Stratégie de négociation composite de suivi quantitatif avancé des tendances et d'inversion des nuages

Auteur:ChaoZhang est là., Date: 2025-01-06 10:56:42 Je suis désoléLes étiquettes:Le taux d'intérêtSMA

Résumé

Cette stratégie est un système de trading composite combinant le croisement de la moyenne mobile exponentielle (EMA) et le nuage Ichimoku. Le croisement EMA est principalement utilisé pour capturer les signaux d'initiation de tendance et confirmer les opportunités d'achat, tandis que le nuage Ichimoku est utilisé pour identifier les renversements du marché et déterminer les points de vente.

Principe de stratégie

La stratégie fonctionne à travers deux composantes essentielles:

- Signal d'achat croisé EMA: utilise le croisement des moyennes mobiles exponentielles à court terme (9 jours) et à long terme (21 jours) pour confirmer la direction de la tendance.

- Ichimoku Cloud Sell Signal: Détermine les renversements de tendance à travers la position des prix par rapport au nuage et à la structure interne du nuage. Les signaux de vente sont déclenchés lorsque le prix tombe en dessous du nuage ou lorsque le Leading Span A traverse le Leading Span B. La stratégie comprend un stop-loss à 1,5% et un take-profit à 3%.

Les avantages de la stratégie

- Confirmation multi-dimensionnelle du signal: la combinaison du crossover EMA et de Ichimoku Cloud valide les signaux de négociation sous différents angles.

- Contrôle complet du risque: les objectifs de stop-loss et de profit fixés en pourcentage contrôlent efficacement le risque pour chaque transaction.

- Une forte capacité de capture de tendance: le croisement EMA capture le début de la tendance tandis que Ichimoku Cloud identifie efficacement les fins de tendance.

- Signaux clairs et objectifs: Les signaux de négociation sont générés automatiquement par des indicateurs techniques, ce qui réduit les interférences subjectives.

Risques stratégiques

- Risque de marché variable: peut générer de fréquents faux signaux sur les marchés latéraux, entraînant des arrêts consécutifs.

- Risque de décalage: les moyennes mobiles et le Cloud Ichimoku ont tous deux un décalage inhérent, manquant potentiellement des points d'entrée optimaux dans les mouvements rapides du marché.

- Sensibilité aux paramètres: la performance de la stratégie est sensible aux paramètres, ce qui nécessite un ajustement dans différentes conditions de marché.

Optimisation de la stratégie

- Ajouter des filtres d'environnement de marché: inclure des indicateurs de volatilité ou de force de tendance pour ajuster les paramètres de stratégie en fonction des conditions du marché.

- Optimiser le mécanisme d'arrêt des pertes: envisager la mise en œuvre d'arrêts dynamiques, tels que les arrêts de retard ou les arrêts basés sur ATR.

- Améliorer la confirmation du signal: ajouter des indicateurs de volume et de momentum pour améliorer la fiabilité du signal.

- Mettre en œuvre la dimensionnement des positions: ajuster dynamiquement la taille des positions en fonction de la force du signal et de la volatilité du marché.

Résumé

Cette stratégie construit un système de trading capable à la fois de suivre la tendance et de capturer l'inversion grâce à la combinaison organique de crossover EMA et Ichimoku Cloud. La conception de la stratégie est rationnelle avec un bon contrôle des risques, montrant une bonne valeur d'application pratique.

