Multi-Indicator Divergence Trading Strategy with Adaptive Take Profit and Stop Loss

Author: ChaoZhang, Date: 2024-07-29 17:02:12Tags: RSIMACD

Overview

This strategy is a trading system based on multiple technical indicator divergences, combining signals from RSI, MACD, and Stochastic indicators to identify potential buying and selling opportunities. The strategy also integrates flexible take profit and stop loss mechanisms to manage risk and lock in profits. By comprehensively analyzing divergence signals from multiple indicators, this strategy aims to improve the accuracy and reliability of trading decisions.

Strategy Principle

The core principle of this strategy is to utilize divergences from multiple technical indicators to identify potential trend reversal points. Specifically, the strategy uses the following three indicators:

- Relative Strength Index (RSI): Used to measure price momentum.

- Moving Average Convergence Divergence (MACD): Used to identify trend direction and strength.

- Stochastic Oscillator: Used to determine if an asset is overbought or oversold.

The strategy operates through the following steps:

- Calculate the values of RSI, MACD, and Stochastic indicators.

- Detect divergences for each indicator:

- RSI divergence: When RSI crosses its 14-period simple moving average.

- MACD divergence: When the MACD line crosses the signal line.

- Stochastic divergence: When the Stochastic oscillator crosses its 14-period simple moving average.

- Generate trading signals when all three indicators show divergences:

- Buy signal: RSI divergence + MACD divergence + Stochastic divergence

- Sell signal: RSI divergence + MACD divergence + No Stochastic divergence

- Execute trades and set take profit and stop loss levels:

- Take profit level: 20% of the entry price

- Stop loss level: 10% of the entry price

This multiple confirmation approach aims to reduce false signals and improve trading accuracy.

Strategy Advantages

Multiple indicator confirmation: By combining signals from RSI, MACD, and Stochastic indicators, the strategy can more accurately identify potential trend reversal points, reducing the impact of false signals.

Flexible risk management: The integrated take profit and stop loss mechanism allows traders to adjust risk-reward ratios according to personal risk preferences and market conditions.

High adaptability: The strategy can be applied to different time frames and various financial instruments, offering wide applicability.

Automated trading: The strategy can be easily automated, reducing human emotional influence and improving execution efficiency.

Clear entry and exit rules: Well-defined trading rules eliminate subjective judgment, helping maintain trading discipline.

Dynamic take profit and stop loss: Setting take profit and stop loss based on entry price percentages allows for automatic adjustment according to different market volatilities.

Trend capturing ability: By identifying divergences, the strategy has the potential to capture new trend formations in their early stages.

Strategy Risks

Overtrading risk: Multiple indicators may lead to frequent trading signals, increasing trading costs and potentially affecting overall performance.

Lag issue: Technical indicators are inherently lagging, which may result in trades being executed after significant trend changes have already occurred.

Market condition sensitivity: The strategy may underperform in ranging or low volatility markets, generating more false signals.

Limitations of fixed take profit and stop loss: Although percentage-based take profit and stop loss provide some flexibility, they may not be suitable for all market conditions.

Parameter optimization risk: Over-optimizing indicator parameters may lead to overfitting, resulting in poor performance in actual trading.

Correlation risk: Under certain market conditions, different indicators may be highly correlated, reducing the effectiveness of multiple confirmations.

Lack of fundamental considerations: A purely technical analysis approach may ignore important fundamental factors, affecting long-term performance.

Strategy Optimization Directions

Dynamic indicator parameters: Introduce adaptive mechanisms to dynamically adjust RSI, MACD, and Stochastic indicator parameters based on market volatility.

Market regime recognition: Integrate market state classification algorithms to adjust strategy behavior in different market environments (e.g., trending, ranging).

Take profit and stop loss optimization: Implement dynamic take profit and stop loss considering market volatility and support/resistance levels, rather than relying solely on fixed percentages.

Incorporate volume analysis: Integrate volume indicators to improve the accuracy of trend reversal identification.

Time filters: Introduce time-based filters to avoid trading during known low liquidity or high volatility periods.

Machine learning enhancement: Utilize machine learning algorithms to optimize indicator combinations and weights, improving signal quality.

Risk management improvements: Implement more sophisticated position management strategies, such as volatility-based position sizing adjustments.

Multi-timeframe analysis: Integrate analysis from multiple timeframes to improve the robustness of trading decisions.

Fundamental integration: Consider incorporating key fundamental indicators or events into the decision-making process for more comprehensive analysis.

