概述

该策略利用相对强弱指数(RSI)来判断市场的超卖状态,当RSI低于设定的超卖阈值时产生买入信号,同时设置止损(Stop Loss)和止盈(Take Profit)来控制风险和锁定利润。该策略只做多,不做空。

策略原理

- 计算RSI指标,用来衡量市场的超买超卖状态。

- 当RSI低于设定的超卖阈值(默认为30)时,产生买入信号。

- 买入后,根据当前收盘价和设定的止损止盈百分比,计算出止损价和止盈价。

- 持有仓位过程中,如果价格触及止损价,则平仓止损;如果价格触及止盈价,则平仓止盈。

- 在持仓的同时,不会再产生新的买入信号,直到当前仓位平仓。

策略优势

- 简单易用:该策略逻辑清晰,只需要设置少量参数,适合新手使用。

- 趋势追踪:通过RSI指标来判断超卖状态,能够在趋势的早期介入,捕捉潜在的反转机会。

- 风险控制:设置了止损和止盈,能够有效控制单次交易的风险敞口,同时能够锁定已获得的利润。

策略风险

- 参数优化:该策略的表现依赖于RSI的周期和超卖阈值等参数的选择,不同的参数设置可能带来不同的结果。

- 市场风险:当市场持续下跌时,RSI可能长时间处于超卖区域,导致频繁的虚假信号。

- 趋势风险:该策略在震荡市中表现较好,但在强趋势市场中,由于缺乏趋势追踪能力,可能错失部分利润。

策略优化方向

- 加入趋势过滤:在产生买入信号前,先判断当前是否处于上升趋势,可以使用移动平均线或其他趋势指标来辅助判断。

- 优化止损止盈:可以考虑使用移动止损或者动态止盈,随着价格的变化自动调整止损止盈的位置,以追求更高的收益风险比。

- 结合其他指标:可以考虑将RSI与其他指标(如MACD、布林带等)结合使用,提高信号的可靠性和精确度。

总结

该策略通过RSI指标来捕捉市场的超卖反转机会,同时设置了固定的止损止盈来控制风险。策略逻辑简单清晰,适合新手使用。但是该策略也存在一定的局限性,如对趋势把握能力较弱,信号可靠性有待提高等。因此,在实际应用中,可以考虑从趋势判断、止损止盈优化、指标组合等方面对策略进行优化和改进,以获得更稳健的交易表现。

