略は次の方法でさらに最適化できます.

-

判断する要素を増やす.判断を助けるために,異なるタイプのより多くの指標,例えば波動性,ボリュームなどからのシグナルを組み合わせる.

-

ストップ損失アルゴリズムの最適化. ストップ損失の確率をさらに減らすために,ストップ損失を追う,不安定性ストップ損失などのより高度なストップ損失アルゴリズムを導入する.

-

機械学習モデルの導入.購入/販売決定を助けるためにRNN,LSTMなどを使用して歴史的なデータをモデル化する.

-

戦略を統合する.複数のサブ戦略を採用し,より堅牢な全体的なパフォーマンスのために統合するアンサンブル方法を使用する.

結論

多要素適応動量追跡戦略は,複数の技術指標を統合して取引機会を特定する.単一の指標と比較して,この戦略は,より正確な判断を備えており,リスク制御のためのパラメータ適応とストップ損失メカニズムが組み込まれています.次のステップには,より多くの補助判断要因,高度なストップ損失アルゴリズム,機械学習などを導入することで戦略のパフォーマンスをさらに向上させることができます.

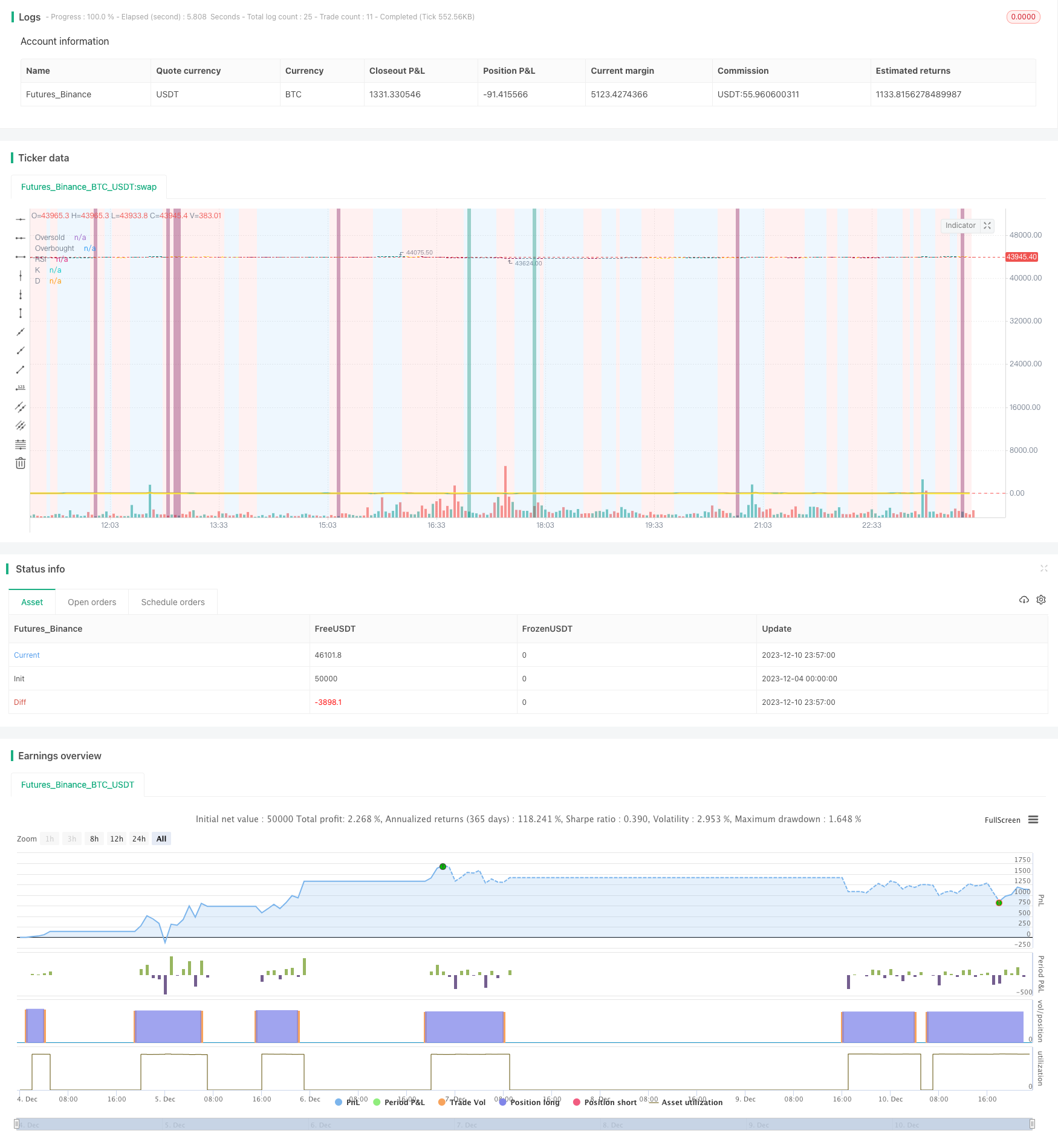

/*backtest

start: 2023-12-04 00:00:00

end: 2023-12-11 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

// ██████╗██████╗ ███████╗ █████╗ ████████╗███████╗██████╗ ██████╗ ██╗ ██╗

//██╔════╝██╔══██╗██╔════╝██╔══██╗╚══██╔══╝██╔════╝██╔══██╗ ██╔══██╗╚██╗ ██╔╝

//██║ ██████╔╝█████╗ ███████║ ██║ █████╗ ██║ ██║ ██████╔╝ ╚████╔╝

//██║ ██╔══██╗██╔══╝ ██╔══██║ ██║ ██╔══╝ ██║ ██║ ██╔══██╗ ╚██╔╝

//╚██████╗██║ ██║███████╗██║ ██║ ██║ ███████╗██████╔╝ ██████╔╝ ██║

// ╚═════╝╚═╝ ╚═╝╚══════╝╚═╝ ╚═╝ ╚═╝ ╚══════╝╚═════╝ ╚═════╝ ╚═╝

//███████╗ ██████╗ ██╗ ██╗ ██╗████████╗██╗ ██████╗ ███╗ ██╗███████╗ ██╗ █████╗ ███████╗ █████╗

//██╔════╝██╔═══██╗██║ ██║ ██║╚══██╔══╝██║██╔═══██╗████╗ ██║██╔════╝███║██╔══██╗╚════██║██╔══██╗

//███████╗██║ ██║██║ ██║ ██║ ██║ ██║██║ ██║██╔██╗ ██║███████╗╚██║╚██████║ ██╔╝╚█████╔╝

//╚════██║██║ ██║██║ ██║ ██║ ██║ ██║██║ ██║██║╚██╗██║╚════██║ ██║ ╚═══██║ ██╔╝ ██╔══██╗

//███████║╚██████╔╝███████╗╚██████╔╝ ██║ ██║╚██████╔╝██║ ╚████║███████║ ██║ █████╔╝ ██║ ╚█████╔╝

//╚══════╝ ╚═════╝ ╚══════╝ ╚═════╝ ╚═╝ ╚═╝ ╚═════╝ ╚═╝ ╚═══╝╚══════╝ ╚═╝ ╚════╝ ╚═╝ ╚════╝

