Dynamic Position Dual Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-07-30 16:04:59Tags: SMAMA

Overview

The Dynamic Position Dual Moving Average Crossover Strategy is a quantitative trading approach that utilizes the crossover signals of two Simple Moving Averages (SMAs) with different periods to execute trades. This strategy leverages the crossover of short-term and long-term moving averages to determine market trends and dynamically adjusts position direction based on crossover signals and the relationship between price and the long-term average. The strategy operates on a daily timeframe and allows for flexibility in sensitivity and reaction speed through adjustable moving average parameters.

Strategy Principle

- Moving Average Calculation: The strategy employs two SMAs - a 9-day and a 21-day.

- Trade Signal Generation:

- Buy Signal: Short-term MA (9-day SMA) crosses above the long-term MA (21-day SMA)

- Sell Signal: Short-term MA crosses below the long-term MA

- Position Management:

- Opening Positions: Enter long on buy signals; enter short on sell signals

- Closing and Reversing Positions: a) When holding a long position, close and go short if the opening price is below the long-term MA or a sell signal occurs b) When holding a short position, close and go long if the opening price is above the long-term MA or a buy signal occurs

- Risk Control: The strategy does not use fixed stop-losses but controls risk through dynamic position adjustment

Strategy Advantages

- Trend Following: Captures market trends using MA crossovers, potentially yielding significant returns in strong trends

- Dynamic Positioning: Flexibly adjusts positions based on price-MA relationship, enhancing adaptability

- Simplicity: Clear and easy-to-understand logic, facilitating implementation

- Adjustable Parameters: MA periods can be tuned to suit different market environments and instruments

- All-Weather Trading: Operates continuously under various market conditions

- Automated Execution: Can be fully automated, reducing emotional interference

- Risk Management: Avoids slippage losses associated with fixed stop-losses through dynamic position adjustment

Strategy Risks

- Unfavorable in Choppy Markets: May incur losses due to frequent trading in sideways or volatile markets

- Lagging Nature: Moving averages are inherently lagging indicators, potentially missing initial phases of sharp moves

- False Breakout Risk: Short-term price fluctuations may trigger false MA crossovers, leading to erroneous signals

- Lack of Stop-Loss: Absence of fixed stop-losses may result in significant losses in extreme market conditions

- Overtrading: Frequent position adjustments can lead to high transaction costs

- Parameter Sensitivity: Strategy performance is highly dependent on MA period selection

- Single Indicator Limitation: Relying solely on MA crossovers may overlook other crucial market information

Optimization Directions

- Incorporate Additional Indicators: Combine with RSI, MACD, etc., to improve signal reliability

- Optimize Entry Timing: Add volume and volatility filters to reduce false breakouts

- Implement Stop-Loss Mechanisms: Introduce fixed or trailing stop-losses to control per-trade risk

- Adjust Position Sizing: Dynamically size positions based on market volatility for better capital management

- Add Market State Identification: Distinguish between trending and ranging markets, applying different strategies accordingly

- Optimize Parameter Selection: Use historical data backtesting to find optimal MA period combinations

- Introduce Trend Strength Filters: Implement indicators like ADX to trade only in strong trend conditions

- Develop Adaptive Parameters: Automatically adjust MA periods based on market volatility for improved adaptability

Conclusion

The Dynamic Position Dual Moving Average Crossover Strategy is a classic and practical quantitative trading method that captures market trends by leveraging MA crossover signals and dynamically adjusting positions. This strategy is simple to understand, fully automatable, and demonstrates good trend-following capabilities with flexibility. However, it also faces potential risks such as poor performance in choppy markets and lagging signals. By incorporating additional technical indicators, optimizing parameter selection, and implementing stop-loss mechanisms, the strategy’s stability and profitability can be further enhanced. Traders employing this strategy should adjust parameters and manage risks according to specific trading instruments and market environments to achieve long-term, stable trading results.

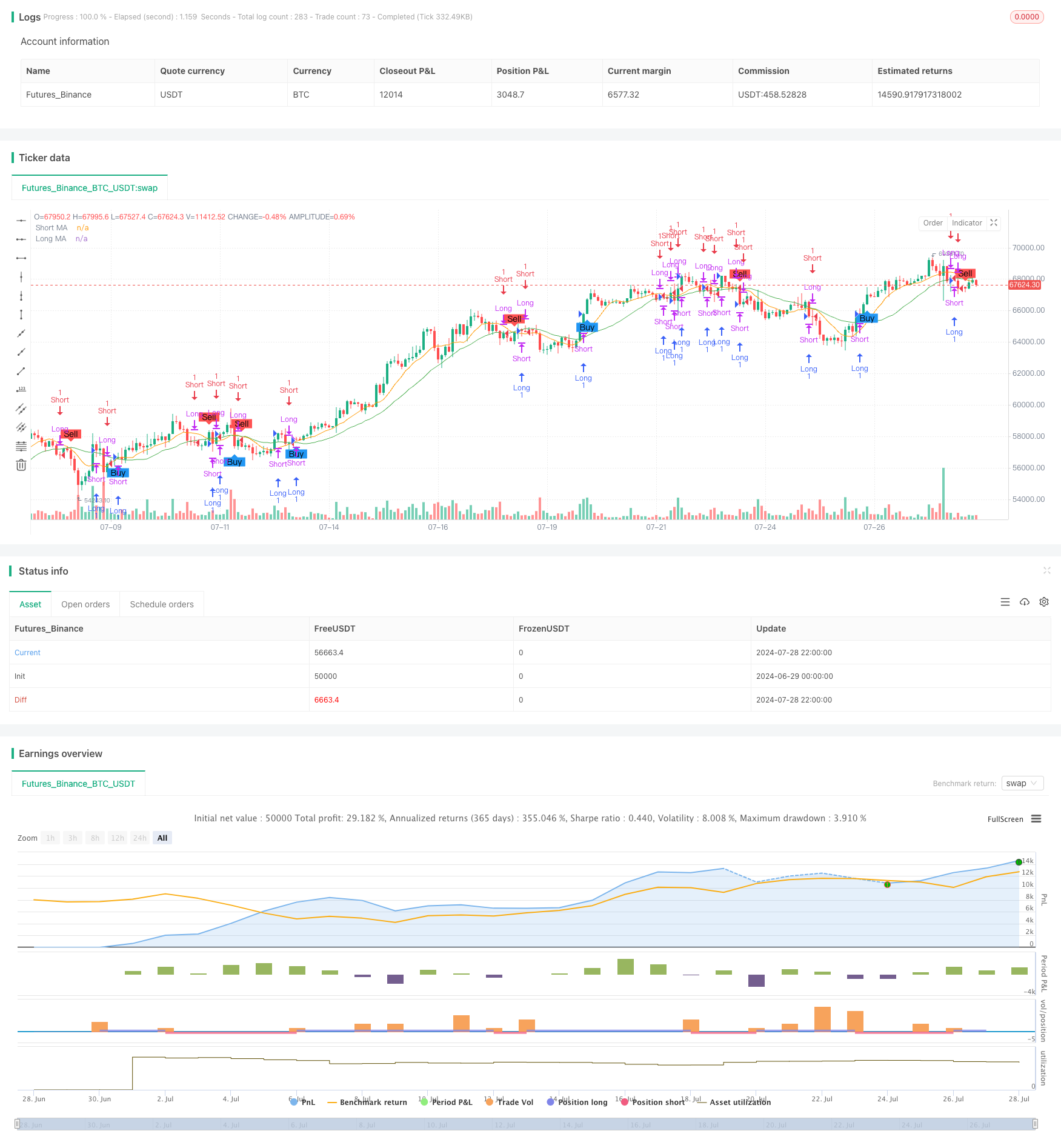

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="MA Cross Backtest", overlay=true, default_qty_type=strategy.cash, default_qty_value=10)

// Parâmetros das Médias Móveis

shortlen = input.int(9, "Short MA Length", minval=1)

longlen = input.int(21, "Long MA Length", minval=1)

// Cálculo das Médias Móveis

short = ta.sma(close, shortlen)

long = ta.sma(close, longlen)

// Plotagem das Médias Móveis

plot(short, color=color.orange, title="Short MA")

plot(long, color=color.green, title="Long MA")

// Sinal de Compra baseado no cruzamento das médias móveis

buySignal = ta.crossover(short, long)

// Sinal de Venda (Short) baseado no cruzamento das médias móveis

sellSignal = ta.crossunder(short, long)

// Plotagem dos Sinais de Compra e Venda

plotshape(series=buySignal, location=location.belowbar, color=color.blue, style=shape.labelup, text="Buy", title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell", title="Sell Signal")

// Condições para alertas

alertcondition(buySignal, title="Buy Signal", message="MA Cross Buy Signal")

alertcondition(sellSignal, title="Sell Signal", message="MA Cross Sell Signal")

// Lógica da Estratégia de Backtest

if (buySignal)

// Se não há posição aberta ou se a posição atual é curta, feche a posição curta antes de abrir uma nova posição longa

if (strategy.position_size < 0)

strategy.close("Short", comment="Closing Short Position before Long Entry")

strategy.entry("Long", strategy.long)

// Alerta de compra

alert("MA Cross Buy Signal", alert.freq_once_per_bar_close)

if (strategy.position_size > 0)

// Se o preço abrir abaixo da média longa

if (open < long)

strategy.close("Long", comment="Price Opened Below Long MA")

strategy.entry("Short", strategy.short, comment="Switched to Short")

// Alerta de venda

alert("Price Opened Below Long MA - Switched to Short", alert.freq_once_per_bar_close)

// Se a média móvel curta cruzar abaixo da média móvel longa

else if (sellSignal)

strategy.close("Long", comment="Short MA Crossed Below Long MA")

strategy.entry("Short", strategy.short, comment="Switched to Short")

// Alerta de venda

alert("Short MA Crossed Below Long MA - Switched to Short", alert.freq_once_per_bar_close)

if (strategy.position_size < 0)

// Se o preço abrir acima da média longa

if (open > long)

strategy.close("Short", comment="Price Opened Above Long MA")

strategy.entry("Long", strategy.long, comment="Switched to Long")

// Alerta de compra

alert("Price Opened Above Long MA - Switched to Long", alert.freq_once_per_bar_close)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Moving Average Crossover Strategy

- SMA Dual Moving Average Trading Strategy

- MA Cross Strategy

- Multi-Moving Average Trend Trading Strategy

- Trend Catcher Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- Dual Moving Average Momentum Trading Strategy: Time-Optimized Trend Following System

- Multiple Moving Average and Stochastic Oscillator Crossover Quantitative Strategy

- Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

- Dual Dynamic Indicator Optimization Strategy

- VWAP Crossover Dynamic Profit Target Trading Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Dimensional Order Flow Analysis and Trading Strategy

- Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System

- Dynamic Trend-Following Trading Strategy Based on Gann Angles

- VWAP-ATR Trend Following and Price Reversal Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy

- Multi-Level Oversold Oscillator Buy Strategy

- Adaptive Trend Following Strategy Combining AlphaTrend and KAMA with Risk Management

- Dual Indicator Cross-Confirmation Momentum Volume Quantitative Trading Strategy

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Multi-EMA and Supertrend Crossover Strategy