Adaptive Trend Following Dynamic Trend Recognition Trading Strategy

Author: ChaoZhang, Date: 2024-12-27 15:41:30Tags: KAMAATRSTSLTPEMAMA

Overview

This strategy is a trend-following trading system that combines the Supertrend indicator with the Kaufman Adaptive Moving Average (KAMA). It dynamically identifies market trend changes, seeks long opportunities in uptrends, and employs flexible stop-loss mechanisms for risk control. The core concept relies on the Supertrend indicator’s trend direction determination capability, combined with KAMA’s market volatility adaptive characteristics, to establish long positions in upward market trends.

Strategy Principles

The strategy employs a dual technical indicator confirmation system. First, the Supertrend indicator calculates trend direction using ATR and custom coefficients, indicating an uptrend when the indicator line is below the price. Second, the KAMA indicator adjusts moving average sensitivity through an adaptive mechanism, better accommodating different market conditions. Entry signals require two simultaneous conditions: Supertrend indicating an uptrend and price above the KAMA line. Similarly, exit signals need dual confirmation: Supertrend switching to downtrend and price falling below the KAMA line. This dual confirmation mechanism effectively reduces false signals.

Strategy Advantages

- Implements dual technical indicator confirmation, improving signal reliability

- KAMA indicator features adaptive characteristics, adjusting sensitivity to market volatility

- Supertrend indicator provides clear trend direction signals

- Comprehensive stop-loss mechanism for effective risk control

- Clear strategy logic with adjustable parameters

- Definitive entry and exit signals, easy to execute

Strategy Risks

- May generate frequent trading signals in choppy markets, increasing transaction costs

- Potential lag during initial trend reversals, affecting stop-loss effectiveness

- Improper parameter selection may lead to oversensitivity or sluggishness

- Significant slippage possible during rapid market fluctuations

- Trading costs and slippage may impact overall strategy returns

Strategy Optimization Directions

- Introduce volatility filtering mechanism to adjust parameters or pause trading during high volatility

- Add volume indicators for additional confirmation

- Optimize stop-loss mechanism, consider implementing trailing stops

- Enhance market environment assessment for strategy applicability

- Implement time filtering to avoid trading during specific periods

- Develop adaptive parameter optimization system

Conclusion

This strategy constructs a robust trend-following trading system by combining Supertrend and KAMA technical indicators. Its main advantages lie in adaptability and risk control capabilities, with enhanced trading signal reliability through dual confirmation. While facing challenges in choppy markets, the strategy’s overall performance can be further improved through appropriate parameter settings and optimization implementations. It is particularly suitable for medium to long-term trend trading and performs well in markets with clear trends.

