Indeks Kekuatan Relatif - Perbezaan - Libertus

Penulis:ChaoZhang, Tarikh: 2022-05-24 15:24:22Tag:RSI

Hai semua,

Untuk memudahkan semua orang pengalaman perdagangan saya membuat skrip ini yang warna RSI overbought dan oversold keadaan dan sebagai bonus memaparkan bullish atau bearish divergensi dalam 50 lilin terakhir (secara lalai, anda boleh mengubahnya). Script adalah sumber terbuka, sebahagian kod adalah dari contoh Trading View. Jika anda mempunyai cadangan atau anda sudah membuat beberapa penambahbaikan, sila lapor dalam komen.

Selamat berdagang dan semoga berjaya!

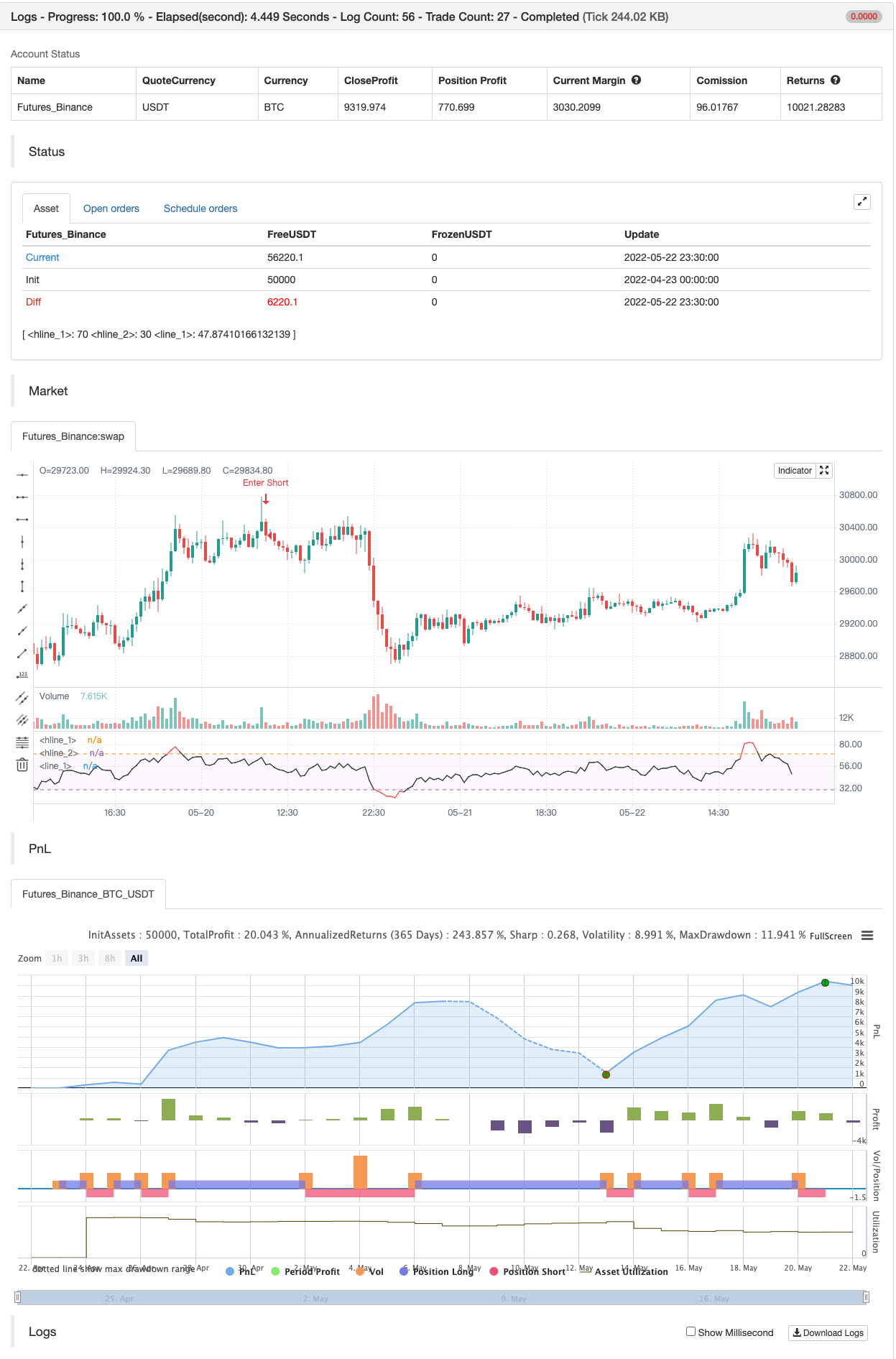

Ujian belakang

//@version=4

// Copyright by Libertus - 2021

// RSI Divergences v3.2

// Free for private use

study(title="Relative Strength Index - Divergences - Libertus", shorttitle="RSI Div - Lib")

len = input(14, minval=1, title="RSI Length")

ob = input(defval=70, title="Overbought", type=input.integer, minval=0, maxval=100)

os = input(defval=30, title="Oversold", type=input.integer, minval=0, maxval=100)

