Dual RSI Differential Strategy

Author: ChaoZhang, Date: 2024-05-15 10:41:10Tags: RSI

Overview

The Dual RSI Differential Strategy is a trading approach that utilizes the difference between two Relative Strength Index (RSI) indicators calculated over different time periods to make trading decisions. Unlike traditional single RSI strategies, this method provides a more nuanced analysis of market dynamics by examining the difference between a short-term and a long-term RSI. This approach enables traders to more accurately capture overbought and oversold market conditions, resulting in more precise trading decisions.

Strategy Principle

The core of this strategy lies in calculating two RSI indicators over different time periods and analyzing the difference between them. Specifically, the strategy employs a short-term RSI (default: 21 days) and a long-term RSI (default: 42 days). By calculating the difference between the long-term RSI and the short-term RSI, we obtain an RSI differential indicator. When the RSI differential falls below -5, it suggests strengthening short-term momentum, indicating a potential long trade. Conversely, when the RSI differential rises above +5, it implies weakening short-term momentum, signaling a potential short trade.

Strategy Advantages

The advantage of the Dual RSI Differential Strategy lies in its ability to provide a more granular analysis of market dynamics. By examining the difference between RSIs of different time periods, the strategy can more accurately capture shifts in market momentum, providing traders with more reliable trading signals. Moreover, the strategy introduces the concept of holding days and the option to set take profit and stop loss levels, allowing traders to have greater control over their risk exposure.

Strategy Risks

Despite its many advantages, the Dual RSI Differential Strategy is not without potential risks. Firstly, the strategy relies on the correct interpretation of the RSI differential indicator. If traders misunderstand the indicator, it may lead to incorrect trading decisions. Secondly, the strategy may generate more false signals in highly volatile market conditions, resulting in frequent trades and high transaction costs. To mitigate these risks, traders may consider combining the Dual RSI Differential Strategy with other technical indicators or fundamental analysis to validate trading signals.

Strategy Optimization Directions

To further enhance the performance of the Dual RSI Differential Strategy, we can consider optimizing the strategy in the following aspects:

-

Parameter Optimization: By optimizing parameters such as RSI periods, RSI differential thresholds, and holding days, we can find the most suitable parameter combination for the current market environment, thereby improving the strategy’s profitability and stability.

-

Signal Filtering: Introducing other technical indicators or market sentiment indicators to provide secondary confirmation of the Dual RSI Differential Strategy’s trading signals, reducing the occurrence of false signals.

-

Risk Control: Optimizing the settings for take profit and stop loss levels, or introducing dynamic risk control mechanisms to adjust position sizes based on changes in market volatility, allowing for better control of the strategy’s risk exposure.

-

Multi-Market Adaptation: Extending the Dual RSI Differential Strategy to other financial markets, such as forex, commodities, and bonds, to verify the strategy’s universality and robustness.

Summary

The Dual RSI Differential Strategy is a momentum trading strategy based on the Relative Strength Index. By analyzing the difference between RSIs of different time periods, it provides traders with a more granular method of market analysis. Although the strategy has some potential risks, through appropriate optimization and improvement, we can further enhance the strategy’s performance, making it a more reliable and effective trading tool.

