Advanced Dual Moving Average Momentum Trend Following Trading System

Author: ChaoZhang, Date: 2024-11-27 16:54:54Tags: SMAMAEMD

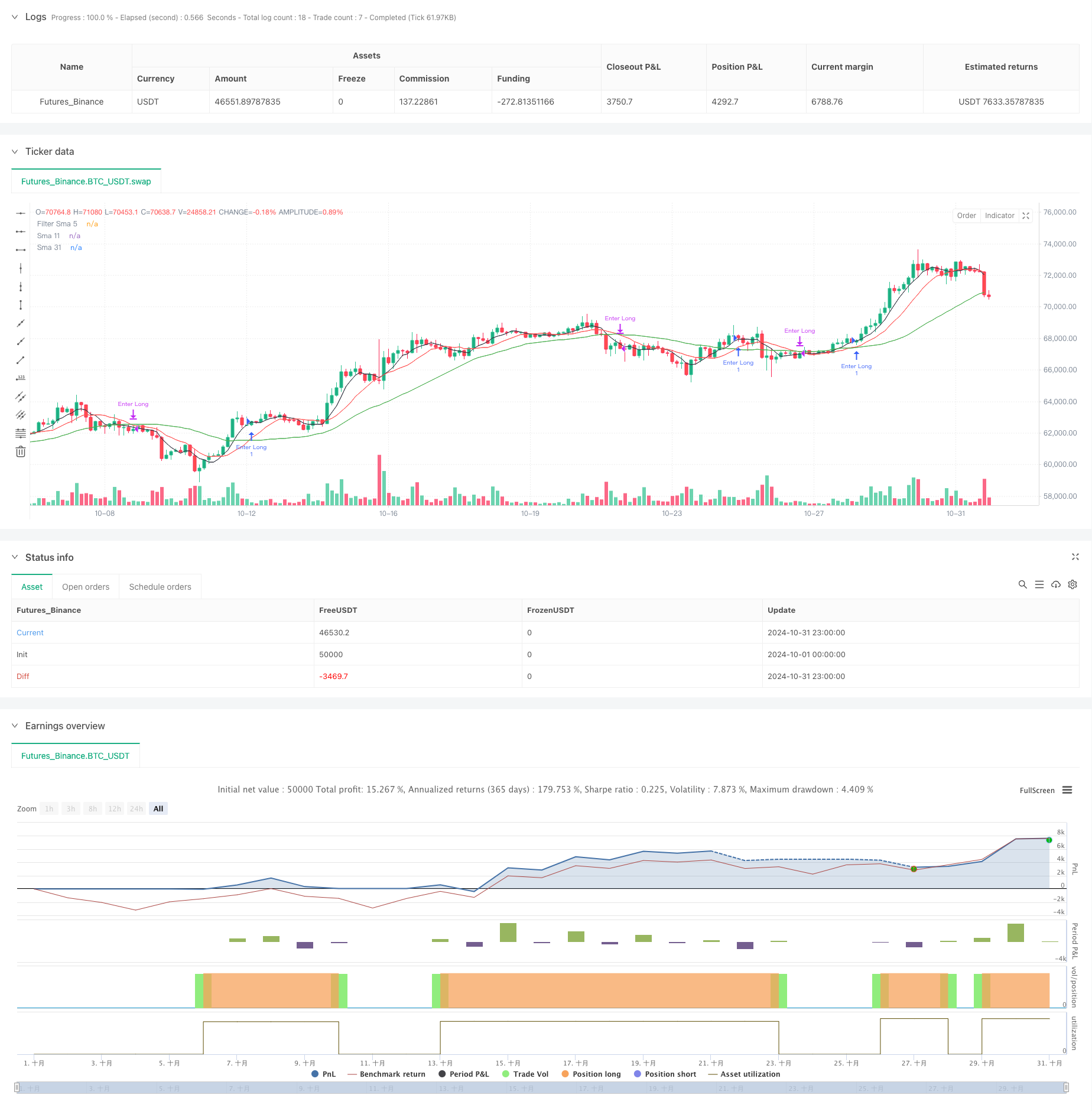

This strategy is a momentum trend following system based on dual moving averages, combining crossover signals from fast and slow moving averages with a filter line to optimize entry timing, achieving stable trading results through proper money management and risk control.

