概述

本策略是一个基于LuxAlgo®信号和叠加指标的量化交易系统。它主要通过捕捉自定义警报条件来开启多头仓位,并结合多个退出信号来管理持仓。该系统采用模块化设计,支持多种退出条件的组合使用,包括智能追踪止损、趋势反转确认、以及传统的百分比止损等方式。同时,系统还支持在已有持仓的基础上进行加仓操作,这为资金管理提供了更大的灵活性。

策略原理

策略的核心逻辑包含以下几个关键部分: 1. 入场信号系统:通过自定义的LuxAlgo®警报条件触发多头入场信号。 2. 加仓管理:可选择性地启用加仓功能,在现有持仓基础上增加头寸。 3. 多层次退出机制: - 智能追踪止损:监控价格与智能追踪线的关系 - 趋势确认退出:包括基础和增强版的空头确认信号 - 内置退出信号:利用指标自带的多种退出条件 - 传统止损:支持基于百分比的固定止损设置 4. 时间窗口管理:提供灵活的回测日期范围设置功能。

策略优势

- 系统化风险管理:通过多层次的退出机制,有效控制下行风险。

- 灵活的持仓管理:支持多种加仓和减仓策略,可根据市场情况动态调整。

- 高度可定制性:用户可自由组合不同的退出条件,打造个性化的交易系统。

- 模块化设计:各个功能模块相对独立,便于维护和优化。

- 完整的回测支持:提供详细的回测参数设置,支持历史数据验证。

策略风险

- 信号依赖性风险:策略严重依赖LuxAlgo®指标的信号质量。

- 市场环境适应性风险:在不同市场环境下,策略表现可能存在较大差异。

- 参数敏感性风险:多个退出条件的组合可能导致过早退出或错过机会。

- 流动性风险:在市场流动性不足时,可能影响入场和出场执行效果。

- 技术实现风险:需要确保指标和策略的稳定运行,避免技术故障。

策略优化方向

- 信号系统优化:

- 引入更多的技术指标进行信号确认

- 开发自适应的信号阈值调整机制

- 风险控制增强:

- 添加波动率自适应的止损机制

- 开发动态的仓位管理系统

- 性能优化:

- 优化计算效率,减少资源消耗

- 改进信号处理逻辑,减少延迟

- 功能扩展:

- 增加更多的市场环境分析工具

- 开发更灵活的参数优化框架

总结

该策略通过结合LuxAlgo®的高质量信号和多层次的风险管理系统,为量化交易提供了一个完整的解决方案。其模块化设计和灵活的配置选项使其具有很好的适应性和可扩展性。虽然存在一些固有风险,但通过持续的优化和完善,策略的整体表现仍有很大的提升空间。建议使用者在实际应用中要注意市场环境的变化,适时调整参数设置,并保持对风险的持续监控。

