概述

这个策略是一个基于MACD(移动平均线收敛发散指标)的高级量化交易系统,通过动态背景显示和多种预设参数组合来增强交易决策的准确性。该策略的核心在于通过MACD指标的交叉信号来捕捉市场趋势的转换点,并通过可视化的方式直观地展示市场的多空状态。

策略原理

策略采用了十种不同的MACD参数预设,包括标准设置(12,26,9)、短期(5,35,5)、长期(19,39,9)等,以适应不同的市场环境和交易风格。当MACD线与信号线发生黄金交叉时,系统生成买入信号;当发生死亡交叉时,系统生成卖出信号。策略通过动态背景颜色变化(绿色表示多头,红色表示空头)来增强视觉辨识度,帮助交易者更好地把握市场走势。

策略优势

- 参数灵活性强:提供十种预设参数组合,适应不同市场环境

- 视觉反馈清晰:通过背景颜色动态变化直观显示市场趋势

- 信号明确:基于MACD交叉产生明确的买卖信号

- 适应性强:可用于不同时间周期的交易

- 代码结构清晰:使用switch结构实现参数切换,便于维护和扩展

策略风险

- 滞后性风险:MACD作为滞后指标可能在剧烈波动市场中产生延迟信号

- 假突破风险:在横盘市场中可能产生虚假交叉信号

- 参数依赖性:不同参数组合在不同市场环境下表现差异较大

- 市场条件限制:在剧烈波动或流动性不足的市场环境下可能表现不佳

策略优化方向

- 引入波动率过滤器,过滤掉市场波动过大时期的交易信号

- 添加趋势确认指标,如RSI或ATR,提高信号可靠性

- 实现自适应参数优化,根据市场状况动态调整MACD参数

- 增加止损止盈功能,提高风险管理能力

- 添加交易量分析,提高信号的可靠性

总结

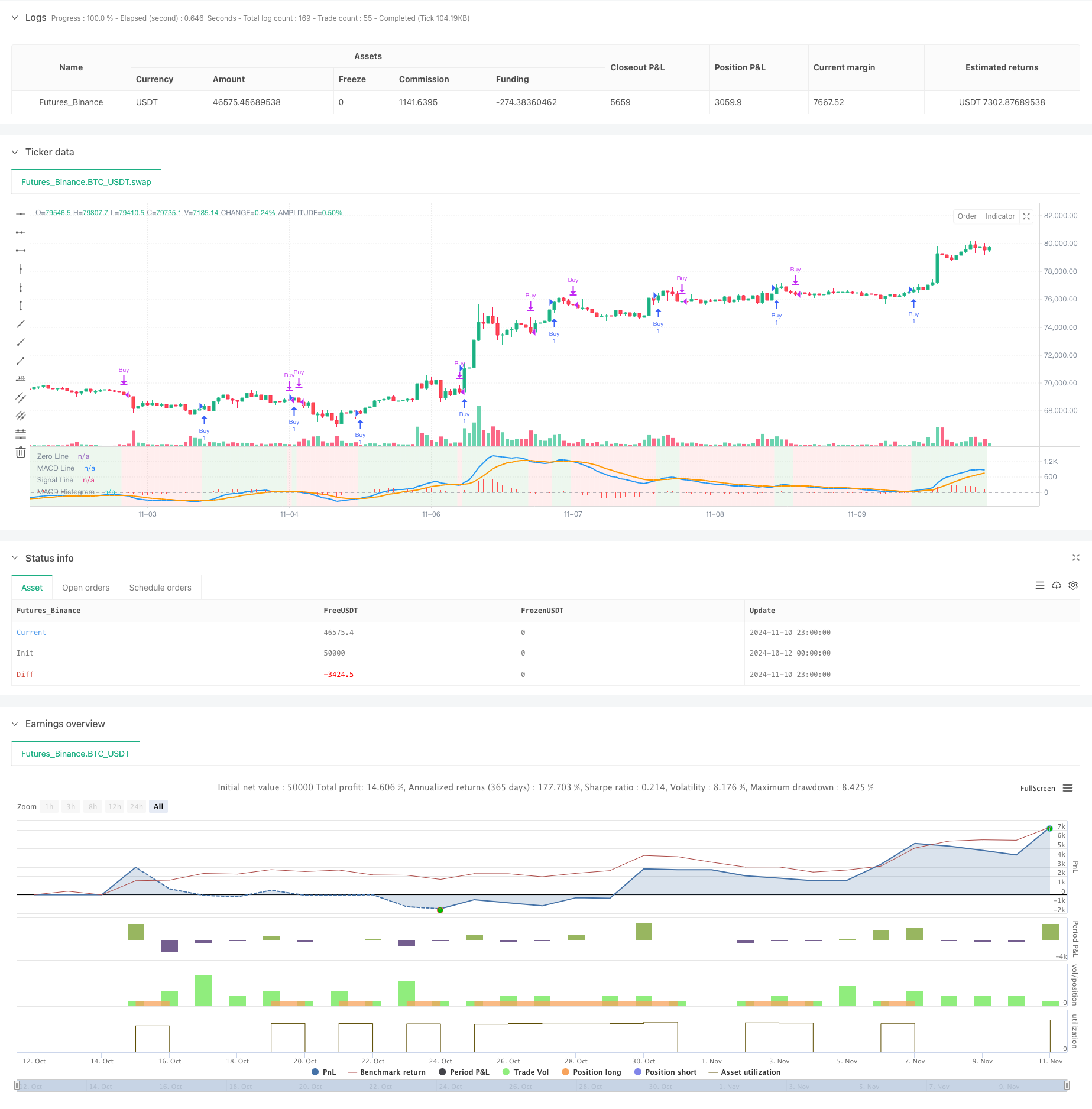

这是一个结构完善、逻辑清晰的MACD策略进阶版本。通过多参数预设和动态视觉反馈,大大提升了策略的实用性和可操作性。虽然存在一些固有的风险,但通过提供的优化方向进行改进后,该策略有望成为一个稳健的交易系统。建议交易者在实盘使用前进行充分的回测,并根据具体市场环境选择合适的参数设置。

策略源码

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hanzo - Top 10 MACD Strategy", overlay=false) // MACD in a separate pane

// Define dropdown options for MACD settings

macdOption = input.string(title="Select MACD Setting",

defval="Standard (12, 26, 9)",

options=["Standard (12, 26, 9)",

"Short-Term (5, 35, 5)",

"Long-Term (19, 39, 9)",

"Scalping (3, 10, 16)",

"Cryptocurrency (20, 50, 9)",

"Forex (8, 17, 9)",

"Conservative (24, 52, 18)",

"Trend-Following (7, 28, 7)",

"Swing Trading (5, 15, 5)",

"Contrarian (15, 35, 5)"])

// MACD setting based on user selection

var int fastLength = 12

var int slowLength = 26

var int signalLength = 9

switch macdOption

"Standard (12, 26, 9)" =>

fastLength := 12

slowLength := 26

signalLength := 9

"Short-Term (5, 35, 5)" =>

fastLength := 5

slowLength := 35

signalLength := 5

"Long-Term (19, 39, 9)" =>

fastLength := 19

slowLength := 39

signalLength := 9

"Scalping (3, 10, 16)" =>

fastLength := 3

slowLength := 10

signalLength := 16

"Cryptocurrency (20, 50, 9)" =>

fastLength := 20