Strategy Principles

The strategy employs 11-period and 31-period Simple Moving Averages (SMA) as the main signal system, with a 5-period moving average as a filter. Long entry signals are generated when the fast line (SMA11) crosses above the slow line (SMA31) and price is above the filter average. Positions are closed when the fast line crosses below the slow line. The strategy implements risk management through fixed position sizing.

Strategy Advantages

- Simple and clear signal system, easy to understand and execute

- Multiple moving average confirmation reduces false signals

- Fixed position sizing ensures controllable risk

- Effective trend following capabilities

- Clear entry and exit logic reduces decision hesitation

- Adaptable to different market conditions

Strategy Risks

- Frequent trading may occur in ranging markets

- Inherent lag in moving average systems

- Fixed position sizing may not optimize capital efficiency

- Market volatility changes not considered

- Lack of stop-loss mechanism may lead to significant drawdowns

Strategy Optimization Directions

- Introduce adaptive moving average periods based on market volatility

- Add volatility filters to adjust position sizing in high volatility environments

- Design dynamic money management system to improve capital efficiency

- Implement stop-loss and take-profit mechanisms to control single trade risk

- Consider adding trend strength indicators to optimize entry timing

- Include trading time filters to avoid unfavorable trading periods

Summary

The strategy builds a relatively robust trend following system through multiple moving averages. While it has some inherent limitations, stability and profitability can be further enhanced through appropriate optimization and improvements. Traders are advised to adjust parameters based on specific market conditions when implementing the strategy in live trading.

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Nifty 30m SMA Crossover Long', overlay=true)

start = timestamp(2020, 1, 1, 0, 0)

end = timestamp(2024, 12, 31, 0, 0)

SlowSma = ta.sma(close, 31)

FastSma = ta.sma(close, 11)

FilterSma = ta.sma(close, 5)

plot(SlowSma, title='Sma 31', color=color.new(color.green, 0))

plot(FastSma, title='Sma 11', color=color.new(color.red, 0))

plot(FilterSma, title='Filter Sma 5', color=color.new(color.black, 0))

// strategy

LongEntry = FastSma > SlowSma and close > FilterSma

LongExit = FastSma < SlowSma

MyQty = 10000000 / close

// // Plot signals to chart

// plotshape(not LongExit and strategy.position_size > 0 and bIndicator, title='Hold', location=location.abovebar, color=color.new(color.blue, 0), style=shape.square, text='Hold', textcolor=color.new(color.blue, 0))

// plotshape(LongExit and bIndicator and strategy.position_size > 0, title='Exit', location=location.belowbar, color=color.new(color.red, 0), style=shape.triangledown, text='Sell', textcolor=color.new(color.red, 0))

// plotshape(LongEntry and strategy.position_size == 0 and bIndicator, '', shape.arrowup, location.abovebar, color.new(color.green, 0), text='Buy', textcolor=color.new(color.green, 0))

// plotshape(not LongEntry and strategy.position_size == 0 and bIndicator, '', shape.circle, location.belowbar, color.new(color.yellow, 0), text='Wait', textcolor=color.new(color.black, 0))

if time >= start and time < end

strategy.entry('Enter Long', strategy.long, qty=1, when=LongEntry)

strategy.close('Enter Long', when=LongExit)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Moving Average Crossover Strategy Based on Dual Moving Averages

- Dynamic Position Dual Moving Average Crossover Strategy

- Moving Average Crossover Strategy

- SMA Dual Moving Average Trading Strategy

- Stochastic Oscillator and Moving Average Crossover Strategy with Stop Loss and Stochastic Filter

- Trend Catcher Strategy

- Multi-Moving Average Trend Trading Strategy

- MA Cross Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- High-Frequency Dynamic Multi-Indicator Moving Average Crossover Strategy

- Triple Exponential Moving Average Trend Trading Strategy

- Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

- Advanced Flexible Multi-Period Moving Average Crossover Strategy

- T3 Moving Average Trend Following Strategy with Trailing Stop Loss

- Multi-Technical Indicator Trend Following Strategy with Ichimoku Cloud Breakout and Stop-Loss System

- Dual Standard Deviation Bollinger Bands Momentum Breakout Strategy

- Advanced Timeframe Fibonacci Retracement with High-Low Breakout Trading System

- RSI Dynamic Exit Level Momentum Trading Strategy

- Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

- Dynamic Take-Profit Smart Trailing Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration