Gambaran Keseluruhan Strategi

Strategi ini adalah sistem perdagangan trend-tracking dan pembalikan berdasarkan titik-titik keseimbangan harga. Ia menentukan harga keseimbangan dengan mengira nilai tengah titik tertinggi dan terendah pada garis K akar X yang lalu, dan menilai arah trend berdasarkan kedudukan harga penutupan terhadap harga keseimbangan. Sistem akan mengenal pasti trend apabila harga terus kekal di sebelah harga keseimbangan mencapai jumlah garis K yang ditetapkan.

Prinsip Strategi

- Pengiraan harga keseimbangan: Menggunakan harga tertinggi dan harga terendah pada garis K akar X yang lalu sebagai harga keseimbangan, yang sama dengan kaedah pengiraan garis asas pada carta keseimbangan pertama.

- Penghakiman trend: apabila harga terus mengekalkan X-root K line pada sisi yang sama dengan harga keseimbangan (default 7-root), ia dianggap sebagai trend.

- Isyarat masuk: mencetuskan isyarat masuk apabila pengembalian pertama selepas trend ditubuhkan (harga menembusi harga keseimbangan).

- Hentikan Kerosakan: Menggunakan ATR 60 peratus untuk menyesuaikan jarak hentikan kerosakan secara dinamik, memberikan fleksibiliti untuk mengawal risiko.

- Perlindungan Fluktuasi Besar: Apabila harga menyimpang dari titik keseimbangan melebihi kelipatan ATR yang ditetapkan, sistem akan secara automatik melonggarkan kedudukan untuk mengelakkan penarikan balik yang besar.

Kelebihan Strategik

- Kebolehsuaian: Ia dapat mengikuti trend dan membalikkan mod dagangan mengikut ciri-ciri pasaran.

- Kawalan risiko yang sempurna: penggunaan ATR yang dinamik dan mekanisme perlindungan yang berfluktuasi besar.

- Operasi yang jelas: isyarat perdagangan jelas dan tidak bergantung pada kombinasi indikator teknikal yang rumit.

- Kesan visual yang baik: menggunakan warna K dan latar belakang untuk menunjukkan keadaan pasaran secara intuitif.

- Automasi yang mesra: Perdagangan automatik boleh dilakukan dengan mudah melalui platform perdagangan seperti MT5

Risiko Strategik

- Risiko pasaran goyah: Isyarat palsu yang sering berlaku dalam pasaran goyah.

- Kesan slippage: mungkin terdapat slippage yang lebih besar apabila turun naik dengan kuat.

- Sensitiviti parameter: parameter teras seperti tempoh keseimbangan, kitaran penilaian trend dan lain-lain perlu dioptimumkan dengan teliti untuk pasaran yang berbeza.

- Risiko pertukaran pasaran: Pergeseran pasaran dari trend ke goyah boleh menyebabkan penurunan yang lebih besar.

Arah pengoptimuman strategi

- Pengenalan keadaan pasaran: menambah modul penilaian keadaan pasaran, menyesuaikan parameter strategi secara dinamik dalam keadaan pasaran yang berbeza.

- Penapisan isyarat: Pertimbangkan untuk menambah petunjuk tambahan seperti jumlah trafik, kadar turun naik untuk menapis isyarat palsu.

- Pengurusan kedudukan: memperkenalkan mekanisme pengurusan kedudukan yang lebih kompleks, seperti penyesuaian dinamik berdasarkan kadar turun naik.

- Multiple time period: menggabungkan isyarat dari pelbagai tempoh masa untuk meningkatkan ketepatan perdagangan.

- Pengoptimuman kos transaksi: Optimumkan ciri kos untuk pelbagai jenis transaksi dalam masa keluar.

ringkaskan

Ini adalah sistem perdagangan trend yang dirancang dengan wajar, memberikan logik perdagangan yang jelas melalui konsep teras harga keseimbangan. Ciri utama strategi ini adalah fleksibiliti yang tinggi, boleh digunakan untuk mengikuti trend dan boleh digunakan untuk bertukar perdagangan, dengan mekanisme kawalan risiko yang baik. Walaupun mungkin menghadapi cabaran dalam keadaan pasaran tertentu, strategi ini dijangka dapat mengekalkan prestasi yang stabil dalam pelbagai keadaan pasaran melalui pengoptimuman berterusan dan penyesuaian fleksibel.

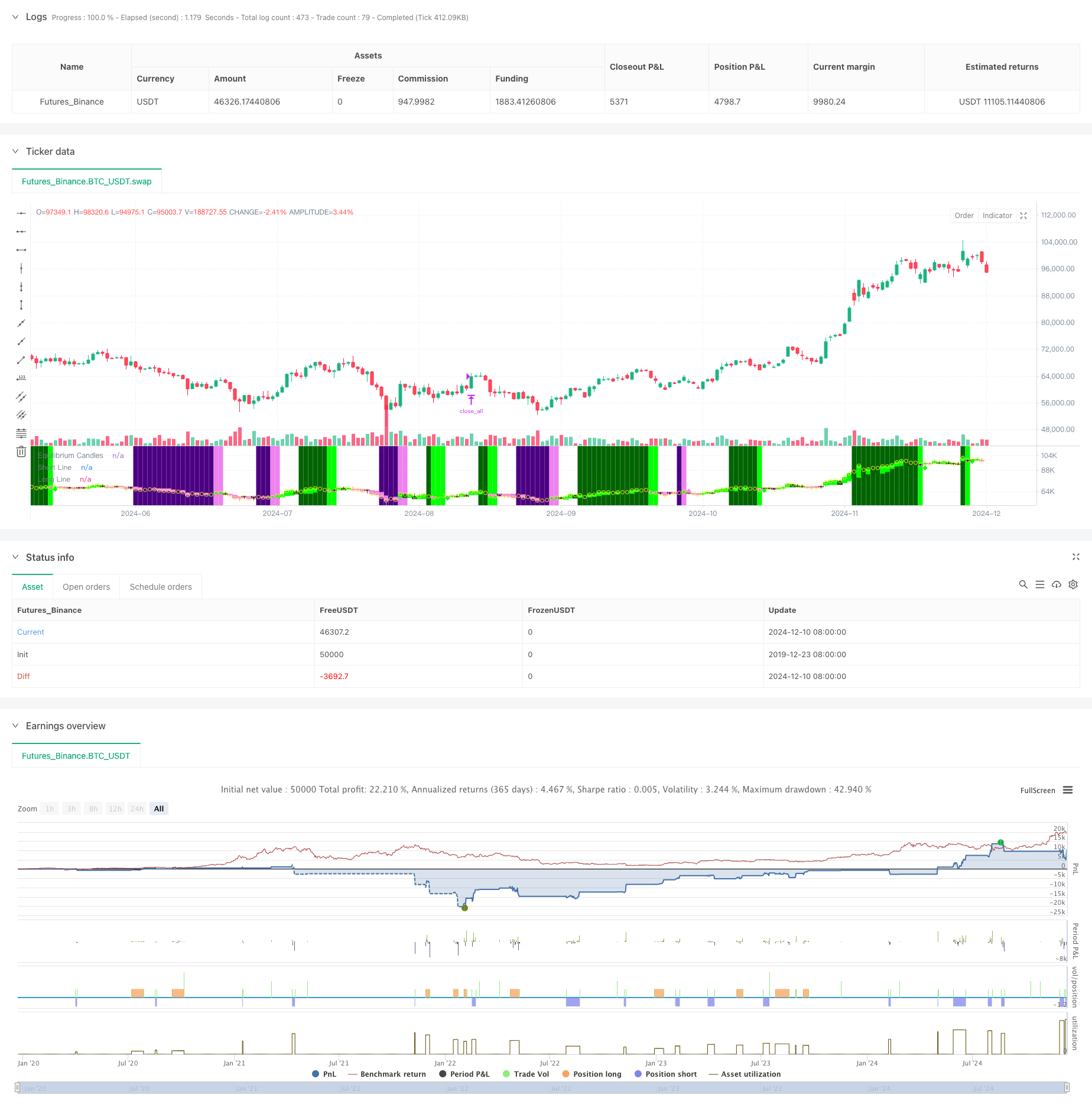

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Honestcowboy

//@version=5

strategy("Equilibrium Candles + Pattern [Honestcowboy]", overlay=false)

