Estratégia de negociação ATR de várias etapas com obtenção de lucros dinâmicos

Autora:ChaoZhang, Data: 2024-12-05 16:49:57Tags:ATRSMATRMFTPSLMAAATR

Resumo

Esta é uma estratégia de negociação de várias camadas que integra cálculos adaptativos do Average True Range (ATR) com detecção de tendência baseada em impulso. A característica mais distinta da estratégia é seu mecanismo de lucro único de 7 passos, que combina quatro níveis de saída baseados em ATR e três níveis percentuais fixos. Esta abordagem híbrida permite que os comerciantes se ajustem dinamicamente à volatilidade do mercado enquanto capturam lucros sistematicamente em posições de mercado longas e curtas. A estratégia fornece uma solução de negociação abrangente através da combinação de cálculos dinâmicos de ATR, detecção de força de tendência e múltiplos mecanismos de lucro.

Princípios de estratégia

A estratégia funciona através de vários componentes-chave: 1. Cálculo de gama verdadeira aprimorada: mede a volatilidade do mercado considerando os movimentos de preços mais significativos. 2. Integração do Fator de Momento: Ajusta o ATR com base nos movimentos recentes dos preços para melhor adaptabilidade. 3. Cálculo ATR adaptativo: modifica o ATR tradicional com base no fator de momento para aumentar a sensibilidade durante períodos voláteis. 4. Quantificação da Força da Tendência: Avalia a força da tendência através de algoritmos sofisticados. Mecanismo de lucro de sete passos: inclui quatro níveis de saída baseados em ATR e três níveis de percentagem fixa.

Vantagens da estratégia

- Alta adaptabilidade: adapta-se a diferentes condições de mercado através de cálculos dinâmicos do ATR.

- Gerenciamento abrangente do risco: O mecanismo de captação de lucros em várias camadas proporciona um controlo sistemático do risco.

- Alta flexibilidade: funciona igualmente eficazmente em mercados longos e curtos.

- Parâmetros ajustáveis: oferece vários parâmetros personalizáveis para atender a diferentes estilos de negociação.

- Execução sistemática: regras claras de entrada e saída reduzem o comércio emocional.

Riscos estratégicos

- Sensibilidade dos parâmetros: configurações inadequadas dos parâmetros podem levar a excesso de negociação ou oportunidades perdidas.

- Dependência das condições de mercado: Pode apresentar um desempenho inferior em mercados altamente voláteis ou variáveis.

- Risco de complexidade: o mecanismo de obtenção de lucros em várias camadas pode aumentar a dificuldade de execução.

- Impacto do deslizamento: vários pontos de lucro podem ser significativamente afetados pelo deslizamento.

- Requisitos de capital: Requer capital suficiente para executar uma estratégia de lucro de várias camadas.

Orientações para a otimização da estratégia

- Ajuste dinâmico dos parâmetros: ajuste automático dos parâmetros com base nas condições do mercado.

- Filtragem do ambiente de mercado: adicionar um mecanismo de identificação do ambiente de mercado.

- Melhoria da gestão de riscos: Introdução de um mecanismo dinâmico de stop-loss.

- Optimização da execução: simplificar o mecanismo de obtenção de lucros para reduzir o impacto do deslizamento.

- Melhoria do quadro de backtesting: incluir factores comerciais mais realistas.

Resumo

Esta estratégia fornece aos traders um sistema de negociação abrangente, combinando ATR adaptativo e mecanismos de captação de lucros em várias camadas. Sua força reside em sua capacidade de se adaptar a diferentes condições de mercado, enquanto gerencia o risco através de uma abordagem sistemática. Embora existam alguns riscos potenciais, a estratégia pode se tornar uma ferramenta de negociação eficaz através de otimização e gestão de risco adequados. Seu inovador mecanismo de captação de lucros em várias camadas é particularmente adequado para os traders que buscam maximizar os lucros, mantendo o controle do risco.

