MACD与马丁策略结合的多头优化交易策略

Author: ChaoZhang, Date: 2024-06-07 15:01:13Tags: MACDMASMAEMA

概述

该策略结合了MACD指标和马丁格尔资金管理方法,旨在优化多头交易。策略通过比较MACD线和信号线的相对位置,以及它们之间的比例关系,来判断买入和卖出信号。同时,策略采用马丁格尔方法对合约大小进行动态调整,以期在亏损时通过加大下单量来实现盈利。该策略的主要优势在于能够捕捉强势上涨行情,并通过马丁格尔方法来提高盈利能力。但同时,策略也存在一定的风险,如果连续亏损,可能会面临较大的回撤。

策略原理

该策略的核心是MACD指标和马丁格尔资金管理方法。MACD指标由两条移动平均线(快线和慢线)构成,通过比较快线和慢线的位置关系,可以判断当前的趋势方向。当快线上穿慢线,且快线与慢线的比值大于等于1.07时,产生买入信号;当快线下穿慢线,且慢线与快线的比值大于等于1.07时,产生卖出信号。

马丁格尔方法则用于动态调整合约大小。当上一笔交易亏损时,策略会将合约大小加倍,最多加倍5次。如果连续亏损超过5次,或者盈利时,合约大小会重置为初始值。这种方法的目的是通过加大下单量来弥补之前的亏损,但同时也增加了风险。

策略优势

能够捕捉强势上涨行情:通过比较MACD快线和慢线的位置关系,以及它们之间的比例,策略可以识别出强势的上涨趋势,并及时买入。

马丁格尔方法可以提高盈利能力:在亏损时,通过加大下单量,策略有机会在后续的盈利交易中弥补之前的亏损,从而提高整体盈利能力。

止盈止损设置合理:策略设置了明确的止盈止损条件,在价格达到一定水平时平仓,既能锁定利润,又能控制风险。

策略风险

连续亏损可能导致大额损失:如果策略连续遇到亏损交易,马丁格尔方法会不断加大下单量,这可能导致大额损失。虽然策略设置了最大加倍次数,但在极端情况下,仍可能面临较大风险。

趋势判断可能出现失误:策略依赖于MACD指标对趋势的判断,但在某些情况下,指标可能会发出错误信号,导致策略作出错误决策。

合约大小的频繁调整可能增加交易成本:由于马丁格尔方法需要频繁调整合约大小,这可能会增加交易成本,影响策略的整体表现。

策略优化方向

结合其他技术指标:除了MACD,策略还可以结合其他技术指标,如RSI、BOLL等,以提高趋势判断的准确性。

优化马丁格尔方法:可以考虑在马丁格尔方法中引入风险控制措施,如设置最大亏损限额,或者根据市场波动性动态调整加倍比例,以降低连续亏损的风险。

引入市场情绪分析:策略可以结合市场情绪指标,如恐慌指数(VIX)等,来判断市场的风险偏好,并相应调整策略参数。

总结

该策略通过结合MACD指标和马丁格尔资金管理方法,实现了一种用于优化多头交易的量化交易策略。策略的主要优势在于能够捕捉强势上涨行情,并通过马丁格尔方法来提高盈利能力。但同时,策略也存在连续亏损可能导致大额损失的风险。为了进一步优化策略,可以考虑结合其他技术指标,优化马丁格尔方法,并引入市场情绪分析。总的来说,该策略为多头交易提供了一种可行的思路,但在实际应用中,还需要根据具体市场环境进行适当调整和优化。

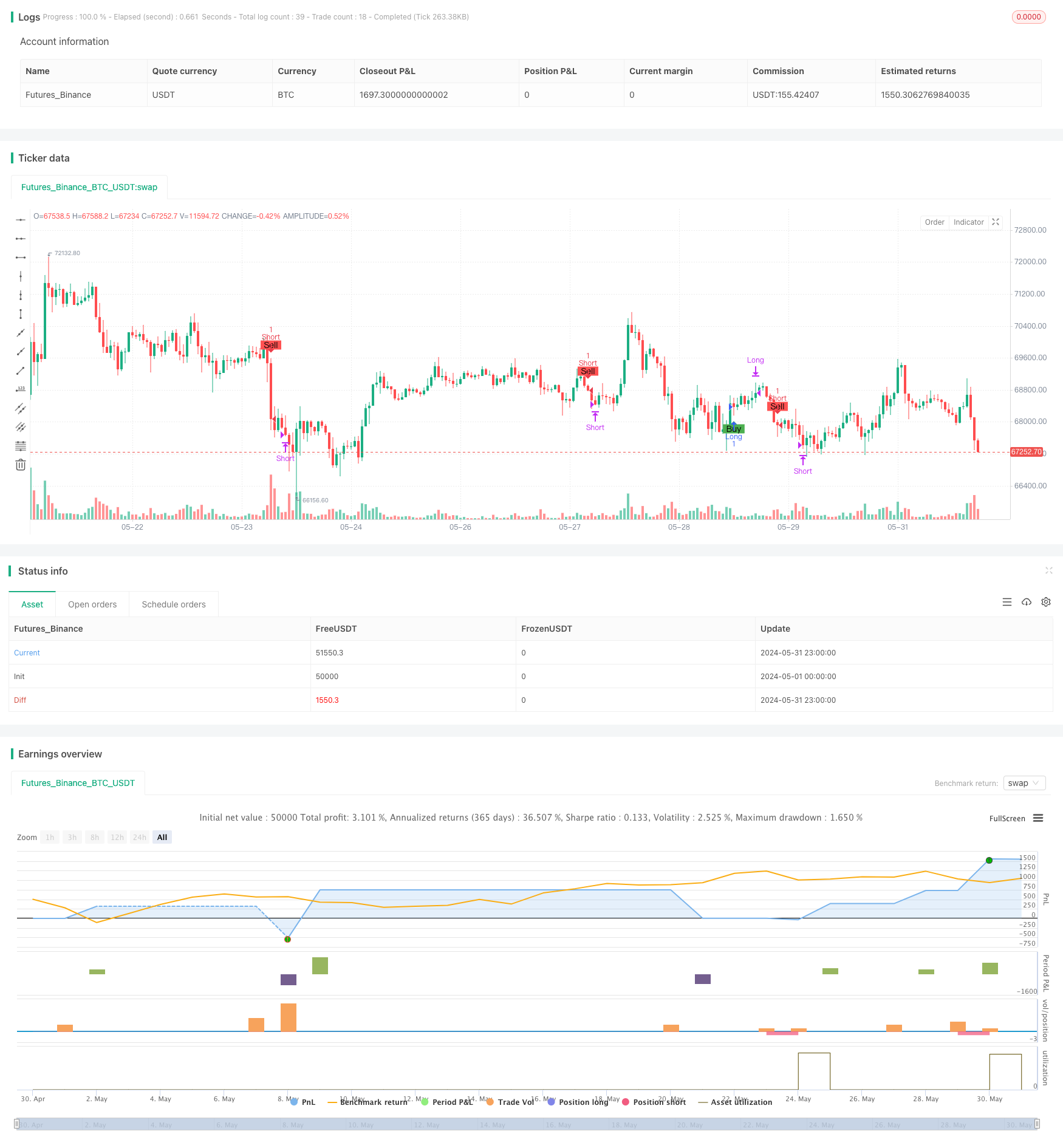

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy("Advanced MACD Strategy with Limited Martingale", overlay=true)

// MACD settings

fastLength = 15

slowLength = 30

signalSmoothing = 9

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// Contract size and previous trade result tracking

var float contractSize = 1

var int martingaleCount = 0 // Martingale count

var float lastTradeResult = 0

// Buy and sell conditions

longCondition = ta.crossover(macdLine, signalLine) and ( signalLine / macdLine >= 1.07)

shortCondition = ta.crossunder(macdLine, signalLine) and ( macdLine / signalLine >= 1.07)

// Buy signal

if (longCondition)

strategy.entry("Long", strategy.long, qty=contractSize)

lastTradeResult := strategy.netprofit

// Sell signal

if (shortCondition)

strategy.entry("Short", strategy.short, qty=contractSize)

lastTradeResult := strategy.netprofit

// Take profit and stop loss conditions

strategy.close("Long", when=(close / strategy.position_avg_price >= 1.005))

strategy.close("Short", when=(strategy.position_avg_price / close >= 1.005))

strategy.close("Long", when=(close / strategy.position_avg_price <= 0.99))

strategy.close("Short", when=(strategy.position_avg_price / close <= 0.99))

// Martingale strategy implementation

if (strategy.netprofit < lastTradeResult)

if (martingaleCount < 5)

contractSize := contractSize * 2

martingaleCount := martingaleCount + 1

else

contractSize := 1

martingaleCount := 0

else

contractSize := 1

martingaleCount := 0

// Plot buy and sell points as arrows

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

- MACD多区间动态止盈止损交易系统

- 双均线MACD交叉日期可调节量化交易策略

- 增强型量价趋势判断动量策略

- 多周期EMA交叉高胜率趋势跟踪策略(进阶版)

- 多重均线交叉动态趋势捕捉量化交易策略

- 基于G通道和指数移动平均的量化多空转换策略

- 多策略组合型技术分析交易系统

- 双均线交叉动态优化量化交易策略

- 多指标融合均值回归趋势跟踪策略

- 多级动态MACD趋势跟踪量化策略结合52周高低位延展研判系统

- Williams %R 动态调整止盈止损策略

- RSI动态回撤止损策略

- VWAP交易策略与成交量异常监测

- Supertrend和EMA组合策略

- TGT基于价格下跌买入策略

- EMA交叉与RSI过滤的双重趋势策略

- EMA均线与抛物线SAR组合策略

- MACD与RSI相结合的多重过滤日内交易策略

- 基于两个市场价格关系的套利交易策略

- RSI基于百分比止盈止损的交易策略

- Elliott 波动随机EMA策略

- 布林带交叉移动平均策略

- SMA双均线交叉策略

- 10SMA与MACD双重趋势跟踪交易策略

- MACD和RSI结合的自然交易策略

- 动态时间框架高低点突破策略

- 动态趋势跟踪策略

- 趋势过滤与异常退出的平滑移动平均止损止盈策略

- MACD与R:R比率日内限制收敛策略

- 星光移动平均交叉策略