Overview

This strategy is an intraday trading approach that combines multiple-period Exponential Moving Averages (EMAs) with the Volume Weighted Average Price (VWAP). It primarily uses the crossover of 8-period and 21-period EMAs to generate trading signals, while employing a 55-period EMA as a trend filter and incorporating VWAP for trade direction confirmation. The strategy also includes fixed percentage stop-loss and take-profit settings, as well as an end-of-day closing mechanism, aiming to achieve high win rates and stable trading performance.

Strategy Principles

Signal Generation: A buy signal is generated when the 8-period EMA crosses above the 21-period EMA; a sell signal is produced when the 8-period EMA crosses below the 21-period EMA.

Trend Filtering: The 55-period EMA is used as a trend filter. Long trades are only executed when the price is above the 55-period EMA, and vice versa for short trades.

VWAP Confirmation: Buy signals require the price to be above the VWAP, while sell signals require the price to be below the VWAP, ensuring that trade direction aligns with institutional money flow.

Risk Management: The strategy employs a fixed 0.5% stop-loss and 1.5% take-profit percentage to control risk for each trade.

Intraday Trading: All positions are closed before the end of each trading day to avoid overnight risk.

Strategy Advantages

Multiple Confirmation Mechanism: Combines short-term, medium-term, and long-term EMAs, as well as VWAP, increasing the reliability of trading signals.

Trend Following: The 55-period EMA trend filter ensures that trades align with the main trend direction.

Risk Control: Fixed percentage stop-loss and take-profit settings effectively manage risk for each trade.

Flexibility: Strategy parameters can be adjusted for different markets and trading instruments.

Intraday Trading: Avoids overnight position risk, suitable for traders with lower risk tolerance.

Strategy Risks

Frequent Trading: EMA crossovers may lead to overtrading, increasing transaction costs.

Lag: EMAs are inherently lagging indicators, potentially producing delayed signals in highly volatile markets.

False Breakouts: In ranging markets, frequent false breakout signals may occur.

Fixed Stop-Loss: In highly volatile markets, fixed percentage stop-losses may be triggered prematurely.

Reliance on Historical Data: Strategy performance may be affected by overfitting, potentially not replicating backtest results in future market conditions.

Optimization Directions

Dynamic Parameters: Consider dynamically adjusting EMA periods and VWAP calculation periods based on market volatility.

Additional Filters: Introduce other technical indicators such as RSI or MACD as extra filtering conditions to reduce false signals.

Adaptive Stop-Loss: Dynamically adjust stop-loss levels based on market volatility, for example, using the Average True Range (ATR) to set stop-losses.

Trading Time Filters: Avoid high volatility periods near market open and close, which may help improve strategy stability.

Incorporate Fundamental Factors: Integrate important economic data releases or company earnings reports to optimize trading decisions.

Conclusion

This multi-period EMA crossover strategy combined with VWAP for high win-rate intraday trading aims to capture intraday trend opportunities by integrating multiple technical indicators and strict risk management. The core advantages of the strategy lie in its multiple confirmation mechanisms and strict risk control, but it also faces challenges such as overtrading and signal lag. Future optimization directions could focus on dynamic parameter adjustment, adding extra filtering conditions, and introducing more sophisticated risk management mechanisms. Traders using this strategy need to perform appropriate parameter adjustments and backtesting based on specific trading instruments and market environments to ensure the strategy’s stability and profitability in live trading.