策略源码

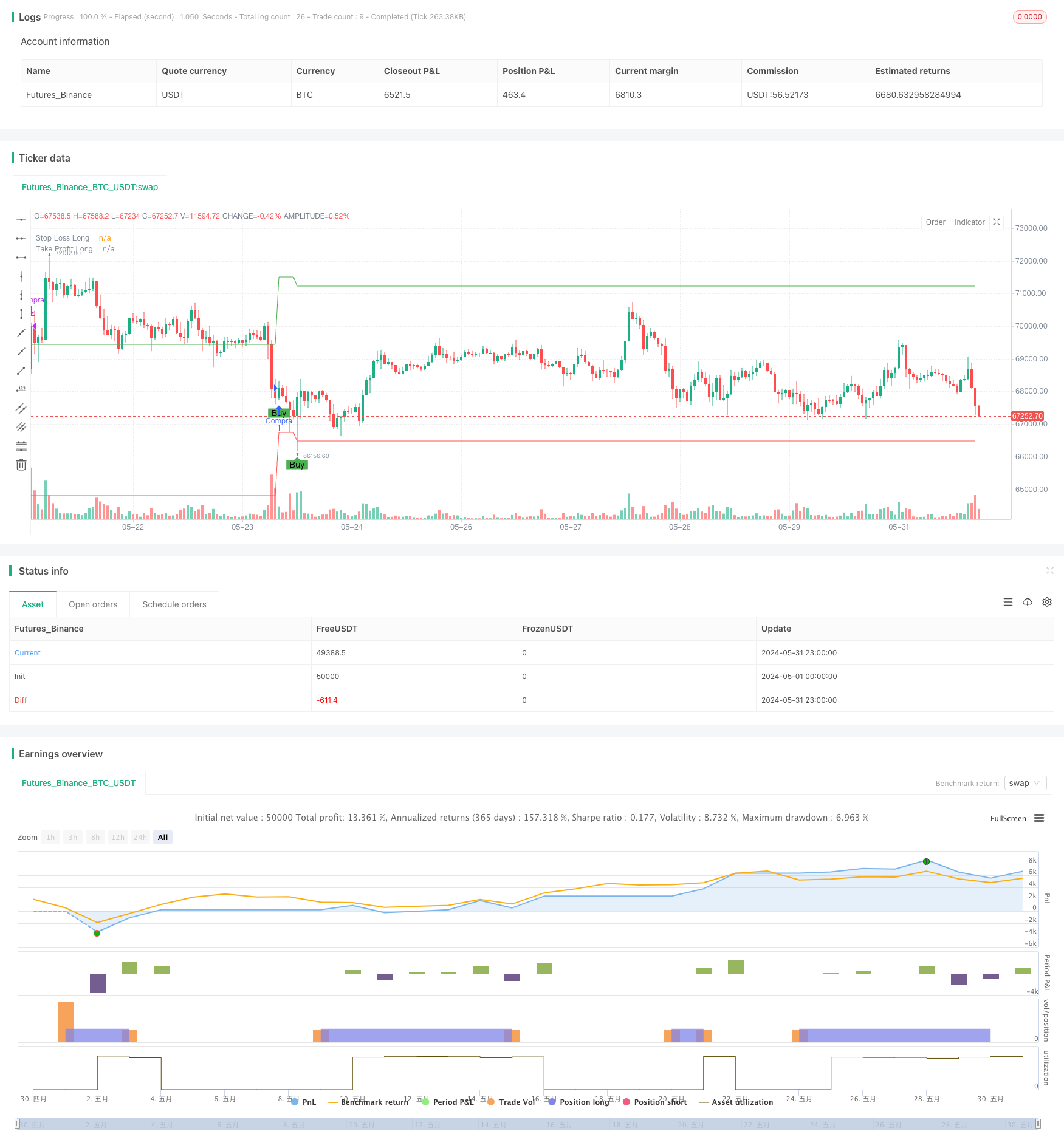

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estratégia com RSI (Apenas Compras)", overlay=true)

// Parâmetros de entrada

rsiLength = input.int(14, title="Período do RSI")

oversold = input.int(30, title="Nível de Sobrevenda (RSI)")

stopLossPercent = input.float(2.0, title="Stop Loss (%)")

takeProfitPercent = input.float(5.0, title="Take Profit (%)")

// Cálculo do RSI

rsi = ta.rsi(close, rsiLength)

// Sinal de Compra

buySignal = ta.crossover(rsi, oversold)

// Plotando o sinal de compra

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Compra", text="Buy")

// Variáveis para Stop Loss e Take Profit

var float longStop = na

var float longTake = na

// Entrando na posição de compra

if (buySignal)

entryPrice = close

longStop := entryPrice * (1 - stopLossPercent / 100)

longTake := entryPrice * (1 + takeProfitPercent / 100)

strategy.entry("Compra", strategy.long)

label.new(x=bar_index, y=low, text="Compra", style=label.style_label_up, color=color.green)

// Gerenciamento de Stop Loss e Take Profit

if (strategy.position_size > 0)

if (close <= longStop)

strategy.close("Compra", comment="Stop Loss")

label.new(x=bar_index, y=low, text="Stop Loss", style=label.style_label_down, color=color.red)

if (close >= longTake)

strategy.close("Compra", comment="Take Profit")

label.new(x=bar_index, y=high, text="Take Profit", style=label.style_label_up, color=color.green)

// Plotando as linhas de Stop Loss e Take Profit

plot(longStop, color=color.red, linewidth=1, title="Stop Loss Long")

plot(longTake, color=color.green, linewidth=1, title="Take Profit Long")

相关推荐