Sistema dinámico de detección de la divergencia de precios RSI y estrategia de negociación adaptativa

El autor:¿ Qué pasa?, Fecha: 2025-01-10 16:20:25Las etiquetas:Indicador de riesgoTPSL

Resumen general

Esta estrategia es un sistema de negociación inteligente basado en el RSI y la divergencia de precios, que captura señales de reversión del mercado mediante el monitoreo dinámico de la relación de divergencia entre los indicadores del RSI y las tendencias de precios.

Principios de estrategia

La lógica central de la estrategia se basa en los siguientes elementos clave: 1. Detección de divergencia RSI: identifica patrones de divergencia potenciales comparando los máximos y mínimos de los indicadores RSI y las tendencias de precios. Las señales de venta de divergencia bajista se forman cuando el precio alcanza nuevos máximos mientras que RSI no lo hace; las señales de compra de divergencia alcista se forman cuando el precio alcanza nuevos mínimos mientras que RSI no lo hace. Confirmación fractal: utiliza la teoría de los fractales para analizar la estructura de precios, confirmando la validez de la divergencia mediante la detección de máximos y mínimos locales para mejorar la confiabilidad de la señal. Adaptación de parámetros: Introduce parámetros de sensibilidad para ajustar dinámicamente los intervalos de juicio fractal, logrando la adaptación a diferentes entornos de mercado. Control de riesgos: integra mecanismos de Stop Loss y Take Profit basados en porcentajes para garantizar un riesgo controlado para cada operación.

Ventajas estratégicas

- Alta confiabilidad de la señal: El mecanismo de confirmación dual de la divergencia del RSI y la teoría de los fractales mejora enormemente la precisión de la señal de negociación.

- Gran adaptabilidad: la estrategia puede ajustar de forma flexible los parámetros de acuerdo con las diferentes condiciones del mercado, lo que demuestra una buena adaptabilidad ambiental.

- Gestión integral del riesgo: los mecanismos dinámicos integrados de stop-loss y take-profit controlan eficazmente la exposición al riesgo para cada operación.

- Alto nivel de automatización: La automatización completa desde la identificación de señales hasta la ejecución de operaciones reduce el impacto emocional de la intervención humana.

- Buena escalabilidad: el marco estratégico admite aplicaciones multiinstrumento y multiplazos, lo que facilita la inversión de cartera.

Riesgos estratégicos

- Dependencia del entorno del mercado: la fiabilidad de la señal de divergencia puede disminuir en los mercados de tendencia, lo que requiere mecanismos adicionales de filtrado de tendencias.

- Sensibilidad de los parámetros: los parámetros clave como los umbrales del RSI y los intervalos de juicio fractal requieren un ajuste cuidadoso, la configuración inadecuada de los parámetros puede afectar el rendimiento de la estrategia.

- Lag de señal: esperar la formación completa del patrón de divergencia antes de confirmar las señales puede resultar en un retraso en el tiempo de entrada.

- Interferencia del ruido del mercado: en los mercados volátiles pueden producirse señales de divergencia falsa, lo que requiere condiciones de filtrado adicionales.

Direcciones para la optimización de la estrategia

- Añadir filtrado de tendencias: Introducir indicadores de juicio de tendencias para filtrar señales de tendencia contraria en mercados de tendencias fuertes, mejorando la adaptabilidad de la estrategia en diferentes entornos de mercado.

- Optimizar la adaptación de parámetros: Desarrollar mecanismos dinámicos de ajuste de parámetros basados en la volatilidad del mercado, mejorando la respuesta de la estrategia a los cambios del mercado.

- Mejorar el control del riesgo: introducir mecanismos dinámicos de stop-loss para ajustar automáticamente las posiciones de stop-loss en función de la volatilidad del mercado, optimizando los efectos de la gestión del dinero.

- Mejorar la confirmación de señales: Construir un sistema de confirmación de señales más completo mediante la combinación de volumen, volatilidad y otros indicadores de microestructura del mercado.

Resumen de las actividades

La estrategia construye un sistema de negociación robusto a través de una combinación innovadora de la divergencia del RSI y la teoría de los fractales. Sus ventajas se encuentran en la alta fiabilidad de la señal, la fuerte adaptabilidad y los mecanismos integrales de control de riesgos. A través de la optimización y mejora continuas, se espera que la estrategia mantenga un rendimiento estable en diferentes entornos de mercado.