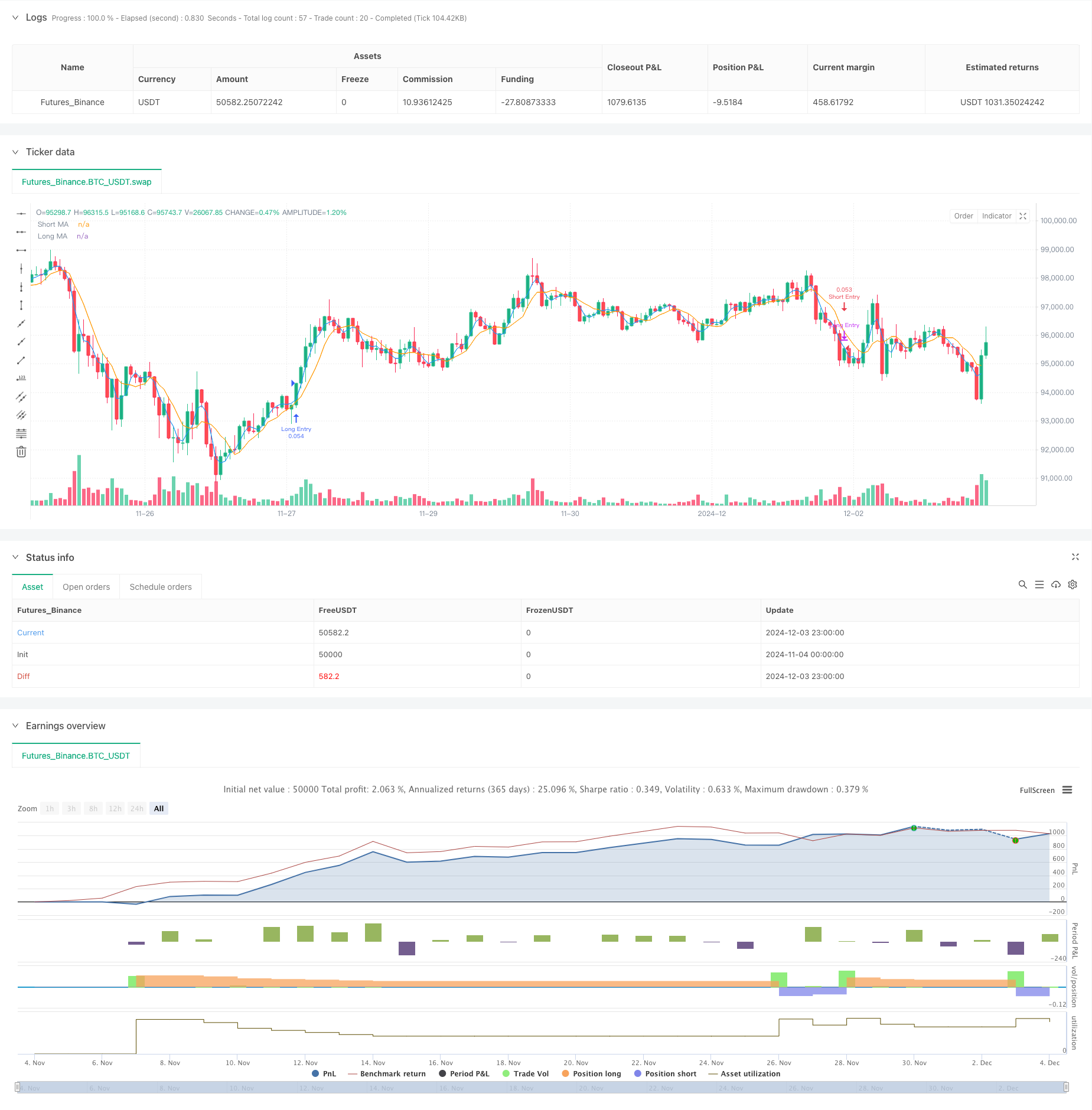

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

- Estratégia dupla de cruzamento de médias móveis com gestão dinâmica do risco

- Estratégia de Stop Loss & Take Profit com filtro de tendência e saída de exceção

- Estratégia de cruzamento de média móvel dinâmica e bandas de Bollinger com modelo fixo de otimização de stop-loss

- Modelo de estratégia de otimização da tendência de fusão ATR

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação.

- Estratégia de negociação filtrada com múltiplos indicadores com Bollinger Bands e Woodies CCI

- Sistema de negociação de breakout de tendência com média móvel (estratégia TBMA)

- Tendência cruzada de média móvel dinâmica, seguindo uma estratégia com gestão adaptativa do risco

- Estratégia de negociação quantitativa adaptativa com duplo cruzamento da média móvel e take profit/stop loss

- Estabilização dinâmica de tracção

- O valor da posição em risco deve ser calculado de acordo com o método de cálculo da posição em risco, de acordo com o método de cálculo da posição em risco.

- As bandas de Bollinger e a estratégia de negociação dinâmica combinada do RSI

- RSI-ATR Momentum Volatilidade Estratégia de negociação combinada

- Estratégia de dupla EMA de seguimento da tendência com entrada de compra limitada

- Sistema de negociação de análise técnica multiestratégica

- Estratégia de negociação combinada de reconhecimento de padrões de velas de vários prazos

- As bandas de Bollinger triplos atingem a tendência após uma estratégia quantitativa de negociação

- Sistema de negociação de breakout dinâmico multidimensional baseado em bandas de Bollinger e RSI

- Estratégia de ruptura do RSI de reversão média

- Tendência de ímpeto da dupla EMA na sequência da estratégia

- Sistema de negociação de suporte dinâmico de duplo prazo

- Tendência cruzada da média móvel de vários períodos e do ímpeto do RSI

- Sistema de média de saída e sinalização de zona de sobrevenda de activos financeiros baseado em IFM

- Estratégia de negociação de cruzamento multi-EMA com indicadores de momento

- Estratégia de negociação quantitativa de pirâmide combinada de Martingale MACD-KDJ

- Reconhecimento de padrões múltiplos e estratégia de negociação ao nível do SR

- Sistema de negociação de filtros de tendência G-Channel e EMA

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação.

- Sistema dinâmico de negociação de média móvel dupla de avanço

- Tendência de ímpeto cruzado de múltiplos indicadores Seguindo uma estratégia com sistema de captação de lucro e stop-loss otimizado