概述

诺罗波动通道scalping策略(Noro’s Price Channel Scalping Strategy)是一个基于价格通道和价格波动带的scalping交易策略。该策略利用价格通道和价格波动带来识别市场趋势,并在趋势方向发生转折时进行入场。

策略原理

该策略首先计算价格的最高价通道(lasthigh)和最低价通道(lastlow),然后计算出价格通道中线(center)。接着计算价格与中线的距离(dist)以及距离的简单移动平均(distsma)。 据此可以计算出距离中线1倍(hd和ld)和2倍(hd2和ld2)的价格波动带。

当价格上穿距离中线1倍的波动带时判断为看涨,当价格下穿距离中线1倍的波动带时判断为看跌。策略在衰竭的迹象出现时进行反向开仓。例如在看涨的趋势下,如果出现两根阳线,则在第二根阳线收盘时做空;在看跌的趋势下,如果出现两根阴线,则在第二根阴线收盘时做多。

策略优势

- 利用价格通道判断市场趋势方向,避免错误交易

- 基于价格波动带来判断趋势是否衰竭,精确捕捉转折点

- 采用scalping交易方式,获利快速

策略风险

- 价格震荡大时,价格通道和波动带可能失效

- scalping交易需要较高的交易频率,容易增加交易成本和滑点风险

- 需要充分考虑止损策略,以控制亏损风险

策略优化

- 优化价格通道和波动带的参数,适应更多市场情况

- 结合其他指标判断趋势和转折点

- 增加止损策略

- 考虑交易成本和滑点的影响

总结

诺罗波动通道scalping策略整体来说是一个非常适合scalping交易的策略。它利用价格通道和波动带判断市场走势,并在见顶或见底迹象出现时反向开仓。该策略交易频率高、获利快速,但也面临一定的风险。通过进一步优化,可以使该策略在更多不同市场中应用。

策略源码

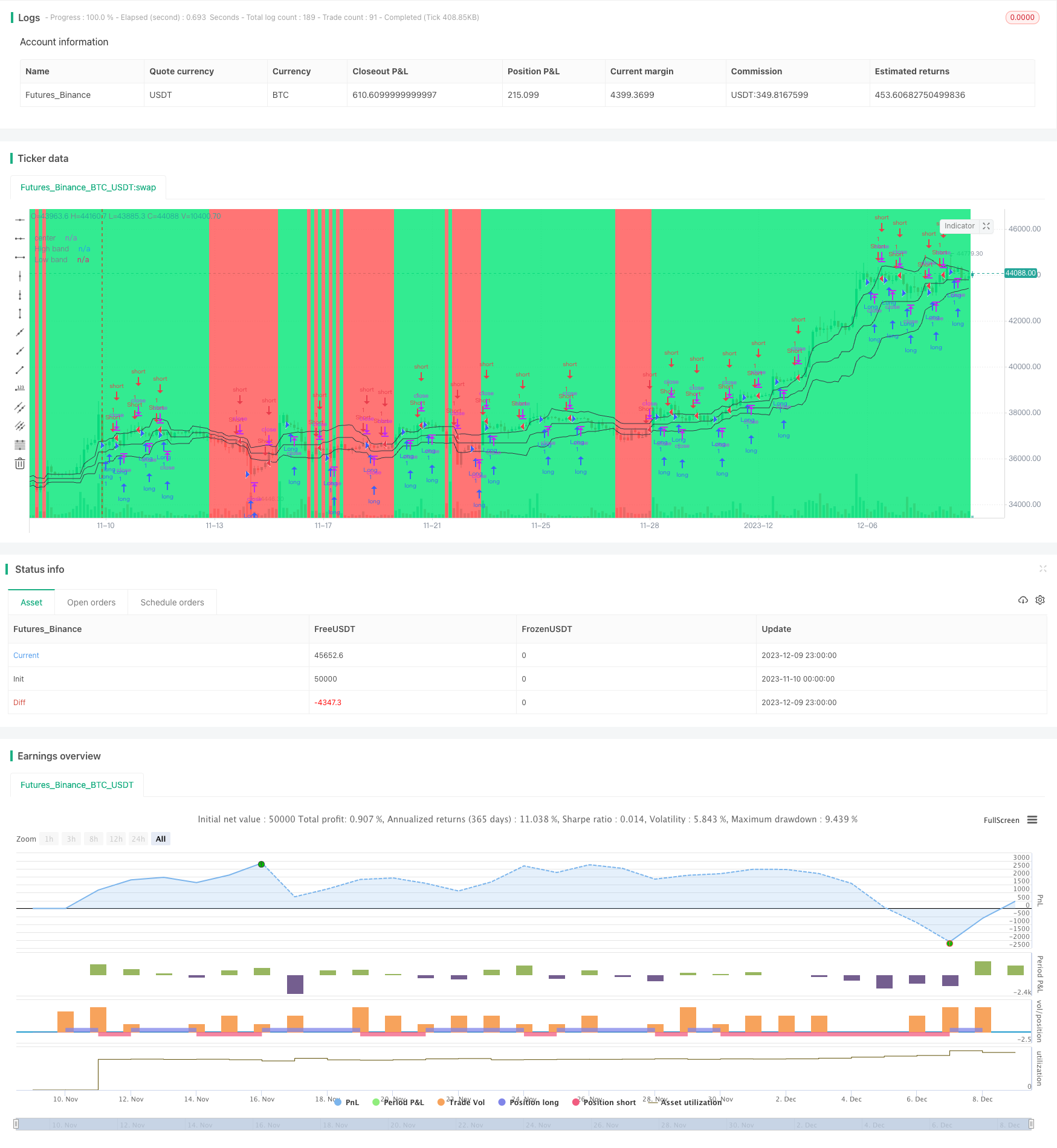

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Noro's Bands Scalper Strategy v1.0", shorttitle = "Scalper str 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

len = input(20, defval = 20, minval = 2, maxval = 200, title = "Period")

needbb = input(true, defval = true, title = "Show Bands")

needbg = input(true, defval = true, title = "Show Background")

src = close

//PriceChannel

lasthigh = highest(src, len)

lastlow = lowest(src, len)

center = (lasthigh + lastlow) / 2

//Distance

dist = abs(src - center)

distsma = sma(dist, len)

hd = center + distsma

ld = center - distsma

hd2 = center + distsma * 2

ld2 = center - distsma * 2

//Trend

trend = close < ld and high < hd ? -1 : close > hd and low > ld ? 1 : trend[1]

//Lines

colo = needbb == false ? na : black

plot(hd, color = colo, linewidth = 1, transp = 0, title = "High band")

plot(center, color = colo, linewidth = 1, transp = 0, title = "center")

plot(ld, color = colo, linewidth = 1, transp = 0, title = "Low band")

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up7 = trend == 1 and bar == -1 and bar[1] == -1 ? 1 : 0

dn7 = trend == 1 and bar == 1 and bar[1] == 1 and close > strategy.position_avg_price ? 1 : 0

up8 = trend == -1 and bar == -1 and bar[1] == -1 and close < strategy.position_avg_price ? 1 : 0

dn8 = trend == -1 and bar == 1 and bar[1] == 1 ? 1 : 0

if up7 == 1 or up8 == 1

strategy.entry("Long", strategy.long, needlong == false ? 0 : trend == -1 ? 0 : na)

if dn7 == 1 or dn8 == 1

strategy.entry("Short", strategy.short, needshort == false ? 0 : trend == 1 ? 0 : na)