概要

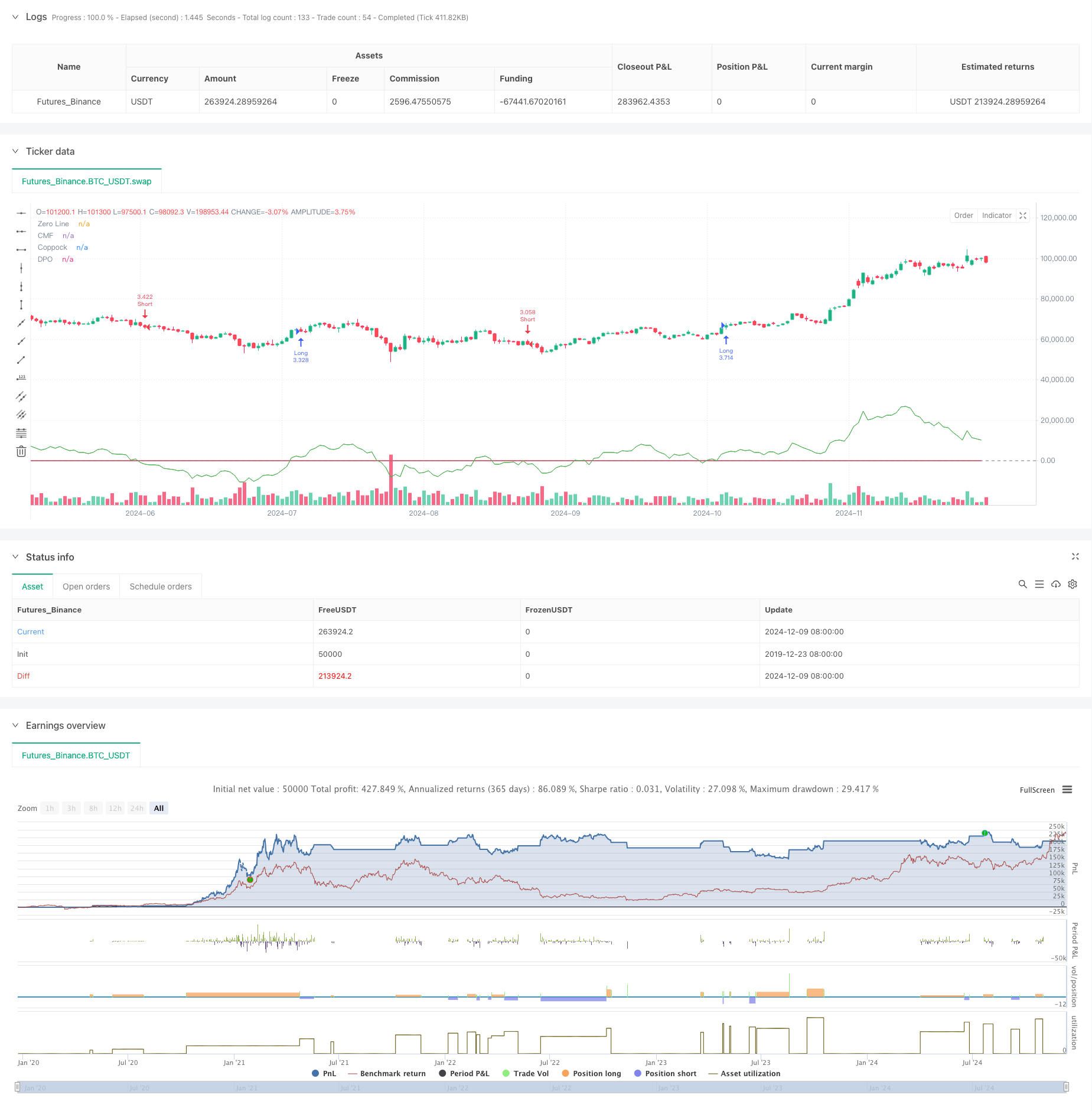

これは,複数の技術指標の組み合わせに基づいた自己適応トレンド追跡戦略で,異なる市場特性に応じてパラメータを自動的に調整することができる.この戦略は,資金流動指標 ((CMF),トレンド価格変動指標 ((DPO) およびコップコック指標 ((Coppock) を利用して,市場のトレンドを捉え,変動率調整因子を使って,異なる市場の特性に適合させる.この戦略は,完全なポジション管理とリスク制御システムを持ち,市場の変動動向に応じて取引規模を調整することができる.

戦略原則

戦略の核心的な論理は,複数の指標を組み合わせてトレンドの方向と取引のタイミングを確認することです.具体的には:

- CMF指数を使って資金の流れを測り,市場情勢を判断する

- DPO指数で長期トレンドの影響を排除し,中短期価格変動に注目

- コッポック指数の改良により,トレンドの転換点を捉える

- 3つの指標が一致したときに取引シグナルが生成されます.

- ATRによる動的計算によるストップダスト位置

- 異なる市場特性 (株式,外為,先物) に応じて,レバレッジ率と変動率のパラメータを自動的に調整する

戦略的優位性

- マルチ指標のクロス検証により,偽信号を効果的にフィルターできます.

- 市場環境に適応する強さ

- ポジション管理システムにより,変動率に合わせてポジションを動的に調整

- リスクの管理と利益の保護

- 複数の品種を同時取引し,リスクを分散させる

- 取引の論理が明確で,維持と最適化が容易です.