// RSI code

rsi = rsi(close, len)

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=(rsi > ob or rsi < os ? color.new(color.red, 0) : color.new(color.black, 0)))

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false,"Hide pivots?")

shrt = input(false,"Shorter labels?")

hidel = input(false, "Hide labels and color background")

xbars = input(defval=90, title="Div lookback period (bars)?", type=input.integer, minval=1)

hb = abs(highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = abs(lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

// Finds pivot point with at least 2 right candles with lower value

pivoth := (max_rsi == max_rsi[2]) and (max_rsi[2] != max_rsi[3]) ? true : na

pivotl := (min_rsi == min_rsi[2]) and (min_rsi[2] != min_rsi[3]) ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if (max[1] > max[2]) and (rsi[1] < max_rsi) and (rsi <= rsi[1])

divbear := true

if (min[1] < min[2]) and (rsi[1] > min_rsi) and (rsi >= rsi[1])

divbull := true

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

if divbull

strategy.entry("Enter Long", strategy.long)

else if divbear

strategy.entry("Enter Short", strategy.short)

// // Plots divergences and pivots with offest

// l = divbear ?

// label.new (bar_index-1, rsi[1]+1, "BEAR", color=color.red, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// divbull ?

// label.new (bar_index-1, rsi[1]-1, "BULL", color=color.green, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// pivoth ?

// label.new (bar_index-2, max_rsi+1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// pivotl ?

// label.new (bar_index-2, min_rsi-1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// na

// // Shorter labels

// if shrt

// label.set_text (l, na)

// // Hides pivots or labels

// if (piv and (pivoth or pivotl)) or hidel

// label.delete (l)

// // Colors indicator background

// bgcolor (hidel ? (divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na) : na, offset=-1)

// bgcolor (hidel ? (piv ? na : (pivoth or pivotl ? color.new(color.blue, 50) : na)) : na, offset=-2)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

Berkaitan

- Sistem Dagangan Berpeluang Berpeluang

- Strategi Dagangan Berimbang Berasaskan Masa Berputar Pendek dan Lama

- Strategi Dagangan Kuantitatif Trend Dinamik MACD Lanjutan

- RSI Sistem Dagangan Beradaptasi Pintar Berasaskan Momentum dengan Pengurusan Risiko Berbilang Tahap

- Strategi Dagangan Dinamis RSI Osilator Beradaptasi dengan Pengoptimuman Sempadan

- RSI dan AO Trend Synergistic Berikutan Strategi Dagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Penapis Purata Bergerak

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Pengoptimuman Risiko-Penghargaan

- Strategi Kuantitatif Pembalikan Julat Dinamik RSI dengan Model Optimasi Volatiliti

- Trend Momentum Bollinger Bands Berikutan Strategi Kuantitatif

- Analisis Teknikal Pelbagai Tempoh dan Strategi Perdagangan Sentimen Pasaran

Lebih lanjut

- Strategi Swing Hull/rsi/EMA

- Alat Perdagangan Swing Scalping R1-4

- BEST Engulfing + Breakout Strategi

- Bollinger Awesome Alert R1

- Plugin yang disambungkan ke pelbagai bursa

- Ganjaran segitiga (menghasilkan mata wang kecil dengan harga yang berbeza)

- bybit reverse contract dynamic grid (grid khas)

- Peringatan TradingView untuk MT4 MT5 + pembolehubah dinamik

- Siri Matriks

- Super Scalper - 5 minit 15 minit

- Regresi Linear ++

- RedK Dual VADER dengan Bar Tenaga

- Zon Pengukuhan - Hidup

- Perkiraan Kuantitatif Kualitatif

- Amaran rentas rata-rata bergerak, pelbagai jangka masa (MTF)

- MACD Reloaded STRATEGY

- Purata Bergerak SuperTrended

- Perdagangan ABC

- 15MIN BTCUSDTPERP BOT

- Shannon Entropy V2