Strategi perdagangan rentang frekuensi tinggi multi-indikator

Penulis:ChaoZhang, Tanggal: 2024-12-27 14:18:57Tag:RSIEMAVOLN-BARTPSL

Gambaran umum

Ini adalah strategi perdagangan rentang frekuensi tinggi yang didasarkan pada beberapa indikator teknis. Strategi ini menggabungkan sinyal dari Exponential Moving Average (EMA), Relative Strength Index (RSI), analisis volume, dan pengakuan pola harga periode N untuk mengidentifikasi titik masuk optimal dalam perdagangan jangka pendek.

Prinsip Strategi

Logika inti bergantung pada konfirmasi sinyal multidimensi:

- Menggunakan crossover EMA 8 periode dan 21 periode untuk menentukan arah tren jangka pendek

- Memvalidasi momentum pasar menggunakan RSI 14 periode, dengan RSI>50 mengkonfirmasi momentum bullish dan RSI<50 mengkonfirmasi momentum bearish

- Membandingkan volume saat ini dengan volume rata-rata 20 periode untuk memastikan aktivitas pasar

- Mengidentifikasi pola pembalikan potensial dengan membandingkan 5 lilin terakhir dengan 10 lilin sebelumnya Sinyal perdagangan hanya dihasilkan ketika semua kondisi sejajar. Posisi panjang dibuka dengan harga pasar untuk sinyal bullish, dan posisi pendek untuk sinyal bearish. Risiko dikendalikan melalui 1,5% take profit dan 0,7% stop loss level.

Keuntungan Strategi

- Validasi silang sinyal multidimensi secara signifikan mengurangi sinyal palsu

- Menggabungkan manfaat dari mengikuti tren dan perdagangan momentum untuk meningkatkan kemampuan beradaptasi

- Konfirmasi volume mencegah perdagangan selama periode tidak likuid

- Pengakuan pola periode N memungkinkan deteksi tepat waktu pembalikan pasar

- Rasio laba/rugi yang wajar untuk pengendalian risiko yang efektif

- Logika yang jelas memfasilitasi optimasi terus menerus dan penyesuaian parameter

Risiko Strategi

- Stop-loss yang sering dapat terjadi di pasar yang sangat volatile

- Penundaan penawaran yang sensitif terhadap pembuat pasar

- Relatif sedikit kesempatan ketika semua indikator selaras

- Kemungkinan kerugian berturut-turut di berbagai pasar Langkah-langkah mitigasi:

- Mengatur rasio laba/rugi secara dinamis berdasarkan volatilitas pasar

- Perdagangan selama periode likuiditas tinggi

- Mengoptimalkan parameter untuk menyeimbangkan kuantitas dan kualitas sinyal

- Menerapkan penghentian trailing untuk meningkatkan profitabilitas

Arahan Optimasi

- Memperkenalkan mekanisme penyesuaian parameter adaptif untuk optimasi otomatis berdasarkan kondisi pasar

- Tambahkan filter volatilitas untuk menghentikan perdagangan dalam volatilitas yang berlebihan

- Mengembangkan algoritma pengenalan pola N-periode yang lebih canggih

- Menerapkan ukuran posisi berdasarkan ekuitas akun

- Tambahkan konfirmasi beberapa kerangka waktu untuk meningkatkan keandalan sinyal

Ringkasan

Strategi ini mengidentifikasi peluang perdagangan berkualitas dalam perdagangan frekuensi tinggi melalui kolaborasi indikator teknis multi-dimensi. Strategi ini mempertimbangkan tren, momentum, dan karakteristik volume sambil memastikan stabilitas melalui kontrol risiko yang ketat.