strategy(shorttitle='Ain1 No Label',title='All in One Strategy no RSI Label', overlay=true, scale=scale.left, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = color.new(#0094FF, 60)

dcolor = color.new(#FF6A00, 60)

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "End Time", type = input.time)

window() => true // create function "within window of time"

// Strategy Selection - Long, Short, or Both

stratinfo = input(true, "Long/Short for Mixed Market, Long for Bull, Short for Bear")

strat = input(title="Trade Types", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

useXRSI = input(false, "Use RSI crossing back, select only one strategy")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

RSIInfo = input(true, "These are the RSI Strategy Inputs, RSI Length applies to MACD, set OB and OS to 45 for using Stoch and EMA strategies.")

length = input(14, "RSI Length", minval=1)

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

cl1 = input(3, "Connor's MA Length 1", minval=1, step=1)

cl2 = input(20, "Connor's MA Lenght 2", minval=1, step=1)

cl3 = input(50, "Connor's MA Lenght 3", minval=1, step=1)

// MACD and EMA Inputs

useMACD = input(false, "Use MACD Only, select only one strategy")

useEMA = input(false, "Use EMA Only, select only one strategy (EMA uses Stochastic inputs too)")

MACDInfo=input(true, "These are the MACD strategy variables")

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Price Movement Inputs

PriceInfo = input(true, "Price Change Percentage Cross Check Inputs for all Strategies, added logic to avoid early sell")

lkbk = input(5,"Max Lookback Period")

// EMA and SMA Background Inputs

useStoch = input(false, "Use Stochastic Strategy, choose only one")

StochInfo = input(true, "Stochastic Strategy Inputs")