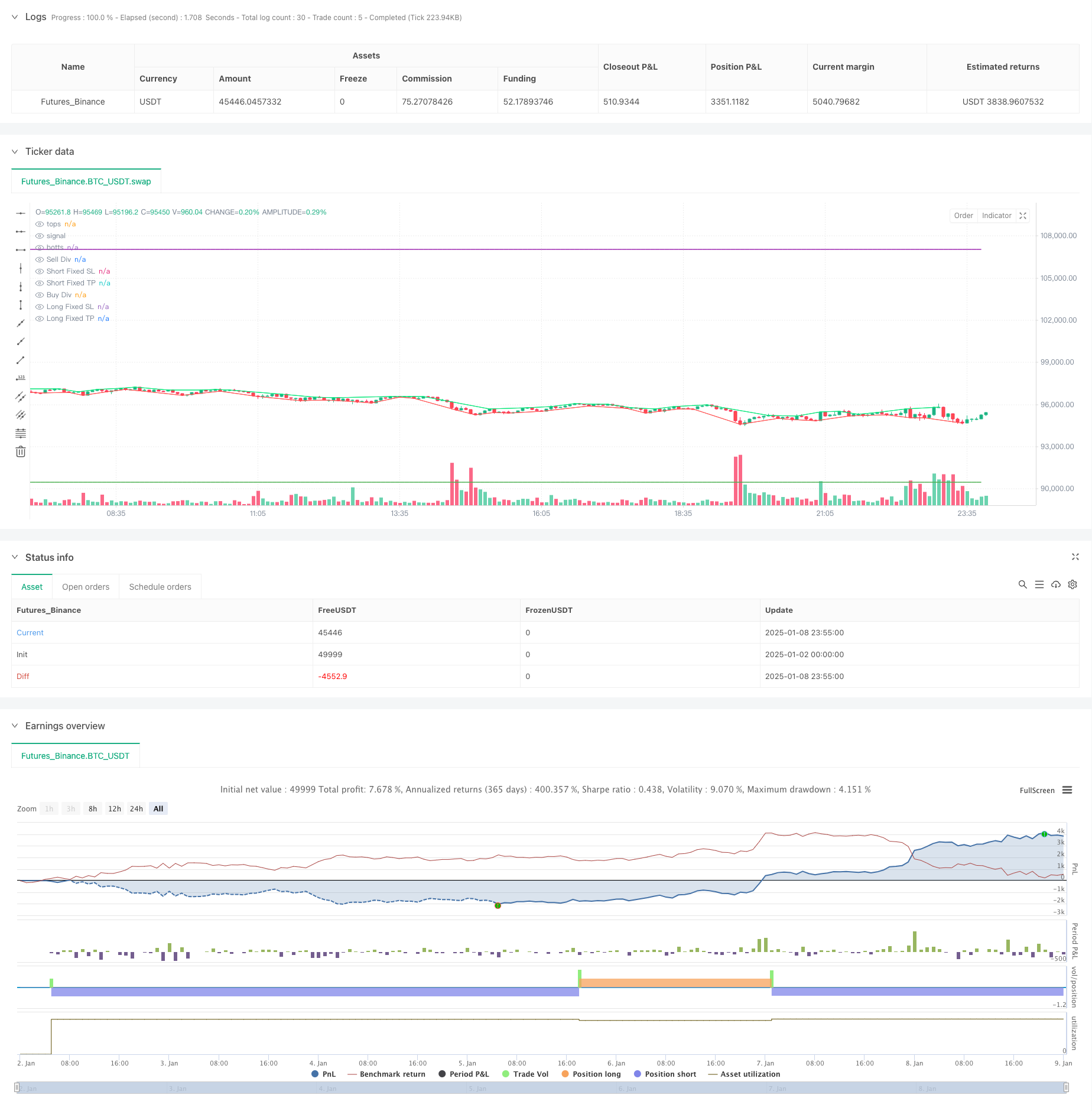

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//FRACTALS

//@version=5

//last : 30m 70 68 22 25 0 0 4.7 11.5

//init

capital=1000

percent=100

fees=0//in percent for each entry and exit

//Inputs

start = input(timestamp("1 Feb 2002"), "Start Time", group = "Date")

end = input(timestamp("1 Feb 2052"), "End Time", group = "Date")

//Strategy

strategy("Divergence Finder (RSI/Price) Strategy with Options", overlay = true, initial_capital=capital, default_qty_value=percent, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, calc_on_order_fills=false,process_orders_on_close=true , commission_value=fees, currency=currency.EUR, calc_on_every_tick=true, use_bar_magnifier=false)

//indicator("Divergence Finder (RSI/Price) with Options", overlay=true, max_boxes_count=200, max_bars_back=500,max_labels_count=500)

srcUp=input.source(close, "Source for Price Buy Div", group="sources")

srcDn=input.source(close, "Source for Price Sell Div", group="sources")

srcRsi=input.source(close, "Source for RSI Div", group="sources")

