Enhanced EMA Crossover Strategy with RSI/MACD/ATR

Author: ChaoZhang, Date: 2024-04-29 17:33:05Tags: EMARSIMACDATR

Overview

This strategy uses the crossover of two Exponential Moving Averages (EMAs) as the main trading signal, combined with the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR) as auxiliary indicators to improve the reliability of trading signals. When the fast EMA crosses above the slow EMA, RSI is below 70, MACD line is above the signal line, and ATR value increases by more than 10% compared to the previous period, a long signal is generated; conversely, when the fast EMA crosses below the slow EMA, RSI is above 30, MACD line is below the signal line, and ATR value increases by more than 10% compared to the previous period, a short signal is generated. The strategy also sets fixed-point stop loss and take profit to control risk.

Strategy Principle

- Calculate the 8-period and 14-period EMAs as the fast and slow lines.

- Calculate the 14-period RSI and MACD indicators, using 12, 26, 9 as parameters for MACD.

- Calculate the 14-period ATR value.

- When the fast EMA crosses above the slow EMA, RSI is below 70, MACD line is above the signal line, and ATR value increases by more than 10% compared to the previous period, a long signal is generated.

- When the fast EMA crosses below the slow EMA, RSI is above 30, MACD line is below the signal line, and ATR value increases by more than 10% compared to the previous period, a short signal is generated.

- Set a stop loss of 100 points and a take profit of 200 points.

- Execute trades based on the trading signals and exit trades according to the stop loss and take profit settings.

Strategy Advantages

- Combines multiple technical indicators to improve the reliability of trading signals.

- Uses ATR as a filtering condition to trade only when market volatility increases, avoiding frequent trades in low-volatility ranges.

- Sets fixed-point stop loss and take profit to effectively control risk.

- The code is concise and easy to understand, making it easy to comprehend and optimize.

Strategy Risks

- Under certain market conditions, such as sideways markets or early stages of trend reversals, the strategy may generate more false signals.

- Fixed-point stop loss and take profit may not adapt to different market volatility situations, sometimes leading to premature stop loss or delayed take profit.

- The strategy does not consider fundamental factors of the market and relies entirely on technical indicators, which may lead to a disconnect from the market in some cases.

Strategy Optimization Directions

- Consider introducing more technical indicators or market sentiment indicators, such as Bollinger Bands, trading volume, etc., to further improve signal reliability.

- Optimize the setting of stop loss and take profit, such as using dynamic stop loss and take profit or volatility-based stop loss and take profit, to better adapt to market changes.

- Combine fundamental analysis, such as economic data and major events, to filter trading signals and avoid false signals in certain special situations.

- Optimize parameters, such as EMA periods, RSI and MACD parameters, etc., to find the most suitable parameter combination for the current market.

Summary

This strategy generates relatively reliable trading signals by combining multiple technical indicators such as EMA, RSI, MACD, and ATR, while controlling risk by setting fixed-point stop loss and take profit. Although the strategy still has some shortcomings, it can be improved through further optimization, such as introducing more indicators, optimizing stop loss and take profit, and combining fundamental analysis. Overall, the strategy is clear in its logic, easy to understand and implement, and suitable for beginners to learn and use.

