Custom Signal Oscillator Strategy (CSO)

Author: ChaoZhang, Date: 2024-06-21 14:26:20Tags: CSO

Overview

The Custom Signal Oscillator Strategy (CSO) is a flexible trading strategy tool designed to help traders easily test their trading theories. The core of this strategy lies in generating trading signals by calculating the difference between two customizable indicators. The main advantage of the CSO strategy is its simplicity and customizability, allowing users without programming experience to easily test and implement their trading ideas.

This strategy uses the difference between two custom indicators to create an oscillator. When the oscillator crosses the zero line, the strategy generates buy or sell signals. Additionally, the strategy offers some extra features, such as a glow effect on the chart and a long-only option, to increase its flexibility and visual appeal.

Strategy Principles

The core principle of the CSO strategy is based on calculating the difference between two custom indicators:

- Indicator Selection: Users can choose two custom indicators as inputs, referred to as “Fast Signal” and “Slow Signal”.

- Oscillator Calculation: The strategy creates an oscillator by calculating the fast signal minus the slow signal.

- Signal Generation:

- A buy signal is generated when the oscillator crosses from negative to positive.

- A sell signal is generated when the oscillator crosses from positive to negative.

- Trade Execution:

- The strategy opens a long position when a buy signal appears.

- When a sell signal appears, the strategy opens a short position if not in long-only mode; if in long-only mode, it closes the long position.

- Visualization: The strategy plots the oscillator line on the chart and optionally adds a glow effect to enhance visibility.

- Reference Line: A zero line is added to the chart as a reference to help identify signals.

Strategy Advantages

Flexibility: The CSO strategy allows users to customize two indicators as inputs, making it adaptable to various market conditions and trading styles.

Ease of Use: Even traders without programming experience can easily use this strategy, testing different trading theories through simple parameter adjustments.

Visualization: The strategy provides clear chart representation, including the oscillator line, zero line, and trade signals, helping traders intuitively understand market dynamics.

Versatility: The inclusion of a long-only option allows the strategy to adapt to different market environments and regulatory requirements.

Aesthetics: The optional glow effect adds visual appeal to the strategy, helping to highlight signals on complex charts.

Adaptability: It can be used in conjunction with various technical indicators and chart overlay tools, increasing the strategy’s range of applications.

Quick Validation: Traders can rapidly validate their trading ideas without delving into complex code writing.

Strategy Risks

Overtrading: As the strategy generates signals based on zero-line crossovers, it may produce too many false signals in ranging markets, leading to overtrading.

Lag: Depending on the characteristics of the chosen indicators, the strategy may have a certain lag, potentially missing important turning points in fast-moving markets.

Parameter Sensitivity: The strategy’s performance is highly dependent on the chosen indicators and parameters; inappropriate choices may lead to poor strategy performance.

Lack of Stop-Loss Mechanism: The current version of the strategy does not have a built-in stop-loss mechanism, which may result in significant losses in adverse market conditions.

Changing Market Conditions: The strategy may perform well under certain market conditions but poorly under others, requiring continuous monitoring and adjustment.

Over-reliance: Traders may become overly reliant on the strategy’s signals, neglecting other important market factors and fundamental analysis.

To mitigate these risks, it is recommended that traders: - Carefully select and test indicator combinations - Conduct thorough backtesting and paper trading before live trading - Combine with other analysis methods and risk management techniques - Regularly evaluate and adjust strategy parameters - Set appropriate stop-loss and profit targets - Avoid overtrading, especially in highly volatile market environments

Strategy Optimization Directions

Introduce Filters: Add trend filters or volatility filters to reduce false signals and improve strategy stability under different market conditions.

Dynamic Parameter Adjustment: Implement adaptive functionality for parameters, allowing the strategy to automatically adjust indicator parameters based on market conditions.

Multi-Timeframe Analysis: Integrate signals from multiple timeframes to improve the accuracy and robustness of trading decisions.

Stop-Loss and Take-Profit: Add dynamic stop-loss and take-profit mechanisms to better control risk and lock in profits.

Position Sizing Management: Implement dynamic position management based on volatility or account risk to optimize risk-reward ratios.

Market Regime Recognition: Add market state recognition functionality to allow the strategy to automatically adjust trading behavior in different market environments.

Machine Learning Integration: Utilize machine learning algorithms to optimize indicator selection and parameter adjustment processes, improving strategy adaptability.

Sentiment Indicators: Integrate market sentiment indicators, such as VIX or option implied volatility, to enhance the strategy’s market awareness.

Drawdown Control: Add drawdown control mechanisms to automatically reduce trading frequency or pause trading during consecutive losses.

Correlation Analysis: Introduce correlation analysis with other assets or strategies to achieve better risk diversification.

These optimization directions aim to improve the strategy’s stability, adaptability, and overall performance. By gradually implementing these improvements, the CSO strategy can evolve into a more powerful and reliable trading system.

Conclusion

The Custom Signal Oscillator Strategy (CSO) is a powerful and flexible trading tool that provides traders with a simple method to test and implement various trading theories. By allowing users to customize input indicators, the CSO strategy can adapt to multiple market conditions and trading styles. Its simple signal generation mechanism, combined with clear visual representation, makes the strategy easy to understand and use.

However, like all trading strategies, CSO also faces some potential risks, such as overtrading and parameter sensitivity. Traders need to use it cautiously and in conjunction with other analysis methods and risk management techniques.

Through continuous optimization and improvement, such as introducing advanced filters, dynamic parameter adjustments, and multi-dimensional analysis, the CSO strategy has the potential to evolve into a more comprehensive and effective trading system. Ultimately, the success of the CSO strategy will depend on how traders skillfully leverage its flexibility and combine it with solid market knowledge and strict risk management.

