EMAフィルターによるクロスマーケット・オナイトポジション戦略

作者: リン・ハーンチャオチャン開催日:2024年11月12日 10:49タグ:エイママルチ

この戦略は,EMAの技術指標に基づくクロスマーケット・オブナイトポジション戦略であり,市場閉店前と市場開業後の取引機会を把握するために設計されています.この戦略は,正確な時間制御と技術指標フィルタリングを通じて,異なる市場環境でスマートな取引を達成します.

戦略の概要

この戦略は,主に市場閉じる前の特定の時間にエントリーし,翌日の市場開業後の特定の時間に退出することで収益を得ます.トレンド確認のためのEMA指標と組み合わせて,複数のグローバル市場 (米国,アジア,ヨーロッパ) で取引機会を探します.この戦略は,監視されていない操作のための自動取引機能も統合しています.

戦略原則

- 時間制御: 閉店前の固定時間に入場し,異なる市場取引時間に基づいて開店後固定時間に退場

- EMA フィルタリング: 入力信号の検証のためにオプションの EMA 指標を使用する

- 市場選択:米国,アジア,欧州市場向け取引時間の調整を支援する

- 週末の保護: 週末の保有リスクを避けるために金曜日の閉店前にポジションを強制的に閉鎖する

戦略 の 利点

- 多市場適応性: 異なる市場の特徴に応じて取引時間を柔軟に調整する

- 総合的なリスク管理: 週末のポジション閉鎖保護メカニズムを含む

- 高自動化レベル:自動化取引インターフェースの統合をサポート

- 柔軟なパラメータ: 調整可能な取引時間と技術指標パラメータ

- 取引コストの考慮: 佣金とスリップ設定を含む

戦略リスク

- 市場変動リスク: 一夜間ポジションはギャップリスクに直面する可能性があります.

- 時間依存性: 市場時間期間選択の影響を受ける戦略の有効性

- 技術指標の制限:単一EMA指標は遅延を示す可能性があります. 提案:ストップ・ロスの制限を設定し,検証のためのより多くの技術指標を追加

戦略の最適化方向

- より多くの技術指標の組み合わせを追加

- 不安定性フィルタリングメカニズムを導入する

- 入出時間の選択を最適化

- アダプティブパラメータ調整機能を追加する

- リスク管理モジュールを強化する

概要

この戦略は,正確な時間制御と技術指標フィルタリングを通じて信頼性の高いオバーナイト取引システムを達成する. 戦略設計は,マルチマーケット適応,リスク制御,自動取引要素を含む実用的な要件を包括的に考慮し,強力な実用的な価値を示している. 継続的な最適化と改善を通じて,この戦略はライブ取引で安定した収益を達成する可能性がある.