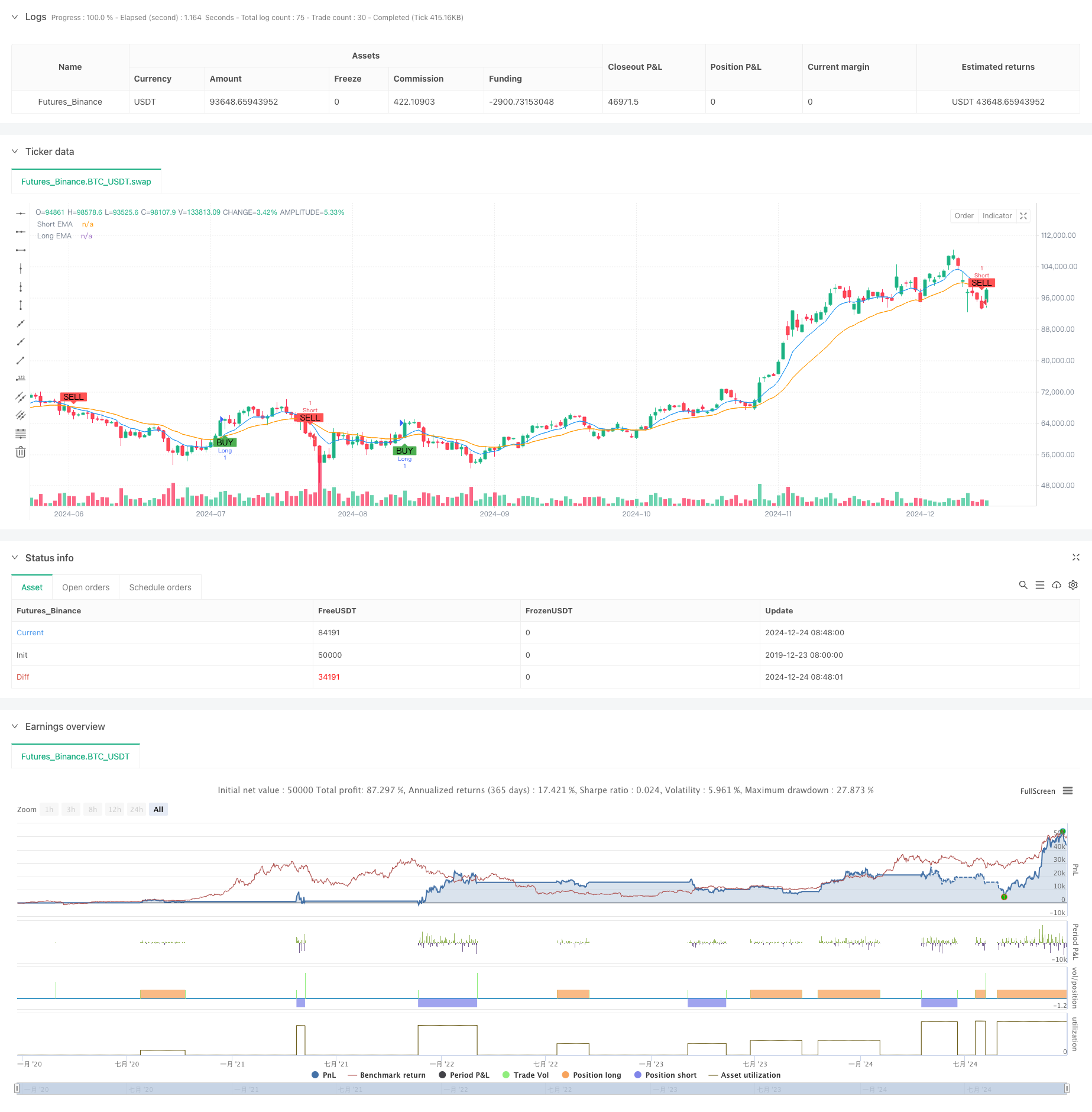

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USD Scalping Strategy with Alerts", overlay=true)

// Input parameters

ema_short = input.int(8, title="Short EMA Period")

ema_long = input.int(21, title="Long EMA Period")

rsiperiod = input.int(14, title="RSI Period")

vol_lookback = input.int(20, title="Volume Lookback Period")

n_bars = input.int(5, title="N-Bars Detection")

take_profit_perc = input.float(1.5, title="Take Profit (%)") / 100

stop_loss_perc = input.float(0.7, title="Stop Loss (%)") / 100

// Indicators

ema_short_line = ta.ema(close, ema_short)

ema_long_line = ta.ema(close, ema_long)

rsi = ta.rsi(close, rsiperiod)

avg_volume = ta.sma(volume, vol_lookback)

// N-bar detection function

bullish_nbars = ta.lowest(low, n_bars) > ta.lowest(low, n_bars * 2)

bearish_nbars = ta.highest(high, n_bars) < ta.highest(high, n_bars * 2)