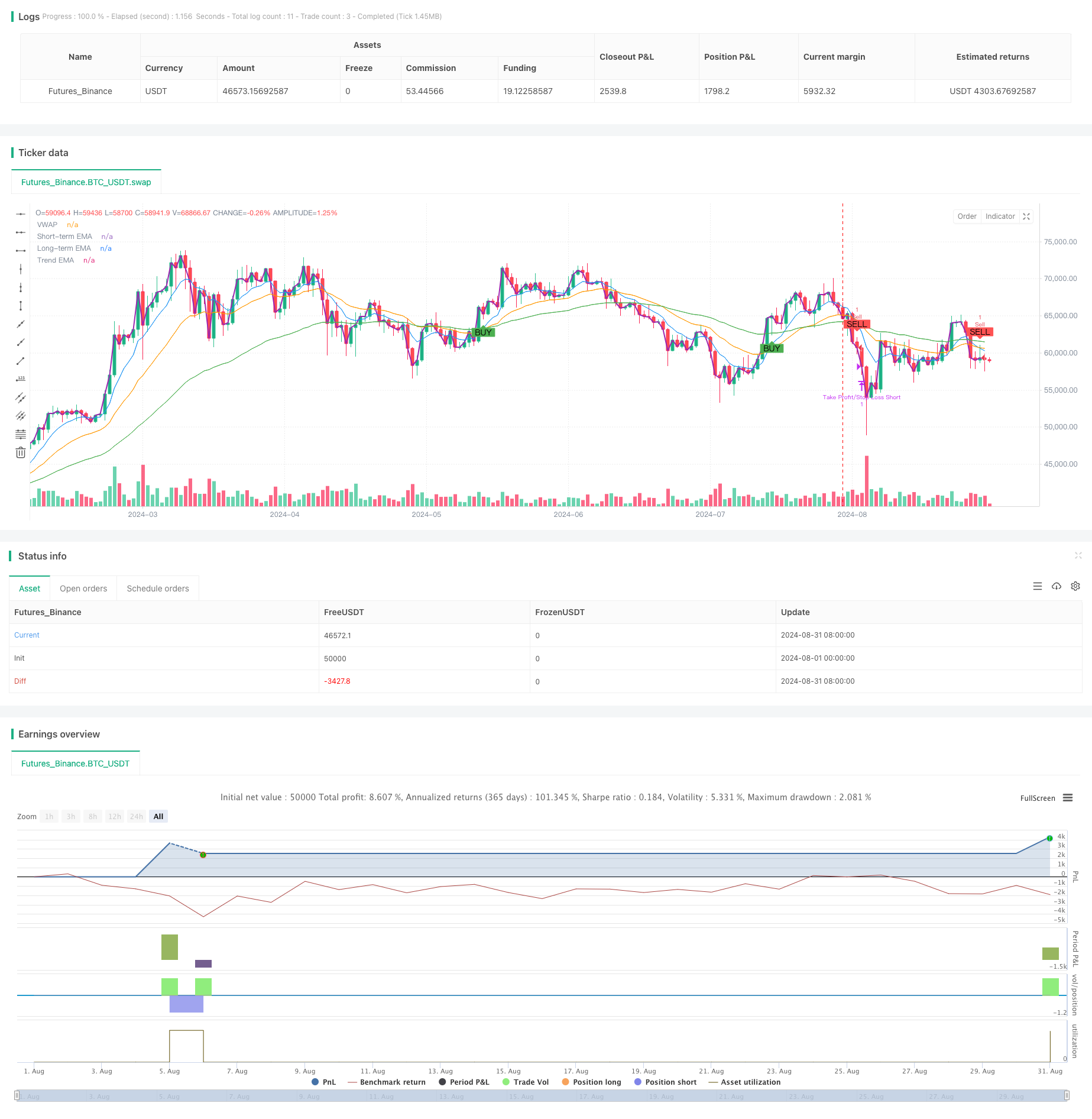

/*backtest

start: 2024-08-01 00:00:00

end: 2024-08-31 23:59:59

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Win Rate EMA VWAP Strategy with Alerts", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Inputs

emaShort = input.int(8, title="Short-term EMA", minval=1)

emaLong = input.int(21, title="Long-term EMA", minval=1)

emaTrend = input.int(55, title="Trend EMA", minval=1)

stopLossPerc = input.float(0.5, title="Stop Loss Percentage", minval=0.1, step=0.1)

takeProfitPerc = input.float(1.5, title="Take Profit Percentage", minval=0.1, step=0.1)

// Calculate EMAs and VWAP

shortEMA = ta.ema(close, emaShort)

longEMA = ta.ema(close, emaLong)

trendEMA = ta.ema(close, emaTrend)

vwap = ta.vwap(close)

// Trend Filter: Only trade in the direction of the trend

isBullishTrend = close > trendEMA

isBearishTrend = close < trendEMA

// Generate Buy and Sell Signals with Trend Confirmation

buySignal = ta.crossover(shortEMA, longEMA) and close > vwap and isBullishTrend

sellSignal = ta.crossunder(shortEMA, longEMA) and close < vwap and isBearishTrend

// Strategy Execution

if (buySignal and strategy.opentrades == 0)

strategy.entry("Buy", strategy.long, qty=1)

if (sellSignal and strategy.opentrades == 0)

strategy.entry("Sell", strategy.short, qty=1)

// Stop Loss and Take Profit (Signal-Based)

if (strategy.position_size > 0) // Long position

strategy.exit("Take Profit/Stop Loss Long", from_entry="Buy", stop=strategy.position_avg_price * (1 - stopLossPerc / 100), limit=strategy.position_avg_price * (1 + takeProfitPerc / 100))

if (strategy.position_size < 0) // Short position

strategy.exit("Take Profit/Stop Loss Short", from_entry="Sell", stop=strategy.position_avg_price * (1 + stopLossPerc / 100), limit=strategy.position_avg_price * (1 - takeProfitPerc / 100))

// Close All Trades at End of Day

if (hour == 15 and minute == 59) // Adjust this time according to your market's closing time

strategy.close("Buy")

strategy.close("Sell")

// Plot Buy/Sell Signals on the chart

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot the EMAs and VWAP

plot(shortEMA, color=color.blue, title="Short-term EMA")

plot(longEMA, color=color.orange, title="Long-term EMA")

plot(trendEMA, color=color.green, title="Trend EMA")

plot(vwap, color=color.purple, title="VWAP", linewidth=2)

// Alert Conditions

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Triggered")