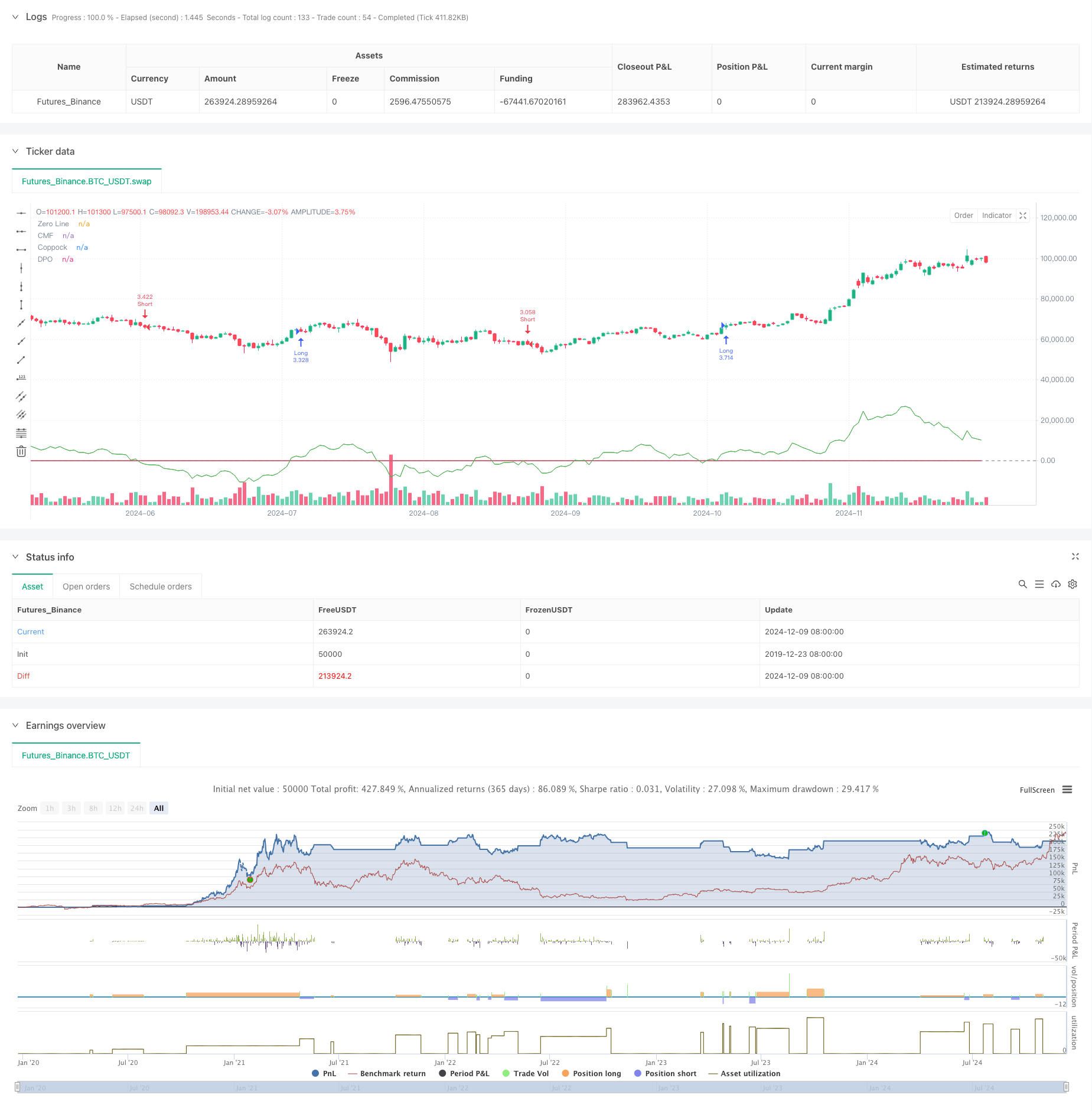

概述

这是一个基于多个技术指标组合的自适应趋势跟踪策略,可以根据不同市场特征自动调整参数。该策略综合运用了资金流向指标(CMF)、去趋势价格震荡指标(DPO)以及考普克指标(Coppock)来捕捉市场趋势,并通过波动率调整因子来适配不同市场的特点。策略具有完整的仓位管理和风险控制体系,能够根据市场波动性动态调整交易规模。

策略原理

策略的核心逻辑是通过多指标配合来确认趋势方向和交易时机。具体来说: 1. 使用CMF指标来衡量资金流向,判断市场情绪 2. 通过DPO指标剔除长期趋势影响,关注中短期价格波动 3. 采用改良的Coppock指标捕捉趋势转折点 4. 当三个指标共同确认时才会产生交易信号 5. 通过ATR动态计算止损止盈位置 6. 根据不同市场特征(股票、外汇、期货)自动调整杠杆率和波动率参数