策略源码

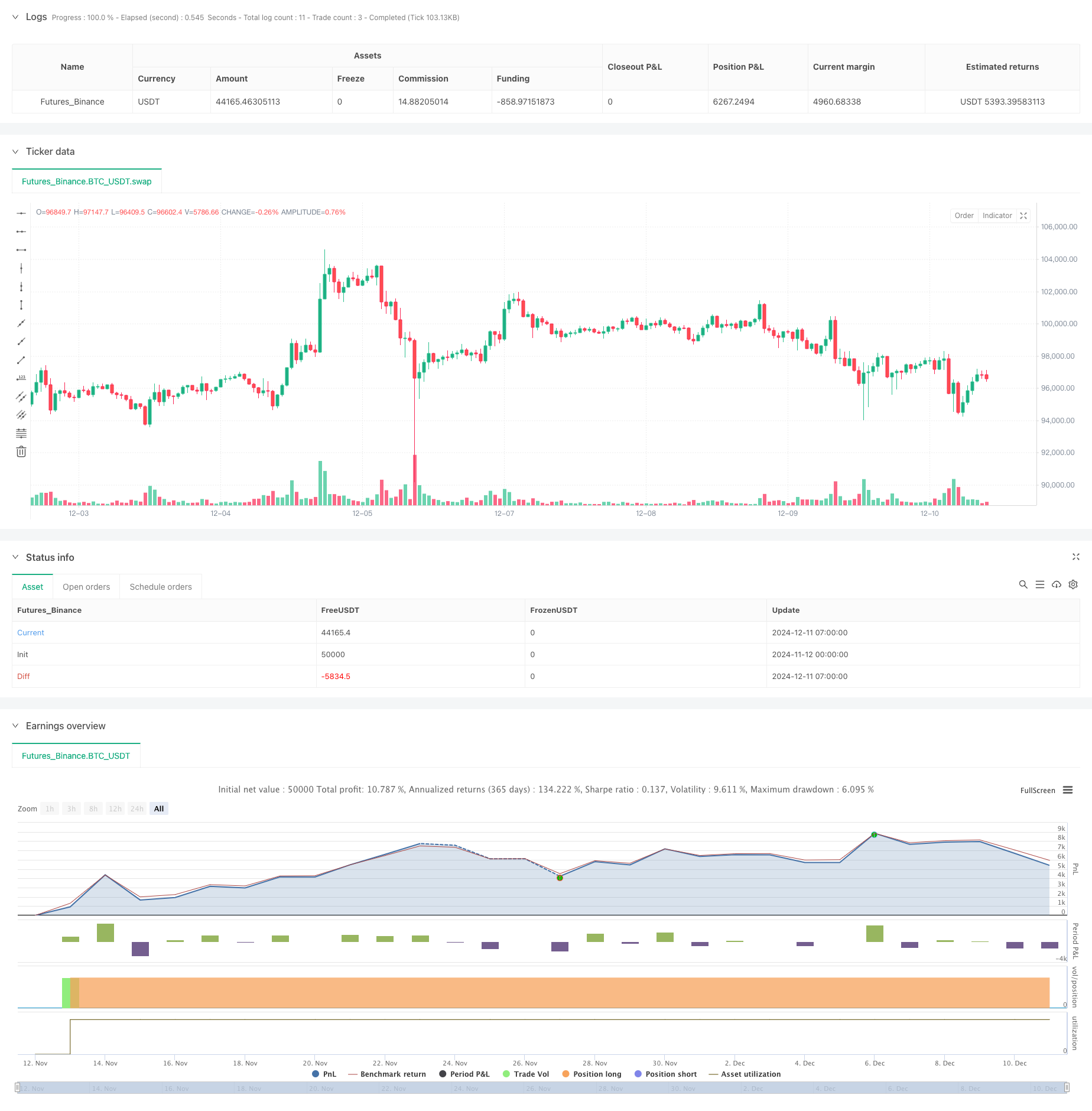

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

// This strategy is NOT from the LuxAlgo® developers. We created this to compliment their hard work. No association with LuxAlgo® is intended nor implied.

// Please visit https://chart.observer to test your Tradingview Strategies in our paper-trading sandbox environment. Webhook your alerts to our API.

// Past performance does not ensure future results. This strategy provided with absolutely no warranty and is for educational purposes only

// The goal of this strategy is to enter a long position using the Custom Alert condition feature of LuxAlgo® Signals & Overlays™ indicator

// To trigger an exit from the long position, use one or more of the common exit signals which the Signals & Overlays™ indicator provides.

// You will need to connect those signals to this strategy in the dialog box.

// We're calling this a "piggyback" strategy because the LuxAlgo® Signals & Overlays indicator must be present, and remain on the chart.

// The Signals and Overlays™ indicator is invite-only, and requires a paid subscription from LuxAlgo® - https://luxalgo.com/?rfsn=8404759.b37a73

//@version=6

strategy("Simple Backtester for LuxAlgo® Signals & Overlays™", "Simple Backtester for LuxAlgo® S&O ", true, pyramiding=3, default_qty_type = 'percent_of_equity', calc_on_every_tick = true, process_orders_on_close=false, calc_on_order_fills=true, default_qty_value = 33, initial_capital = 10000, currency = currency.USD, commission_type = format.percent, commission_value = 0.10 )

// Initialize a flag to track order placement

var bool order_placed = false

// Reset the flag at the start of each new bar

if (not na(bar_index) and bar_index != bar_index[1])

order_placed := false

// === Inputs which the user needs to change in the configuration dialog to point to the corresponding LuxAlgo alerts === //

// === The Signals & Overlays indicator must be present on the chart in order for this to work === //

la_EntryAlert = input.source(close, "LuxAlgo® Custom Alert signal", "Replace 'close' with your LuxAlgo® entry signal. For example, try using their Custom Alert.", display=display.none, group="Enter Long Position")

useAddOnTrades = input.bool(false, "Add to your long position on LuxAlgo® signals", display=display.none, group="Add-On Trade Signal for Longs")

la_AddOnAlert = input.source(close, "Add to open longs with this signal", "Replace 'close' with your desired Add-On Trade Signal", display=display.none, group="Add-On Trade Signal for Longs")

la_SmartTrail = input.source(close, "LuxAlgo® Smart Trail", "Replace close with LuxAlgo® Smart Trail", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BearishConfirm = input.source(close, "LuxAlgo® Any Bearish Confirmation", "Replace close with LuxAlgo® Any Bearish Confirmation", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BearishConfirmPlus = input.source(close, "LuxAlgo® Bearish Confirmation+", "Replace close with LuxAlgo® Bearish Confirmation+", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BuiltInExits = input.source(close, "LuxAlgo® Bullish Exit", "Replace close with LuxAlgo® Bullish Exit", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_TrendCatcherDn = input.source(close, "LuxAlgo® Trend Catcher Down", "Replace close with LuxAlgo® Trend Catcher Down", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