HighRSILimit=input.int(70, "Min RSI for Sell divergence (p1:pre last)", group="signals", inline="1", step=1)

HighRSILimit2=input.int(68, "Min RSI for Sell divergence (p2):last", group="signals", inline="1", step=1)

LowRSILimit=input.int(22, "Min RSI for Buy divergence (p1:pre last)", group="signals", inline="2", step=1)

LowRSILimit2=input.int(25, "Min RSI for Buy divergence (p2:last)", group="signals", inline="2", step=1)

minMarginP=input.float(0, "Min margin between price for displaying divergence (%)", group="signals", step=0.01)

minMarginR=input.float(0, "Min margin between RSI for displaying divergence (%)", group="signals", step=1)

nb=input.int(2, "Sensivity: Determine how many candle will be used to determine last top or bot (too high cause lag, too low cause repaint)", group="Sensivity", inline="3", step=1)

stopPer= input.float(4.7, title='Stop %', group = "Per", inline="3", step=0.01)

tpPer = input.float(11.5, title='TP %', group = "Per", inline="4", step=0.01)

//nb=2

leftBars = nb

rightBars=nb

labels=input.bool(true, "Display Divergence labels", group="Display")

draw=input.bool(true, "Display tops/bottoms")

dnFractal = (close[nb-2] < close[nb]) and (close[nb-1] < close[nb]) and (close[nb+1] < close[nb]) and (close[nb+2] < close[nb])

upFractal = (close[nb-2] > close[nb]) and (close[nb-1] > close[nb]) and (close[nb+1] > close[nb]) and (close[nb+2] > close[nb])

ph=dnFractal

pl=upFractal

plot(dnFractal and draw ? close[nb] : na, style=plot.style_line,offset=-2, color=color.lime, title="tops")

plot(upFractal and draw ? close[nb] : na, style=plot.style_line, offset=-2, color=color.red, title="botts")

plotchar(dnFractal ? high[nb] : na, char='⮝',location=location.absolute,offset=-2, color=color.rgb(236, 255, 63), title="Down Fractal")

plotchar(upFractal ? low[nb] : na, char='⮟', location=location.absolute, offset=-2, color=color.rgb(67, 227, 255), title="Up Fractal")

float myRSI=ta.rsi(srcRsi, 14)

bool divUp=false

bool divDn=false

//compare lasts bots

p2=ta.valuewhen( ph,srcDn[nb], 0 ) //last price

p1=ta.valuewhen( ph,srcDn[nb], 1 ) //pre last price

r2=ta.valuewhen( ph,myRSI[nb], 0 ) //last rsi

r1=ta.valuewhen( ph,myRSI[nb], 1 ) //pre last rsi

if ph

if p1 < p2// - (p2 * minMarginP)/100

if r1 > HighRSILimit and r2 > HighRSILimit2

if r1 > r2 + (r2 * minMarginR)/100

divDn:=true

plot(divDn ? close:na, style=plot.style_cross, linewidth=3, color= color.red, offset=-rightBars, title="Sell Div")

if labels and divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

else if divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence",xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

p2:=ta.valuewhen( pl,srcUp[nb], 0 )

p1:=ta.valuewhen( pl,srcUp[nb], 1 )

r2:=ta.valuewhen( pl,myRSI[nb], 0 )

r1:=ta.valuewhen( pl,myRSI[nb], 1 )

if pl

if p1 > p2 + (p2 * minMarginP)/100

if r1 < LowRSILimit and r2 < LowRSILimit2

if r1 < r2 - (r2 * minMarginR)/100

divUp:=true

plot(divUp ? close:na, style=plot.style_cross, linewidth=3, color= color.green, offset=-rightBars, title="Buy Div")

if labels and divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

else if divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence",xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

//strat LONG

longEntry = divUp// and strategy.position_size == 0

longExit = divDn// and strategy.position_size == 0

//strat SHORT

shortEntry = divDn

shortExit = divUp

LongActive=input(true, title='Activate Long', group = "Directions", inline="2")

ShortActive=input(true, title='Activate Short', group = "Directions", inline="2")

//StopActive=input(false, title='Activate Stop', group = "Directions", inline="2")

//tpActive = input(false, title='Activate Take Profit', group = "TP", inline="4")

//RR=input(0.5, title='Risk Reward Multiplier', group = "TP")

//QuantityTP = input(100.0, title='Trade Ammount %', group = "TP")

//calc stop

//longStop = strategy.position_avg_price * (1 - stopPer)

