Ringkasan

Strategi ini adalah sistem perdagangan komprehensif berdasarkan Indeks Kekuatan Relatif (RSI), Rata-Rata Pergerakan (MA), dan momentum harga. Strategi ini terutama mengidentifikasi peluang perdagangan potensial dengan memantau perubahan tren RSI, persilangan rata-rata pergerakan beberapa periode waktu, dan perubahan momentum harga. Strategi ini memberikan perhatian khusus pada tren naik RSI dan tren kenaikan harga yang berkelanjutan, dan meningkatkan akurasi transaksi melalui berbagai konfirmasi.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada komponen-komponen kunci berikut:

- Analisis Tren RSI: Gunakan indikator RSI 13 periode dan rata-rata pergerakannya untuk mengonfirmasi kekuatan harga

- Konfirmasi momentum harga: memerlukan 3 titik tertinggi berturut-turut untuk mengonfirmasi keberlanjutan tren naik

- Sistem Rata-rata Pergerakan Berganda: Menggunakan rata-rata pergerakan 21 hari, 55 hari dan 144 hari sebagai filter tren

- Manajemen dana: Gunakan 10% ekuitas akun untuk kontrol posisi untuk setiap transaksi Kondisi pembelian harus terpenuhi: RSI lebih besar dari rata-ratanya, harga membentuk titik tertinggi yang lebih tinggi berturut-turut, RSI mempertahankan tren naik Kondisi penjualan meliputi: harga turun di bawah rata-rata pergerakan 55 hari atau RSI turun di bawah rata-rata dan harga turun di bawah rata-rata pergerakan 55 hari

Keunggulan Strategis

- Mekanisme konfirmasi ganda: Meningkatkan keandalan sinyal perdagangan melalui beberapa verifikasi RSI, momentum harga, dan sistem rata-rata pergerakan

- Kemampuan pelacakan tren: Strategi ini dapat secara efektif menangkap tren jangka menengah dan panjang serta menghindari penembusan palsu

- Pengendalian risiko yang sempurna: pengendalian risiko melalui manajemen posisi dan kondisi stop loss yang jelas

- Kemampuan beradaptasi yang kuat: dapat diterapkan pada periode waktu dan lingkungan pasar yang berbeda

- Manajemen dana yang wajar: Gunakan persentase ekuitas akun untuk mengendalikan posisi dan menghindari risiko posisi tetap

Risiko Strategis

- Risiko keterlambatan: Rata-rata pergerakan dan indikator RSI memiliki keterlambatan tertentu, yang dapat menyebabkan sedikit keterlambatan dalam waktu masuk dan keluar.

- Risiko pasar yang fluktuatif: Sinyal palsu sering terjadi di pasar yang sideways dan fluktuatif

- Risiko kerugian berkelanjutan: Anda mungkin menghadapi stop loss berkelanjutan selama periode fluktuasi pasar Larutan:

- Tambahkan filter lingkungan pasar

- Mengoptimalkan parameter indikator

- Memperkenalkan mekanisme adaptif volatilitas

Arah optimasi strategi

- Optimasi parameter indikator:

- Pertimbangkan untuk menggunakan siklus RSI adaptif

- Sesuaikan parameter rata-rata bergerak sesuai dengan siklus pasar yang berbeda

- Meningkatkan identifikasi lingkungan pasar:

- Memperkenalkan Indikator Volatilitas

- Tambahkan Filter Kekuatan Tren

- Meningkatkan pengendalian risiko:

- Menerapkan mekanisme stop loss yang dinamis

- Meningkatkan target manajemen laba

- Mengoptimalkan manajemen posisi:

- Sesuaikan ukuran posisi berdasarkan kekuatan sinyal

- Terapkan mekanisme untuk membangun dan mengurangi posisi secara berkelompok

Meringkaskan

Strategi ini membangun sistem perdagangan yang relatif lengkap dengan menggunakan indikator analisis teknis dan metode analisis momentum secara komprehensif. Keuntungan strategi ini terletak pada mekanisme konfirmasi ganda dan pengendalian risiko yang sempurna, tetapi perhatian tetap harus diberikan pada kemampuan beradaptasi terhadap lingkungan pasar dan masalah optimalisasi parameter. Dengan pengoptimalan dan perbaikan berkelanjutan, strategi ini berpotensi menjadi sistem perdagangan yang kuat.