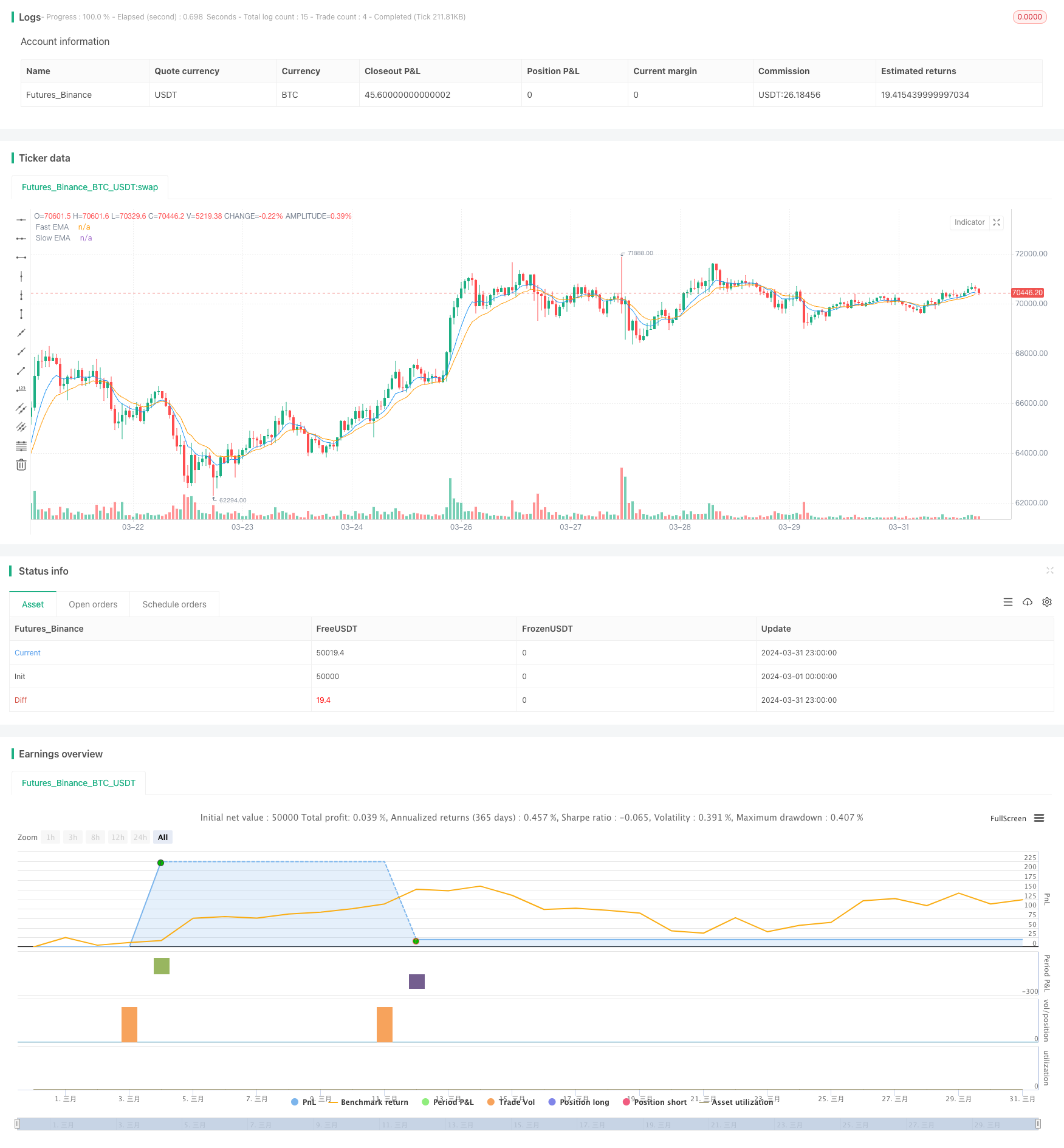

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Enhanced EMA Crossover Strategy", overlay=true)

// Indicators

ema_fast = ema(close, 8)

ema_slow = ema(close, 14)

rsi = rsi(close, 14)

// Correcting the MACD variable definitions

[macd_line, signal_line, _] = macd(close, 12, 26, 9)

atr_value = atr(14)

// Entry conditions with additional filters

long_condition = crossover(ema_fast, ema_slow) and rsi < 70 and (macd_line > signal_line) and atr_value > atr_value[1] * 1.1

short_condition = crossunder(ema_fast, ema_slow) and rsi > 30 and (macd_line < signal_line) and atr_value > atr_value[1] * 1.1

// Adding debug information

plotshape(series=long_condition, color=color.green, location=location.belowbar, style=shape.xcross, title="Long Signal")

plotshape(series=short_condition, color=color.red, location=location.abovebar, style=shape.xcross, title="Short Signal")

// Risk management based on a fixed number of points

stop_loss_points = 100

take_profit_points = 200

// Order execution

if (long_condition)

strategy.entry("Long", strategy.long, comment="Long Entry")

strategy.exit("Exit Long", "Long", stop=close - stop_loss_points, limit=close + take_profit_points)

if (short_condition)

strategy.entry("Short", strategy.short, comment="Short Entry")

strategy.exit("Exit Short", "Short", stop=close + stop_loss_points, limit=close - take_profit_points)

// Plotting EMAs for reference

plot(ema_fast, color=color.blue, title="Fast EMA")

plot(ema_slow, color=color.orange, title="Slow EMA")

- MACD Valley Detector Strategy

- EMA/MACD/RSI Crossover Strategy

- Multi-Indicator High Leverage Short-Term Trading Strategy

- Multi-Timeframe Market Momentum Crossover Strategy

- Multi-Timeframe Trend Dynamic ATR Tracking Strategy

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Multi-Indicator Trend Following Dynamic Risk Management Strategy

- Dual EMA Trend Momentum Trading Strategy

- Short-term Short Selling Strategy for High-liquidity Currency Pairs

- Gaussian Cross EMA Trend Retracement Strategy

- Triple EMA Crossover Strategy

- Moving Average and RSI Comprehensive Trading Strategy

- Exponential Moving Average Crossover Leverage Strategy

- Price Action, Pyramiding, 5% Profit Target, 3% Stop Loss

- Turnaround Tuesday Strategy (Weekend Filter)

- Bollinger Bands Double Standard Deviation Filtering 5-Minute Quantitative Trading Strategy

- Pivot Reversal Strategy with Pivot Exit

- Khaled Tamim's Avellaneda-Stoikov Strategy

- GM-8 & ADX Dual Moving Average Strategy

- Multi-Timeframe Bitcoin, Binance Coin, and Ethereum Pullback Trading Strategy

- Fibonacci Golden Ratio Retracement Buying Strategy

- Z-Score Trend Following Strategy

- MA99 Touch and Dynamic Stop-Loss Strategy

- Donchian Breakout Trading Strategy

- Ichimoku Leading Span B Breakout Strategy

- Long Entry on EMA Cross with Risk Management Strategy

- MACD and RSI Combined Long-term Trading Strategy

- DCA Dual Moving Average Turtle Trading Strategy

- VWAP Trading Strategy

- Multi-Indicator Combination Strategy (CCI, DMI, MACD, ADX)