RSI and Bollinger Bands Double Strategy

Author: ChaoZhang, Date: 2024-04-03 17:54:52Tags: RSIBBSMAstdev

Overview

This strategy combines the Relative Strength Index (RSI) and Bollinger Bands technical indicators. It generates buy signals when the price falls below the lower Bollinger Band and sell signals when the price rises above the upper Bollinger Band. The strategy only triggers trading signals when both the RSI and Bollinger Bands indicators are simultaneously in an oversold or overbought state.

Strategy Logic

- Calculate the RSI value based on the set RSI parameters.

- Use the Bollinger Bands formula to calculate the middle, upper, and lower Bollinger Bands.

- Determine if the current closing price breaks through the upper or lower Bollinger Band.

- Determine if the current RSI value is above the overbought threshold or below the oversold threshold.

- Generate corresponding buy or sell signals when both the Bollinger Bands and RSI indicators meet the respective conditions.

Strategy Advantages

- Combines trend and momentum indicators for a more comprehensive assessment of market conditions.

- Using two indicators as filters effectively reduces the probability of false signals.

- Clear code logic and flexible parameter settings, suitable for different market environments and trading styles.

Strategy Risks

- In choppy markets, this strategy may generate more losing trades.

- Improper parameter settings may lead to poor strategy performance and require optimization based on actual conditions.

- The strategy does not include a stop-loss, potentially exposing it to significant drawdown risk.

Strategy Optimization Directions

- Optimize RSI and Bollinger Bands parameters based on market characteristics and personal preferences.

- Introduce additional technical indicators such as MACD, moving averages, etc., to improve signal reliability.

- Set reasonable stop-loss and take-profit levels to control single-trade risk.

- For choppy markets, consider adding more conditions or reducing position size to lower costs associated with frequent trading.

Summary

The RSI and Bollinger Bands Double Strategy combines trend and momentum indicators to provide a relatively comprehensive assessment of market conditions and generate corresponding trading signals. However, the strategy may underperform in choppy markets and lacks risk control measures, so caution is needed when applying it to live trading. By optimizing parameters, introducing other indicators, and setting reasonable stop-loss and take-profit levels, the stability and profitability of this strategy can be further improved.