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

// ------------------ Dynamic RSI Calculation ----------------------------------------

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// ------------------ Price Percentage Change Calculation -----------------------------------------

perc_change(lkbk) =>

overall_change = ((close[0] - open[lkbk]) / open[lkbk]) * 100

highest_high = 0.0

lowest_low = 0.0

for i = lkbk to 0

highest_high := i == lkbk ? high : high[i] > high[(i + 1)] ? high[i] : highest_high[1]

lowest_low := i == lkbk ? low : low[i] < low[(i + 1)] ? low[i] : lowest_low[1]

start_to_high = ((highest_high - open[lkbk]) / open[lkbk]) * 100

start_to_low = ((lowest_low - open[lkbk]) / open[lkbk]) * 100

previous_to_high = ((highest_high - open[1])/open[1])*100

previous_to_low = ((lowest_low-open[1])/open[1])*100

previous_bar = ((close[1]-open[1])/open[1])*100

[overall_change, start_to_high, start_to_low, previous_to_high, previous_to_low, previous_bar]

// Call the function

[overall, to_high, to_low, last_high, last_low, last_bar] = perc_change(lkbk)

// Plot the function

//plot(overall*50, color=color.white, title='Overall Percentage Change', linewidth=3)

//plot(to_high*50, color=color.green,title='Percentage Change from Start to High', linewidth=2)

//plot(to_low*50, color=color.red, title='Percentage Change from Start to Low', linewidth=2)

//plot(last_high*100, color=color.teal, title="Previous to High", linewidth=2)

//plot(last_low*100, color=color.maroon, title="Previous to Close", linewidth=2)

//plot(last_bar*100, color=color.orange, title="Previous Bar", linewidth=2)

//hline(0, title='Center Line', color=color.orange, linewidth=2)

true_dip = overall < 0 and to_high > 0 and to_low < 0 and last_high > 0 and last_low < 0 and last_bar < 0

true_peak = overall > 0 and to_high > 0 and to_low > 0 and last_high > 0 and last_low < 0 and last_bar > 0

alertcondition(true_dip, title='True Dip', message='Dip')

alertcondition(true_peak, title='True Peak', message='Peak')

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

//plot(rsi_ema, color=color.white, title='RSI EMA', linewidth=3)

//plot(v2, color=color.green,title='v2', linewidth=2)

//plot(v3, color=color.red, title='v3', linewidth=2)

//plot(emaFast, color=color.teal, title="EMA Fast", linewidth=2)

//plot(emaSlow, color=color.maroon, title="EMA Slow", linewidth=2)

EMABuy = crossunder(emaFast, v2) and window()

EMASell = crossover(emaFast, emaSlow) and window()

alertcondition(EMABuy, title='EMA Buy', message='EMA Buy Condition')

alertcondition(EMASell, title='EMA Sell', message='EMA Sell Condition')

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

ruleColor = ruleState==1 ? color.new(color.blue, 90) : ruleState == -1 ? color.new(color.red, 90) : ruleState == 0 ? color.new(color.gray, 90) : na

bgcolor(showZones ? ruleColor : na, title="Bullish/Bearish Zones")

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,lkbk)

l_low = lowest(low_source ,lkbk)

stoch = stoch(RSI, RSI_high, RSI_low, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", color=kcolor)

dp = plot(showStoch ? d : na, "D", color=dcolor)

fill(kp, dp, color = signalColor, title="K-D")

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

//plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

//plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

//StochBuy = crossover(k, d) and kd>0 and to_low<0 and window()

//StochSell = crossunder(k,d) and kd<0 and to_high>0 and window()

StochBuy = crossover(k, d) and window()

StochSell = crossunder(k, d) and window()

alertcondition(StochBuy, title='Stoch Buy', message='K Crossing D')

alertcondition(StochSell, title='Stoch Sell', message='D Crossing K')

// -------------- Add Price Movement -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

//plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

//plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fillcolor = color.new(#9915FF, 90)

fill(over, under, fillcolor, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = overbought

connor_os = oversold

ma1 = sma(close,cl1)

ma2 = sma(close, cl2)

ma3 = sma(close, cl3)

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma1 > ma2 and open > ma3 and RSI >= connor_ob and true_peak and window()

RSI_BUY = ma2 < ma3 and ma3 > close and RSI <= connor_os and true_dip and window()

alertcondition(RSI_BUY, title='Connors Buy', message='Connors RSI Buy')

alertcondition(RSI_SELL, title='Connors Sell', message='Connors RSI Sell')

