다단계 ATR 거래 전략

저자:차오장, 날짜: 2024-12-05 16:49:57태그:ATRSMATRMFTPSLMAAATR

전반적인 설명

이 전략의 가장 특징적인 특징은 ATR 기반의 출구 레벨 4개와 고정된 비율 레벨 3개를 결합한 독특한 7단계 수익 취득 메커니즘이다. 이 하이브리드 접근 방식은 거래자가 장기 및 단위 시장 포지션 모두에서 수익을 체계적으로 캡처하면서 시장 변동성에 동적으로 조정할 수 있게 해준다. 이 전략은 동적인 ATR 계산, 트렌드 강도 탐지 및 여러 수익 취득 메커니즘의 조합을 통해 포괄적인 거래 솔루션을 제공한다.

전략 원칙

이 전략은 몇 가지 핵심 요소를 통해 작동합니다. 1. 향상 된 진정한 범위 계산: 가장 중요한 가격 움직임을 고려하여 시장 변동성을 측정합니다. 2. 모멘텀 팩터 통합: 더 나은 적응력을 위해 최근 가격 움직임에 따라 ATR을 조정합니다. 3. 적응성 ATR 계산: 변동성 기간 동안 민감도를 높이기 위해 모멘텀 인자를 기반으로 전통적인 ATR을 수정합니다. 4. 트렌드 강도 정량화: 정교한 알고리즘을 통해 트렌드 강도를 평가합니다. 7. 7단계 수익 메커니즘: ATR 기반 출구 수준 4개와 고정 비율 수준 3개를 포함합니다.

전략적 장점

- 높은 적응력: 동적 ATR 계산을 통해 다른 시장 조건에 적응합니다.

- 포괄적 리스크 관리: 다단계 수익 취득 메커니즘은 체계적인 리스크 통제를 제공합니다.

- 높은 유연성: 긴 시장과 짧은 시장에서 똑같이 효과적입니다.

- 조정 가능한 매개 변수: 다양한 거래 스타일에 맞게 여러 가지 사용자 정의 가능한 매개 변수를 제공합니다.

- 체계적인 실행: 명확한 출입 및 출입 규칙은 감정적 인 거래를 줄입니다.

전략 위험

- 매개 변수 민감성: 매개 변수 설정이 잘못되면 거래가 과다하거나 기회를 놓칠 수 있습니다.

- 시장 조건 의존성: 매우 변동성 있는 시장이나 변동성 있는 시장에서 실적이 저하될 수 있습니다.

- 복잡성 위험: 다단계 수익 메커니즘은 실행의 어려움을 증가시킬 수 있습니다.

- 미끄러짐 영향: 여러 이익 포인트가 미끄러짐에 의해 크게 영향을받을 수 있습니다.

- 자본 요구 사항: 다단계 수익 전략을 실행하기 위해 충분한 자본이 필요합니다.

전략 최적화 방향

- 동적 매개 변수 조정: 시장 조건에 따라 매개 변수를 자동 조정합니다.

- 시장 환경 필터링: 시장 환경 식별 메커니즘을 추가합니다.

- 리스크 관리 강화: 동적인 스톱 로스 메커니즘을 도입합니다.

- 실행 최적화: 미끄러짐 영향을 줄이기 위해 수익 취득 메커니즘을 단순화합니다.

- 백테스팅 프레임워크 개선: 더 현실적인 거래 요인을 포함합니다.

요약

이 전략은 트레이더들에게 적응성 있는 ATR과 다층 수익 취득 메커니즘을 결합함으로써 포괄적인 거래 시스템을 제공한다. 이 전략의 강점은 체계적인 접근을 통해 위험을 관리하면서 다른 시장 조건에 적응할 수 있는 능력에 있다. 잠재적인 위험이 있지만, 이 전략은 적절한 최적화와 위험 관리를 통해 효과적인 거래 도구가 될 수 있다. 이 혁신적인 다층 수익 취득 메커니즘은 특히 위험 통제를 유지하면서 수익을 극대화하려는 트레이더들에게 적합하다.

