Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-27 16:08:16Tags: EMATEMAMACDSMA

Overview

This is a quantitative trading strategy that combines trend following and momentum analysis. The strategy utilizes Triple Exponential Moving Average (TEMA), multiple moving average crossovers, and a MACD variant to identify market trends and entry points. It implements strict risk control mechanisms, including fixed stop-loss, profit targets, and trailing stops to optimize risk-reward balance.

Strategy Principles

The strategy determines trading signals through three core technical indicator systems:

- Triple Exponential Moving Average (TEMA) system confirms overall trend direction. It calculates three layers of EMA and combines their dynamic changes to judge trend strength.

- Fast/Slow MA crossover system uses 9-period and 15-period EMAs to capture medium-term trend reversal points.

- Price crossing with 5-period EMA serves as final confirmation signal for precise entry timing.

Trade signals are triggered when all conditions are met:

- MACD crosses above its signal line with upward TEMA trend

- Short-term EMA crosses above long-term EMA

- Price crosses above 5-period EMA

Strategy Advantages

- Multiple confirmation mechanisms greatly reduce false signals and improve trading accuracy.

- Combines benefits of trend following and momentum analysis to capture both major trends and short-term opportunities.

- Implements comprehensive stop-loss mechanisms including fixed stops and dynamic trailing stops for effective risk control.

- High parameter adaptability for different market environments.

- Clear entry logic that’s easy to understand and execute.

Strategy Risks

- Multiple confirmation requirements may lead to delayed entries, missing opportunities in fast-moving markets.

- Fixed stop-loss points need adjustment for different market volatilities to avoid premature exits.

- May generate frequent false signals in range-bound, choppy markets.

- Trailing stops might exit quality trends too early during severe market fluctuations.

Optimization Directions

- Introduce volatility indicators for dynamic adjustment of stops and profit targets to better match market conditions.

- Add volume indicators as auxiliary confirmation to improve signal reliability.

- Implement market environment recognition for different parameter combinations in various market states.

- Develop counter-trend position building mechanism for moderate accumulation during pullbacks.

- Optimize trailing stop algorithm for better adaptation to market volatility.

Summary

The strategy builds a robust trading system by integrating multiple technical indicator systems. Its core strengths lie in multiple confirmation mechanisms and comprehensive risk control systems. While there are certain lag risks, the strategy has significant improvement potential through parameter optimization and functional expansion. Suitable for traders seeking stable returns.

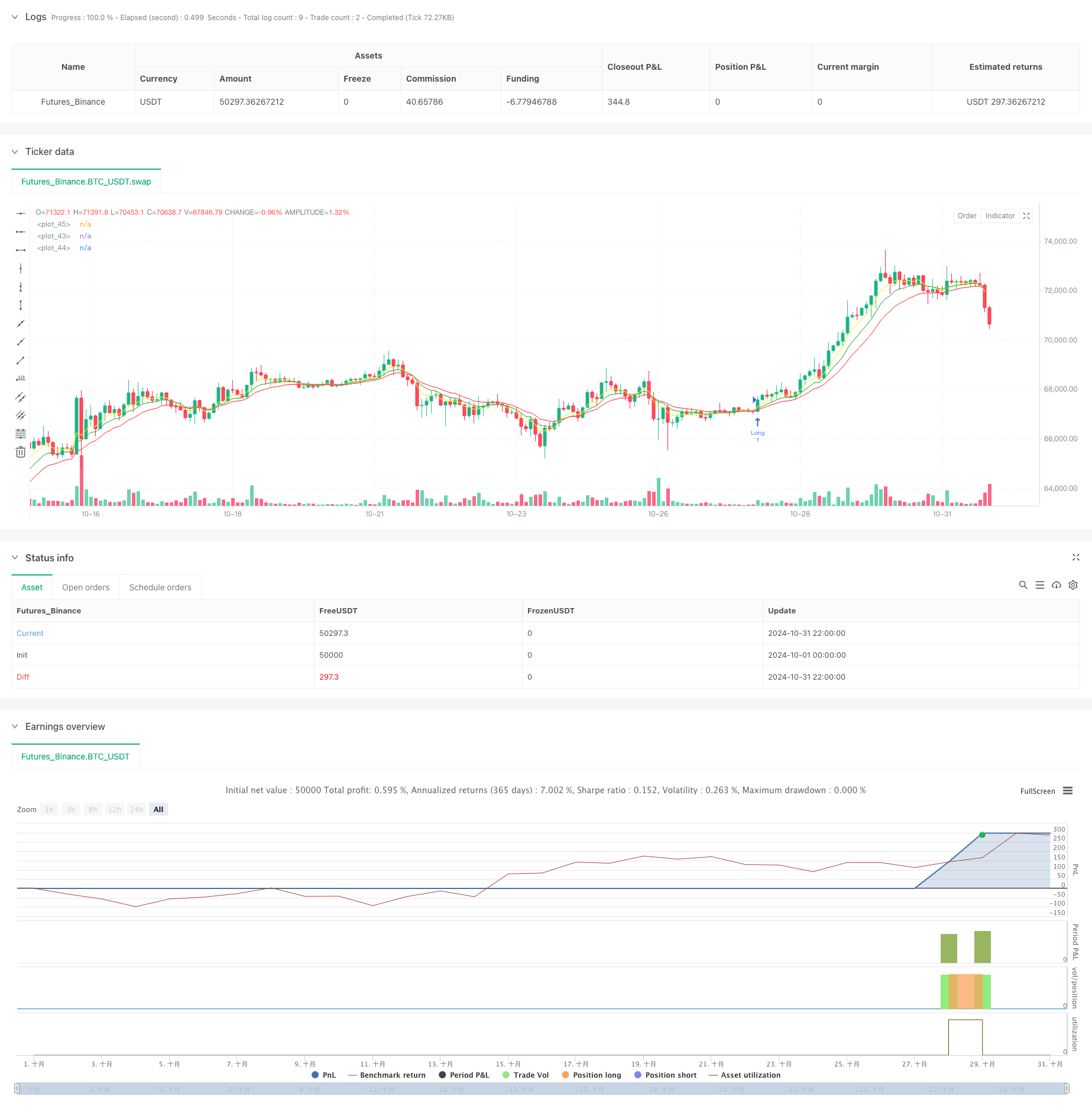

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ITG Scalper Strategy", shorttitle="lokesh_ITG_Scalper_Strategy", overlay=true)

// General inputs

len = input(14, title="TEMA period")

FfastLength = input.int(13, title="Filter fast length")

FslowLength = input.int(18, title="Filter slow length")

FsignalLength = input.int(14, title="Filter signal length")

sl_points = 7 // 5 points stop loss

tp_points = 100 // 100 points target profit

trail_points = 15 // Trailing stop loss every 10 points

// Validate input

if FfastLength < 1

FfastLength := 1

if FslowLength < 1

FslowLength := 1

if FsignalLength < 1

FsignalLength := 1

// Get real close price

realC = close

// Triple EMA definition

ema1 = ta.ema(realC, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

// Triple EMA trend calculation

avg = 3 * (ema1 - ema2) + ema3

// Filter formula

Fsource = close

FfastMA = ta.ema(Fsource, FfastLength)

FslowMA = ta.ema(Fsource, FslowLength)

Fmacd = FfastMA - FslowMA

Fsignal = ta.sma(Fmacd, FsignalLength)

// Plot EMAs for visual reference

shortema = ta.ema(close, 9)

longema = ta.ema(close, 15)

yma = ta.ema(close, 5)

plot(shortema, color=color.green)

plot(longema, color=color.red)

plot(yma, color=#e9f72c)

// Entry conditions

firstCrossover = ta.crossover(Fmacd, Fsignal) and avg > avg[1]

secondCrossover = ta.crossover(shortema, longema) // Assuming you meant to cross shortema with longema

thirdCrossover = ta.crossover(close, yma)

var bool entryConditionMet = false

if (firstCrossover)

entryConditionMet := true

longSignal = entryConditionMet and secondCrossover and thirdCrossover

// Strategy execution

if (longSignal)

strategy.entry("Long", strategy.long)

entryConditionMet := false // Reset the entry condition after taking a trade

// Calculate stop loss and take profit prices

var float long_sl = na

var float long_tp = na

if strategy.position_size > 0 // Long position

long_sl := close - sl_points

long_tp := close + tp_points

// Adjust stop loss with trailing logic

if (close - long_sl > trail_points)

long_sl := close - trail_points

strategy.exit("Exit Long", "Long", stop=long_sl, limit=long_tp)

// Plotting Buy signals

plotshape(series=longSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

// Alerts

alertcondition(longSignal, title="Buy Signal", message="Buy Signal")

- MACD and Linear Regression Dual Signal Intelligent Trading Strategy

- K's Reversal Indicator I

- CM MACD Custom Indicator - Multiple Time Frame - V2

- Dual MACD Trend Confirmation Trading System

- Zero Lag MACD Dual Crossover Trading Strategy - High-Frequency Trading Based on Short-Term Trend Capture

- ZeroLag MACD Long Short Strategy

- Moving Average Crossover + MACD Slow Line Momentum Strategy

- MACD TEMA Crossover Strategy

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- MACD and Martingale Combination Strategy for Optimized Long Trading

- Advanced Timeframe Fibonacci Retracement with High-Low Breakout Trading System

- RSI Dynamic Exit Level Momentum Trading Strategy

- Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

- Advanced Dual Moving Average Momentum Trend Following Trading System

- Dynamic Take-Profit Smart Trailing Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- MACD Dynamic Oscillation Cross-Prediction Strategy