概述

这是一个基于44周期指数移动平均线(EMA)的趋势跟踪策略。该策略主要在上升趋势中寻找买入机会,通过分析EMA斜率、蜡烛图形态以及价格回撤等多个条件来确定入场时机。策略设计适用于2分钟和5分钟等较短时间周期,旨在捕捉短期价格波动中的交易机会。

策略原理

- 计算44周期EMA及其斜率,判断趋势是否足够倾斜。

- 分析前一根蜡烛的形态,要求其为阳线且收盘价高于EMA。

- 观察当前蜡烛是否回撤到前一根蜡烛实体的50%位置。

- 确保前一根蜡烛的收盘价高于更早一根蜡烛的最高价,以验证上升趋势的持续性。

- 当所有条件满足时,在当前蜡烛的回撤位置开仓做多。

- 出场条件为:前一根蜡烛为阴线或当前蜡烛低点跌破前一根蜡烛低点。

策略优势

- 多重过滤:结合EMA、蜡烛图形态和价格回撤等多个指标,有效降低虚假信号。

- 趋势跟随:通过EMA斜率判断确保在明确上升趋势中交易,提高胜率。

- 回撤入场:利用价格回撤作为入场点,优化买入价格,potentially提高盈利空间。

- 灵活性强:可应用于不同时间周期,适合短线和日内交易者。

- 风险控制:设有明确的止损条件,有助于控制每次交易的风险。

策略风险

- 滞后性:EMA作为滞后指标,可能在剧烈波动行情中反应不及时。

- 假突破:在横盘整理区间可能产生频繁的假突破信号。

- 过度交易:在高波动市场可能触发过多交易,增加交易成本。

- 趋势逆转:快速的趋势逆转可能导致较大亏损。

- 参数敏感性:策略效果对EMA周期等参数设置较为敏感。

策略优化方向

- 引入额外过滤器:如RSI或MACD,进一步确认趋势强度和方向。

- 动态止损:使用ATR指标设置动态止损,更好地适应市场波动。

- 增加成交量分析:结合成交量指标,提高入场信号的可靠性。

- 优化EMA周期:通过回测不同的EMA周期,找出最优参数组合。

- 加入趋势强度指标:如ADX,确保只在强劲趋势中入场。

- 改进出场机制:设计更精细的获利了结策略,如trailing stop。

总结

高斯交叉EMA趋势滑点追踪策略是一个结合多重技术指标的趋势跟踪系统。通过EMA、蜡烛图形态分析和价格回撤等多维度判断,该策略在识别上升趋势和优化入场时机方面展现出良好的潜力。然而,使用者需要注意控制过度交易风险,并针对不同市场环境进行参数优化。通过引入额外的技术指标和改进风险管理机制,该策略有望在短期交易中取得更稳定的表现。

