Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

Author: ChaoZhang, Date: 2024-12-11 15:42:36Tags: MTFTFS

Overview

This strategy is a trend following system based on smoothed Heikin Ashi candlesticks. By calculating Heikin Ashi candlesticks at a higher timeframe and applying them to trading decisions at lower timeframes, it effectively reduces market noise. The strategy offers flexible trading direction options, allowing long-only, short-only, or bi-directional trading, and integrates stop-loss and take-profit functions for fully automated trading.

Strategy Principles

The core logic utilizes the smoothing characteristics of Heikin Ashi candlesticks at higher timeframes to identify trends. Heikin Ashi candlesticks effectively filter market noise and highlight major trends through moving average calculations of opening and closing prices. The system enters long positions in long-only mode when green candles appear, indicating an uptrend, and enters short positions in short-only mode when red candles appear, indicating a downtrend. The strategy also includes percentage-based stop-loss and take-profit mechanisms to help control risk and lock in profits.

Strategy Advantages

- Multi-timeframe integration reduces false signals: Calculating Heikin Ashi indicators at higher timeframes effectively reduces interference from short-term fluctuations.

- Comprehensive risk management: Integrated stop-loss and take-profit functions with flexible parameters adjustable to market volatility.

- Flexible direction selection: Can choose long-only, short-only, or bi-directional trading based on market characteristics.

- Fully automated operation: Clear strategy logic with adjustable parameters, suitable for automated trading.

- Strong adaptability: Applicable to different markets and timeframes with good universality.

Strategy Risks

- Trend reversal risk: May experience significant drawdowns during trend reversals, requiring proper stop-loss settings.

- Range-bound market risk: May incur losses due to frequent trading in sideways markets.

- Parameter optimization risk: Over-optimization may lead to poor performance in live trading.

- Slippage cost risk: Frequent trading may result in high transaction costs.

Strategy Optimization Directions

- Add trend confirmation indicators: Can introduce other technical indicators like RSI or MACD as auxiliary confirmation.

- Optimize stop-loss mechanism: Can implement trailing stops or volatility-based dynamic stop-losses.

- Incorporate volume analysis: Combine volume indicators to improve entry signal reliability.

- Develop adaptive parameters: Automatically adjust stop-loss and take-profit ratios based on market volatility.

- Add time filters: Avoid frequent trading during non-active trading hours.

Summary

This strategy effectively captures market trends through the smoothing characteristics of multi-timeframe Heikin Ashi indicators while controlling drawdowns through comprehensive risk management mechanisms. The strategy’s flexibility and scalability give it good practical value, and through continuous optimization and improvement, it can adapt to different market environments. While certain risks exist, stable trading performance can be achieved through appropriate parameter settings and risk management.