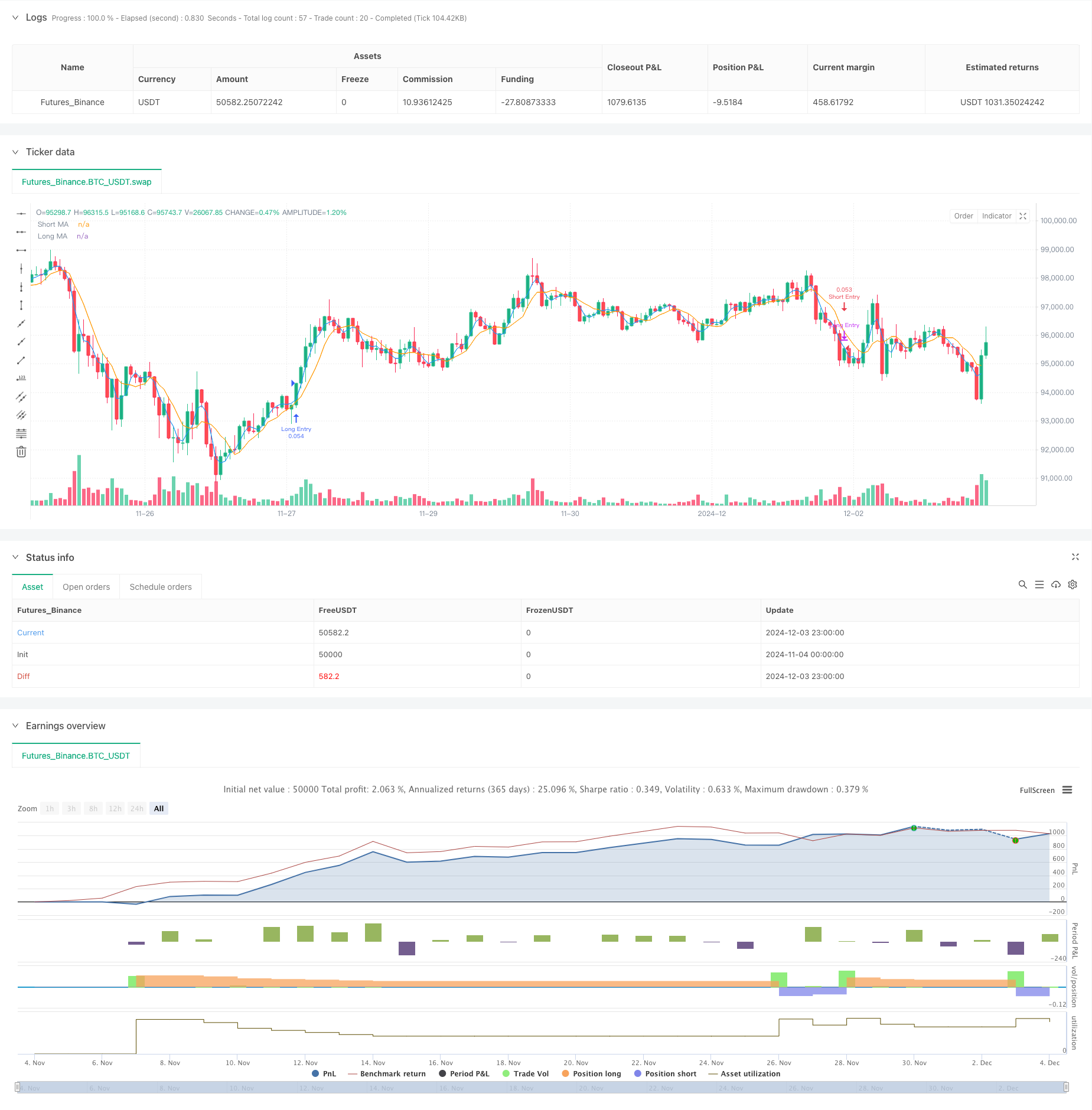

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

- 동적 리스크 관리와 함께 두 가지 이동 평균 크로스오버 전략

- 트렌드 필터와 예외 출구와 함께 부드러운 이동 평균 스톱 손실 & 취득 전략

- 동적 이동 평균 및 고정 스톱 손실 최적화 모델과 볼링거 밴드 교차 전략

- ATR 핵융합 트렌드 최적화 모델 전략

- 후속 스톱 로스 전략과 함께 적응적인 이동 평균 크로스오버

- 볼링거 반드와 우디스 CCI를 이용한 다중 지표 필터링 거래 전략

- 트렌드 브레이크 트레이딩 시스템 (TBMA 전략)

- 동적 이동 평균 크로스오버 트렌드 적응적 리스크 관리 전략

- 이중 이동 평균 크로스오버와 수익/손실 중지 트레이딩 전략

- 동적 후속 정지 두 개의 목표 이동 평균 교차 전략

- 동적 이중 EMA 크로스오버 전략

- 볼링거 밴드 및 RSI 결합 동적 거래 전략

- RSI-ATR 모멘텀 변동성 결합 거래 전략

- 이중 EMA 트렌드 추후 전략과 제한 구매 입점

- 멀티 전략 기술 분석 거래 시스템

- 다중 시간 프레임 결합 된 촛불 패턴 인식 거래 전략

- 트리플 볼링거 밴드는 양적 거래 전략에 따라 트렌드를 감지합니다.

- 볼링거 밴드와 RSI를 기반으로 한 다차원 동적 브레이크오프 거래 시스템

- RSI 평균 반전 브레이크업 전략

- 이중 EMA 크로스오버 모멘텀 트렌드 전략

- 듀얼 타임프레임 동적 지원 거래 시스템

- 전략에 따른 다기간 이동평균 및 RSI 모멘텀 크로스 트렌드

- 금융자산 MFI 기반 과잉판매구역 출구 및 신호 평균화 시스템

- 모멘텀 인디케이터와 멀티 EMA 크로스오버 거래 전략

- MACD-KDJ 결합된 마틴게일 피라미딩 양적 거래 전략

- 다중 패턴 인식 및 SR 레벨 거래 전략

- G 채널 및 EMA 트렌드 필터 거래 시스템

- 동적 스톱 로스 다 기간 RSI 트렌드 전략

- 동적 이중 이동 평균 돌파구 거래 시스템

- 다중 지표 크로스오버 모멘텀 트렌드 최적화 된 영업 및 중단 손실 시스템으로 전략을 따르는 것