基于布林带和分形突破的动态转折点策略

Author: ChaoZhang, Date: 2024-06-28 15:06:36Tags: BBMASMASDFRAC

概述

这个策略是一个结合了布林带和价格分形的动态转折点识别系统。它旨在捕捉市场的主要反转点,通过识别价格突破布林带以及突破重要分形水平来生成交易信号。该策略利用了技术分析中常用的布林带指标和价格分形理论,试图在波动的市场中找到高概率的交易机会。

策略原理

策略的核心原理基于以下几个关键元素:

布林带:使用20周期的简单移动平均线(SMA)作为中轨,上下轨分别为中轨加减2倍标准差。布林带用于判断价格是否处于超买或超卖状态。

价格分形:策略使用5根K线来识别看涨和看跌分形。看涨分形出现在当前K线的高点高于前后两根K线的高点时;看跌分形则相反。

突破信号:

- 当价格跌破布林带下轨时,标记为潜在的下跌突破。

- 如果在下跌突破后,价格上涨突破最近的看涨分形高点,则生成做多信号。

- 当价格突破布林带上轨时,标记为潜在的上涨突破。

- 如果在上涨突破后,价格下跌突破最近的看跌分形低点,则生成做空信号。

交易执行:

- 在识别到看涨分形时开仓做多。

- 在识别到看跌分形时开仓做空。

这种设计结合了趋势跟踪和反转交易的元素,旨在捕捉主要的市场转折点。

策略优势

多重确认:策略结合了布林带和价格分形两个独立的技术指标,提供了多重确认,可以降低假突破的风险。

动态适应:布林带能够根据市场波动性自动调整,使策略能够适应不同的市场环境。

趋势和反转兼顾:策略既可以捕捉趋势的延续(通过分形突破),又可以识别潜在的反转点(通过布林带突破),增加了策略的灵活性。

清晰的进场点:通过明确的条件(布林带突破和分形突破)定义了清晰的交易信号,减少了主观判断的需要。

可视化辅助:策略在图表上绘制了布林带和分形点,有助于交易者直观地理解市场结构和潜在的交易机会。

策略风险

滞后性:使用20周期的布林带和5根K线的分形可能导致信号产生的滞后,在快速市场中可能错过一些机会。

假突破:在震荡市场中,价格可能频繁突破布林带或分形水平,但并未形成真正的趋势,可能导致频繁的假信号。

缺乏止损机制:当前策略没有明确的止损规则,可能导致在错误的交易中承受过大损失。

过度交易:在波动较大的市场中,策略可能生成过多的交易信号,增加交易成本。

单一时间框架:策略仅基于单一时间框架的数据,可能忽视了更大时间框架的重要市场结构。

策略优化方向

引入止损和止盈:可以考虑在布林带中轨或对侧布林带设置止损点,并根据ATR(平均真实波幅)动态调整止损水平。

增加交易过滤器:可以引入额外的指标(如RSI或MACD)来过滤潜在的假突破信号,提高交易质量。

多时间框架分析:结合更大时间框架的趋势信息,只有在大趋势方向上的信号才执行交易,可以提高胜率。

优化参数:对布林带周期、分形K线数量等参数进行回测优化,找到最适合特定市场的参数组合。

加入波动性过滤:在低波动性时期可能需要收紧交易条件,以避免在盘整市场中过度交易。

考虑加入移动止损:随着交易盈利的增加,可以逐步提高止损点,锁定部分利润。

引入交易量确认:可以结合交易量信息来确认突破的有效性,提高信号的可靠性。

总结

基于布林带和分形突破的动态转折点策略是一个结合了趋势跟踪和反转交易思想的综合系统。它通过布林带来判断价格的相对位置,同时利用价格分形来识别关键的支撑和阻力水平。这种方法旨在捕捉市场的主要转折点,特别适合中长期交易者。

策略的主要优势在于其多重确认机制和动态适应市场波动的能力。然而,它也面临着信号滞后和可能产生假突破的风险。为了提高策略的稳健性,建议引入止损机制、多时间框架分析和额外的交易过滤器。

通过持续优化和调整,这个策略有潜力成为一个可靠的交易系统。但是,像所有交易策略一样,它需要在实际交易中进行充分的测试和验证。交易者在使用此策略时,应当结合自身的风险承受能力和市场经验,并始终保持对市场的警惕和学习态度。