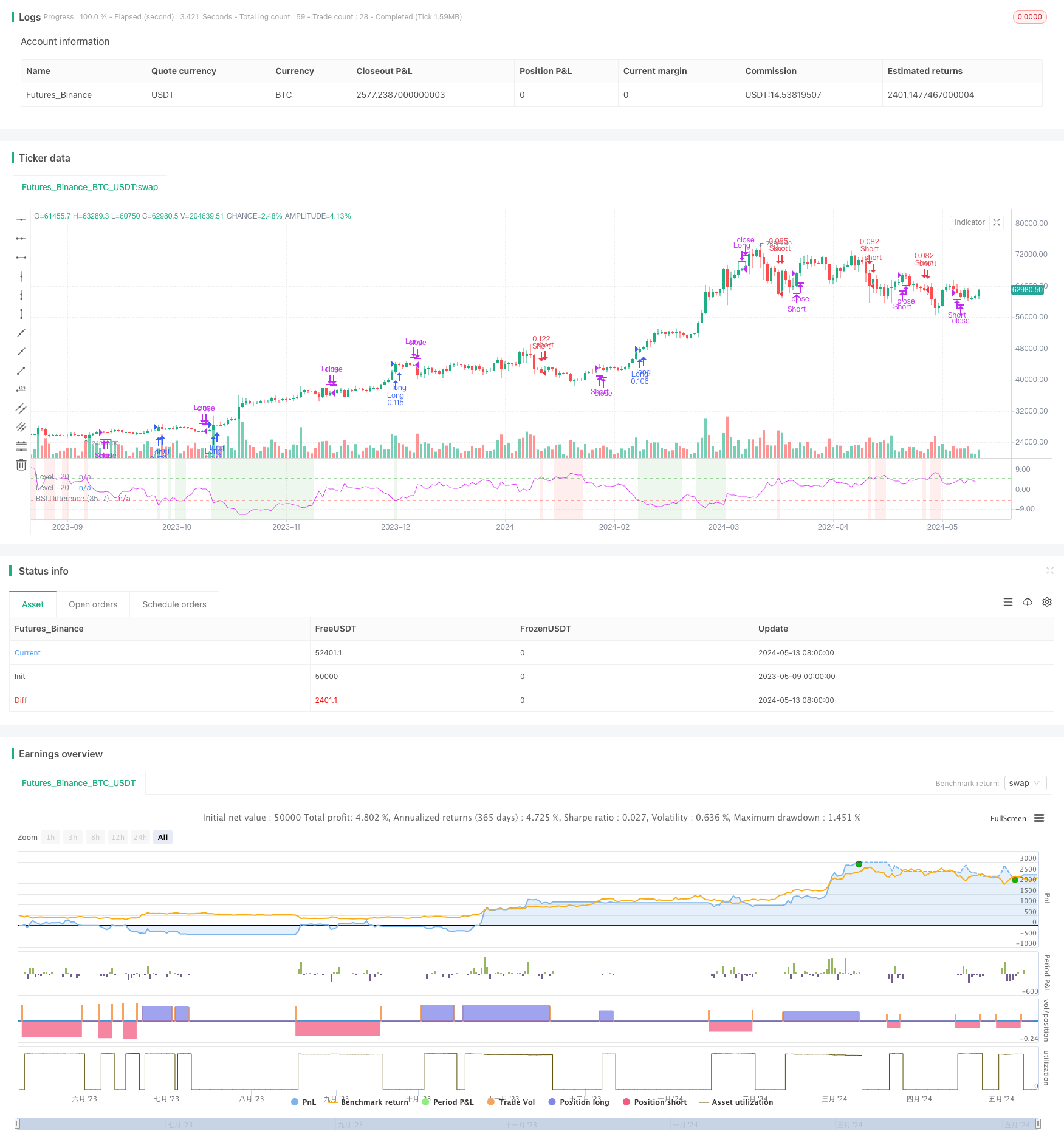

/*backtest

start: 2023-05-09 00:00:00

end: 2024-05-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy stands out by using two distinct RSI lengths, analyzing the differential between these to make precise trading decisions.

// Unlike conventional single RSI strategies, this method provides a more nuanced view of market dynamics, allowing traders to exploit

// both overbought and oversold conditions with greater accuracy.

//@version=5

strategy("Dual RSI Differential - Strategy [presentTrading]", overlay=false, precision=3,

commission_value=0.1, commission_type=strategy.commission.percent, slippage=1,

currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// Input parameters for user customization

tradeDirection = input.string("Both", "Trading Direction", options=["Long", "Short", "Both"])

lengthShort = input(21, title="Short RSI Period")

lengthLong = input(42, title="Long RSI Period")

rsiDiffLevel = input(5, title="RSI Difference Level")

useHoldDays = input.bool(true, title="Use Hold Days")

holdDays = input.int(5, title="Hold Days", minval=1, maxval=20, step=1)

TPSLCondition = input.string("None", "TPSL Condition", options=["TP", "SL", "Both", "None"])

takeProfitPerc = input(15.0, title="Take Profit (%)")

stopLossPerc = input(10.0, title="Stop Loss (%)")

// Calculate RSIs

rsiShort = ta.rsi(close, lengthShort)

rsiLong = ta.rsi(close, lengthLong)

// Calculate RSI Difference

rsiDifference = rsiLong - rsiShort

// Plotting

hline(rsiDiffLevel, "Level +20", color=color.green, linestyle=hline.style_dashed)

hline(-rsiDiffLevel, "Level -20", color=color.red, linestyle=hline.style_dashed)