// Color Definition

col = useCRSI ? (close > ma2 and close < ma3 and RSI <= connor_os ? color.lime : close < ma2 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

//------------------- MACD Strategy -------------------------------------------------

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = macdLine>signalLine and RSI<RSI_low and overall<0 and window()

MACDSell = macdLine<signalLine and RSI>RSI_high and overall>0 and window()

//plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

//plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

MACColor = MACDBuy ? color.new(color.teal, 50) : MACDSell ? color.new(color.maroon, 50) : na

bgcolor(showMACD ? MACColor : na, title ="MACD Signals")

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and overall<0 and window()

RSI_OB = RSI>overbought and true_peak and window()

XRSI_OS = crossover(RSI, oversold) and overall>0 and window()

RSI_OS = RSI<oversold and true_dip and window()

alertcondition(XRSI_OB, title='Reverse RSI Sell', message='RSI Crossing back under OB')

alertcondition(XRSI_OS, title='Reverse RSI Buy', message='RSI Crossing back over OS')

alertcondition(RSI_OS, title='RSI Buy', message='RSI Crossover OS')

alertcondition(RSI_SELL, title='RSI Sell', message='RSI Crossunder OB')

// Strategy Entry and Exit with built in Risk Management

GoLong = strategy.position_size==0 and strat_val > -1 and rsi_ema > RSI and k < d ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : useStoch ? StochBuy : RSI_OS) : false

GoShort = strategy.position_size==0 and strat_val < 1 and rsi_ema < RSI and d < k ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : useStoch ? StochSell : RSI_OB) : false

if (GoLong)

strategy.entry("LONG", strategy.long)

if (GoShort)

strategy.entry("SHORT", strategy.short)

longStopPrice = strategy.position_avg_price * (1 - stoploss)

longTakePrice = strategy.position_avg_price * (1 + TargetProfit)

shortStopPrice = strategy.position_avg_price * (1 + stoploss)

shortTakePrice = strategy.position_avg_price * (1 - TargetProfit)

//plot(series=(strategy.position_size > 0) ? longTakePrice : na, color=color.green, style=plot.style_circles, linewidth=3, title="Long Take Profit")

//plot(series=(strategy.position_size < 0) ? shortTakePrice : na, color=color.green, style=plot.style_circles, linewidth=3, title="Short Take Profit")

//plot(series=(strategy.position_size > 0) ? longStopPrice : na, color=color.red, style=plot.style_cross, linewidth=2, title="Long Stop Loss")

//plot(series=(strategy.position_size < 0) ? shortStopPrice : na, color=color.red, style=plot.style_cross, linewidth=2, title="Short Stop Loss")

if (strategy.position_size > 0)

strategy.exit(id="Exit Long", from_entry = "LONG", stop = longStopPrice, limit = longTakePrice)

if (strategy.position_size < 0)

strategy.exit(id="Exit Short", from_entry = "SHORT", stop = shortStopPrice, limit = shortTakePrice)

CloseLong = strat_val > -1 and strategy.position_size > 0 and rsi_ema > RSI and d > k ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

CloseShort = strat_val < 1 and strategy.position_size < 0 and rsi_ema < RSI and k > d ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")

- ストカスティックモメントムインデックスとRSIベースの量子取引戦略

- トレーディング戦略をフォローするモメントインジケーター駆動傾向

- トレンド・トレード・ストラテジーは,価格・エクストリームに基づいている.

- MACD戦略 - 二方向の出口取引

- モメントフィルタリング 移動平均戦略

- SMA と EMA に基づく量的な取引戦略

- 高級スーパートレンド追跡戦略

- ジュコフの移動平均のクロスオーバートレンド

- マルチタイムフレーム・ダイナミック・EMA・トレーディング・戦略

- EMAとMACDの定量戦略 市場指数を二重走行してリードする

- RSIとボリンジャー帯の二重戦略

- 波動性 価格チャネル移動平均取引戦略

- 双方向取引のための移動平均クロスオーバー戦略

- ボリュームオシレーター 長期・短期移動平均クロスオーバー戦略

- ピボット逆転に基づく定量取引戦略

- 超期価値領域のブレイク戦略

- 傾向分析指数に基づく定量的な取引戦略

- 移動平均RSI 仮想通貨関連トレンド戦略

- ADXの動的上昇傾向 戦略をフォローする

- ノロの価格チャネルスキルピング戦略