Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

Author: ChaoZhang, Date: 2024-11-27 15:05:02Tags: SMAMATPSL

Overview

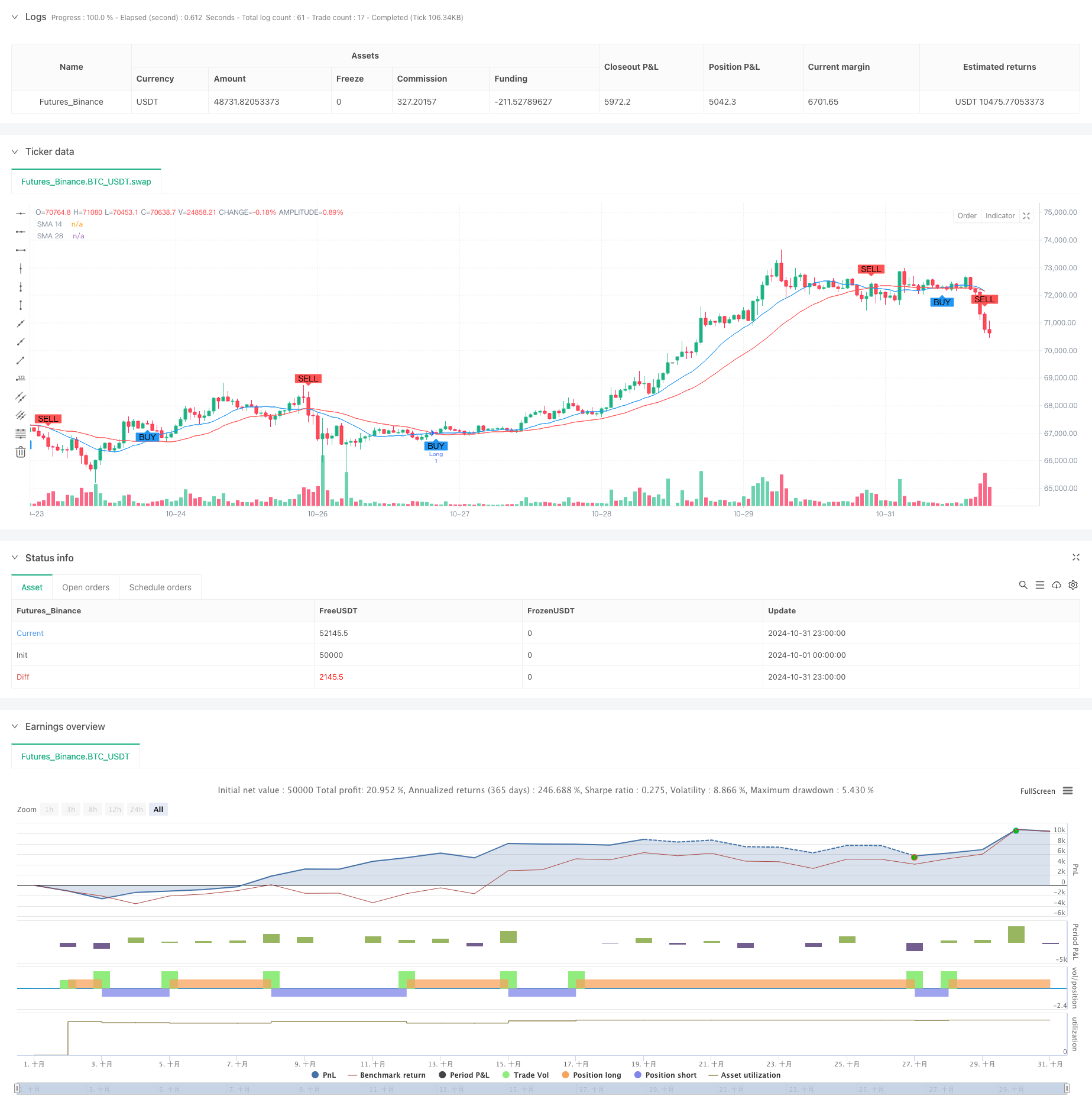

This is an adaptive trading strategy based on dual moving average crossover signals. The strategy utilizes 14-period and 28-period Simple Moving Averages (SMA) to generate trading signals, combined with adjustable stop-loss and take-profit mechanisms to achieve balanced risk-reward management. The strategy employs fixed money management with an initial capital of 2000 and 200 per trade.