// Variables to track entry times

var float longEntryTime = na

var float shortEntryTime = na

// Condition for significant RSI difference

combinedLongCondition = rsiDifference < -rsiDiffLevel

combinedExitLongCondition = rsiDifference > rsiDiffLevel

combinedShortCondition = rsiDifference > rsiDiffLevel

combinedExitShortCondition = rsiDifference < -rsiDiffLevel

// Strategy logic using conditions and direction selection

if (tradeDirection == "Long" or tradeDirection == "Both")

if (combinedLongCondition)

strategy.entry("Long", strategy.long)

longEntryTime := time

if (useHoldDays and (time - longEntryTime >= holdDays * 86400000 or combinedExitLongCondition))

strategy.close("Long")

else if (useHoldDays == false and combinedExitLongCondition)

strategy.close("Long")

if (tradeDirection == "Short" or tradeDirection == "Both")

if (combinedShortCondition)

strategy.entry("Short", strategy.short)

shortEntryTime := time

if (useHoldDays and (time - shortEntryTime >= holdDays * 86400000 or combinedExitShortCondition))

strategy.close("Short")

else if (useHoldDays == false and combinedExitShortCondition)

strategy.close("Short")

// Conditional Profit and Loss Management

if (TPSLCondition == "TP" or TPSLCondition == "Both")

// Apply take profit conditions

strategy.exit("TakeProfit_Long", "Long", profit=close * (1 + takeProfitPerc / 100), limit=close * (1 + takeProfitPerc / 100))

strategy.exit("TakeProfit_Short", "Short", profit=close * (1 - takeProfitPerc / 100), limit=close * (1 - takeProfitPerc / 100))

if (TPSLCondition == "SL" or TPSLCondition == "Both")

// Apply stop loss conditions

strategy.exit("StopLoss_Long", "Long", loss=close * (1 - stopLossPerc / 100), stop=close * (1 - stopLossPerc / 100))

strategy.exit("StopLoss_Short", "Short", loss=close * (1 + stopLossPerc / 100), stop=close * (1 + stopLossPerc / 100))

bgcolor(combinedLongCondition ? color.new(color.green, 90) : na, title="Background Color for Significant Long RSI Diff")

bgcolor(combinedShortCondition ? color.new(color.red, 90) : na, title="Background Color for Significant Short RSI Diff")

// Plot RSIs and their difference

plot(rsiDifference, title="RSI Difference (35-7)", color=color.fuchsia)

// Alerts

alertcondition(combinedLongCondition, title="Significant Long RSI Difference Alert", message="RSI Difference is significant Long at {{close}} with RSI7 at {{rsiShort}} and RSI35 at {{rsiLong}}.")

alertcondition(combinedShortCondition, title="Significant Short RSI Difference Alert", message="RSI Difference is significant Short at {{close}} with RSI7 at {{rsiShort}} and RSI35 at {{rsiLong}}.")

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Multi-Period RSI Divergence with Support/Resistance Quantitative Trading Strategy

- Adaptive Trend Following Strategy with Dynamic Drawdown Control System

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI and Stochastic RSI Synergy Trading System

- MACD-RSI Crossover Trend Following Strategy with Bollinger Bands Optimization System

- Multi-Indicator Dynamic Trading Optimization Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

- ATR Average Breakout Strategy

- KNN Machine Learning Strategy: Trend Prediction Trading System Based on K-Nearest Neighbors Algorithm

- CCI+RSI+KC Trend Filter Bi-Directional Trading Strategy

- BMSB Breakout Strategy

- SR Breakout Strategy

- Bollinger Bands Dynamic Breakout Strategy

- 8 hours ema

- RSI Quantitative Trading Strategy

- Bollinger Band ATR Trend Following Strategy

- Delta Volume with Fibonacci Levels Trading Strategy

- Crypto Big Move Stochastic RSI Strategy

- Triple Relative Strength Index Quantitative Trading Strategy

- Dual MACD Optimization Strategy Combining Trend Following and Momentum Trading

- Trading Strategy Based on Three Consecutive Bearish Candles and Dual Moving Averages

- DZ Session Breakout Strategy

- Han Yue - Trend Following Trading Strategy Based on Multiple EMAs, ATR and RSI

- 200 EMA, VWAP, MFI Trend Following Strategy

- EMA Cross Strategy with RSI Divergence, 30-Minute Trend Identification, and Price Exhaustion

- No Upper Wick Bullish Candle Breakout Strategy

- Relative Strength Index Mean Reversion Strategy