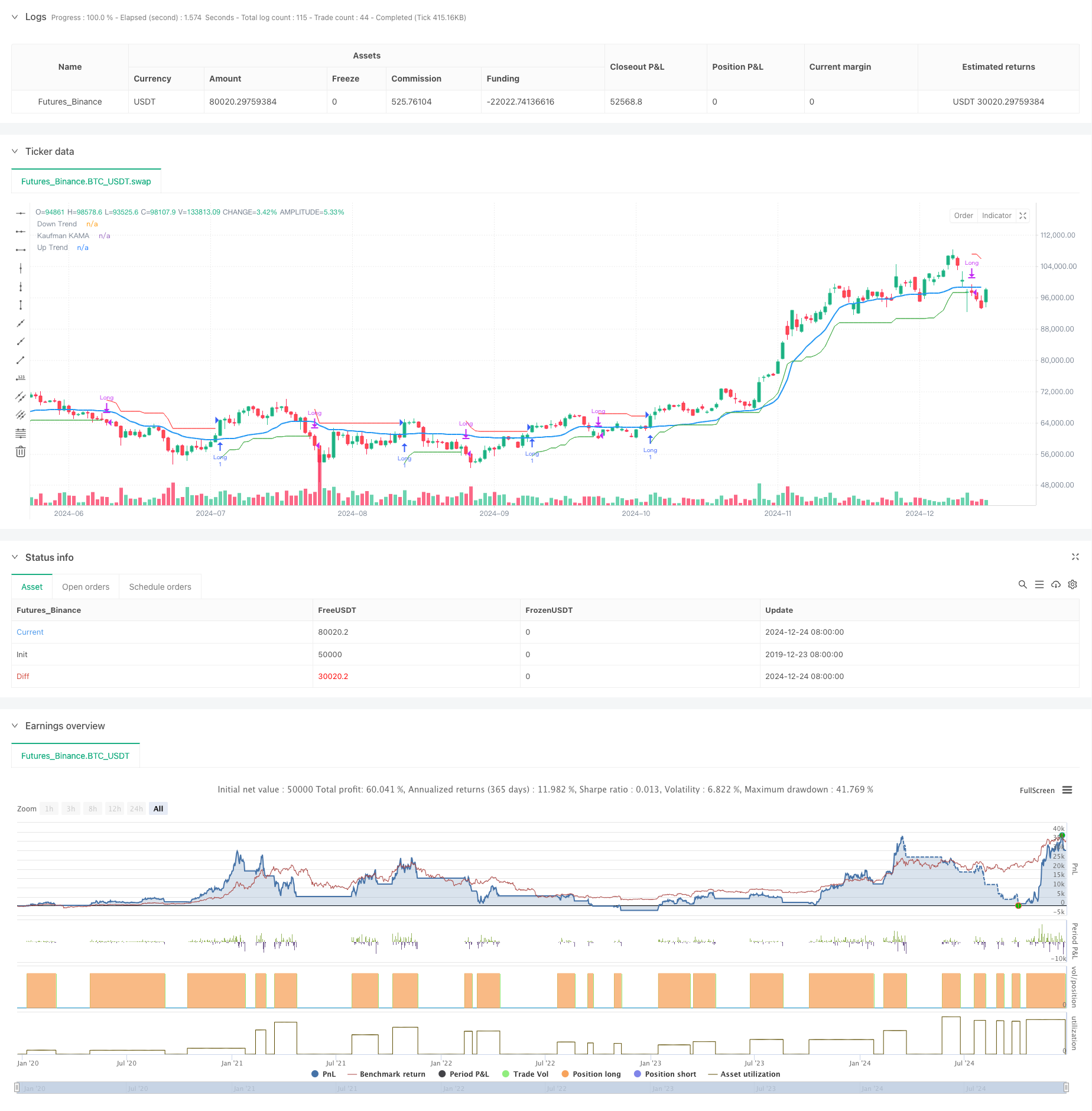

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Supertrend + KAMA Long Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// User-defined inputs for date range

startDate = input(timestamp("2018-01-01 00:00:00"), title="Start Date")

endDate = input(timestamp("2069-12-31 23:59:59"), title="End Date")

inDateRange = true

// Inputs for KAMA and Supertrend

kamaLength = input.int(21, title="KAMA Length", minval=1)

atrPeriod = input.int(10, title="Supertrend ATR Length", minval=1)

factor = input.float(3.0, title="Supertrend Factor", minval=0.01, step=0.01)

//------------------------- Kaufman Moving Average Adaptive (KAMA) -------------------------

xPrice = close

xvnoise = math.abs(xPrice - xPrice[1])

Length = kamaLength

nfastend = 0.666

nslowend = 0.0645

nsignal = math.abs(xPrice - xPrice[Length])

float nnoise = 0.0

for i = 0 to Length - 1

nnoise := nnoise + xvnoise[i]

nefratio = nnoise != 0.0 ? nsignal / nnoise : 0.0

nsmooth = math.pow(nefratio * (nfastend - nslowend) + nslowend, 2)

var float nAMA = na

nAMA := nz(nAMA[1]) + nsmooth * (xPrice - nz(nAMA[1]))

plot(nAMA, color=color.blue, linewidth=2, title="Kaufman KAMA")

//------------------------- Supertrend Calculation -------------------------

[stValue, dirValue] = ta.supertrend(factor, atrPeriod)

upTrend = dirValue < 0

downTrend = dirValue >= 0

plot(dirValue < 0 ? stValue : na, "Up Trend", color=color.green, style=plot.style_linebr)

plot(dirValue >= 0 ? stValue : na, "Down Trend", color=color.red, style=plot.style_linebr)

//------------------------- Strategy Logic -------------------------

// Entry condition: Supertrend is in uptrend AND price is above KAMA

canLong = inDateRange and upTrend and close > nAMA

// Exit condition (Take Profit): Supertrend switches to downtrend AND price is below KAMA

stopLoss = inDateRange and downTrend and close < nAMA

if canLong

strategy.entry("Long", strategy.long)

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_down, size=size.normal)

if stopLoss

strategy.close("Long", comment="Stop Loss")

label.new(bar_index, high, "STOP LOSS", color=color.red, textcolor=color.white, style=label.style_label_up, size=size.normal)

//------------------------- Alerts -------------------------

alertcondition(canLong, title="Long Entry", message="Supertrend + KAMA Long Signal")

alertcondition(stopLoss, title="Stop Loss", message="Supertrend switched to Downtrend and Price below KAMA")

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Precision Trading Strategy and Risk Management System Based on SuperTrend Indicator

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Multi-Technical Indicator Synergistic Trading System

- Multi-Technical Indicator Based High-Frequency Dynamic Optimization Strategy

- Triple Supertrend and Exponential Moving Average Trend Following Quantitative Trading Strategy

- Cloud-Based Bollinger Bands Double Moving Average Quantitative Trend Strategy

- Multi-Level Quantitative Trading Strategy Based on Bollinger Bands Trend Divergence

- Quantitative Trading Strategy Based on Fibonacci 0.7 Level Trend Breakthrough

- Multi-Period Fractal Breakout Order Block Adaptive Trading Strategy

- Risk-Reward Ratio Optimized Strategy Based on Moving Average Crossover

- Cross-boundary Dynamic Range Quantitative Trading Strategy Based on Bollinger Bands

- Momentum-Based SMI Crossover Signal Adaptive Prediction Strategy

- Multiple Moving Average Crossover Signal Enhanced Trading Strategy

- Multi-Indicator Filtered Trading Strategy with Bollinger Bands and Woodies CCI

- Dynamic Moving Average Trend Following with RSI Confirmation Trading Strategy

- Dynamic Multi-Period Exponential Moving Average Cross Strategy with Pullback Optimization System

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Adaptive Trading Strategy Based on Stochastic RSI Dual-Line Crossover

- Multi-Level Institutional Order Flow Quantitative Strategy with Dynamic Position Scaling System

- Multi-EMA Dynamic Trend Capture Quantitative Trading Strategy