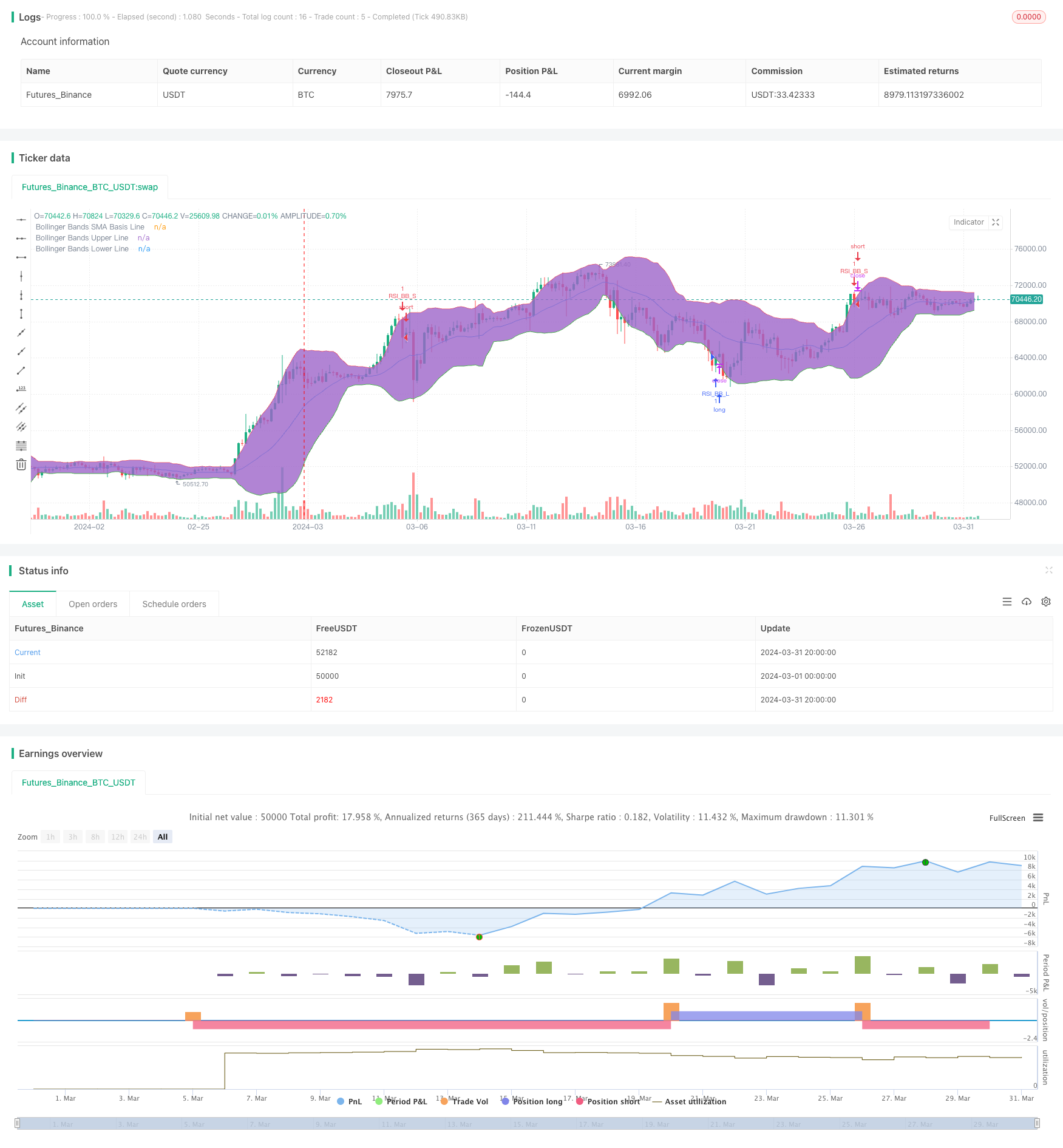

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger + RSI, Double Strategy (by ChartArt) v1.1", shorttitle="CA_-_RSI_Bol_Strat_1.1", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy - Update

//

// Version 1.1

// Idea by ChartArt on January 18, 2015.

//

// This strategy uses the RSI indicator

// together with the Bollinger Bands

// to sell when the price is above the

// upper Bollinger Band (and to buy when

// this value is below the lower band).

//

// This simple strategy only triggers when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a overbought or oversold condition.

//

// In this version 1.1 the strategy was

// both simplified for the user and

// made more successful in backtesting.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input(14,title="RSI Period Length")

RSIoverSold = 30

RSIoverBought = 70

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, minval=1,title="Bollinger Period Length")

BBmult = input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=color.blue,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=color.red,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=color.green,title="Bollinger Bands Lower Line")

fill(p1, p2)

// Entry conditions

crossover_rsi = crossover(vrsi, RSIoverSold) and crossover(source, BBlower)

crossunder_rsi = crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (crossover_rsi)

strategy.entry("RSI_BB_L", strategy.long, comment="RSI_BB_L")

else

strategy.cancel(id="RSI_BB_L")

if (crossunder_rsi)

strategy.entry("RSI_BB_S", strategy.short, comment="RSI_BB_S")

else

strategy.cancel(id="RSI_BB_S")

- Multi-Indicator Dynamic Volatility Alert Trading System

- Bollinger Bands RSI Trading Strategy

- Bollinger Band Crossover with Slippage and Price Impact Combined Strategy

- Bollinger Bands Breakout Strategy

- Bollinger Bands Accurate Entry And Risk Control Strategy

- Bollinger Bands Breakout Strategy

- Bollinger Bands and RSI Crossover Trading Strategy

- Dual Technical Indicator Momentum Reversal Trading Strategy with Risk Management System

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Bollinger Bands and RSI Combined Trading Strategy

- Moving Average Crossover + MACD Slow Line Momentum Strategy

- Volume-based Dynamic DCA Strategy

- MACD Valley Detector Strategy

- N Bars Breakout Strategy

- Low-Risk Stable Cryptocurrency High-Frequency Trading Strategy Based on RSI and MACD

- Bollinger Bands Stochastic RSI Extreme Signal Strategy

- RSI Dual-Side Trading Strategy

- KRK ADA 1H Stochastic Slow Strategy with More Entries and AI

- Volume MA-based Adaptive Pyramiding Dynamic Stop Loss and Take Profit Trading Strategy

- MACD TEMA Crossover Strategy

- VWMA-ADX Momentum and Trend-Based Bitcoin Long Strategy

- Multi-Indicator Trend Following Dynamic Risk Management Strategy

- Ruda Momentum Trend Trading Strategy

- Dual Moving Average Crossover Strategy

- Modified Bollinger Bands Strategy

- Dynamic Threshold Price Change Breakout Strategy

- Dual Moving Average Lagging Breakout Strategy

- Momentum Trading with Dual Moving Average Crossover Strategy

- Multi-indicator BTC Trading Strategy

- TD Sequential Breakout and Retracement Buy/Sell Strategy