// ================================== //

// ---------> User Input <----------- //

// ================================== //

candleSmoothing = input.int(9, title="Equilibrium Length", tooltip="The lookback for finding equilibrium.\nIt is same calculation as the Baseline in Ichimoku Cloud and is the mid point between highest and lowest value over this length.", group="Base Settings")

candlesForTrend = input.int(7, title="Candles needed for Trend", tooltip="The amount of candles in one direction (colored) before it's considered a trend.\nOrders get created on the first candle in opposite direction.", group="Base Settings")

maxPullbackCandles = input.int(2, title="Max Pullback (candles)", tooltip="The amount of candles can go in opposite direction until a pending trade order is cancelled.", group="Base Settings")

candle_bull_c1 = input.color(color.rgb(0,255,0), title="", inline="1", group="Candle Coloring")

candle_bull_c2 = input.color(color.rgb(0,100,0), title="", inline="1", group="Candle Coloring")

candle_bear_c1 = input.color(color.rgb(238,130,238), title="", inline="2", group="Candle Coloring")

candle_bear_c2 = input.color(color.rgb(75,0,130), title="", inline="2", group="Candle Coloring")

highlightClosePrices = input.bool(defval=true, title="Highlight close prices", group="Candle Coloring", tooltip="Will put small yellow dots where closing price would be.")

useBgColoring = input.bool(defval=true, title="color main chart Bg based on trend and entry point", tooltip="colors main chart background based on trend and entry points", group="Chart Background")

trend_bull_c = input.color(color.rgb(0,100,0,50), title="Trend Bull Color", group="Chart Background")

trend_bear_c = input.color(color.rgb(75,0,130, 50), title="Trend Bear Color", group="Chart Background")

long_zone_c = input.color(color.rgb(0,255,0,60), title="Long Entry Zone Color", group="Chart Background")

short_zone_c = input.color(color.rgb(238,130,238,60), title="Short Entry Zone Color", group="Chart Background")

atrLenghtScob = input.int(14, title="ATR Length", group = "Volatility Settings")

atrAverageLength = input.int(200, title="ATR percentile averages lookback", group = "Volatility Settings")

atrPercentile = input.int(60, minval=0, maxval=99, title="ATR > bottom X percentile", group = "Volatility Settings", tooltip="For the Final ATR value in which percentile of last X bars does it need to be a number. At 60 it's the lowest ATR in top 40% of ATR over X bars")

useReverse = input.bool(true, title="Use Reverse", group="Strategy Inputs", tooltip="The Strategy will open short orders where normal strategy would open long orders. It will use the SL as TP and the TP as SL. So would create the exact opposite in returns as the normal strategy.")

stopMultiplier = input.float(2, title="stop+tp atr multiplier", group="Strategy Inputs")

useTPSL = input.bool(defval=true, title="use stop and TP", group="Strategy Inputs")

useBigCandleExit = input.bool(defval=true, title="Big Candle Exit", group="Strategy Inputs", inline="1", tooltip="Closes all open trades whenever price closes too far from the equilibrium")

bigCandleMultiplier = input.float(defval=1, title="Exit Multiplier", group="Strategy Inputs", inline="1", tooltip="The amount of times in ATR mean candle needs to close outside of equilibrium for it to be a big candle exit.")

tvToQPerc = input.float(defval=1, title="Trade size in Account risk %", group="Tradingview.to Connection (MT5)", tooltip="Quantity as a percentage with stop loss in the commands; the lot size is calculated based on the percentage to lose in case sl is hit. If SL is not specified, the Lot size will be calculated based on account balance.")

tvToOverrideSymbol = input.bool(defval=false, title="Override Symbol?", group="Tradingview.to Connection (MT5)")

tvToSymbol = input.string(defval="EURUSD", title="", group="Tradingview.to Connection (MT5)")

// ================================== //

// -----> Immutable Constants <------ //

// ================================== //

var bool isBullTrend = false

var bool isBearTrend = false

var bool isLongCondition = false

var bool isShortCondition = false

var int bullCandleCount = 0

var int bearCandleCount = 0

var float longLine = na

var float shortLine = na

// ================================== //

// ---> Functional Declarations <---- //

// ================================== //

baseLine(len) =>

math.avg(ta.lowest(len), ta.highest(len))

// ================================== //

// ----> Variable Calculations <----- //

// ================================== //

longSignal = false

shortSignal = false

equilibrium = baseLine(candleSmoothing)

atrEquilibrium = ta.atr(atrLenghtScob)

atrAveraged = ta.percentile_nearest_rank(atrEquilibrium, atrAverageLength, atrPercentile)

equilibriumTop = equilibrium + atrAveraged*bigCandleMultiplier

equilibriumBottom = equilibrium - atrAveraged*bigCandleMultiplier

// ================================== //

// -----> Conditional Variables <---- //

// ================================== //

if not isBullTrend and close>equilibrium

bullCandleCount := bullCandleCount + 1

bearCandleCount := 0

isBearTrend := false

if not isBearTrend and close<equilibrium

bearCandleCount := bearCandleCount + 1

bullCandleCount := 0

isBullTrend := false

if bullCandleCount >= candlesForTrend

isBullTrend := true

isBearTrend := false

bullCandleCount := 0

bearCandleCount := 0

if bearCandleCount >= candlesForTrend

isBearTrend := true

isBullTrend := false

bullCandleCount := 0

bearCandleCount := 0

// ================================== //

// ------> Strategy Execution <------ //

// ================================== //

if isBullTrend[1] and close<equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("short", strategy.short, limit=high)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high-stopMultiplier*atrAveraged)+ " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("long", strategy.long, stop=high)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high+stopMultiplier*atrAveraged) + " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isLongCondition := true

isBullTrend := false

longLine := high

if isBearTrend[1] and close>equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("long", strategy.long, limit=low)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low+stopMultiplier*atrAveraged) + " SL=" + str.tostring(low-stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("short", strategy.short, stop=low)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low-stopMultiplier*atrAveraged) + " SL=" + str.tostring(low+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isShortCondition := true

isBearTrend := false

shortLine := low

if isLongCondition and (bearCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

if not useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

isLongCondition := false

bullCandleCount := 0

longLine := na

if isShortCondition and (bullCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

if not useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

isShortCondition := false

bearCandleCount := 0

shortLine := na

// ---- Save for graphical display that there is a longcondition + reset other variables

if high>longLine

longSignal := true

longLine := na

isLongCondition := false

if low<shortLine

shortSignal := true

shortLine := na

isShortCondition := false

// ---- Get Stop loss and Take Profit in there

if useReverse

if useTPSL

if strategy.position_size < 0 and strategy.position_size[1] >= 0

strategy.exit("short exit", "short", limit=longLine[1]-stopMultiplier*atrAveraged, stop=longLine[1]+stopMultiplier*atrAveraged)

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=shortLine[1]+stopMultiplier*atrAveraged, stop=shortLine[1]-stopMultiplier*atrAveraged)

if not useReverse

if useTPSL

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=longLine[1]+stopMultiplier*atrAveraged, stop=longLine[1]-stopMultiplier*atrAveraged)

if strategy.position_size < 0 and strategy.position_size[1] >=0

strategy.exit("short exit", "short", limit=shortLine[1]-stopMultiplier*atrAveraged, stop=shortLine[1]+stopMultiplier*atrAveraged)

// ----- Logic for closing positions on a big candle in either direction

if (strategy.position_size[1]>0 or strategy.position_size[1]<0) and useBigCandleExit

if close>equilibriumTop or close<equilibriumBottom

strategy.close_all("Big Candle Stop")

alert("close " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)))

// ================================== //

// ------> Graphical Display <------- //

// ================================== //

// Deviation from equilibrium using smoothed ATR and percentile nearest rank to rank the coloring of the candles

candle_c2 = close>equilibrium ? close>open ? candle_bull_c1 : candle_bull_c2 : close<open ? candle_bear_c1 : candle_bear_c2

//

plotcandle(equilibrium, high, low, close, title="Equilibrium Candles", color=candle_c2, wickcolor=candle_c2, bordercolor=candle_c2)

plotshape(highlightClosePrices ? close : na, title="Closing Bubble", style=shape.circle, location=location.absolute, color=color.yellow)

bgcolor(useBgColoring ? (isBullTrend ? trend_bull_c : isBearTrend ? trend_bear_c : isLongCondition ? long_zone_c : isShortCondition ? short_zone_c : na) : na, force_overlay=true)

plot(longLine, color=candle_bull_c1, title="Long Line", style=plot.style_linebr, linewidth=4)

plot(shortLine, color=candle_bear_c1, title="Short Line", style=plot.style_linebr, linewidth=4)

plotshape(longSignal ? math.min(equilibrium, low)+(-0.5*atrAveraged) : na, title="Long Signal", color=candle_bull_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

plotshape(shortSignal ? math.max(equilibrium, high)+(0.5*atrAveraged) : na, title="Short Signal", color=candle_bear_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

// =================================== //

// ------> Simple Form Alerts <------- //

// =================================== //

alertcondition(longSignal, "Simple Long Signal")

alertcondition(shortSignal, "Simple Short Signal")