// Entry conditions

long_condition = ta.crossover(ema_short_line, ema_long_line) and rsi > 50 and volume > avg_volume and bullish_nbars

short_condition = ta.crossunder(ema_short_line, ema_long_line) and rsi < 50 and volume > avg_volume and bearish_nbars

// Plot signals

plotshape(long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy execution

if (long_condition)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", from_entry="Long", limit=close * (1 + take_profit_perc), stop=close * (1 - stop_loss_perc))

if (short_condition)

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL", from_entry="Short", limit=close * (1 - take_profit_perc), stop=close * (1 + stop_loss_perc))

// Plot EMA lines

plot(ema_short_line, color=color.blue, title="Short EMA")

plot(ema_long_line, color=color.orange, title="Long EMA")

// Create alerts

alertcondition(long_condition, title="Buy Alert", message="Buy Signal: EMA Crossover, RSI > 50, Volume > Avg, Bullish N-Bars")

alertcondition(short_condition, title="Sell Alert", message="Sell Signal: EMA Crossunder, RSI < 50, Volume > Avg, Bearish N-Bars")

Berkaitan

- Strategi Hedging Momentum Multi-RSI-EMA dengan Scaling Posisi

- Strategi pembalikan RSI berjangka waktu yang berlebihan

- Dual EMA Crossover dengan RSI Momentum Enhanced Trading Strategy

- Adaptive Trend Following Strategy dengan Sistem Pengendalian Penarikan Dinamis

- Strategi Perdagangan Dinamis Multi-Indikator

- Multi-Trend Following dan Struktur Breakout Strategy

- Multi-EMA Crossover dengan Indikator Momentum Trading Strategy

- Strategi Intelijen Pembalikan Tren Multi-Indikator yang Ditingkatkan

- KRK ADA 1H Strategi Slow Stochastic dengan lebih banyak entri dan AI

- Multi-Indikator Crossover Momentum Trading Strategy dengan Optimized Take Profit dan Stop Loss System

Lebih banyak

- Strategi perdagangan kuantitatif untuk menangkap tren dinamis multi-EMA

- Strategi lintas rata-rata bergerak dinamis dan Bollinger Bands dengan model optimasi stop-loss tetap

- RSI Trend Reversal Trading Strategy dengan ATR Stop Loss dan Kontrol Zona Trading

- Multi-EMA Cross dengan Oscillator dan Strategi Perdagangan Dukungan/Resistansi Dinamis

- Multi-SMA dan Stochastic Combined Trend Mengikuti Strategi Trading

- Adaptive Dynamic Trading Strategy Berdasarkan Standardized Logarithmic Returns

- Multi-Indikator Cross-Trend Mengikuti Strategi Trading: Analisis Kuantitatif Berdasarkan Stochastic RSI dan Sistem Moving Average

- Multi-Indicator Trend Crossing Strategy: Bull Market Support Band Trading System (Sistem Perdagangan Band Dukungan Bursa)

- Multi-Level Dynamic MACD Trend Following Strategy dengan Sistem Analisis Ekstensi Tinggi/Rendah 52-Minggu

- Sistem Perdagangan Pembalikan Tren Momentum RSI Dual EMA - Strategi Terobosan Momentum Berdasarkan EMA dan RSI Crossover

- Strategi Trading Reversal Trendline Breakout yang Dinamis

- Trend Dinamis Multi-Indikator Mengikuti Strategi Berdasarkan EMA dan SMA

- Peningkatan Fibonacci Trend Following dan Strategi Manajemen Risiko

- Adaptive Multi-State EMA-RSI Momentum Strategy dengan Sistem Filter Indeks Choppiness

- Sistem Optimasi Strategi Perdagangan Rata-rata Bergerak Eksponensial Cerdas

- Strategi Perdagangan Divergensi Sistem Harga Volatilitas Berbasis AI

- Multi-EMA Trend-Following Swing Trading Strategy dengan manajemen risiko berbasis ATR

- Strategi pembalikan rata-rata yang ditingkatkan dengan Bollinger Bands dan Integrasi RSI

- Divergensi RSI Multi-Periode dengan Strategi Perdagangan Kuantitatif Dukungan/Resistensi

- Adaptive Trend Following Strategy dengan Sistem Pengendalian Penarikan Dinamis