戦略リスク

- 多指標システムは遅滞し,高速で機会を逃している可能性がある

- パラメータを過度に最適化すると,過度にフィットする可能性があります.

- 市場転換期には誤ったシグナルが生じる可能性があります.

- 止損設定が過密である場合,頻繁に止損する可能性があります.

- 取引コストが戦略的利益に影響する リスク管理には以下の方法が推奨されています.

- パラメータの有効性を定期的にチェックする

- ポジションの実況をリアルタイムで監視する

- リーバーレートを合理的に管理する

- 設定する最大撤回制限

戦略最適化の方向性

- 市場変動率の判断を導入し,異なる波動環境で異なるパラメータの組み合わせを使用する

- 市場特性を示す指標を追加し,戦略の適応性を向上させる

- モバイル・ストップを使用することを検討するストップ・ストップメカニズムを最適化

- 自動パラメータ最適化システムを開発し,パラメータを定期的に調整

- 取引コスト分析モジュールを追加

- リスクの早期警告システムへの参加

要約する

この戦略は,多指標配合とリスク制御機構により,収益を保証しながらも,リスクをうまく制御する,より完全なトレンド追跡システムである.戦略は,拡張性があり,最適化の大きな余地がある.戦略のパフォーマンスを継続的に監視し,パラメータを適時に調整しながら,実物取引の小さな規模から取引の規模を徐々に増加させることを推奨する.

ストラテジーソースコード

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Market Adaptive Trading Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

i_market_type = input.string("Crypto", "Market Type", options=["Forex", "Crypto", "Futures"])

i_risk_percent = input.float(1, "Risk Per Trade (%)", minval=0.1, maxval=100, step=0.1)

i_volatility_adjustment = input.float(1.0, "Volatility Adjustment", minval=0.1, maxval=5.0, step=0.1)

i_max_position_size = input.float(5.0, "Max Position Size (%)", minval=1.0, maxval=100.0, step=1.0)

i_max_open_trades = input.int(3, "Max Open Trades", minval=1, maxval=10)

// Indicator Parameters

i_cmf_length = input.int(20, "CMF Length", minval=1)

i_dpo_length = input.int(21, "DPO Length", minval=1)

i_coppock_short = input.int(11, "Coppock Short ROC", minval=1)

i_coppock_long = input.int(14, "Coppock Long ROC", minval=1)

i_coppock_wma = input.int(10, "Coppock WMA", minval=1)

i_atr_length = input.int(14, "ATR Length", minval=1)

// Market-specific Adjustments

volatility_factor = i_market_type == "Forex" ? 0.1 : i_market_type == "Futures" ? 1.5 : 1.0

volatility_factor *= i_volatility_adjustment

leverage = i_market_type == "Forex" ? 100.0 : i_market_type == "Futures" ? 20.0 : 3.0

// Calculate Indicators

mf_multiplier = ((close - low) - (high - close)) / (high - low)

mf_volume = mf_multiplier * volume

cmf = ta.sma(mf_volume, i_cmf_length) / ta.sma(volume, i_cmf_length)

dpo_offset = math.floor(i_dpo_length / 2) + 1

dpo = close - ta.sma(close, i_dpo_length)[dpo_offset]

roc1 = ta.roc(close, i_coppock_short)

roc2 = ta.roc(close, i_coppock_long)

coppock = ta.wma(roc1 + roc2, i_coppock_wma)

atr = ta.atr(i_atr_length)

// Define Entry Conditions

long_condition = cmf > 0 and dpo > 0 and coppock > 0 and ta.crossover(coppock, 0)

short_condition = cmf < 0 and dpo < 0 and coppock < 0 and ta.crossunder(coppock, 0)

// Calculate Position Size

account_size = strategy.equity

risk_amount = math.min(account_size * (i_risk_percent / 100), account_size * (i_max_position_size / 100))

position_size = (risk_amount / (atr * volatility_factor)) * leverage

// Execute Trades

if (long_condition and strategy.opentrades < i_max_open_trades)

sl_price = close - (atr * 2 * volatility_factor)

tp_price = close + (atr * 3 * volatility_factor)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Long Exit", "Long", stop=sl_price, limit=tp_price)

if (short_condition and strategy.opentrades < i_max_open_trades)

sl_price = close + (atr * 2 * volatility_factor)

tp_price = close - (atr * 3 * volatility_factor)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Short Exit", "Short", stop=sl_price, limit=tp_price)

// Plot Indicators

plot(cmf, color=color.blue, title="CMF")

plot(dpo, color=color.green, title="DPO")

plot(coppock, color=color.red, title="Coppock")

hline(0, "Zero Line", color=color.gray)

// Alerts

alertcondition(long_condition, title="Long Entry", message="Potential Long Entry Signal")

alertcondition(short_condition, title="Short Entry", message="Potential Short Entry Signal")

// // Performance reporting

// if barstate.islastconfirmedhistory

// label.new(bar_index, high, text="Strategy Performance:\nTotal Trades: " + str.tostring(strategy.closedtrades) +

// "\nWin Rate: " + str.tostring(strategy.wintrades / strategy.closedtrades * 100, "#.##") + "%" +

// "\nProfit Factor: " + str.tostring(strategy.grossprofit / strategy.grossloss, "#.##"))