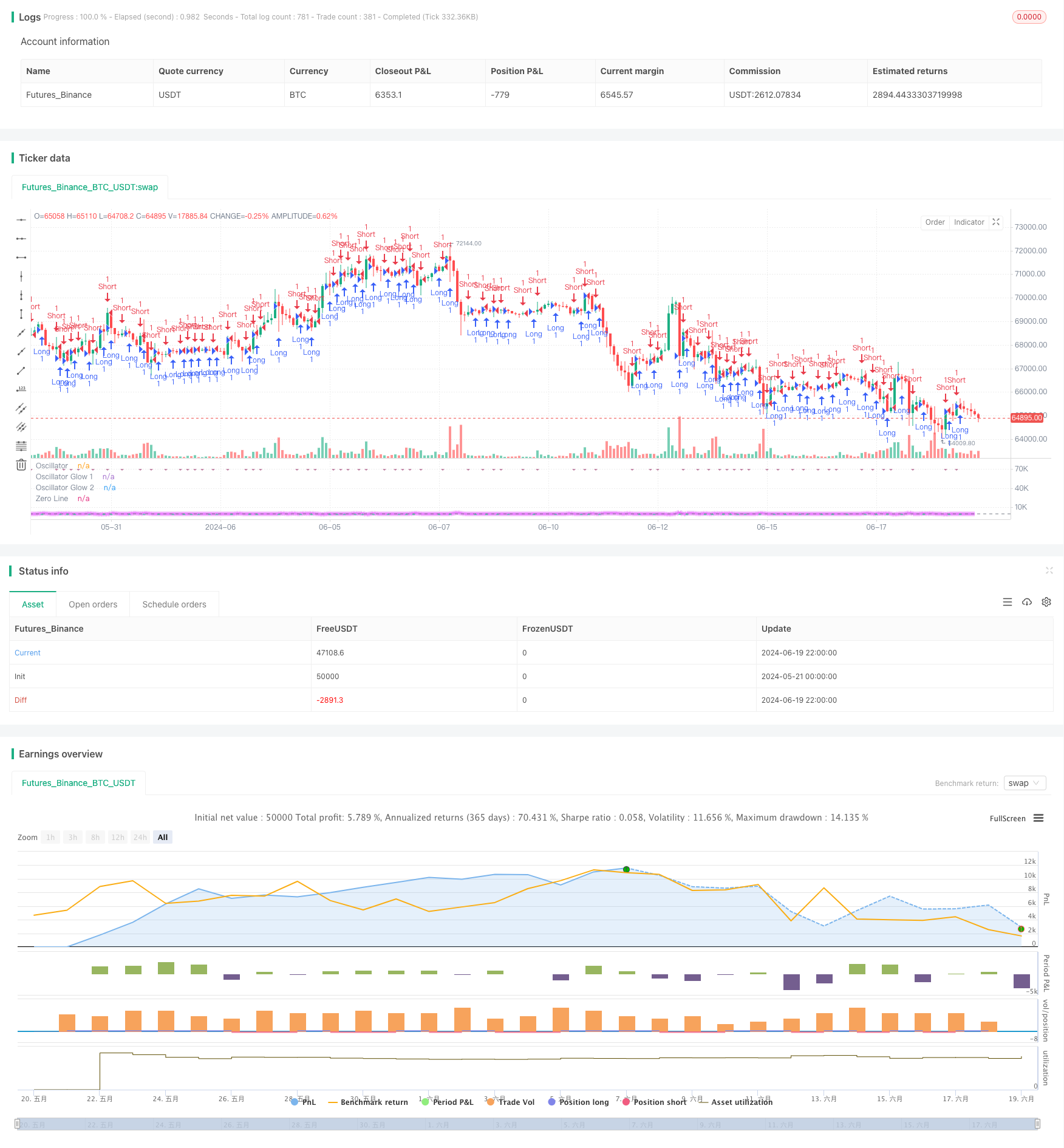

/*backtest

start: 2024-05-21 00:00:00

end: 2024-06-20 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © NantzOS

//@version=5

strategy("Custom Signal Oscillator Strategy", shorttitle="CSO-TEST", overlay=false)

// Input: Select two plots

plot1 = input(open, title="Fast Signal")

plot2 = input(close, title="Slow Signal")

// Input: Enable glow colors

enableGlow = input.bool(true, title="Enable Glow Colors")

// Input: Long only option

longOnly = input.bool(false, title="Long Only")

// Calculate the difference

oscillator = plot1 - plot2

// Plot the oscillator with a glow effect if enabled

plot(oscillator, title= "Oscillator", color=color.new(color.white, 20), linewidth=1)

plot(oscillator, title= "Oscillator Glow 1", color=enableGlow ? color.new(color.fuchsia, 50) : na, linewidth=enableGlow ? 4 : na)

plot(oscillator, title= "Oscillator Glow 2", color=enableGlow ? color.new(color.fuchsia, 70) : na, linewidth=enableGlow ? 8 : na)

// Adding zero line for reference

hline(0, "Zero Line", color=color.gray)

// Long and Short Entries

longEntry = ta.crossover(oscillator, 0)

shortEntry = ta.crossunder(oscillator, 0)

// Long Exit (for long-only mode)

longExit = ta.crossunder(oscillator, 0)

// Plot shapes for entries and exits

plotshape(series=(longEntry), style=shape.triangleup, location=location.bottom, color=color.rgb(0, 230, 118, 50), size=size.tiny, title = "Cross Over")

plotshape(series=(shortEntry), style=shape.triangledown, location=location.top, color=color.rgb(136, 14, 79, 50), size=size.tiny, title = "Cross Under")

// Strategy entries and exits

if longEntry

strategy.entry("Long", strategy.long)

if longExit and longOnly

strategy.close("Long")

if shortEntry and not longOnly

strategy.entry("Short", strategy.short)

- Multi-EMA Crossover Trend Following Strategy

- Dynamic Oscillation Trend Capture Strategy

- VAWSI and Trend Persistence Reversal Strategy with Dynamic Length Calculation Multi-Indicator Analysis System

- Dynamic Channel Percentage Envelope Strategy

- SuperTrend Strategy Optimization: Dynamic Volatility Tracking and Enhanced Trading Signal System

- Machine Learning Inspired Dual Moving Average RSI Trading Strategy

- Multi-Indicator High-Frequency Trading Strategy: Short-Term Trading System Combining Exponential Moving Averages and Momentum Indicators

- Triple Standard Deviation Momentum Reversal Trading Strategy

- Multi-Period Exponential Moving Average Crossover Strategy with Options Trading Suggestion System

- Double Supertrend Multi-Step Trailing Take-Profit Strategy

- Multi-Level RSI Mean Reversion Strategy with Dynamic Volatility Adjustment

- Bollinger Bands Momentum Crossover Strategy

- Super Triple Indicator RSI-MACD-BB Momentum Reversal Strategy

- CCI Momentum Divergence Trend Trading Strategy

- Hilo Activator MACD Dynamic Stop-Loss Take-Profit Trading Strategy

- Dynamic Take-Profit and Stop-Loss Dual Moving Average Crossover Trading Strategy

- RSI Dual-Period Moving Average Reversal Strategy with Dynamic Risk Management System

- Markov Chain Probability Transition State Quantitative Trading Strategy

- SMA Crossover Strategy with RSI Filter and Alerts

- Dynamic Donchian Channel and Simple Moving Average Combination Quantitative Strategy