Overview

This strategy is a trend-following trading system that combines MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index). Operating on a 5-minute timeframe, it generates trading signals by analyzing MACD crossovers and RSI overbought/oversold levels. The strategy incorporates percentage-based stop-loss and take-profit mechanisms for risk management.

Strategy Principles

The strategy is based on the following core logic: 1. Uses MACD indicator with 12-26-9 parameters to capture price trends 2. Employs 14-period RSI to identify overbought/oversold conditions 3. Generates long signals when MACD line crosses above signal line and RSI is below 45 4. Triggers exit signals when MACD line crosses below signal line and RSI is above 55 5. Sets 1.2% stop-loss for risk control and 2.4% take-profit to secure gains 6. Uses 10-period EMA as trend filter to improve signal quality

Strategy Advantages

- Indicator Combination: Merges MACD’s trend-following characteristics with RSI’s oscillation properties for more accurate market turning points

- Comprehensive Risk Control: Uses fixed-ratio stop-loss and take-profit to strictly control single trade risk

- Signal Confirmation: Requires both MACD and RSI conditions for entry, reducing false signals

- High Adaptability: Can be adjusted through parameters to suit different market conditions

- Clear Execution Logic: Trading rules are explicit and easy to automate

Strategy Risks

- Choppy Market Risk: May generate frequent trades leading to losses in ranging markets

- Slippage Risk: Frequent trading on 5-minute timeframe may face significant slippage

- False Breakout Risk: MACD crossover signals may produce false breakouts

- Parameter Sensitivity: Strategy performance heavily depends on indicator parameter settings

- Market Environment Dependency: Strategy performs better in clear trending markets

Strategy Optimization Directions

- Add Volume Filters: Consider volume factors in signal generation to improve reliability

- Dynamic Stop-Loss: Implement adaptive stop-loss based on market volatility

- Introduce Trend Strength Filter: Add ADX or similar indicators to optimize trading timing

- Improve Position Management: Implement volatility-based dynamic position sizing

- Optimize Parameter Adaptation: Develop dynamic parameter optimization mechanism

Summary

This strategy builds a trading system combining trend-following and momentum characteristics through MACD and RSI integration. Its comprehensive risk control mechanisms and clear trading logic provide good practicality. Through suggested optimization directions, the strategy has room for further improvement. Before live trading, it’s recommended to conduct thorough backtesting and adjust parameters according to specific market characteristics.

