概述

该策略是一个基于VWAP(成交量加权平均价格)和标准差通道的趋势突破策略。它通过计算VWAP和上下标准差通道,构建了一个动态的价格波动区间,用于捕捉价格向上突破的交易机会。策略主要依靠标准差带的突破信号进行交易,并设置了利润目标和订单间隔来控制风险。

策略原理

- 核心指标计算:

- 使用日内HL2价格和成交量计算VWAP

- 基于价格波动计算标准差

- 设置1.28倍标准差上下通道

- 交易逻辑:

- 入场条件:价格下穿下轨后回升至上方

- 出场条件:达到预设利润目标

- 设置最小下单间隔以避免频繁交易

策略优势

- 统计学基础

- 基于VWAP的价格中枢参考

- 利用标准差衡量波动性

- 动态调整交易区间

- 风险控制

- 设定固定利润目标

- 控制交易频率

- 仅做多策略降低风险

策略风险

- 市场风险

- 剧烈波动可能导致假突破

- 趋势转折点难以准确把握

- 单边下跌行情损失加大

- 参数风险

- 标准差倍数设置敏感

- 利润目标设置需要优化

- 交易间隔影响收益表现

优化方向

- 信号优化

- 增加趋势判断过滤器

- 结合成交量变化确认

- 添加其他技术指标验证

- 风险管理优化

- 动态设置止损位置

- 根据波动率调整仓位

- 完善订单管理机制

总结

这是一个结合了统计学原理和技术分析的量化交易策略。通过VWAP和标准差带的配合,构建了相对可靠的交易系统。策略的核心优势在于其科学的统计学基础和完善的风险控制机制,但仍需要在实际应用中不断优化参数和交易逻辑。