策略源码

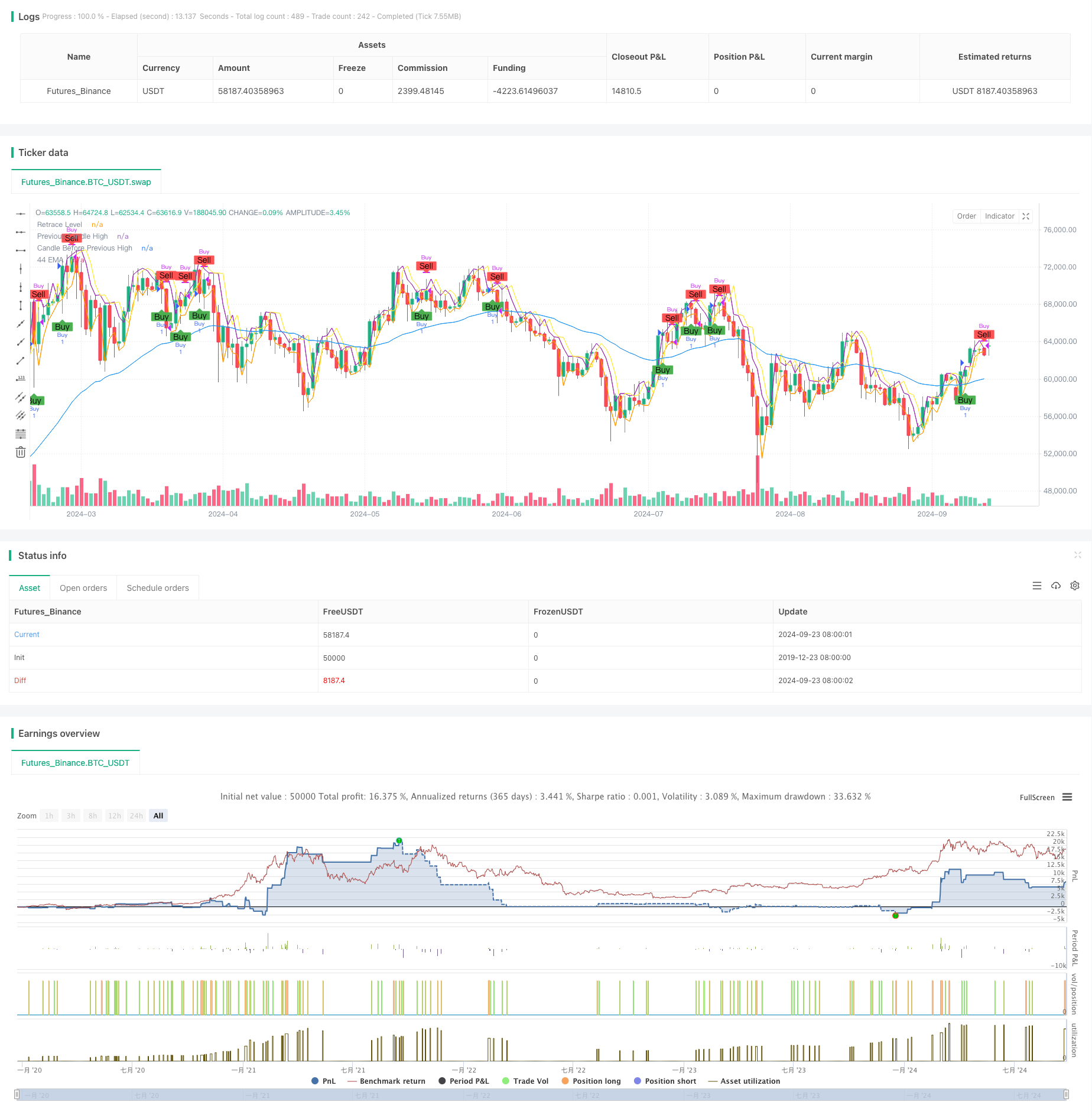

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Strategy with EMA and Candle Conditions", overlay=true)

// Define parameters

ema_length = 44

// Calculate EMA

ema_44 = ta.ema(close, ema_length)

// Calculate the slope of the EMA

ema_slope = ta.ema(close, ema_length) - ta.ema(close[9], ema_length)

// Define a threshold for considering the EMA flat

flat_threshold = 0.5

// Check if the EMA is flat or inclined

ema_is_inclined = math.abs(ema_slope) > flat_threshold

// Define the previous candle details

prev_candle_high = high[1]

prev_candle_low = low[1]

prev_candle_close = close[1]

prev_candle_open = open[1]

// Candle before the previous candle (for high comparison)

candle_before_prev_high = high[2]

// Current candle details

current_candle_high = high

current_candle_low = low

current_candle_close = close

current_candle_open = open

// Previous to previous candle details

prev_prev_candle_low = low[2]

// Previous candle body and wick length

prev_candle_body = math.abs(prev_candle_close - prev_candle_open)

prev_candle_wick_length = math.max(prev_candle_high - prev_candle_close, prev_candle_close - prev_candle_low)

// Calculate retrace level for the current candle

retrace_level = prev_candle_close - (prev_candle_close - prev_candle_low) * 0.5

// Check if the previous candle's wick is smaller than its body

prev_candle_condition = prev_candle_wick_length < prev_candle_body

// Check if the previous candle is a green (bullish) candle and if the previous candle's close is above EMA

prev_candle_green = prev_candle_close > prev_candle_open

prev_candle_red = prev_candle_close < prev_candle_open

prev_candle_above_ema = prev_candle_close > ema_44

// Entry condition: The current candle has retraced to 50% of the previous candle's range, previous candle was green and above EMA, and the high of the current candle is above the retrace level, and EMA is inclined

entry_condition = prev_candle_close > candle_before_prev_high and

prev_candle_green and

prev_candle_above_ema and

current_candle_low <= retrace_level and

current_candle_high >= retrace_level and ema_is_inclined

// Exit condition

exit_condition = (strategy.position_size > 0 and prev_candle_red) or (strategy.position_size > 0 and current_candle_low < prev_candle_low)

// Ensure only one trade is open at a time

single_trade_condition = strategy.position_size == 0

// Plot EMA for visualization

plot(ema_44, color=color.blue, title="44 EMA")

// Plot conditions for debugging

plotshape(series=entry_condition and single_trade_condition, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=exit_condition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Print entry condition value on chart

var label entry_label = na

if (entry_condition and single_trade_condition)

entry_label := label.new(bar_index, low, text="Entry Condition: TRUE", color=color.green, textcolor=color.white, size=size.small, yloc=yloc.belowbar)

else

entry_label := label.new(bar_index, high, text="Entry Condition: FALSE", color=color.red, textcolor=color.white, size=size.small, yloc=yloc.abovebar)

// Debugging: Plot retrace level and other key values

plot(retrace_level, color=color.orange, title="Retrace Level")

plot(prev_candle_high, color=color.purple, title="Previous Candle High")

plot(candle_before_prev_high, color=color.yellow, title="Candle Before Previous High")

// Trigger buy order if entry condition and single trade condition are met

if (entry_condition and single_trade_condition)

strategy.entry("Buy", strategy.long)

// Trigger sell order if exit condition is met

if (exit_condition)

strategy.close("Buy")

相关推荐