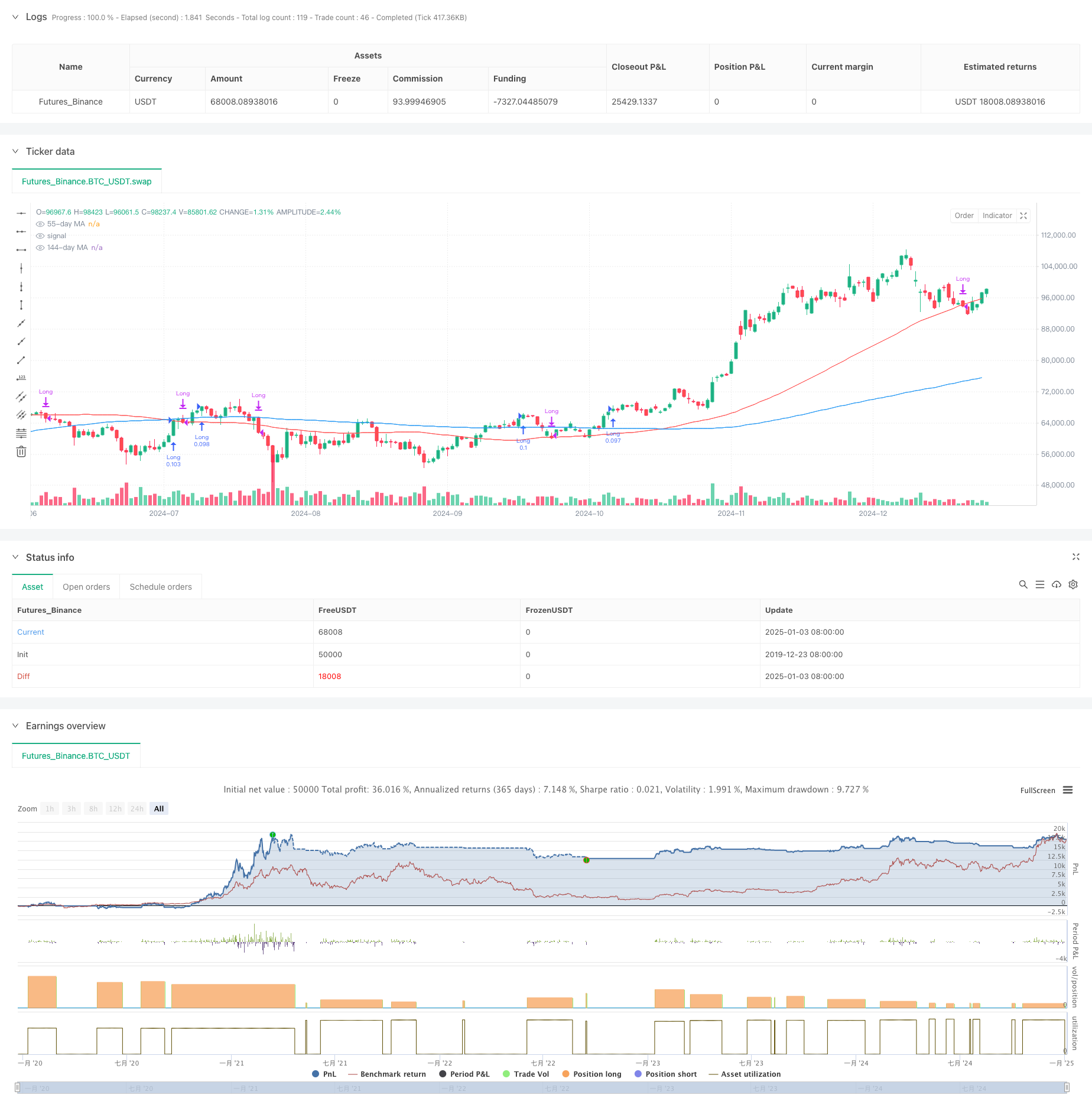

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Strategy with RSI Trending Upwards", overlay=true)

// Inputs for moving averages

ma21_length = input.int(21, title="21-day MA Length")

ma55_length = input.int(55, title="55-day MA Length")

ma144_length = input.int(144, title="144-day MA Length")

// Moving averages

ma21 = ta.sma(close, ma21_length)

ma55 = ta.sma(close, ma55_length)

ma144 = ta.sma(close, ma144_length)

// RSI settings

rsi_length = input.int(13, title="RSI Length")

rsi_avg_length = input.int(13, title="RSI Average Length")

rsi = ta.rsi(close, rsi_length)

rsi_avg = ta.sma(rsi, rsi_avg_length)

// RSI breakout condition

rsi_breakout = ta.crossover(rsi, rsi_avg)

// RSI trending upwards

rsi_trending_up = rsi > rsi[1] and rsi[1] > rsi[2]

// Higher high condition

hh1 = high[2] > high[3] // 1st higher high

hh2 = high[1] > high[2] // 2nd higher high

hh3 = high > high[1] // 3rd higher high

higher_high_condition = hh1 and hh2 and hh3

// Filter for trades starting after 1st January 2007

date_filter = (year >= 2007 and month >= 1 and dayofmonth >= 1)

// Combine conditions for buying

buy_condition = rsi > rsi_avg and higher_high_condition and rsi_trending_up //and close > ma21 and ma21 > ma55

// buy_condition = rsi > rsi_avg and rsi_trending_up

// Sell condition

// Sell condition: Close below 21-day MA for 3 consecutive days

downtrend_condition = close < close[1] and close[1] < close[2] and close[2] < close[3] and close[3] < close[4] and close[4] < close[5]

// downtrend_condition = close < close[1] and close[1] < close[2] and close[2] < close[3]

sell_condition_ma21 = close < ma55 and close[1] < ma55 and close[2] < ma55 and close[3] < ma55 and close[4] < ma55 and downtrend_condition

// Final sell condition

sell_condition = ta.crossunder(close, ma55) or (ta.crossunder(rsi, rsi_avg) and ta.crossunder(close, ma55))

// Execute trades

if (buy_condition and date_filter)

// strategy.entry("Long", strategy.long, comment="Buy")

strategy.entry("Long", strategy.long, qty=strategy.equity * 0.1 / close)

if (sell_condition and date_filter)

strategy.close("Long", comment="Sell")

// Plot moving averages

plot(ma55, color=color.red, title="55-day MA")

plot(ma144, color=color.blue, title="144-day MA")