Conclusion

The “Multi-Indicator Divergence Trading Strategy with Adaptive Take Profit and Stop Loss” is a complex and comprehensive trading system that identifies potential trend reversal opportunities by integrating divergence signals from multiple technical indicators. The strategy’s strengths lie in its multiple confirmation mechanism and flexible risk management approach, which help improve the accuracy and reliability of trading decisions. However, it also faces challenges such as overtrading, lagging issues, and market condition sensitivity.

By implementing the suggested optimization measures, such as dynamic parameter adjustment, market state recognition, and more advanced risk management techniques, the strategy has the potential to further enhance its performance and adaptability. It is important for traders to exercise caution in practical application, thoroughly test the strategy’s performance under various market conditions, and make necessary adjustments based on individual risk tolerance and investment objectives.

Overall, this strategy provides a powerful framework for quantitative traders and can serve as a foundation for building more complex and personalized trading systems. Through continuous optimization and improvement, it has the potential to become an effective trading tool, helping traders achieve success in complex and dynamic financial markets.

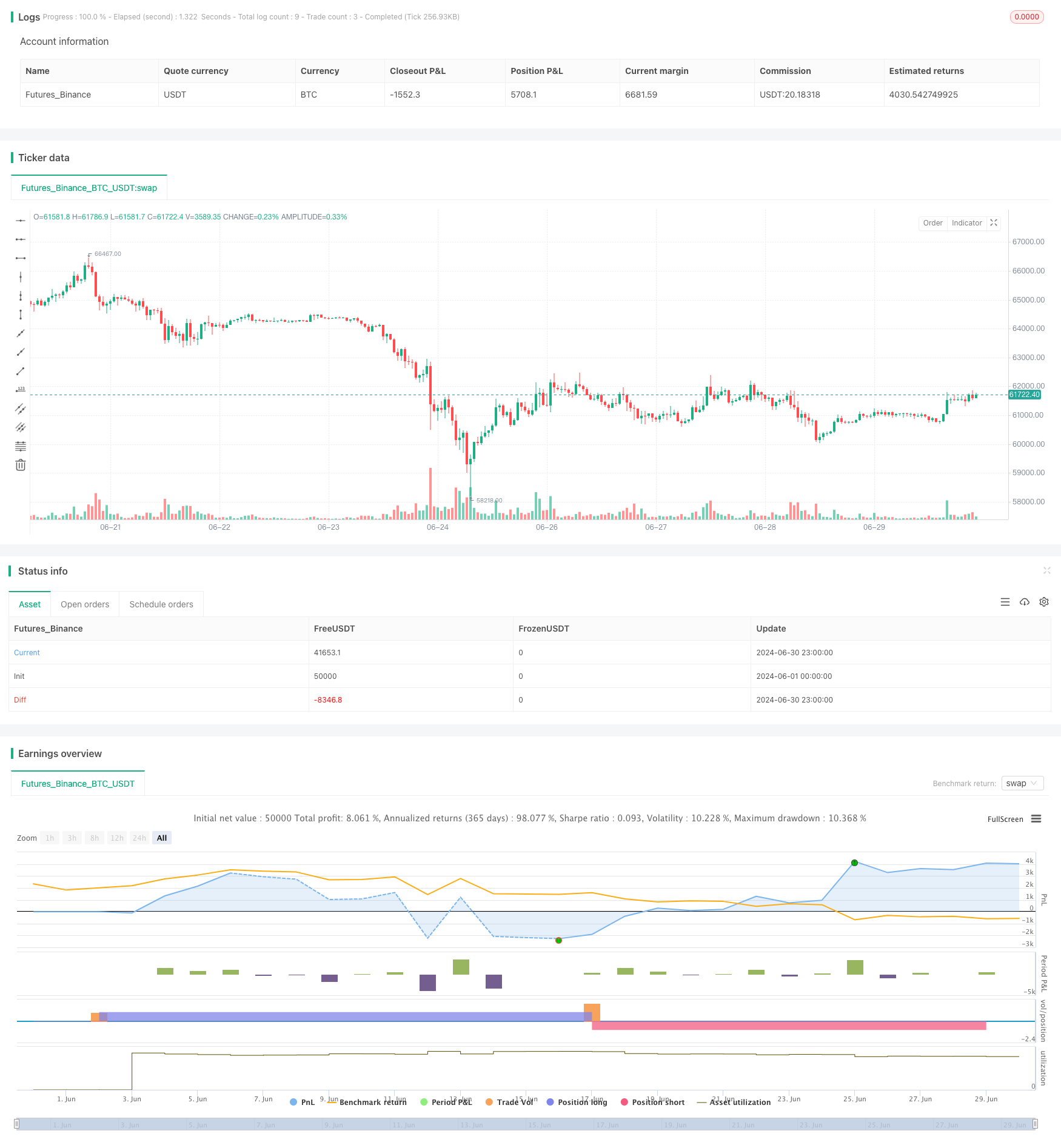

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//You will have to choose between High profits and high risks or low profits and low risks? By adjusting TP and SL values

//.........................Working principle

//Even though many pyramid orders are opened The position will be closed when the specified TP target profit is reached.