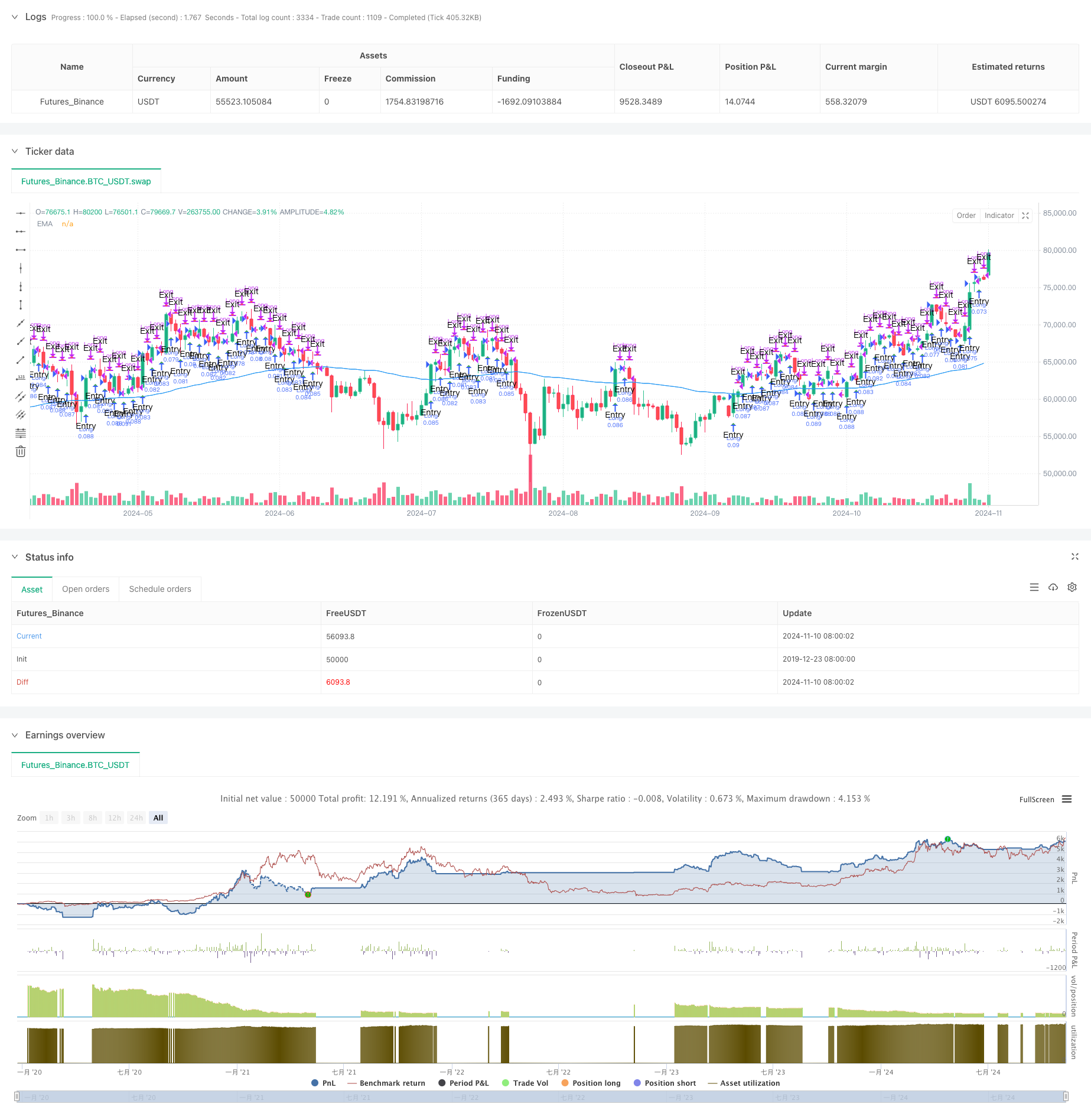

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy, titled "Overnight Market Entry Strategy with EMA Filter," is designed for entering long positions shortly before

// the market closes and exiting shortly after the market opens. The strategy allows for selecting between different global market sessions (US, Asia, Europe) and

// uses an optional EMA (Exponential Moving Average) filter to validate entry signals. The core logic is to enter trades based on conditions set for a specified period before

// the market close and to exit trades either after a specified period following the market open or just before the weekend close.

// Additionally, 3commas bot integration is included to automate the execution of trades. The strategy dynamically adjusts to market open and close times, ensuring trades are properly timed based on the selected market.

// It also includes a force-close mechanism on Fridays to prevent holding positions over the weekend.

//@version=5

strategy("Overnight Positioning with EMA Confirmation - Strategy [presentTrading]", overlay=true, precision=3, commission_value=0.02, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// Input parameters

entryMinutesBeforeClose = input.int(20, title="Minutes Before Close to Enter", minval=1)

exitMinutesAfterOpen = input.int(20, title="Minutes After Open to Exit", minval=1)

emaLength = input.int(100, title="EMA Length", minval=1)

emaTimeframe = input.timeframe("240", title="EMA Timeframe")

useEMA = input.bool(true, title="Use EMA Filter")

// Market Selection Input

marketSelection = input.string("US", title="Select Market", options=["US", "Asia", "Europe"])

// Timezone for each market

marketTimezone = marketSelection == "US" ? "America/New_York" :

marketSelection == "Asia" ? "Asia/Tokyo" :

"Europe/London" // Default to London for Europe

// Market Open and Close Times for each market

var int marketOpenHour = na

var int marketOpenMinute = na

var int marketCloseHour = na

var int marketCloseMinute = na

if marketSelection == "US"

marketOpenHour := 9

marketOpenMinute := 30

marketCloseHour := 16

marketCloseMinute := 0

else if marketSelection == "Asia"

marketOpenHour := 9

marketOpenMinute := 0

marketCloseHour := 15

marketCloseMinute := 0

else if marketSelection == "Europe"

marketOpenHour := 8

marketOpenMinute := 0

marketCloseHour := 16

marketCloseMinute := 30

// 3commas Bot Settings

emailToken = input.string('', title='Email Token', group='3commas Bot Settings')

long_bot_id = input.string('', title='Long Bot ID', group='3commas Bot Settings')

usePairAdjust = input.bool(false, title='Use this pair in PERP', group='3commas Bot Settings')

selectedExchange = input.string("Binance", title="Select Exchange", group='3commas Bot Settings', options=["Binance", "OKX", "Gate.io", "Bitget"])

// Determine the trading pair based on settings

var pairString = ""

if usePairAdjust

pairString := str.tostring(syminfo.currency) + "_" + str.tostring(syminfo.basecurrency) + (selectedExchange == "OKX" ? "-SWAP" : "")

else

pairString := str.tostring(syminfo.currency) + "_" + str.tostring(syminfo.basecurrency)