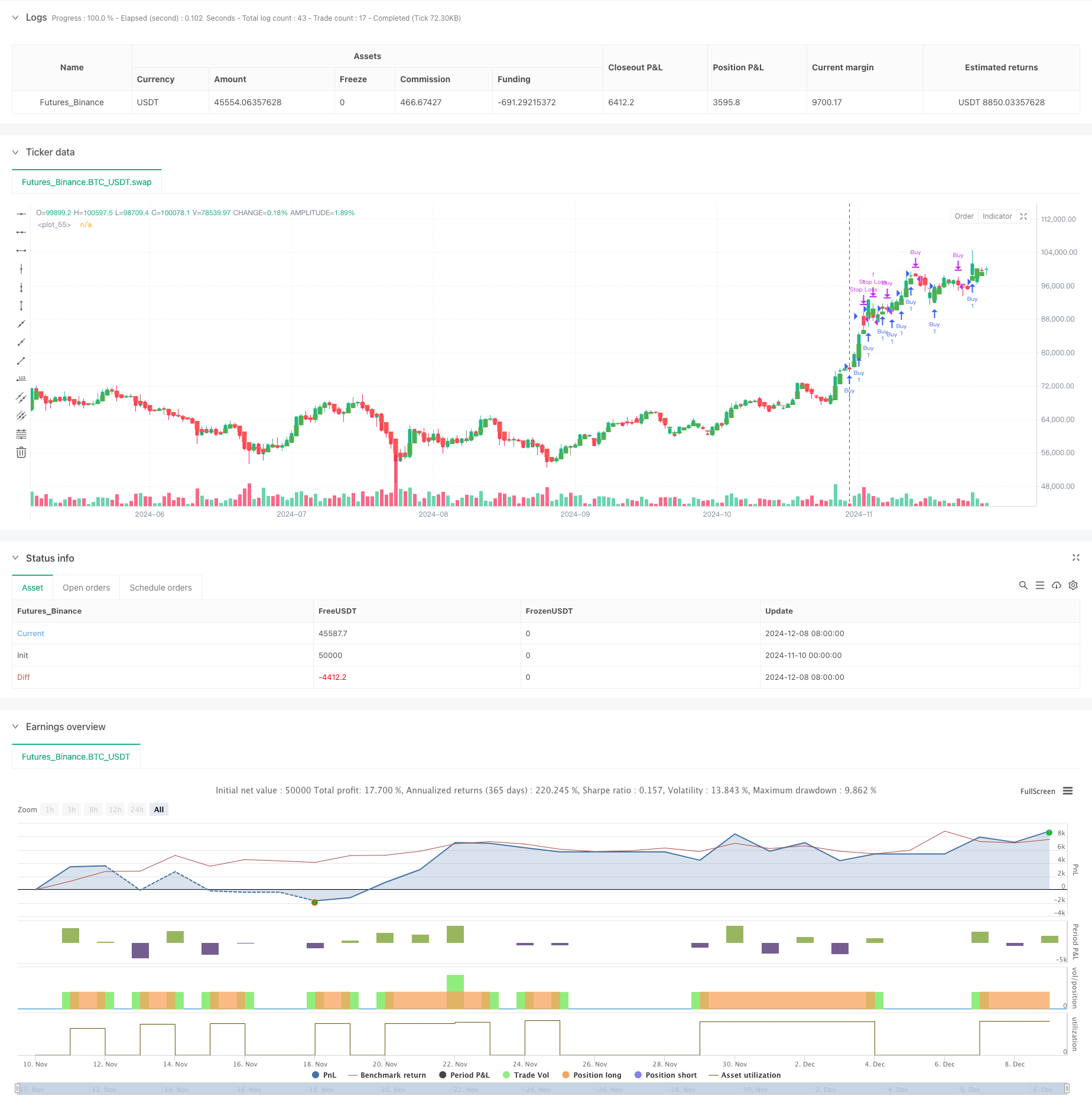

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Heikin Ashi Strategy with Buy/Sell Options", overlay=true)

// User inputs for customizing backtest settings

startDate = input(timestamp("2023-01-01 00:00"), title="Backtest Start Date", tooltip="Start date for the backtest")

endDate = input(timestamp("2024-01-01 00:00"), title="Backtest End Date", tooltip="End date for the backtest")

// Input for Heikin Ashi timeframe optimization

ha_timeframe = input.timeframe("D", title="Heikin Ashi Timeframe", tooltip="Choose the timeframe for Heikin Ashi candles")

// Inputs for optimizing stop loss and take profit

use_stop_loss = input.bool(true, title="Use Stop Loss")

stop_loss_percent = input.float(2.0, title="Stop Loss (%)", minval=0.0, tooltip="Set stop loss percentage")

use_take_profit = input.bool(true, title="Use Take Profit")

take_profit_percent = input.float(4.0, title="Take Profit (%)", minval=0.0, tooltip="Set take profit percentage")

// Input to choose Buy or Sell

trade_type = input.string("Buy Only", options=["Buy Only", "Sell Only"], title="Trade Type", tooltip="Choose whether to only Buy or only Sell")

// Heikin Ashi calculation on a user-defined timeframe

ha_open = request.security(syminfo.tickerid, ha_timeframe, ta.sma(open, 2), barmerge.gaps_off, barmerge.lookahead_on)

ha_close = request.security(syminfo.tickerid, ha_timeframe, ta.sma(close, 2), barmerge.gaps_off, barmerge.lookahead_on)

ha_high = request.security(syminfo.tickerid, ha_timeframe, math.max(high, close), barmerge.gaps_off, barmerge.lookahead_on)

ha_low = request.security(syminfo.tickerid, ha_timeframe, math.min(low, open), barmerge.gaps_off, barmerge.lookahead_on)

// Heikin Ashi candle colors

ha_bullish = ha_close > ha_open // Green candle

ha_bearish = ha_close < ha_open // Red candle

// Backtest period filter

inDateRange = true

// Trading logic depending on user input

if (inDateRange) // Ensures trades happen only in the selected period

if (trade_type == "Buy Only") // Buy when green, Sell when red

if (ha_bullish and strategy.position_size <= 0) // Buy on green candle only if no position is open

strategy.entry("Buy", strategy.long)

if (ha_bearish and strategy.position_size > 0) // Sell on red candle (close the long position)

strategy.close("Buy")

if (trade_type == "Sell Only") // Sell when red, Exit sell when green

if (ha_bearish and strategy.position_size >= 0) // Sell on red candle only if no position is open

strategy.entry("Sell", strategy.short)

if (ha_bullish and strategy.position_size < 0) // Exit the sell position on green candle

strategy.close("Sell")

// Add Stop Loss and Take Profit conditions if enabled

if (use_stop_loss)

strategy.exit("Stop Loss", from_entry="Buy", stop=strategy.position_avg_price * (1 - stop_loss_percent / 100))

if (use_take_profit)

strategy.exit("Take Profit", from_entry="Buy", limit=strategy.position_avg_price * (1 + take_profit_percent / 100))

// Plot Heikin Ashi candles on the chart

plotcandle(ha_open, ha_high, ha_low, ha_close, color=ha_bullish ? color.green : color.red)

- Multi-Timeframe Liquidity Pivot Heatmap Strategy

- Order Block Finder

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Multi-Timeframe Supertrend Dynamic Trend Trading Algorithm

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Timeframe Moving Average and RSI Trend Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- Multi-Timeframe Trend Following Trading System with ATR and MACD Integration

- Dual Timeframe Trend Reversal Candlestick Pattern Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization

- Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Period SuperTrend Dynamic Trading Strategy

- Multi-Timeframe EMA with Fibonacci Retracement and Pivot Points Trading Strategy

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- MACD and Linear Regression Dual Signal Intelligent Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy

- Dynamic Price Zone Breakout Trading Strategy Based on Support and Resistance Quantitative System

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Advanced Dynamic Trailing Stop with Risk-Reward Targeting Strategy

- Advanced Long-Only Dynamic Trendline Breakout Strategy

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR