Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

Author: ChaoZhang, Date: 2024-07-30 17:12:28Tags: SMA

Overview

The Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model is a trading strategy that combines short-term and long-term Simple Moving Averages (SMA) to generate buy and sell signals based on price crossovers. What sets this strategy apart is its incorporation of additional confirmation mechanisms, including volume changes, other technical indicators, or price action analysis, to reduce the occurrence of false signals. The core of the strategy lies in identifying potential trading opportunities while enhancing signal reliability through multiple confirmations, thereby achieving higher success rates and better risk management in trade execution.

Strategy Principles

Moving Average Selection: The strategy allows users to customize the periods for both short-term and long-term SMAs, with options ranging from 5 to 200 days, to adapt to different market conditions and trading styles.

Signal Generation:

- Buy Signal: Generated when the price crosses above the short-term SMA and is simultaneously above the long-term SMA.

- Sell Signal: Generated when the price crosses below the short-term SMA and is simultaneously below the long-term SMA.

Signal Confirmation:

- Buy Confirmation: Requires both the previous and current closing prices to be above the long-term SMA.

- Sell Confirmation: Requires both the previous and current closing prices to be below the long-term SMA.

Trade Execution: The strategy only executes corresponding buy or sell operations after the signals are confirmed.

Visualization: The strategy plots both short-term and long-term SMA lines on the chart and displays buy/sell signals with markers, allowing traders to analyze market conditions intuitively.

Strategy Advantages

Flexibility: Allows users to customize the periods of short-term and long-term SMAs, adapting to different market environments and personal trading preferences.

Signal Confirmation Mechanism: Reduces false signals by requiring price not only to cross the short-term SMA but also to confirm its position relative to the long-term SMA.

Trend Following: Effectively captures medium to long-term trend changes by utilizing the crossover of two SMAs and price position.

Risk Management: Reduces the risk of frequent trading during sideways or highly volatile markets through the confirmation mechanism.

Visual Support: Clearly marks buy and sell signals on the chart, allowing traders to quickly identify potential trading opportunities.

High Adaptability: The strategy framework allows for further integration of other technical indicators or custom conditions, providing room for expansion for advanced users.

Strategy Risks

Lag: As a trend-following strategy, it may react slowly at the beginning of trend reversals, leading to slightly delayed entry or exit timing.

Performance in Sideways Markets: May generate frequent false signals in markets without clear trends, increasing trading costs.

Parameter Sensitivity: Different SMA period settings can lead to significant variations in strategy performance, requiring careful optimization and backtesting.

Over-reliance on Historical Data: The strategy assumes that past price patterns will repeat in the future, which may fail when market structure undergoes significant changes.

Lack of Stop-Loss Mechanism: The current version does not include an explicit stop-loss strategy, potentially facing significant risks under extreme market conditions.

Strategy Optimization Directions

Introduce Dynamic Parameter Adjustment: Automatically adjust SMA periods based on market volatility to adapt to different market phases.

Integrate Volume Analysis: Use volume changes as an additional confirmation indicator to improve signal reliability.

Add Trend Strength Filtering: Use indicators like ADX to measure trend strength and only execute trades in strong trends.

Implement Adaptive Stop-Loss: Dynamically set stop-loss levels based on market volatility to optimize risk management.

Consider Multi-Timeframe Analysis: Combine longer-term trend judgments to improve trading decision accuracy.

Add Volatility Filtering: Adjust strategy parameters or pause trading during high volatility periods to reduce risk.

Incorporate Machine Learning Models: Utilize historical data to train models for optimizing parameter selection and signal confirmation processes.

Conclusion

The Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model is a flexible and expandable trading system framework. By combining short-term and long-term SMAs and introducing additional confirmation mechanisms, this strategy effectively captures market trends while reducing the risk of false signals. Its flexible parameter settings and clear visual support make it suitable for traders with different styles. However, the success of the strategy still depends on reasonable parameter selection and adaptability to market conditions. Future optimization directions should focus on improving the strategy’s adaptability, integrating more technical analysis tools, and introducing advanced risk management techniques. Through continuous improvement and adjustment, this strategy framework has the potential to become a powerful quantitative trading tool, providing reliable decision support for traders in complex and ever-changing market environments.

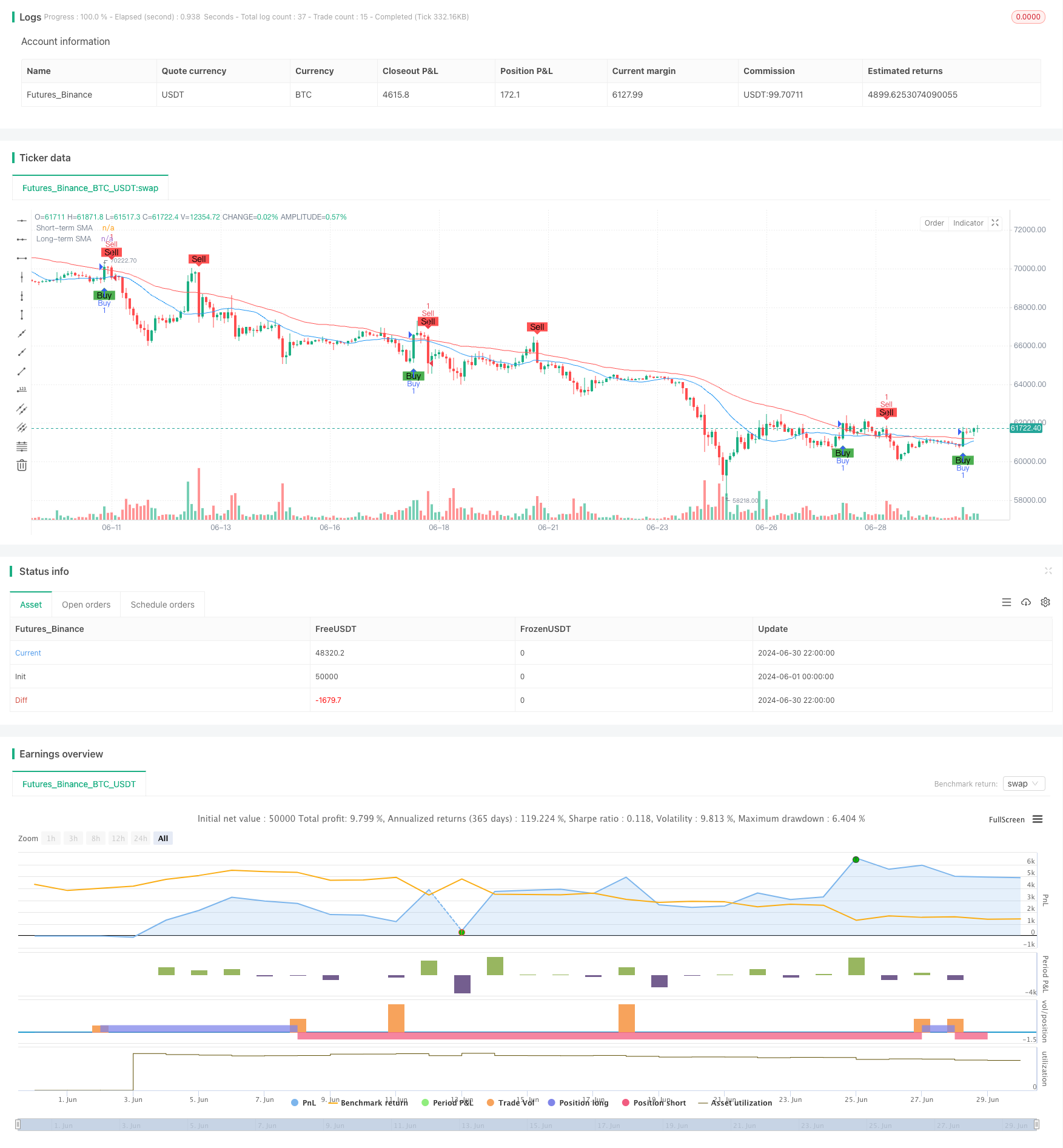

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Customizable SMA Crossover Strategy with Confirmation", overlay=true)

// Input parameters

shortSMA_choice = input.string(title="Short-term SMA Choice", defval="SMA 20", options=["SMA 5", "SMA 10", "SMA 20", "SMA 50", "SMA 100", "SMA 200"])

longSMA_choice = input.string(title="Long-term SMA Choice", defval="SMA 50", options=["SMA 5", "SMA 10", "SMA 20", "SMA 50", "SMA 100", "SMA 200"])

// Determine short-term SMA length based on user choice

shortSMA_length = switch shortSMA_choice

"SMA 5" => 5

"SMA 10" => 10

"SMA 20" => 20

"SMA 50" => 50

"SMA 100" => 100

"SMA 200" => 200

// Determine long-term SMA length based on user choice

longSMA_length = switch longSMA_choice

"SMA 5" => 5

"SMA 10" => 10

"SMA 20" => 20

"SMA 50" => 50

"SMA 100" => 100

"SMA 200" => 200

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// Plot SMAs

plot(shortSMA, title="Short-term SMA", color=color.blue)

plot(longSMA, title="Long-term SMA", color=color.red)

// Generate signals

buySignal = ta.crossover(close, shortSMA) and close > longSMA and close[1] <= longSMA

sellSignal = ta.crossunder(close, shortSMA) and close < longSMA and close[1] >= longSMA

// Confirmation conditions

buyCondition = buySignal and close[1] > longSMA and close > longSMA

sellCondition = sellSignal and close[1] < longSMA and close < longSMA

// Execute trades

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Plot signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy", title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell", title="Sell Signal")

- Multi-Dimensional Trend Analysis with ATR-Based Dynamic Stop Management Strategy

- Adaptive Bollinger Bands Mean-Reversion Trading Strategy

- Advanced Multi-Indicator Trend Confirmation Trading Strategy

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Adaptive Trend Following and Multi-Confirmation Trading Strategy

- Dynamic Stop-Loss Adjustment Elephant Bar Trend Following Strategy

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- SMA-Based Intelligent Trailing Stop Strategy with Intraday Pattern Recognition

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Dual MACD Trend Confirmation Trading System

- High/Low Breakout Strategy with Alpha Trend and Moving Average Filter

- Multi-Candlestick Pattern Recognition and Trading Strategy

- Multi-EMA Crossover Strategy with Trend Confirmation

- Momentum-Driven EMA-RSI Crossover Strategy

- Multi-Indicator Dynamic Trading Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-EMA Crossover Momentum Strategy

- Multi-Order Breakout Trend Following Strategy

- Multi-EMA Crossover with Time Interval Integration Strategy

- Dual Dynamic Indicator Optimization Strategy

- VWAP Crossover Dynamic Profit Target Trading Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Dimensional Order Flow Analysis and Trading Strategy

- Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Position Dual Moving Average Crossover Strategy