策略优势

- 多指标交叉验证,能够有效过滤虚假信号

- 自适应性强,可以适用于不同市场环境

- 完善的仓位管理系统,根据波动率动态调整持仓

- 具有止损止盈机制,控制风险的同时保护利润

- 支持多品种同时交易,分散风险

- 交易逻辑清晰,便于维护和优化

策略风险

- 多指标系统可能存在滞后性,在快速行情中错过机会

- 参数优化过度可能导致过度拟合

- 市场切换时期可能会产生错误信号

- 止损设置过紧可能导致频繁止损

- 交易成本会影响策略收益 建议通过以下方式管理风险:

- 定期检查参数有效性

- 实时监控持仓表现

- 合理控制杠杆率

- 设置最大回撤限制

策略优化方向

- 引入市场波动率状态判断,在不同波动环境下使用不同参数组合

- 添加更多的市场特征识别指标,提高策略适应性

- 优化止损止盈机制,可以考虑使用移动止损

- 开发自动参数优化系统,定期调整参数

- 增加交易成本分析模块

- 加入风险预警机制

总结

该策略是一个较为完整的趋势跟踪系统,通过多指标配合和风险控制机制,在保证收益的同时也很好地控制了风险。策略的可扩展性强,有很大的优化空间。建议在实盘交易中从小规模开始,逐步增加交易规模,同时持续监控策略表现并及时调整参数。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Market Adaptive Trading Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

i_market_type = input.string("Crypto", "Market Type", options=["Forex", "Crypto", "Futures"])

i_risk_percent = input.float(1, "Risk Per Trade (%)", minval=0.1, maxval=100, step=0.1)

i_volatility_adjustment = input.float(1.0, "Volatility Adjustment", minval=0.1, maxval=5.0, step=0.1)

i_max_position_size = input.float(5.0, "Max Position Size (%)", minval=1.0, maxval=100.0, step=1.0)

i_max_open_trades = input.int(3, "Max Open Trades", minval=1, maxval=10)

// Indicator Parameters

i_cmf_length = input.int(20, "CMF Length", minval=1)

i_dpo_length = input.int(21, "DPO Length", minval=1)

i_coppock_short = input.int(11, "Coppock Short ROC", minval=1)

i_coppock_long = input.int(14, "Coppock Long ROC", minval=1)

i_coppock_wma = input.int(10, "Coppock WMA", minval=1)

i_atr_length = input.int(14, "ATR Length", minval=1)

// Market-specific Adjustments

volatility_factor = i_market_type == "Forex" ? 0.1 : i_market_type == "Futures" ? 1.5 : 1.0

volatility_factor *= i_volatility_adjustment

leverage = i_market_type == "Forex" ? 100.0 : i_market_type == "Futures" ? 20.0 : 3.0

// Calculate Indicators

mf_multiplier = ((close - low) - (high - close)) / (high - low)

mf_volume = mf_multiplier * volume

cmf = ta.sma(mf_volume, i_cmf_length) / ta.sma(volume, i_cmf_length)

dpo_offset = math.floor(i_dpo_length / 2) + 1

dpo = close - ta.sma(close, i_dpo_length)[dpo_offset]

roc1 = ta.roc(close, i_coppock_short)

roc2 = ta.roc(close, i_coppock_long)

coppock = ta.wma(roc1 + roc2, i_coppock_wma)

atr = ta.atr(i_atr_length)

// Define Entry Conditions

long_condition = cmf > 0 and dpo > 0 and coppock > 0 and ta.crossover(coppock, 0)

short_condition = cmf < 0 and dpo < 0 and coppock < 0 and ta.crossunder(coppock, 0)

// Calculate Position Size

account_size = strategy.equity

risk_amount = math.min(account_size * (i_risk_percent / 100), account_size * (i_max_position_size / 100))

position_size = (risk_amount / (atr * volatility_factor)) * leverage

// Execute Trades

if (long_condition and strategy.opentrades < i_max_open_trades)

sl_price = close - (atr * 2 * volatility_factor)

tp_price = close + (atr * 3 * volatility_factor)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Long Exit", "Long", stop=sl_price, limit=tp_price)

if (short_condition and strategy.opentrades < i_max_open_trades)

sl_price = close + (atr * 2 * volatility_factor)

tp_price = close - (atr * 3 * volatility_factor)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Short Exit", "Short", stop=sl_price, limit=tp_price)

// Plot Indicators

plot(cmf, color=color.blue, title="CMF")

plot(dpo, color=color.green, title="DPO")

plot(coppock, color=color.red, title="Coppock")

hline(0, "Zero Line", color=color.gray)

// Alerts

alertcondition(long_condition, title="Long Entry", message="Potential Long Entry Signal")

alertcondition(short_condition, title="Short Entry", message="Potential Short Entry Signal")

// // Performance reporting

// if barstate.islastconfirmedhistory

// label.new(bar_index, high, text="Strategy Performance:\nTotal Trades: " + str.tostring(strategy.closedtrades) +

// "\nWin Rate: " + str.tostring(strategy.wintrades / strategy.closedtrades * 100, "#.##") + "%" +

// "\nProfit Factor: " + str.tostring(strategy.grossprofit / strategy.grossloss, "#.##"))

相关推荐