// === Check boxes alowing the user to select exit criteria from th long position === //

exitOnSmartTrail = input.bool(true, "Exit long trade on Smart Trail Switch Bearish", group="Exit Long Conditions")

exitOnBearishConf = input.bool(false, "Exit on Any Bearish Confirmation", group="Exit Long Conditions")

exitOnBearishConfPlus = input.bool(true, "Exit on Bearish Confirmation+", group="Exit Long Conditions")

exitOnBuiltInExits = input.bool(false, "Exit on Bullish Exits", group="Exit Long Conditions")

exitOnTrendCatcher = input.bool(false, "Exit on Trend Catcher Down", group="Exit Long Conditions")

// === Optional Stop Loss ===//

useStopLoss = input.bool(false, "Use a Stop Loss", group="Optional Stop Loss")

stopLossPercent = input.float(0.25, "Stop Loss %", minval=0.25, step=0.25, group="Optional Stop Loss")

// Use Lux Algo's signals as part of your strategy logic

buyCondition = la_EntryAlert > 0

if useAddOnTrades and la_AddOnAlert > 0 and strategy.opentrades > 0 and not buyCondition

buyCondition := true

sellCondition = false

sellComment = ""

if exitOnSmartTrail and ta.crossunder(close, la_SmartTrail)

sellCondition := true

sellComment := "Smart Trail"

if exitOnBearishConf and la_BearishConfirm == 1

sellCondition := true

sellComment := "Bearish"

if exitOnBearishConfPlus and la_BearishConfirmPlus == 1

sellCondition := true

sellComment := "Bearish+"

if exitOnBuiltInExits and la_BuiltInExits == 1

sellCondition := true

sellComment := "Bullish Exit"

if exitOnTrendCatcher and la_TrendCatcherDn == 1

sellCondition := true

sellComment := "Trnd Over"

// Stop Loss Calculation

stopLossMultiplyer = 1 - (stopLossPercent / 100)

float stopLossPrice = na

if strategy.position_size > 0

stopLossPrice := strategy.position_avg_price * stopLossMultiplyer

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12, group='Back-Testing Date Range')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Date Range')

fromYear = input.int(defval=2024, title='From Year', minval=1970, group='Back-Testing Date Range')

thruMonth = 1

thruDay = 1

thruYear = 2112

// === START/FINISH FUNCTION ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// End Date range code -----//

if buyCondition and window() and not order_placed

strategy.entry("Long", strategy.long)

order_placed := true

if sellCondition and window() and not order_placed

strategy.close("Long", comment=sellComment)

order_placed := true

if useStopLoss and window()

strategy.exit("Stop", "Long", stop=stopLossPrice)

更多内容

- 高级量化趋势捕捉策略结合动态范围过滤器

- TradingView信号执行策略(内建Http服务版本)

- 基于RSI和MACD的五日内交叉灵活入场策略优化版本研究

- 基于双RSI指标的自适应波段交易系统

- 动态双重超趋势量价策略

- 黑天鹅波动与均线交叉动量跟踪策略

- 布林带结合超级趋势的智能波动区间交易策略

- 多指标协同趋势跟踪策略与动态止损系统

- 基于波林格带动量突破的自适应趋势跟踪交易策略

- 均值回归增强型MACD-ATR策略

- 双移动平均线与MACD结合的趋势跟踪动态止盈智能交易系统

- 三倍标准差布林带突破量化交易策略结合百日均线优化

- EMA趋势交叉动态入场量化策略

- 多重波浪趋势交叉风险管理量化策略

- 双均线随机指标趋势跟踪交易策略

- 动态趋势跟踪多周期均线交叉策略

- 双重动量突破确认量化交易策略

- MACD-RSI趋势动量交叉策略结合风险管理模型

- 多周期均线穿越结合RSI动量与ATR波动率的趋势跟踪策略

- 双均线交叉风险收益智能调控策略