// Function to check if it's a trading day (excluding weekends)

isTradingDay(t) =>

dayOfWeek = dayofweek(t, marketTimezone)

dayOfWeek >= dayofweek.monday and dayOfWeek <= dayofweek.friday

// Function to get the timestamp for market open and close times

getMarketTimes(t) =>

y = year(t, marketTimezone)

m = month(t, marketTimezone)

d = dayofmonth(t, marketTimezone)

marketOpenTime = timestamp(marketTimezone, y, m, d, marketOpenHour, marketOpenMinute, 0)

marketCloseTime = timestamp(marketTimezone, y, m, d, marketCloseHour, marketCloseMinute, 0)

[marketOpenTime, marketCloseTime]

// Get the current time in the market's timezone

currentTime = time

// Calculate market times

[marketOpenTime, marketCloseTime] = getMarketTimes(currentTime)

// Calculate entry and exit times

entryTime = marketCloseTime - entryMinutesBeforeClose * 60 * 1000

exitTime = marketOpenTime + exitMinutesAfterOpen * 60 * 1000

// Get EMA data from the specified timeframe

emaValue = request.security(syminfo.tickerid, emaTimeframe, ta.ema(close, emaLength))

// Entry condition with optional EMA filter

longCondition = close > emaValue or not useEMA

// Functions to create JSON strings

getEnterJson() =>

'{"message_type": "bot", "bot_id": "' + long_bot_id + '", "email_token": "' + emailToken + '", "delay_seconds": 0, "pair": "' + pairString + '"}'

getExitJson() =>

'{"action": "close_at_market_price", "message_type": "bot", "bot_id": "' + long_bot_id + '", "email_token": "' + emailToken + '", "delay_seconds": 0, "pair": "' + pairString + '"}'

// Entry Signal

entrySignal = isTradingDay(currentTime) and currentTime >= entryTime and currentTime < marketCloseTime and dayofweek(currentTime, marketTimezone) != dayofweek.friday

// Exit Signal

exitSignal = isTradingDay(currentTime) and currentTime >= exitTime and currentTime < marketCloseTime

// Entry Logic

if strategy.position_size == 0 and longCondition

strategy.entry("Long", strategy.long, alert_message=getEnterJson())

// Exit Logic

if strategy.position_size > 0

strategy.close("Long", alert_message=getExitJson())

// Force Close Logic on Friday before market close

isFriday = dayofweek(currentTime, marketTimezone) == dayofweek.friday

if strategy.position_size > 0 // Close 5 minutes before market close on Friday

strategy.close("Long", comment="Force close on Friday before market close", alert_message=getExitJson())

// Plotting entry and exit points

plotshape( strategy.position_size == 0 and longCondition, title="Entry", text="Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape( strategy.position_size > 0, title="Exit", text="Exit", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Plot EMA for reference

plot(useEMA ? emaValue : na, title="EMA", color=color.blue)

関連性

- GチャネルとEMAトレンドフィルター取引システム

- EMAの二重移動平均のクロスオーバー戦略

- EMAのモメンタム・トレード戦略

- マルチEMAクロスオーバートレンド 戦略をフォローする

- 双鎖ハイブリッドモメント EMA トレーディングシステム

- MACDクロスオーバー戦略

- マルチEMAクロスオーバーモメントトレンド 戦略をフォローする

- トレーリング・プロフィート・ロック付きのマルチEMA自動取引システム

- 3分間のキャンドル・ハイ・ロー・ポイントに基づいた日中のブレイクアウト戦略

- 日々の高低ブレイクシステムによる多期EMAトレンド戦略

もっと

- 戦略をフォローするマルチインジケータ融合平均逆転傾向

- ATRベースのダイナミックなポジションマネジメントを備えたオープン後のブレイクアウト取引戦略

- 多指標統合とインテリジェントリスク管理 定量取引システム

- ATR波動性戦略を用いた多指標動的適応位置サイズ化

- RSI ダイナミックストップ・ロスのインテリジェント・トレーディング戦略

- 移動平均フィルター戦略による3回検証されたRSI平均逆転

- Bollinger Bands と RSI 統合による適応性振動トレンド取引戦略

- ADX (平均方向指数) とボリューム・ダイナミック・トレンド・トラッキング戦略

- 複数のボリューム・モメンタム・コンビネッド・トレーディング・戦略

- フィボナッチリトレースメントとエクステンション 多指標量的な取引戦略

- 複数の技術指標に基づく平均逆転とトレンドフォロー戦略

- WebSocket 加速ドライバー

- 複数のスレッドが資金調達シンボルを手に入れる

- EMA/MACD/RSIのクロスオーバー戦略

- 多指標クロスオーバーモメンタム・トレーディング・戦略

- 変動停止クラウド戦略と移動平均クロスオーバーシステム

- ボリンジャー・バンド 精密なクロスオーバー量的な戦略

- ダイナミック・リスク・マネージド・EMA・クロスオーバーとボリンジャー・バンド戦略

- 多レベルバランスのとれた量的な取引戦略

- 多次元数学モデル取引戦略