//shortStop = strategy.position_avg_price * (1 + stopPer)

longStop = strategy.position_avg_price - (strategy.position_avg_price * stopPer/100)

shortStop = strategy.position_avg_price + (strategy.position_avg_price * stopPer/100)

longTP = strategy.position_avg_price + (strategy.position_avg_price * tpPer/100)

shortTP = strategy.position_avg_price - (strategy.position_avg_price * tpPer/100)

//Calc TP

//longTP = ((strategy.position_avg_price-longStop)*RR+strategy.position_avg_price)

//shortTP = (strategy.position_avg_price-((shortStop-strategy.position_avg_price)*RR))

//display stops

plot(strategy.position_size > 0 ? longStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Fixed SL")

plot(strategy.position_size < 0 ? shortStop : na, style=plot.style_linebr, color=color.purple, linewidth=1, title="Short Fixed SL")

//display TP

plot(strategy.position_size > 0 ? longTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Long Fixed TP")

plot(strategy.position_size < 0 ? shortTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Short Fixed TP")

//do

if true

//check money available

if strategy.equity > 0

//if tpActive //Need to put TP before Other exit

strategy.exit("Close Long", from_entry="Long", limit=longTP,stop=longStop, comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

strategy.exit("Close Short", from_entry="Short", limit=shortTP,stop=shortStop, comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

//Set Stops

//if StopActive

// strategy.exit("Stop Long", from_entry="Long", stop=longStop, comment="Stop Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

// strategy.exit("Stop Short", from_entry="Short", stop=shortStop, comment="Stop Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

if longEntry

if ShortActive

strategy.close("Short",comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Short")

if LongActive

strategy.entry("Long", strategy.long, comment="Open Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Long")

if longExit

if LongActive

strategy.close("Long",comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Long")

if ShortActive

strategy.entry("Short", strategy.short, comment="Open Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Short")

//alertcondition(longEntry and LongActive, title="Buy Divergence Open", message="Buy Divergence Long Opened!")

//alertcondition(longExit and ShortActive, title="Sell Divergence Open", message="Buy Divergence Short Opened!")

//alertcondition(longExit and LongActive, title="Buy Divergence Closed", message="Buy Divergence Long Closed!")

//alertcondition(longEntry and ShortActive, title="Sell Divergence Closed", message="Buy Divergence Short Closed!")

- Estrategia de reversión del punto más bajo del RSI

- Estrategia de negociación basada en el índice de rendimiento de la inversión con porcentaje basado en la toma de ganancias y el stop loss

- Estrategia de negociación de índices de rendimiento de riesgo de múltiples zonas

- Tendencia sinérgica de RSI y AO a raíz de una estrategia de negociación cuantitativa

- Estrategia de negociación de impulso estocástico de doble marco de tiempo

- Estrategia de reversión del índice de variabilidad de las cotizaciones

- Estrategia de cruce de la media móvil ponderada y el índice de resistencia relativa con el sistema de optimización de la gestión de riesgos

- Estrategia de cobertura de impulso multi-RSI-EMA con escalación de posiciones

- Estrategia de negociación de impulso de volumen inteligente multi-objetivo

- La estrategia de negociación mejorada de doble cruce de EMA con impulso de RSI

- Tendencia cruzada de múltiples EMA siguiendo una estrategia de negociación cuantitativa

- Estrategia de negociación de indicadores de RSI que se superponen en varios niveles

- Las bandas de Bollinger y la tendencia intradiaria de Fibonacci siguiendo la estrategia

- Tendencia dinámica siguiendo una estrategia de doble canal de media móvil con sistema de gestión de riesgos

- Tendencia de toma de ganancias/detención de pérdidas de múltiples modos siguiendo una estrategia basada en la EMA, la franja de Madrid y el canal de Donchian

- Estrategia de negociación de tendencia de impulso de múltiples indicadores: un sistema de negociación cuantitativo optimizado basado en bandas de Bollinger, Fibonacci y ATR

- Tendencia multidimensional siguiendo la estrategia de negociación piramidal

- Estrategia de ruptura de impulso de rebote triple de fondo

- Estrategia de negociación cuantitativa de patrón de candelero de inversión de tendencia de doble marco de tiempo

- Tendencia de precios-volumen de alta frecuencia siguiendo la estrategia de adaptación del análisis de volumen

- Estrategia mejorada de impulso de la tendencia del volumen de precios

- Estrategia inteligente de cruce de medias móviles con sistema dinámico de gestión de pérdidas y ganancias

- Estrategia de negociación de ruptura de impulso multi-MA adaptativa

- Estrategia de cruce de cambio de impulso medio adaptativo

- Sistema de negociación de tendencias EMA de doble dirección adaptativo con estrategia de optimización inversa de la negociación

- Sistema de negociación de retroceso de doble EMA con optimización dinámica de stop-loss basada en ATR