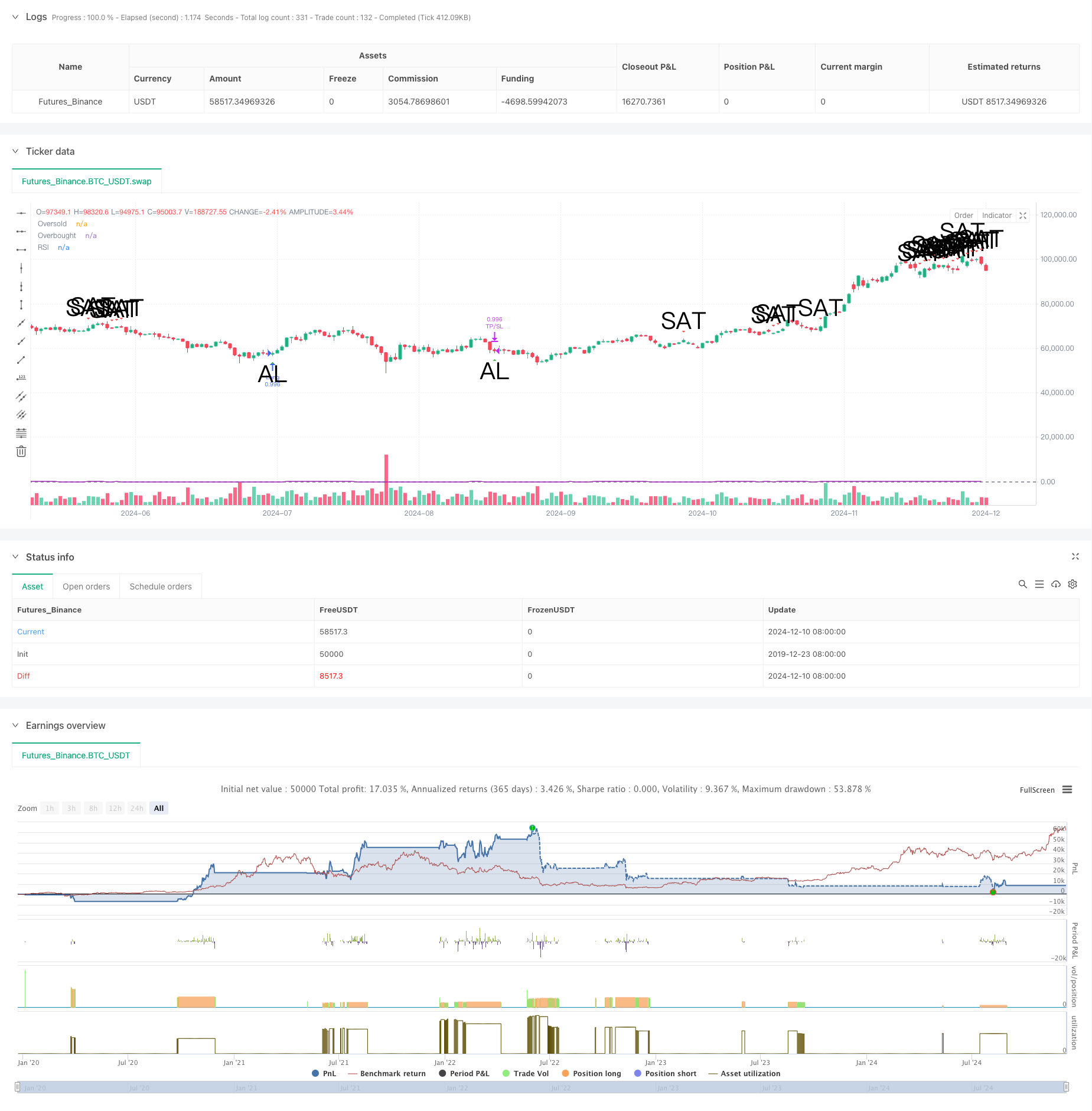

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy("MACD + RSI Basit Strateji", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// İndikatör parametreleri

fastLength = input(12, "MACD Fast Length")

slowLength = input(26, "MACD Slow Length")

signalLength = input(9, "MACD Signal Length")

rsiLength = input(14, "RSI Period")

rsiOversold = input(45, "RSI Oversold Level")

rsiOverbought = input(55, "RSI Overbought Level")

// Stop Loss ve Take Profit ekledim

stopLoss = input(1.2, "Stop Loss (%)")

takeProfit = input(2.4, "Take Profit (%)")

// MACD hesaplama

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

// RSI hesaplama

rsiValue = ta.rsi(close, rsiLength)

// EMA trend filtresi

emaValue = ta.ema(close, 10)

// Alım sinyali koşulları - sadece MACD ve RSI kullanalım

longCondition = macdLine > signalLine and rsiValue < rsiOversold

// Satım sinyali koşulları

shortCondition = macdLine < signalLine and rsiValue > rsiOverbought

// Pozisyon yönetimi - Stop Loss ve Take Profit ekledim

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", "Long",

profit = close * takeProfit / 100,

loss = close * stopLoss / 100)

if (shortCondition)

strategy.close("Long")

// Grafik göstergeleri

plotshape(longCondition, title="Alım",

style=shape.triangleup,

location=location.belowbar,

color=color.green,

size=size.large,

text="AL")

plotshape(shortCondition, title="Satım",

style=shape.triangledown,

location=location.abovebar,

color=color.red,

size=size.large,

text="SAT")

// İndikatörleri göster

plot(rsiValue, "RSI", color=color.purple)

hline(rsiOversold, "Oversold", color=color.gray)

hline(rsiOverbought, "Overbought", color=color.gray)