Sistem Dagangan Trend EMA Beradaptif Dua Arah dengan Strategi Optimum Dagangan Berbalik

Penulis:ChaoZhang, Tarikh: 2025-01-10 15:24:00Tag:EMASPXMA

Ringkasan

Strategi ini adalah sistem perdagangan dua arah yang menggabungkan Purata Bergerak Eksponensial (EMA) dengan selang masa. Sistem menentukan arah perdagangan utama berdasarkan hubungan EMA dalam selang masa tetap yang ditakrifkan oleh pengguna, sambil memantau satu set lain penunjuk EMA untuk isyarat silang atau mendekati kitaran perdagangan seterusnya untuk melaksanakan dagangan lindung nilai terbalik, dengan itu menangkap peluang perdagangan dua arah.

Prinsip Strategi

Strategi ini beroperasi pada dua mekanisme teras: perdagangan utama pada selang masa yang tetap dan perdagangan terbalik yang fleksibel.5⁄40-minit EMA, menjalankan dagangan pada setiap selang waktu (default 30 minit).5⁄10Semua perdagangan berlaku dalam tetingkap masa yang ditakrifkan oleh pengguna untuk memastikan keberkesanan perdagangan.

Kelebihan Strategi

- Menggabungkan pendekatan perdagangan mengikut trend dan pembalikan purata untuk merebut peluang dalam persekitaran pasaran yang berbeza

- Kawalan kekerapan dagangan melalui selang masa untuk mengelakkan overtrading

- Mekanisme perdagangan terbalik menyediakan fungsi lindung nilai risiko untuk membantu mengawal pengeluaran

- Parameter yang sangat boleh disesuaikan termasuk tempoh EMA dan selang perdagangan untuk kebolehsesuaian yang kuat

- Jendela masa dagangan yang boleh diselaraskan untuk pengoptimuman mengikut ciri pasaran yang berbeza

Risiko Strategi

- Penunjuk EMA mempunyai kelewatan yang melekat, berpotensi menghasilkan isyarat tertunda di pasaran yang tidak menentu

- Perdagangan selang masa tetap mungkin kehilangan peluang pasaran penting

- Perdagangan terbalik boleh mengakibatkan kerugian yang tidak perlu semasa trend yang kuat

- Pilihan parameter yang tidak betul boleh menyebabkan isyarat perdagangan yang berlebihan atau tidak mencukupi

- Perlu mempertimbangkan kesan kos dagangan pada pulangan strategi

Arahan Pengoptimuman Strategi

- Memperkenalkan penunjuk turun naik untuk menyesuaikan parameter EMA secara dinamik untuk peningkatan kesesuaian

- Tambah analisis jumlah untuk meningkatkan kebolehpercayaan isyarat dagangan

- Membangunkan mekanisme selang masa dinamik yang menyesuaikan kekerapan dagangan berdasarkan aktiviti pasaran

- Melaksanakan pengurusan sasaran stop-loss dan keuntungan untuk mengoptimumkan pengurusan modal

- Mempertimbangkan untuk memasukkan penunjuk teknikal tambahan untuk pengesahan silang untuk meningkatkan ketepatan dagangan

Ringkasan

Ini adalah strategi komprehensif yang menggabungkan trend berikut dengan perdagangan terbalik, mencapai penangkapan peluang dua arah melalui penyelarasan selang masa dan penunjuk EMA. Strategi ini menawarkan keupayaan penyesuaian yang kuat dan potensi yang baik untuk kawalan risiko, tetapi memerlukan pengoptimuman parameter dan penyempurnaan pengurusan risiko berdasarkan keadaan pasaran sebenar.

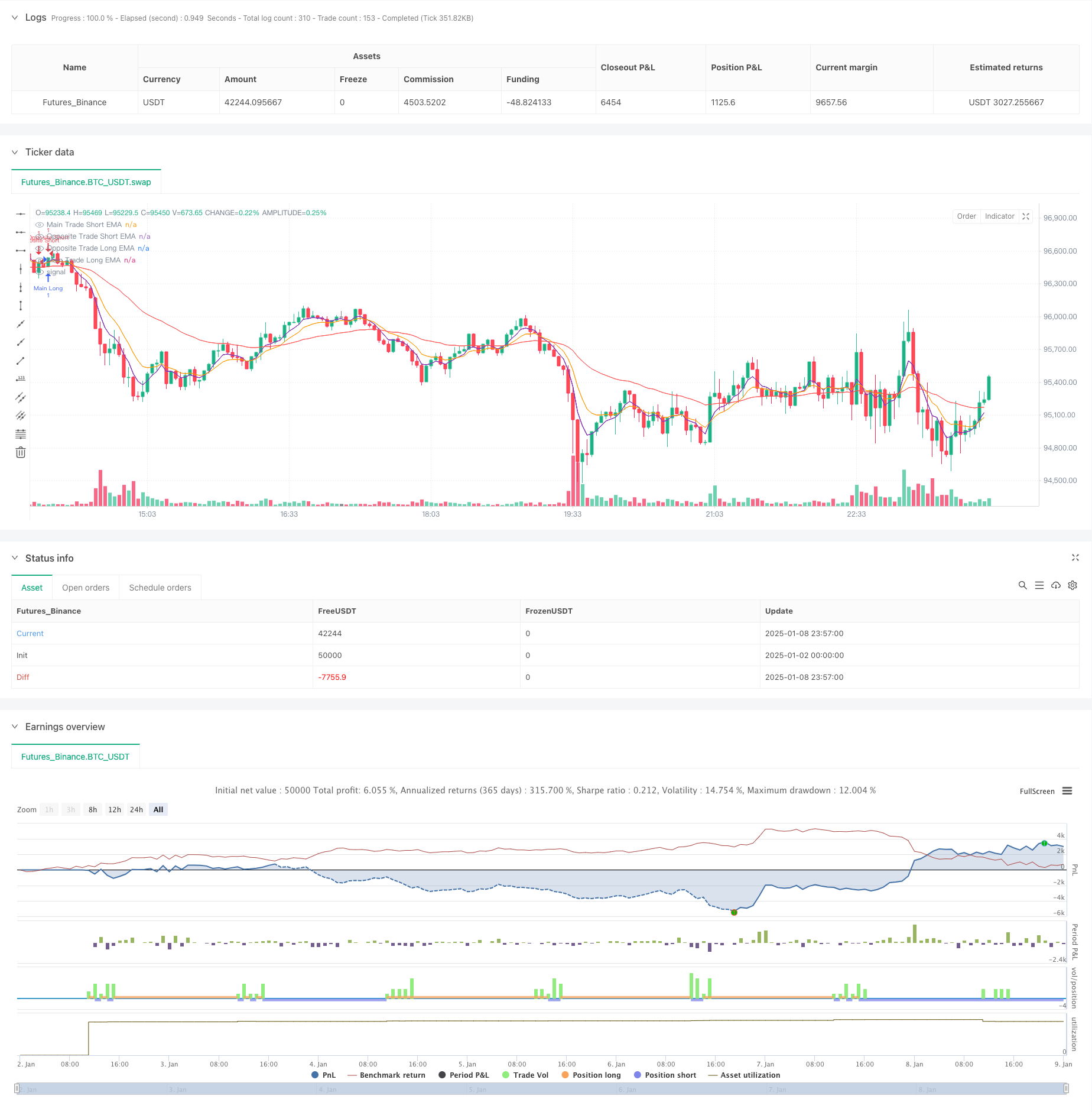

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SPX EMA Strategy with Opposite Trades", overlay=true)

// User-defined inputs

tradeIntervalMinutes = input.int(30, title="Main Trade Interval (in minutes)", minval=1)

oppositeTradeDelayMinutes = input.int(1, title="Opposite Trade time from next trade (in minutes)", minval=1) // Delay of opposite trade (1 min before the next trade)

startHour = input.int(10, title="Start Hour", minval=0, maxval=23)

startMinute = input.int(30, title="Start Minute", minval=0, maxval=59)

stopHour = input.int(15, title="Stop Hour", minval=0, maxval=23)

stopMinute = input.int(0, title="Stop Minute", minval=0, maxval=59)

// User-defined EMA periods for main trade and opposite trade

mainEmaShortPeriod = input.int(5, title="Main Trade EMA Short Period", minval=1)

mainEmaLongPeriod = input.int(40, title="Main Trade EMA Long Period", minval=1)

oppositeEmaShortPeriod = input.int(5, title="Opposite Trade EMA Short Period", minval=1)

oppositeEmaLongPeriod = input.int(10, title="Opposite Trade EMA Long Period", minval=1)

// Calculate the EMAs for main trade

emaMainShort = ta.ema(close, mainEmaShortPeriod)

emaMainLong = ta.ema(close, mainEmaLongPeriod)

// Calculate the EMAs for opposite trade (using different periods)

emaOppositeShort = ta.ema(close, oppositeEmaShortPeriod)

emaOppositeLong = ta.ema(close, oppositeEmaLongPeriod)

// Condition to check if it is during the user-defined time window

startTime = timestamp(year, month, dayofmonth, startHour, startMinute)

stopTime = timestamp(year, month, dayofmonth, stopHour, stopMinute)

currentTime = timestamp(year, month, dayofmonth, hour, minute)

// Ensure the script only trades within the user-defined time window

isTradingTime = currentTime >= startTime and currentTime <= stopTime

// Time condition: Execute the trade every tradeIntervalMinutes

var float lastTradeTime = na

timePassed = na(lastTradeTime) or (currentTime - lastTradeTime) >= tradeIntervalMinutes * 60 * 1000

// Entry Conditions for Main Trade

longCondition = emaMainShort > emaMainLong // Enter long if short EMA is greater than long EMA

shortCondition = emaMainShort < emaMainLong // Enter short if short EMA is less than long EMA

// Detect EMA crossovers for opposite trade (bullish or bearish)

bullishCrossoverOpposite = ta.crossover(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses above long

bearishCrossoverOpposite = ta.crossunder(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses below long

// Track the direction of the last main trade (true for long, false for short)

var bool isLastTradeLong = na

// Track whether an opposite trade has already been executed after the last main trade

var bool oppositeTradeExecuted = false

// Execute the main trades if within the time window and at the user-defined interval

if isTradingTime and timePassed

if longCondition

strategy.entry("Main Long", strategy.long)

isLastTradeLong := true // Mark the last trade as long

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, low, "Main Long", color=color.green, textcolor=color.white, size=size.small)

else if shortCondition

strategy.entry("Main Short", strategy.short)

isLastTradeLong := false // Mark the last trade as short

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, high, "Main Short", color=color.red, textcolor=color.white, size=size.small)

// Execute the opposite trade only once after the main trade

if isTradingTime and not oppositeTradeExecuted

// 1 minute before the next main trade or EMA crossover

if (currentTime - lastTradeTime) >= (tradeIntervalMinutes - oppositeTradeDelayMinutes) * 60 * 1000 or bullishCrossoverOpposite or bearishCrossoverOpposite

if isLastTradeLong

// If the last main trade was long, enter opposite short trade

strategy.entry("Opposite Short", strategy.short)

//label.new(bar_index, high, "Opposite Short", color=color.red, textcolor=color.white, size=size.small)

else

// If the last main trade was short, enter opposite long trade

strategy.entry("Opposite Long", strategy.long)

//label.new(bar_index, low, "Opposite Long", color=color.green, textcolor=color.white, size=size.small)

// After entering the opposite trade, set the flag to true so no further opposite trades are placed

oppositeTradeExecuted := true

// Plot the EMAs for visual reference

plot(emaMainShort, title="Main Trade Short EMA", color=color.blue)

plot(emaMainLong, title="Main Trade Long EMA", color=color.red)

plot(emaOppositeShort, title="Opposite Trade Short EMA", color=color.purple)

plot(emaOppositeLong, title="Opposite Trade Long EMA", color=color.orange)

- Strategi Posisi Sepanjang Malam Pasar dengan Penapis EMA

- Trend Crossover Multi-EMA Berikutan Strategi Dagangan Kuantitatif

- EMA Dual Moving Average Crossover Strategi

- Strategi Perdagangan Momentum EMA

- Strategi Dagangan Crossover EMA Bertiga dengan Stop-Loss dan Take-Profit Dinamik

- Trend Momentum Crossover Multi-EMA Berikutan Strategi

- Sistem Perdagangan Automatik Multi-EMA dengan Kunci Keuntungan Terakhir

- Strategi Perpindahan MACD

- Trend EMA Bertiga Berikutan Strategi Dagangan Kuantitatif

- Strategi Trend EMA Multi-Timeframe dengan Sistem Penembusan Tinggi-Rendah Harian

- Strategi Dagangan Momentum Trend Multi-Indikator: Sistem Dagangan Kuantitatif yang Dioptimumkan Berdasarkan Bollinger Bands, Fibonacci dan ATR

- Sistem Pengesanan Divergensi Harga RSI Dinamis dan Strategi Dagangan Adaptif

- Trend Berbilang Dimensi Mengikut Strategi Perdagangan Piramid

- Triple Bottom Rebound Momentum Strategy Terobosan

- Dual Timeframe Trend Reversal Candlestick Pattern Strategi Dagangan Kuantitatif

- Trend Harga-Volume Frekuensi Tinggi Berikutan dengan Analisis Volume Strategi Penyesuaian

- Strategi Momentum Trend Harga-Jumlah yang Dipertingkatkan

- Strategi silang purata bergerak pintar dengan sistem pengurusan keuntungan / kerugian dinamik

- Strategi Dagangan Penembusan Multi-MA

- Adaptive Momentum Mean-Reversion Crossover Strategy

- Sistem Dagangan Pullback EMA Dual dengan Optimisasi Stop-Loss Dinamik berasaskan ATR

- Perpindahan fasa berbilang tempoh dengan EMA Trend Following Strategy

- Trend silang purata bergerak berbilang mengikut strategi osilasi RSI

- Strategi Penembusan Trend Bollinger Bands Berbilang Tempoh dengan Model Kawalan Risiko Volatiliti

- Strategi Dagangan Pivot Beradaptasi Sokongan dan Rintangan Dinamik

- Strategi Perbezaan EMA-RSI Berganda: Sistem Penangkapan Trend Berdasarkan Purata Bergerak Eksponensial dan Kekuatan Relatif

- Strategi Perdagangan Piramida Dinamik Supertrend Berbilang Tempoh

- Strategi Kuantitatif Melalui SMA Trend Jangka Panjang

- Trend Penggabungan Indikator Multi-Teknikalan Berikutan Strategi Dagangan Kuantitatif

- Indikator Multi-Teknik Momentum-MA Trend Mengikut Strategi