策略源码

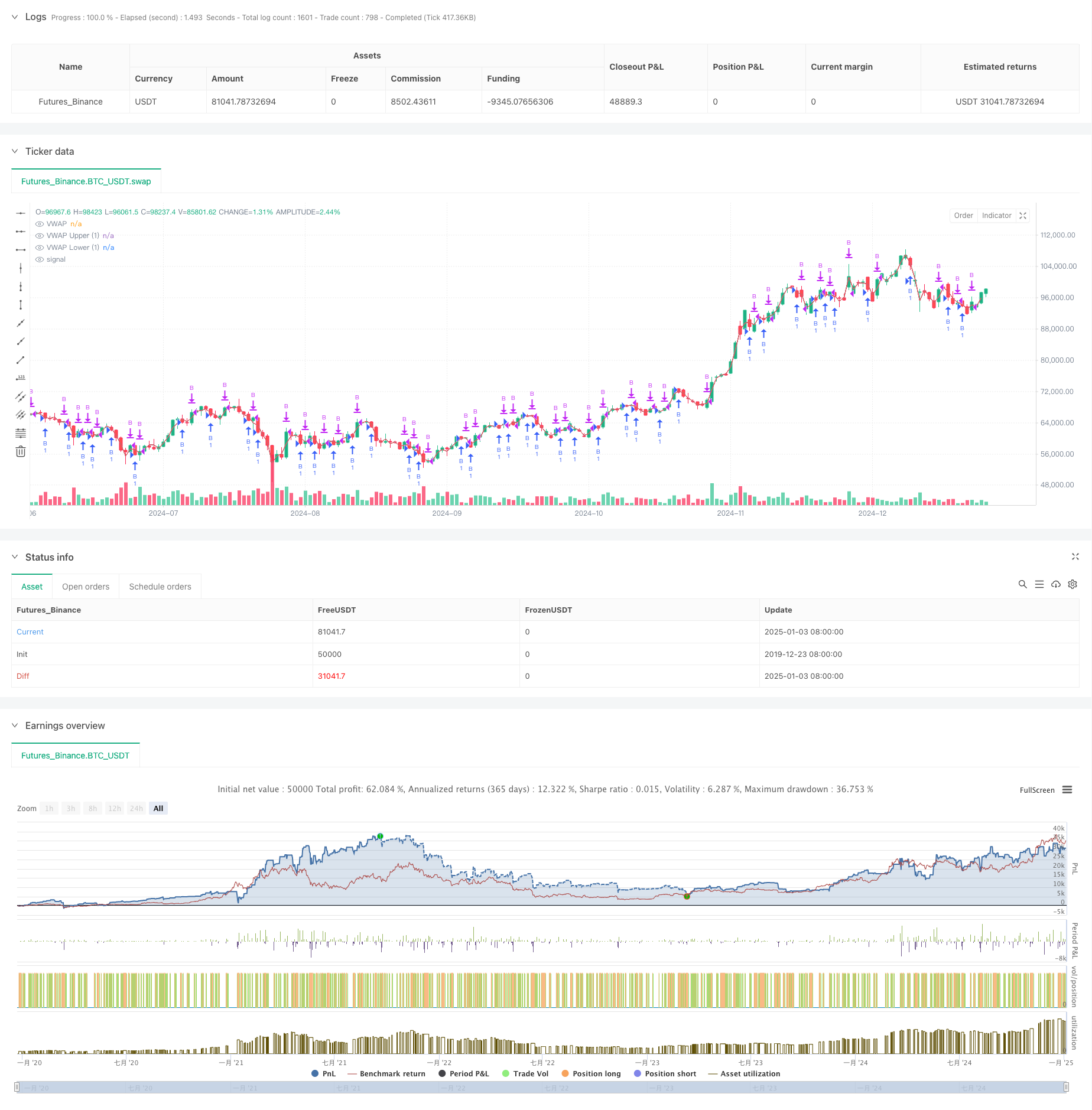

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("VWAP Stdev Bands Strategy (Long Only)", overlay=true)

// Standard Deviation Inputs

devUp1 = input.float(1.28, title="Stdev above (1)")

devDn1 = input.float(1.28, title="Stdev below (1)")

// Show Options

showPrevVWAP = input(false, title="Show previous VWAP close?")

profitTarget = input.float(2, title="Profit Target ($)", minval=0) // Profit target for closing orders

gapMinutes = input.int(15, title="Gap before new order (minutes)", minval=0) // Gap for placing new orders

// VWAP Calculation

var float vwapsum = na

var float volumesum = na

var float v2sum = na

var float prevwap = na // Track the previous VWAP

var float lastEntryPrice = na // Track the last entry price

var int lastEntryTime = na // Track the time of the last entry

start = request.security(syminfo.tickerid, "D", time)

newSession = ta.change(start)

vwapsum := newSession ? hl2 * volume : vwapsum[1] + hl2 * volume

volumesum := newSession ? volume : volumesum[1] + volume

v2sum := newSession ? volume * hl2 * hl2 : v2sum[1] + volume * hl2 * hl2

myvwap = vwapsum / volumesum

dev = math.sqrt(math.max(v2sum / volumesum - myvwap * myvwap, 0))

// Calculate Upper and Lower Bands

lowerBand1 = myvwap - devDn1 * dev

upperBand1 = myvwap + devUp1 * dev

// Plot VWAP and Bands with specified colors

plot(myvwap, style=plot.style_line, title="VWAP", color=color.green, linewidth=1)

plot(upperBand1, style=plot.style_line, title="VWAP Upper (1)", color=color.blue, linewidth=1)

plot(lowerBand1, style=plot.style_line, title="VWAP Lower (1)", color=color.red, linewidth=1)

// Trading Logic (Long Only)

longCondition = close < lowerBand1 and close[1] >= lowerBand1 // Price crosses below the lower band

// Get the current time in minutes

currentTime = timestamp("GMT-0", year(timenow), month(timenow), dayofmonth(timenow), hour(timenow), minute(timenow))

// Check if it's time to place a new order based on gap

canPlaceNewOrder = na(lastEntryTime) or (currentTime - lastEntryTime) >= gapMinutes * 60 * 1000

// Close condition based on profit target

if (strategy.position_size > 0)

if (close - lastEntryPrice >= profitTarget)

strategy.close("B")

lastEntryTime := na // Reset last entry time after closing

// Execute Long Entry

if (longCondition and canPlaceNewOrder)

strategy.entry("B", strategy.long)

lastEntryPrice := close // Store the entry price

lastEntryTime := currentTime // Update the last entry time

// Add label for the entry

label.new(bar_index, close, "B", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

// Optional: Plot previous VWAP for reference

prevwap := newSession ? myvwap[1] : prevwap[1]

plot(showPrevVWAP ? prevwap : na, style=plot.style_circles, color=close > prevwap ? color.green : color.red)

相关推荐