slowLength := 50

signalLength := 9

"Forex (8, 17, 9)" =>

fastLength := 8

slowLength := 17

signalLength := 9

"Conservative (24, 52, 18)" =>

fastLength := 24

slowLength := 52

signalLength := 18

"Trend-Following (7, 28, 7)" =>

fastLength := 7

slowLength := 28

signalLength := 7

"Swing Trading (5, 15, 5)" =>

fastLength := 5

slowLength := 15

signalLength := 5

"Contrarian (15, 35, 5)" =>

fastLength := 15

slowLength := 35

signalLength := 5

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

macdHist = macdLine - signalLine

// Buy and Sell conditions based on MACD crossovers

enterLong = ta.crossover(macdLine, signalLine)

exitLong = ta.crossunder(macdLine, signalLine)

// Execute buy and sell orders with price labels in the comments

if (enterLong)

strategy.entry("Buy", strategy.long, comment="Buy at " + str.tostring(close, "#.##"))

if (exitLong)

strategy.close("Buy", comment="Sell at " + str.tostring(close, "#.##"))

// Plot the signal price using plotchar for buy/sell prices

//plotchar(enterLong ? close : na, location=location.belowbar, color=color.green, size=size.small, title="Buy Price", offset=0)

//plotchar(exitLong ? close : na, location=location.abovebar, color=color.red, size=size.small, title="Sell Price", offset=0)

// Background highlighting based on bullish or bearish MACD

isBullish = macdLine > signalLine

isBearish = macdLine < signalLine

// Change background to green for bullish periods and red for bearish periods

bgcolor(isBullish ? color.new(color.green, 90) : na, title="Bullish Background")

bgcolor(isBearish ? color.new(color.red, 90) : na, title="Bearish Background")

// Plot the MACD and Signal line in a separate pane

plot(macdLine, title="MACD Line", color=color.blue, linewidth=2)

plot(signalLine, title="Signal Line", color=color.orange, linewidth=2)

hline(0, "Zero Line", color=color.gray)

plot(macdHist, title="MACD Histogram", style=plot.style_histogram, color=color.red)

相关推荐