Bollinger Bands Precise Crossover Quantitative Strategy

Author: ChaoZhang, Date: 2024-10-14 11:38:31Tags: BBSMASD

Overview

The Bollinger Bands Precise Crossover Quantitative Strategy is a trading system based on the Bollinger Bands indicator, designed to capture opportunities when prices break through the upper or lower bands. This strategy uses a 1-hour timeframe and determines entry points by observing the interaction between candlesticks and the Bollinger Bands. A buy signal is generated when the price completely breaks below the lower band and the next candle closes above the high of the previous candle. Conversely, a sell signal occurs when the price breaks above the upper band and the next candle closes below the low of the previous candle. This method aims to confirm the validity of price breakouts, thereby reducing the risk of false breakouts.

Strategy Principles

The core principle of this strategy is to use Bollinger Bands as dynamic support and resistance levels. Bollinger Bands consist of three lines: the middle band (20-period simple moving average), the upper band (middle band plus 1.2 times the standard deviation), and the lower band (middle band minus 1.2 times the standard deviation). The key aspects of the strategy are:

-

Buy Condition: When both the high and low of a candle are below the lower band, it’s considered a potential buy signal. If the next candle’s closing price is higher than the high of the trigger candle, a buy entry is confirmed.

-

Sell Condition: When both the high and low of a candle are above the upper band, it’s considered a potential sell signal. If the next candle’s closing price is lower than the low of the trigger candle, a sell entry is confirmed.

-

Visualization: The strategy draws horizontal lines on the chart to mark the high or low points of the trigger candles, helping traders visually identify entry points.

Strategy Advantages

-

Precise Entry Timing: By requiring complete breakouts of the Bollinger Bands and confirmation in the next candle, the strategy reduces the likelihood of false breakouts.

-

Trend Following: The strategy design allows traders to enter in the early stages of new trends, potentially capturing significant price movements.

-

Objective Trading Signals: Based on clear mathematical calculations and price action, reducing the impact of subjective judgment.

-

High Adaptability: Bollinger Bands automatically adjust to market volatility, enabling the strategy to adapt to different market conditions.

-

Risk Management: By waiting for confirmation candles, the strategy incorporates a built-in risk control mechanism.

Strategy Risks

-

Lag: Due to the need for confirmation candles, the strategy may miss some rapid market movements.

-

False Breakouts: Despite the confirmation mechanism, false breakouts can still occur in highly volatile markets.

-

Performance in Ranging Markets: In sideways markets, frequent buy and sell signals may lead to overtrading and increased transaction costs.

-

Reliance on Historical Data: Bollinger Bands are calculated based on historical prices, which may not respond quickly enough to dramatic market changes.

-

Lack of Stop-Loss Mechanism: The code doesn’t include an explicit stop-loss strategy, which could lead to significant losses during trend reversals.

Strategy Optimization Directions

-

Introduce Dynamic Multipliers: Consider dynamically adjusting the Bollinger Bands multiplier based on market volatility to adapt to different market states.

-

Add Filters: Combine other technical indicators (such as RSI or MACD) to filter trading signals and improve accuracy.

-

Implement Stop-Loss and Take-Profit: Add appropriate stop-loss and take-profit mechanisms to better control risk and lock in profits.

-

Optimize Timeframes: Test the strategy on different timeframes to find the optimal application scenario.

-

Consider Trading Volume: Incorporate trading volume as part of the confirmation signal to potentially enhance breakout reliability.

-

Implement Partial Position Management: Develop flexible position management strategies based on signal strength or other market factors.

Summary

The Bollinger Bands Precise Crossover Quantitative Strategy is a trading system that combines technical analysis and statistical principles. Through precisely defined entry conditions, this strategy aims to capture significant market breakouts while reducing the risk of false breakouts through a confirmation mechanism. While the strategy has advantages such as objectivity and adaptability, it also faces risks including lag and false breakouts. To further improve the strategy’s robustness and profitability, consider introducing dynamic parameter adjustments, combining multiple indicators, and implementing comprehensive risk management mechanisms. Overall, this is a promising basic strategy framework that, with continuous optimization and backtesting, has the potential to develop into a reliable trading system.