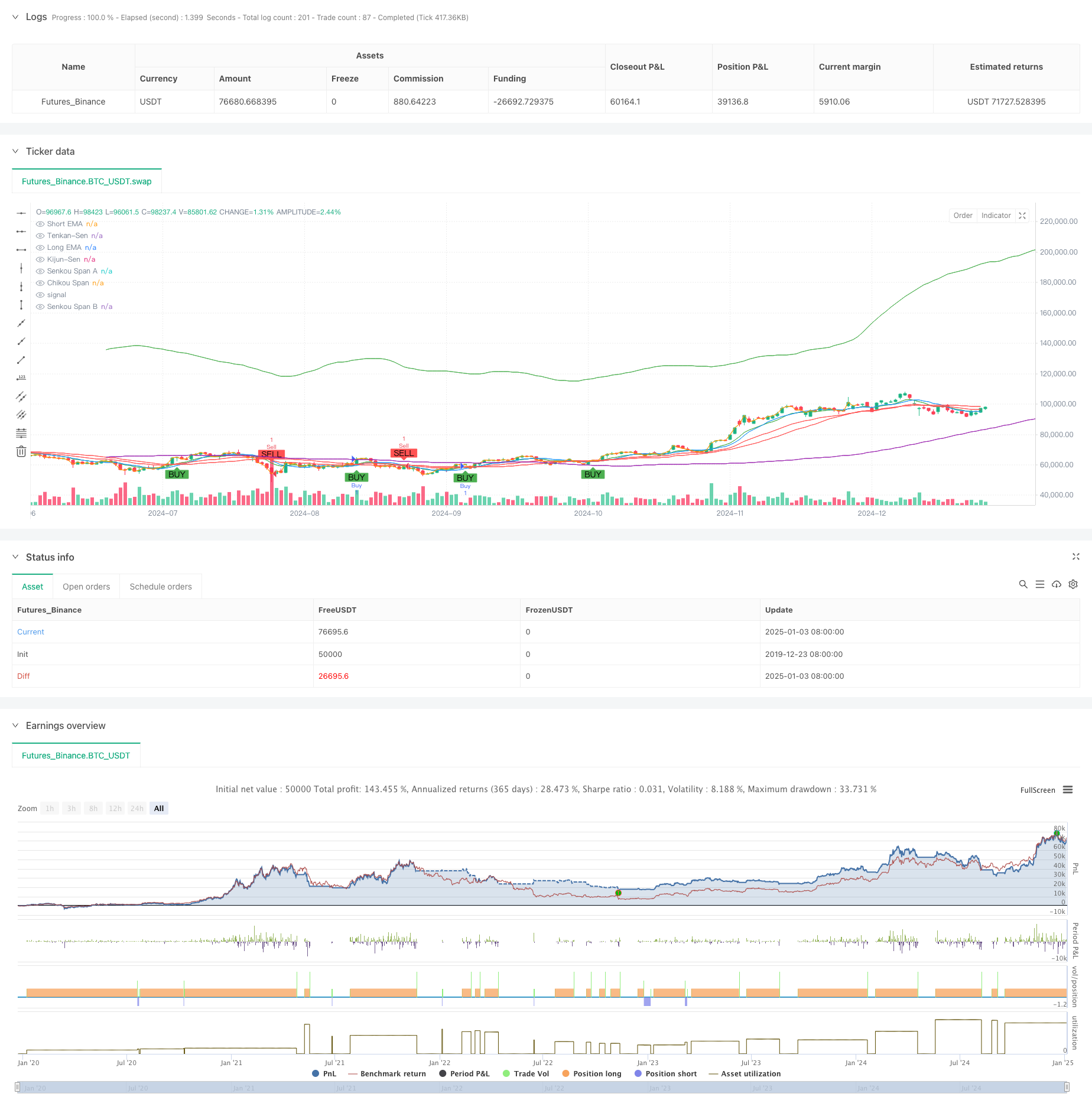

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Buy + Ichimoku Cloud Sell Strategy", overlay=true)

// Input Parameters for the EMAs

shortEmaPeriod = input.int(9, title="Short EMA Period", minval=1)

longEmaPeriod = input.int(21, title="Long EMA Period", minval=1)

// Input Parameters for the Ichimoku Cloud

tenkanPeriod = input.int(9, title="Tenkan-Sen Period", minval=1)

kijunPeriod = input.int(26, title="Kijun-Sen Period", minval=1)

senkouSpanBPeriod = input.int(52, title="Senkou Span B Period", minval=1)

displacement = input.int(26, title="Displacement", minval=1)

// Calculate the EMAs

shortEma = ta.ema(close, shortEmaPeriod)

longEma = ta.ema(close, longEmaPeriod)

// Ichimoku Cloud Calculations

tenkanSen = ta.sma(close, tenkanPeriod)

kijunSen = ta.sma(close, kijunPeriod)

senkouSpanA = ta.sma(tenkanSen + kijunSen, 2)

senkouSpanB = ta.sma(close, senkouSpanBPeriod)

chikouSpan = close[displacement]

// Plot the EMAs on the chart

plot(shortEma, color=color.green, title="Short EMA")

plot(longEma, color=color.red, title="Long EMA")

