该策略是一个基于双均线系统的动量趋势跟踪策略,结合了快速均线与慢速均线的交叉信号,同时引入了过滤均线来优化入场时机,通过资金管理和风险控制,实现稳健的交易效果。

策略原理

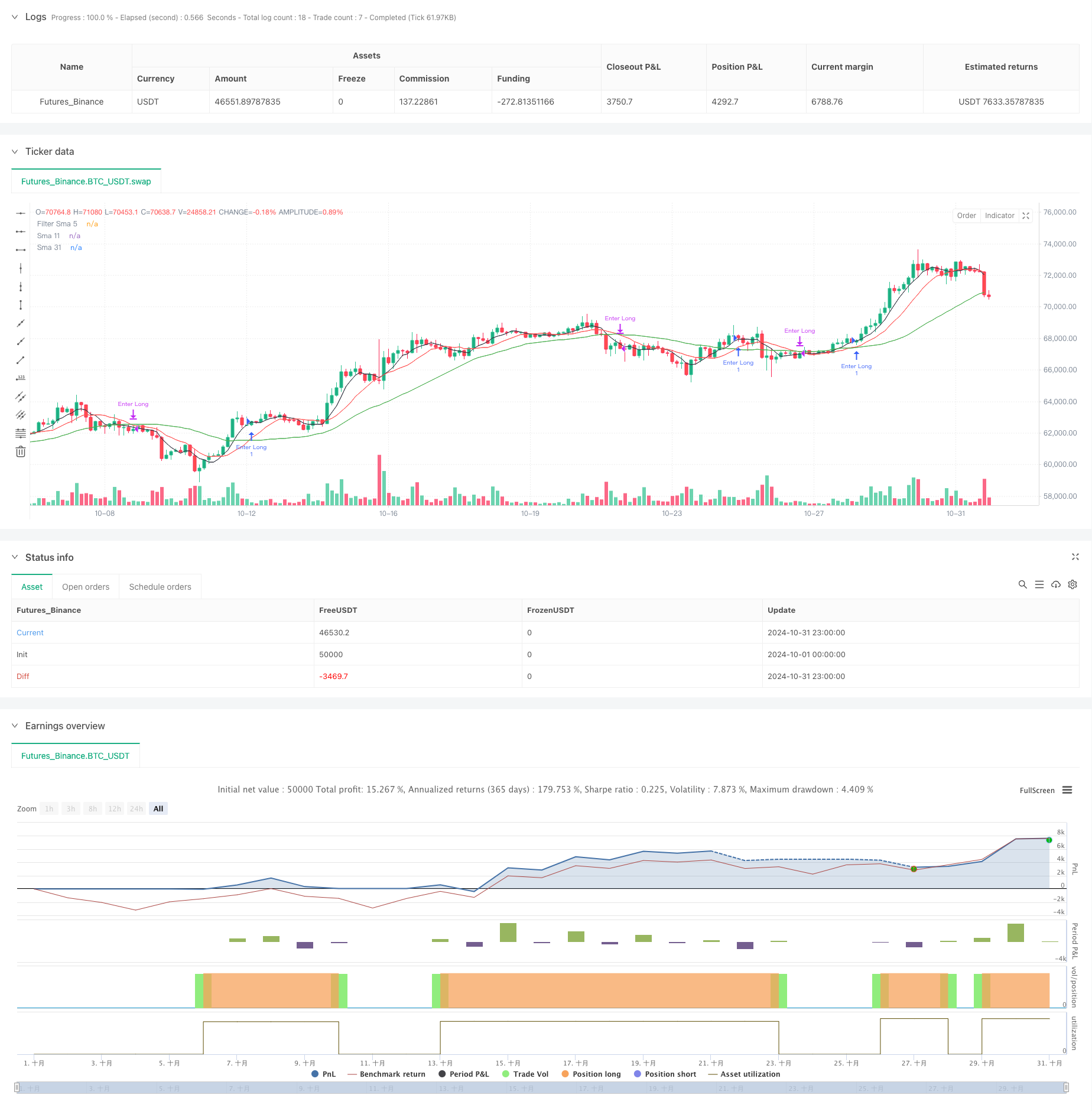

策略采用了11周期和31周期的简单移动平均线(SMA)作为主要信号系统,同时使用5周期均线作为过滤器。当快线(SMA11)上穿慢线(SMA31)且价格位于过滤均线之上时,系统产生做多信号;当快线下穿慢线时,系统平仓。策略通过设定固定的资金量来控制每次交易的规模,从而实现风险管理。

策略优势

- 信号系统简单清晰,易于理解和执行

- 多重均线确认,能有效过滤虚假信号

- 采用固定资金量交易,风险可控

- 具备良好的趋势跟踪能力

- 入场和出场逻辑明确,不易产生决策犹豫

- 可以适应不同的市场环境

策略风险

- 震荡市场可能产生频繁交易

- 均线系统存在一定滞后性

- 固定资金量交易可能无法充分利用资金效率

- 没有考虑市场波动率变化

- 缺乏止损机制,可能面临较大回撤风险

策略优化方向

- 引入自适应的均线周期,根据市场波动率动态调整

- 增加波动率过滤器,在高波动率环境下调整仓位

- 设计动态的资金管理系统,提高资金使用效率

- 加入止损和止盈机制,控制单笔交易风险

- 考虑引入趋势强度指标,优化入场时机

- 增加交易时间过滤,避免在不利时段交易

总结

该策略通过多重均线系统构建了一个相对稳健的趋势跟踪系统。虽然存在一些固有的局限性,但通过合理的优化和改进,可以进一步提升策略的稳定性和盈利能力。建议交易者在实盘应用时,结合市场具体情况,对参数进行针对性调整。

策略源码

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Nifty 30m SMA Crossover Long', overlay=true)

start = timestamp(2020, 1, 1, 0, 0)

end = timestamp(2024, 12, 31, 0, 0)

SlowSma = ta.sma(close, 31)

FastSma = ta.sma(close, 11)

FilterSma = ta.sma(close, 5)

plot(SlowSma, title='Sma 31', color=color.new(color.green, 0))

plot(FastSma, title='Sma 11', color=color.new(color.red, 0))

plot(FilterSma, title='Filter Sma 5', color=color.new(color.black, 0))

// strategy

LongEntry = FastSma > SlowSma and close > FilterSma

LongExit = FastSma < SlowSma

MyQty = 10000000 / close

// // Plot signals to chart

// plotshape(not LongExit and strategy.position_size > 0 and bIndicator, title='Hold', location=location.abovebar, color=color.new(color.blue, 0), style=shape.square, text='Hold', textcolor=color.new(color.blue, 0))

// plotshape(LongExit and bIndicator and strategy.position_size > 0, title='Exit', location=location.belowbar, color=color.new(color.red, 0), style=shape.triangledown, text='Sell', textcolor=color.new(color.red, 0))

// plotshape(LongEntry and strategy.position_size == 0 and bIndicator, '', shape.arrowup, location.abovebar, color.new(color.green, 0), text='Buy', textcolor=color.new(color.green, 0))

// plotshape(not LongEntry and strategy.position_size == 0 and bIndicator, '', shape.circle, location.belowbar, color.new(color.yellow, 0), text='Wait', textcolor=color.new(color.black, 0))

if time >= start and time < end

strategy.entry('Enter Long', strategy.long, qty=1, when=LongEntry)

strategy.close('Enter Long', when=LongExit)

相关推荐