//..... and setting SL is to ensure safety from being dragged down and losing a large sum of money (it is very important, you need to know what percentage the price swings on the moving chart are in most cases).

//I wish you good luck and prosperity as you use this indicator.

//@version=5

strategy("Multi-Divergence Buy/Sell Strategy with TP and SL", overlay=true)

// Input parameters

rsiLength = input(14, "RSI Length")

macdShortLength = input(12, "MACD Short Length")

macdLongLength = input(26, "MACD Long Length")

macdSignalSmoothing = input(9, "MACD Signal Smoothing")

stochLength = input(14, "Stochastic Length")

stochOverbought = input(80, "Stochastic Overbought Level")

stochOversold = input(20, "Stochastic Oversold Level")

// Take Profit and Stop Loss as percentage of entry price

takeProfitPerc = input(20.0, "Take Profit (%)") / 100.0

stopLossPerc = input(10.0, "Stop Loss (%)") / 100.0

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

// Calculate Stochastic

stoch = ta.stoch(close, high, low, stochLength)

// Determine divergences

rsiDivergence = ta.crossover(rsi, ta.sma(rsi, 14))

macdDivergence = ta.crossover(macdLine, signalLine)

stochDivergence = ta.crossover(stoch, ta.sma(stoch, 14))

// Determine buy/sell conditions

buyCondition = rsiDivergence and macdDivergence and stochDivergence

sellCondition = rsiDivergence and macdDivergence and not stochDivergence

// Execute buy/sell orders

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Calculate take profit and stop loss levels

longTakeProfitPrice = strategy.position_avg_price * (1 + takeProfitPerc)

longStopLossPrice = strategy.position_avg_price * (1 - stopLossPerc)

shortTakeProfitPrice = strategy.position_avg_price * (1 - takeProfitPerc)

shortStopLossPrice = strategy.position_avg_price * (1 + stopLossPerc)

// Close positions at take profit or stop loss level

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=longTakeProfitPrice, stop=longStopLossPrice)

if (strategy.position_size < 0)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=shortTakeProfitPrice, stop=shortStopLossPrice)

// Plotting buy/sell signals

plotshape(buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- RSI-MACD Multi-Signal Trading System with Dynamic Stop Management

- Price Divergence Strategy v1.0

- MACD and RSI Combined Long-term Trading Strategy

- RSI and MACD Combined Long-Short Strategy

- Darvas Box Breakout and Risk Management Strategy

- Trend-Following Cloud Momentum Divergence Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Low-Risk Stable Cryptocurrency High-Frequency Trading Strategy Based on RSI and MACD

- Adaptive Moving Average Crossover Strategy

- Technical Indicator Strategy, Risk Management Strategy, Adaptive Trend Following Strategy

- Bollinger Bands Momentum Optimization Strategy

- Multi-Level Dynamic Trend Following System

- Advanced Mean Reversion Trading Strategy: Dynamic Range Breakout System Based on Standard Deviation

- EMA Crossover with Bollinger Bands Double Entry Strategy: A Quantitative Trading System Combining Trend Following and Volatility Breakout

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout with Dynamic Risk Management System

- Multi-Timeframe Market Momentum Crossover Strategy

- Multi-Indicator Trend Following Strategy

- ChandelierExit-EMA Dynamic Stop-Loss Trend-Following Strategy

- Breakout Zone Momentum Trading Strategy

- Precision Trading Strategy and Risk Management System Based on SuperTrend Indicator

- EMA, RSI, Volume-Price Trend, Engulfing Pattern

- Magic Channel Price Action Trading Strategy

- Multi-Indicator Options Trading Strategy

- Dual Moving Average Mean Reversion Strategy with Risk Control

- Dual Moving Average Trend Following Strategy with RSI Filter

- Multi-EMA Crossover with Fibonacci Extension Trend Following Strategy

- Multi-EMA Crossover Stop Strategy

- Adaptive Momentum Trading Strategy with SMA Crossover and SuperTrend