// Plot the Ichimoku Cloud

plot(tenkanSen, color=color.blue, title="Tenkan-Sen")

plot(kijunSen, color=color.red, title="Kijun-Sen")

plot(senkouSpanA, color=color.green, title="Senkou Span A", offset=displacement)

plot(senkouSpanB, color=color.purple, title="Senkou Span B", offset=displacement)

plot(chikouSpan, color=color.orange, title="Chikou Span", offset=-displacement)

// Buy Condition: Short EMA crosses above Long EMA

buyCondition = ta.crossover(shortEma, longEma)

// Sell Condition: Tenkan-Sen crosses below Kijun-Sen, and price is below the cloud

sellCondition = ta.crossunder(tenkanSen, kijunSen) and close < senkouSpanA and close < senkouSpanB

// Plot Buy and Sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Execute Buy and Sell Orders

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Optional: Add Stop Loss and Take Profit (risk management)

stopLossPercentage = input.float(1.5, title="Stop Loss Percentage", minval=0.1) / 100

takeProfitPercentage = input.float(3.0, title="Take Profit Percentage", minval=0.1) / 100

longStopLoss = close * (1 - stopLossPercentage)

longTakeProfit = close * (1 + takeProfitPercentage)

shortStopLoss = close * (1 + stopLossPercentage)

shortTakeProfit = close * (1 - takeProfitPercentage)

strategy.exit("Take Profit/Stop Loss", "Buy", stop=longStopLoss, limit=longTakeProfit)

strategy.exit("Take Profit/Stop Loss", "Sell", stop=shortStopLoss, limit=shortTakeProfit)

- Stratégie d'enveloppe en pourcentage de canal dynamique

- Hull-4ema

- Stratégie de rupture du BMSB

- Suivre la tendance de l'EMA/SMA avec une stratégie de swing trading combinée de filtre de volume et de système de prise de profit/arrêt de perte en pourcentage

- Système de signaux d'investissement à long terme basé sur les indicateurs EMA et SMA

- Stratégie quantitative croisée de tendance SMA à long terme

- Stratégie croisée multi-EMA avec confirmation de tendance

- Stratégie de négociation de la dynamique de la zone de rupture

- Système de négociation à support dynamique à double échéancier

- Stratégie de croisement à double moyenne mobile

- Tendance à la suite d'une stratégie d'évaluation adaptative de la valeur attendue basée sur des moyennes mobiles croisées

- Stratégie de négociation dynamique de volatilité à indicateurs multiples

- Théorie de la négociation dynamique: stratégie de croisement de période de moyenne mobile exponentielle et de volume cumulé

- Stratégie de croisement dynamique EMA avec système de filtrage de la force de tendance ADX

- Stratégie de négociation quantitative de tendance linéaire englobante à plusieurs périodes

- Stratégie de rupture de canal adaptative avec système de négociation dynamique de support et de résistance

- Filtrage dynamique Stratégie croisée EMA pour l'analyse des tendances quotidiennes

- Le système de négociation des tendances de support/résistance Camarilla

- Stratégie de négociation dynamique à tendance multi-signaux améliorée

- Système de négociation de Martingale à dynamique adaptative

- Tendance à la suite de la stratégie de négociation quantitative combinée RSI et moyenne mobile

- Tendance basée sur l'EMA à 5 jours suivant le modèle d'optimisation de la stratégie

- Stratégie d'optimisation dynamique des bénéfices de l'EMA à plusieurs niveaux et à plusieurs périodes

- Système de négociation synergique multi-indicateurs techniques

- Stratégie d'optimisation dynamique à haute fréquence basée sur des indicateurs techniques multiples

- Triple supertrend et tendance moyenne mobile exponentielle suivant une stratégie de négociation quantitative

- Stratégie de tendance quantitative de la moyenne mobile double basée sur le cloud Bollinger Bands

- Stratégie de négociation quantitative à plusieurs niveaux basée sur la divergence de tendance des bandes de Bollinger

- Stratégie de négociation quantitative basée sur la tendance de rupture de niveau Fibonacci 0,7

- Stratégie de négociation adaptative de bloc d'ordre de rupture fractal à plusieurs périodes

- Stratégie optimisée pour le rapport risque-rendement basée sur le croisement des moyennes mobiles