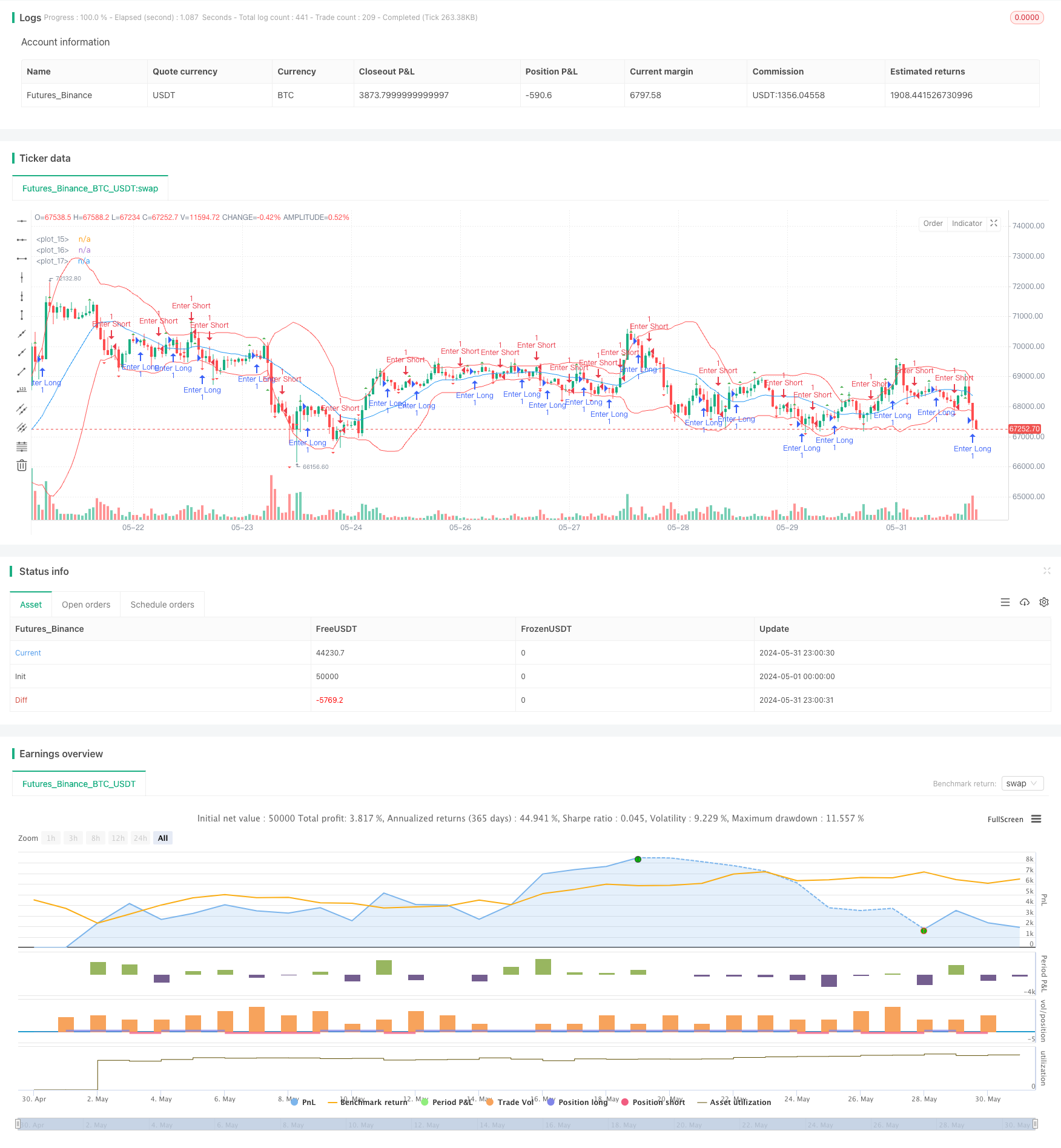

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Breakdown and Breakup Strategy", overlay=true)

// Bollinger Bands settings

length = input.int(20, title="Bollinger Bands Length")

src = close

mult = input.float(2.0, title="Bollinger Bands Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(upper, color=color.red, linewidth=1)

plot(lower, color=color.red, linewidth=1)

plot(basis, color=color.blue, linewidth=1)

// Fractals identification

isBullishFractal = ta.highest(high, 5)[2] == high[2] and high[2] > high[1] and high[2] > high[3]

isBearishFractal = ta.lowest(low, 5)[2] == low[2] and low[2] < low[1] and low[2] < low[3]

// Variables to store the latest fractal values

var float latestBullishFractal = na

var float latestBearishFractal = na

if (isBullishFractal)

latestBullishFractal := high[2]

if (isBearishFractal)

latestBearishFractal := low[2]

// Conditions

breakdownCondition = close < lower

breakupCondition = close > latestBullishFractal

breakupUpperCondition = close > upper

breakdownBearishCondition = close < latestBearishFractal

// Variables to track state

var bool breakdownOccurred = false

var bool breakupUpperOccurred = false

// Signals

var bool plotBreakupSignal = false

var bool plotBreakdownSignal = false

// Logic for breakdown and breakup above bullish fractal

if (breakdownCondition)

breakdownOccurred := true

if (breakdownOccurred and breakupCondition)

plotBreakupSignal := true

breakdownOccurred := false

// Logic for breakup and breakdown below bearish fractal

if (breakupUpperCondition)

breakupUpperOccurred := true

if (breakupUpperOccurred and breakdownBearishCondition)

plotBreakdownSignal := true

breakupUpperOccurred := false

// Plot signals as icons

plotshape(series=plotBreakupSignal, location=location.abovebar, color=color.green, style=shape.triangleup, title="Breakup", size=size.small)

plotshape(series=plotBreakdownSignal, location=location.belowbar, color=color.red, style=shape.triangledown, title="Breakdown", size=size.small)

// Plotting fractals for reference

plotshape(series=isBullishFractal, location=location.abovebar, color=color.green, style=shape.triangleup, title="Bullish Fractal", offset=-2)

plotshape(series=isBearishFractal, location=location.belowbar, color=color.red, style=shape.triangledown, title="Bearish Fractal", offset=-2)

// Reset signals

plotBreakupSignal := false

plotBreakdownSignal := false

if isBullishFractal

strategy.entry("Enter Long", strategy.long)

else if isBearishFractal

strategy.entry("Enter Short", strategy.short)

- 增强型动态布林带交易策略

- 三倍标准差布林带突破量化交易策略结合百日均线优化

- 布林带RSI均值回归增强型量化策略

- 基于布林带的跨界动态区间量化交易策略

- 基于布林带和ATR的多级智能动态跟踪止损策略

- 布林带精确交叉突破量化策略

- 自适应波段突破结合均线交叉量化策略系统

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 布林带突破量化交易策略

- 布林带均值回归交易策略与动态支撑