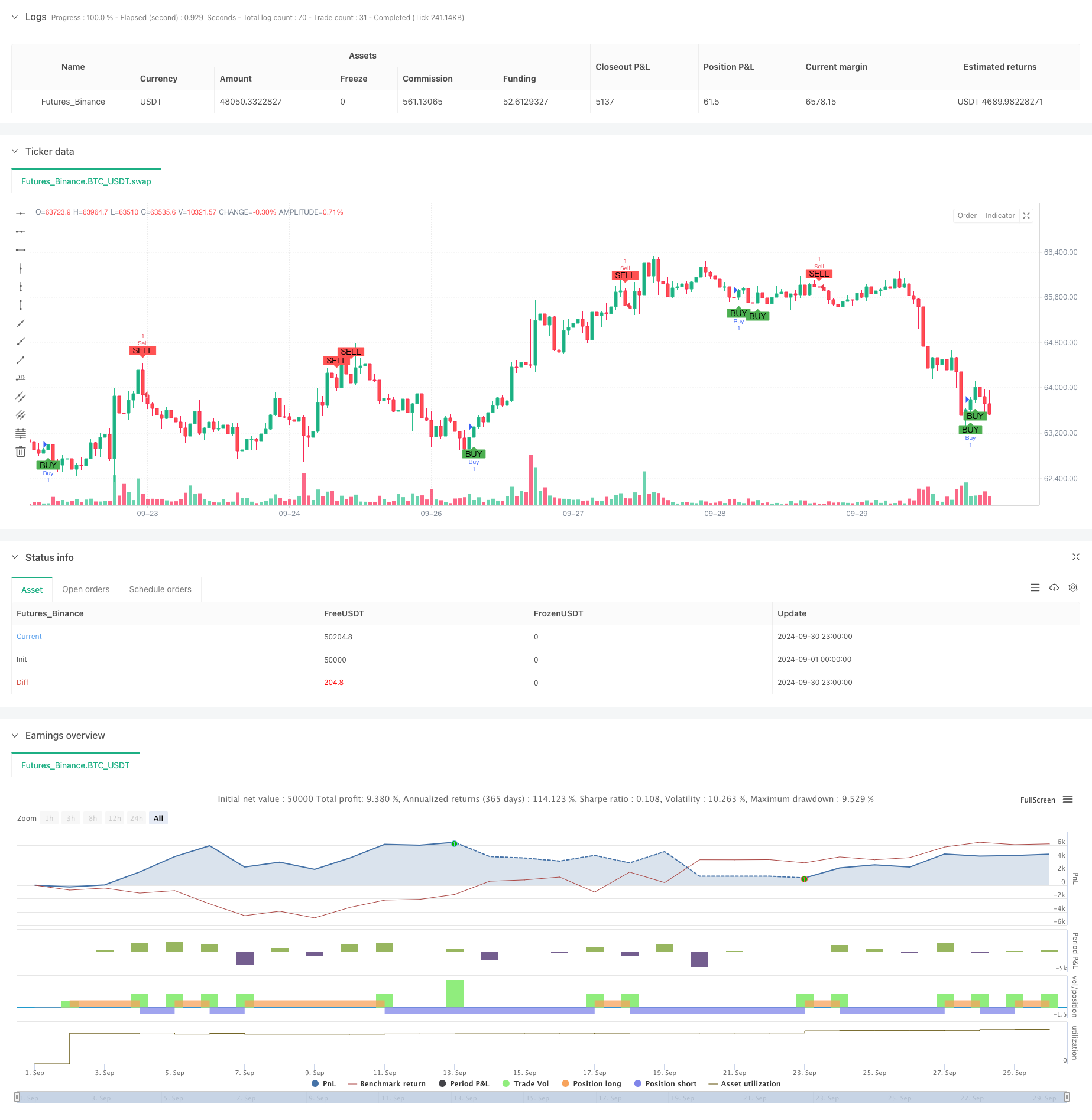

/*backtest

start: 2024-09-01 00:00:00

end: 2024-09-30 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BB BTCUSDT !HR TF ~ Abhay Pratap Singh)", overlay=true)

// Bollinger Bands settings

multiplier = 1.2

length = 20

src = close

basis = ta.sma(src, length)

dev = ta.stdev(src, length)

upper_band = basis + (multiplier * dev)

lower_band = basis - (multiplier * dev)

// Trigger candle conditions

buy_trigger = (high < lower_band and low < lower_band) // Both high and low are below the lower band

sell_trigger = (high > upper_band and low > upper_band) // Both high and low are above the upper band

// Entry conditions for Buy and Sell

buy_entry = buy_trigger[1] and close > high[1] // Buy if the next candle closes above the trigger candle's high

sell_entry = sell_trigger[1] and close < low[1] // Sell if the next candle closes below the trigger candle's low

// Draw horizontal lines for the trigger candle's high and low

var line buy_trigger_line = na

var line sell_trigger_line = na

// if (buy_entry)

// buy_trigger_line := line.new(x1=bar_index[1], y1=low[1], x2=bar_index, y2=low[1], color=color.green, width=2, style=line.style_solid)

// if (sell_entry)

// sell_trigger_line := line.new(x1=bar_index[1], y1=high[1], x2=bar_index, y2=high[1], color=color.red, width=2, style=line.style_solid)

// Execute strategy entries

if (buy_entry)

strategy.entry("Buy", strategy.long)

if (sell_entry)

strategy.entry("Sell", strategy.short)

// Optional plot for debugging or visualization

plotshape(series=buy_entry, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_entry, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- Enhanced Dynamic Bollinger Bands Trading Strategy

- Bollinger Bands and RSI Crossover Trading Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Volume Filter

- Dynamic Reversal Point Strategy Based on Bollinger Bands and Fractal Breakouts

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Technical Support and Resistance Indicator Precision Trading Strategy

- Bollinger Bands Dynamic Breakout Strategy

- ADX (Average Directional Index) and Volume Dynamic Trend Tracking Strategy

- Multi-Volume Momentum Combined Trading Strategy

- Fibonacci Retracement and Extension Multi-Indicator Quantitative Trading Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- Multi-Technical Indicator Based Mean Reversion and Trend Following Strategy

- WebSocket Acceleration Driver

- multiple thread get fundings symbols

- EMA/MACD/RSI Crossover Strategy

- Multi-Indicator Crossover Momentum Trading Strategy with Optimized Take Profit and Stop Loss System

- Volatility Stop Cloud Strategy with Moving Average Crossover System

- Dynamic Risk-Managed EMA Crossover with Bollinger Bands Strategy

- Multi-Level Balanced Quantitative Trading Strategy

- Multi-Dimensional Mathematical Model Trading Strategy

- EMA Crossover Fibonacci Reversal Strategy

- Adaptive Multi-Level Trading Strategy Based on Fibonacci Retracement

- Bollinger Band Overbought/Oversold Strategy

- Multi-Period EMA Crossover with VWAP High Win-Rate Intraday Trading Strategy

- Enhanced Breakout Strategy with Targets and Stop Loss Optimization

- Dual Moving Average Channel Trend Following Strategy

- Multi-Indicator Adaptive Momentum Trading Strategy