Strategy Principles

The core logic is based on the crossover relationship between two SMAs of different periods. A long signal is generated when the short-term (14-period) MA crosses above the long-term (28-period) MA, and a short signal is generated when the short-term MA crosses below the long-term MA. The strategy incorporates percentage-based stop-loss and take-profit mechanisms set at 2% and 4% respectively, allowing for automatic adjustment of exit points based on market prices.

Strategy Advantages

- Clear Signals: The moving average crossover provides clear and objective signals, eliminating subjective judgment.

- Robust Risk Control: The percentage-based stop-loss and take-profit levels automatically adjust with market prices, adapting to different market conditions.

- Rational Money Management: The fixed allocation approach prevents risks associated with excessive leverage.

- Good Visualization: The strategy displays trading signals and moving average trends on the chart, facilitating understanding and monitoring.

- Flexible Parameters: Stop-loss and take-profit parameters can be adjusted according to different market conditions and personal risk preferences.

Strategy Risks

- Choppy Market Risk: Frequent crossovers during sideways markets may generate false signals.

- Slippage Risk: During high volatility periods, actual execution prices may deviate from signal prices.

- Fixed Stop-Loss Range: Although stop-loss points adjust with price, the fixed percentage may not suit all market conditions.

- Capital Efficiency: Fixed money allocation might lead to suboptimal capital utilization in certain scenarios.

Strategy Optimization Directions

- Implement Trend Filters: Add additional trend indicators like MACD or RSI to reduce false signals.

- Dynamic Stop-Loss Mechanism: Adjust stop-loss percentages based on market volatility for better adaptability.

- Optimize Money Management: Introduce volatility-based position sizing to improve capital efficiency.

- Add Time Filters: Implement trading time restrictions to avoid highly volatile periods.

- Incorporate Drawdown Control: Set maximum drawdown limits to pause trading when specific thresholds are reached.

Summary

This is a well-structured and logically sound trading strategy. It captures trading opportunities through dual moving average crossovers while controlling risks with adaptive stop-loss and take-profit mechanisms. While there is room for optimization, the overall design adheres to fundamental quantitative trading principles. Through the suggested optimization directions, the strategy’s stability and profitability potential can be further enhanced.

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('My Custom Strategy', overlay = true)

// Parámetros de las SMAs (Medias Móviles Simples)

sma14 = ta.sma(close, 14)

sma28 = ta.sma(close, 28)

// Stop Loss y Take Profit configurables

stop_loss_percent = input.float(2, title="Stop Loss %", minval=0.1, step=0.1)

take_profit_percent = input.float(4, title="Take Profit %", minval=0.1, step=0.1)

// Cálculo de stop loss y take profit

stop_loss = close * (1 - stop_loss_percent / 100)

take_profit = close * (1 + take_profit_percent / 100)

// Condiciones de entrada para compra (long)

longCondition = ta.crossover(sma14, sma28)

if (longCondition)

strategy.entry('Long', strategy.long, stop=stop_loss, limit=take_profit)

plotshape(series=longCondition, color=color.new(color.blue, 0), style=shape.labelup, location=location.belowbar, text="BUY")

// Condiciones de entrada para venta (short)

shortCondition = ta.crossunder(sma14, sma28)

if (shortCondition)

strategy.entry('Short', strategy.short, stop=stop_loss, limit=take_profit)

plotshape(series=shortCondition, color=color.new(color.red, 0), style=shape.labeldown, location=location.abovebar, text="SELL")

// Visualización de las SMAs en el gráfico

plot(sma14, color=color.blue, title="SMA 14")

plot(sma28, color=color.red, title="SMA 28")

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Risk-Reward Ratio Optimized Strategy Based on Moving Average Crossover

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- MACD Dynamic Oscillation Cross-Prediction Strategy

- VWAP-ATR Dynamic Price Action Trading System

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- Dynamic Trading Strategy System Based on Parabolic SAR Indicator

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Advanced Trend Trading Strategy Based on Bollinger Bands and Candlestick Patterns